How to Trade Bitcoin Crypto Futures in Australia

Australia falls among nations that recognize Bitcoin and all other Cryptocurrencies as legal tender. Expressly, Australian authorities since the year 2017 declared that all returns from dealing with the digital currencies deem to be capital gains, which are thereby taxable.

One keynote highlight pertains to the addition of Bitcoin futures as well as those from Altcoins into the Australian markets through exchange platforms like BTCC.

Taxes are a standard charge across many countries around the globe. And, although the crypto-sphere gives trades great opportunities to do tax planning and evasion altogether, it’s not the actual case.

Governments with outright resistance to Crypto adoption equally face more significant resistance. On one scale that arises when it comes to payment of taxes, from crypto-earnings.

On a broad scale, citizens appreciate their governments by emitting taxes when both are in good terms. Else, when governments resort to forceful regulations, actors take a step back when it comes to compliance.

It’s a rare occurrence to see governments coming out and accepting the Cryptocurrencies, of course, it’s a win-win deal when tax remittances meet public goods survive adequately from public coffers.

In a nutshell, we can agree that Australian levels of acceptance (authorities and citizens) are at an advanced level.

PROMOTION: Do Leverage Trading on BTCC and Grab 2000 USDT Bonus!

Review of Taxes on Digital assets in Australia

Earnings from crypto undertakings in Australia are liable for taxes as applicable on ordinary capital gains, requiring settlement on profits/losses.

However, mining and staking amount to regular incomes.

- Tax from capital gains is chargeable on the profits exclusively (not on capital amounts invested). Losses allow for carrying over into subsequent years of taxation.

- Taxes from ordinary incomes derive from the values of the gains at the fair market valuations. So, if you sell BTC at a profit, the profit is separately liable for capital gains taxes.

Special Aspects with Bitcoin Futures

An outlook of Bitcoins’ first decade globally presents a landscape with tremendous challenges and equally colossal opportunities. But, on a level of its own is the high volatility.

Indeed, a genuine digital-asset flows with corresponding tandem with the powers of supply and demand. Of course, Bitcoin mining is way past 85% mining in total.

What will happen when all the 21 Million Bitcoins get mined?

Bitcoin is here to stay; perhaps a new rave will invent itself with mining directed towards other promising Altcoins. From another viewpoint, Bitcoin futures and other trading vehicles related to it will become stronger.

Similar trends will apply to Ethereum and its colossal investments with smart contracting and aggregate value creation plus distribution across other industries.

When traders invest in Bitcoin and Altcoin futures, they have in place an opportunity to bet to their advantage deriving from the volatile nature of the spot value of Bitcoin in the global market.

From a historical view, Bitcoin hit the highest value of $20,000 in December of 2017. As of August 2020, the same is stitch around the $ 12, 000 mark. For speculators, that’s a whooping $8000 opportunity.

From an ordinary eye, that’s a choppy market. But for speculators who comprehend the aspect of deploying risk management tools the smartest way, Bitcoin futures are a gold mine.

Volatility conforms to normalcy on any trade within the equilibriums arising from the law of supply and demand. Bitcoin futures contracts are one of the most recent establishments of old and sure ways to hedge against risks.

Is Bitcoin a Bubble?

A short answer is a big No.

The static position of BTC as the leading digital asset among the rest is on a clear trajectory. If it were one, things should have gone hay way long before current advancements.

Every other Altcoins rallies to solve a unique problem and time shifts push scammers and jokers aside. The digital assets are and will keep growing, in value and the investment avenues under each.

Reality is, Bitcoin is real, and the inauguration of Bitcoin futures is resounding proof of its realms. Most firms and leading economies, Australia included have gone ahead to recognize the derivative functions that CFDs can play within economies.

At onsets, cognition is a considerable buy-in in itself, and of course, the rest of the variables are under the grill of supply and demand, including speculation itself.

A rally-down of BTC in value is not a sign of any bubble at all. Similar scenarios trajectories scale for the ordinary markets.

Speculation goes beyond the understanding that going long or short is a zero-sum game.

The Reality is, Markets Evolve and Learn Over Time.

Take a keen look at the ICOs boom of 2017, from the angle of sustainability. Supply and demand should create a layer of substantial value for every stakeholder. Any failure to meet that seemingly necessary but stringent condition is a clear red flag for a probable scam.

Possibility of scams died away with time.

Over time, the crypto-sphere re-invents mechanisms to weed out scammers. Primarily, the rise of IEOs and STOs (away from ICOs). Consequently, Bitcoin futures are a result of genuine market growth, the value in capitation and re-inventing the strategies against business risks.

Bitcoin Futures Speculation is Risky but Invokes Equally Higher Rewards

Taking on Bitcoin futures is relatively easy. Risk-averse traders/ speculators will stay away. However, risk-loving ones go for it. Majority of takers are averse.

The wise nuggets are to cover your trades with smart risk management strategies. And, futures contracts give you adequate cover for you to navigate the stormy waters of risks with Bitcoin.

- Here’s a List of Exchanges Where You can Purchase and Sell Crypto Futures in Australia

Plus500 is one robust platform where you can trade CFDs in Australia. You can trade with 30+ languages from across the globe.

Admiral Markets offers CFDs for Australians. They offer you negative balance protection for accounts, and retail traders get up to 1:30X leverage on margins.

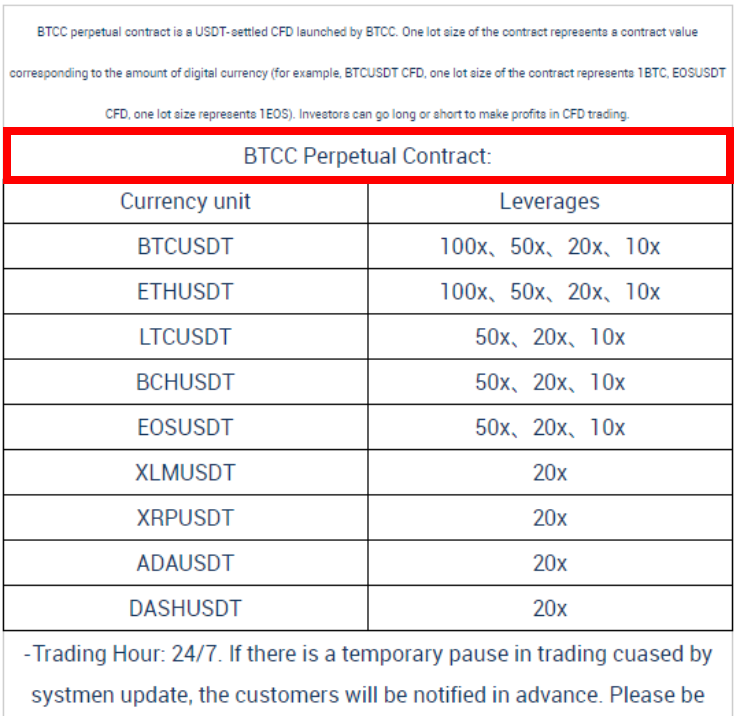

BTCC offers Australians up to 150X for leverage and the lowest KYC policy requirements. You can get started in minutes, and they offer the best security for digital assets. BTCC is the longest-lasting exchange with no significant security incidences.

Mitrade allows Australians an opportunity to take on CFD futures. By speculating, traders end up benefiting from volatile movements in prices.

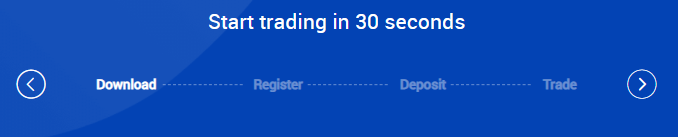

A brief guide on how to use BTCC to trade Crypto futures in Australia

BTCC is a world-class and most accessible platform to open an account and be on the next speculative move for Bitcoin, Ethereum and other CFDs.

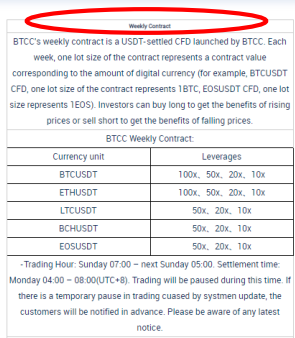

Decide on whether to go for weekly contracts of perpetual ones:

If you are on mobile, you are covered, download your gadgets operating systems respective client – Android or iOS.

Register for an account with BTCC and fund your account ready to take on trades.

Pro-Traders tips: Follow BTCC on Twitter to get the latest news, and the offers they offer from time to time to help you build on the knowledge, earn more and grow with t promotions and contests that run from time to time.

When you bring onboard new traders, BTCC appreciates your efforts incrementally. Visit the referral page for the link and details as to how you earn.

Parting Shot:

BTCC has defied all odds and still thrives nine years on. By offering CFDs on Bitcoin and Ethereum, all based on Tether (USDT). As a platform, the team reaffirms the commitment to create value for account owners in Australia and globally in the unique risk-mitigation instruments out there.

The truth is that businesses will always be risky. What matters for smart traders is the robustness of skills and tools to speculate, while minimizing risks. Bitcoin futures with BTCC are here to stay and open up more opportunities for you.

YOU MAY LIKE: Make your first crypto futures trading on BTCC exchange. The investment threshold is as low as 0.5 USDT.