Bitcoin and Altcoins – the Dotted Connections

Bitcoin and altcoins are digital assets. But, Bitcoin is the most known Cryptocurrency.

Right?

But there are many other digital assets, a.k.a. the altcoins. And they all rally to beat Bitcoin every other moment.

In a nutshell, altcoins propose solutions akin to where Bitcoin is sluggish:

- Start with the mining Cap

- Look into the instantaneous clearance of transactions

- Consider anonymity within the ambit of the peer-to-peer ecosystem.

- Also, consider the vast array of applicable frameworks – finance and non-finance

The reality is, some altcoins are super-performers within the above spheres.

From another outlook, there’s a changing trajectory with Cryptocurrencies.

It concerns Cryptocurrencies altogether being anti-government.

As such, both governments and corporates are in advanced processes.

Either of their approach aims at integrating Crypto or its frameworks within their activity domains.

Bitcoin and Altcoins are the Future of Crypto

Chances are, if your fortunes do not lay in Bitcoin, the highest probability is they are in Altcoins.

It remains indelible. Bitcoin is the mother of all Cryptocurrencies.

It seems every other Dev team was holding onto their guts until Satoshi spilled all the beans- That was with the release of BTC back in 2009

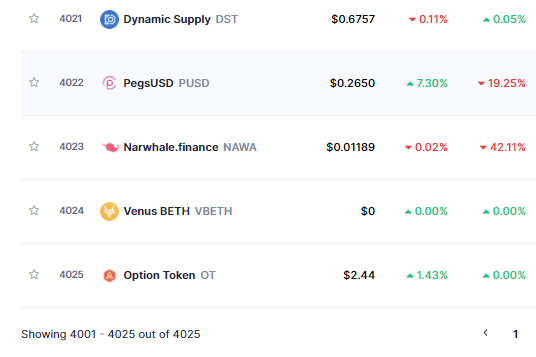

As of this post going live, Coinmarketcap lists over 4000 coins.

Looking back over the past two decades, Bitcoin stays atop. Along the way, many coins have launched and vanished like Onecoin.

Crypto-Scams thrive. And they do so via reaching out to the masses.

Scanners appeal to them via:

- First, is the art of careful crafting whitepapers

- Second, is the selling dream scenarios

Overall, altcoins are a loophole.

Though, it’s not to mean that BTC is never involved in scamming masses around.

Regulatory circles have advanced their games.

But scams arising and involving Altcoins still thrive.

It serves as a constant reminder; that blockchains are decentralized, a double-edge cutting sword.