What is Forex Trading and How Does It Work

Forex trading means exchanging one currency for another. Trading forex is done in currency pairs- whether purchasing or selling simultaneously.

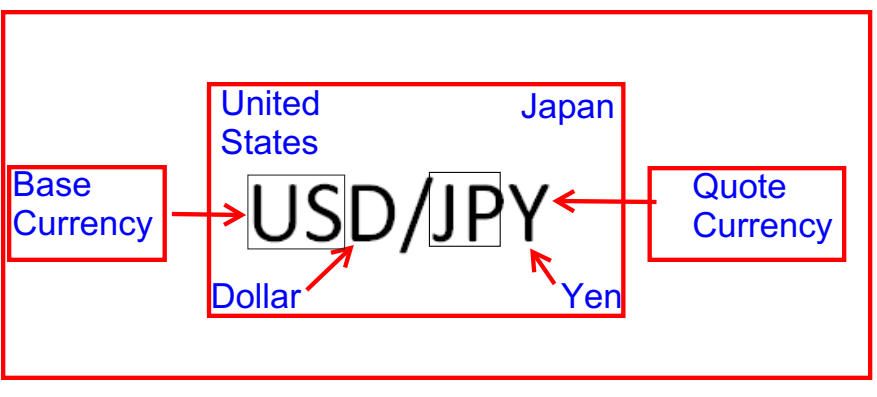

Currency listings conform to three-letter codes: two standing for the region and one for the currency name. For instance, the currency pair USD/JPY is for the Dollar and Yen, respectively.

Professional trader list currency pairs in the following categories:

· Major pairs -these comprise 80% of the entire International market and are USD/JPY, EUR/USD USD/CHF and GBP/USD

· Minor pairs – less traded pairs- and feature a significant currency against another with the USD’s exclusion. Examples are GBP/JPY, EUR/CHF,

and EUR/GBP.

· Exotics pairs- feature major currencies against those from emerging economies. Examples: GBP/MXN, USD/PLN, and EUR/CZK

· Regional pairs – these pairs arise from regional economic blocs. e.g., Australasia or Scandinavia, and comprise AUD/NZD, EUR/NOK, and AUD/SGD

Most forex transactions comprise buyers entering markets at low prices and exiting at higher prices. Sellers also enter at a high price and exit at a lower price and pocket the difference as a profit. At lower scales, exchanging one currency for another for travel or payment purposes is also transacting on forex.

| You May Like: Trade bitcoin, which is more volatile than forex pairs, using CFDs on BTCC to make a quick profit. Up to 2,000 USDT deposit bonus available now. NOTE: BTCC Accepts USDT Deposit Only! |

How forex trading works

Institutional forex trades are over the counter-or OTC engagements. Therefore, forex trading is not centralized, as is the case with stock markets. Forex is run by institutions forming a network of actors, including banks and regulators.

There are four hubs of activity coinciding with global daily timelines. And they compose the significant markets. Traders open with Sydney, Tokyo, London, and New York in that orderly cycle.

Many traders speculate forex by taking advantage of price volatilities. Also, many smart speculators take on derivative products across platforms and profit from correct predictions.

There Are Three different types of forex markets:

- · Spot forex markets – where the exchange per currency pair takes place concurrently with a time that’s on the spot.

- · Forward forex markets -where contracts of agreements to either buy or sell specific amounts of currency and set prices whose settlement into the future has specific dates or within a definite range of time.

- Futures forex markets – contractual agreements specify the sale or buying of set amounts in currency with set prices and dates into the future.

Forex price Determination

Conventionally, all currency pairs start with a base currency exchanging against the quote or second currency, and the exchanging values rely upon set prices.

When the price of a currency increases, traders go long, and the reverse is also true-for going short.

Leverage for Forex Trades

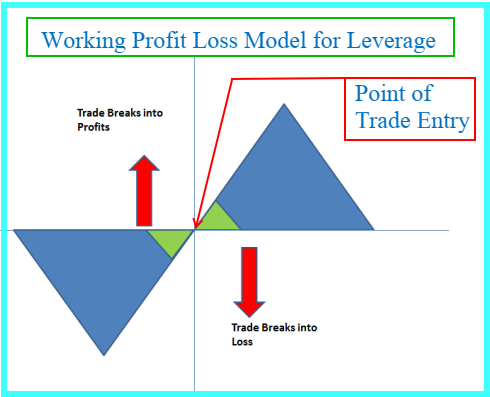

One significant aspect of forex trading is the ability to leverage or trade on borrowings. Traders can open positions many times their amount of commitment in the margins.

Closures of any open positions derive from the amount of leverage commitment. Therefore, it calls for careful trading as losses or profits are equally magnified with respect to leverage commitments.

Profiting from forex purely relies on a trader’s ability to manage risks by opening and closing more winning positions than losing ones.

Margin Trading in Forex

Margin is the initial commitment of capital to open and maintain an open position via leveraging. It varies from one broker to the next alongside other terms. Aside from providing minimum margin, platforms require traders to maintain enough free margins to hold open positions when their trades fall into losses.

Professionals recommend that all leveraged positions’ margin commitments not go past 2% of the entire account. Therefore, working with 2% commitments within smart speculations and schedules, traders can grow their accounts limitlessly by winning more than losing open positions.

Pips in Forex Trading

Pip is a term deriving from movement in percentage. Usually, denoting a fluctuation from the point of trade entry to exit. It’s in decimals across a forex chart.

For example, if a pair like EUR/USD moves from $1.35361 to $1.35371, that’s one pip. Other forex pairs work with micro pips or pipettes. For instance, EUR/JPY moves on price charts from ¥172.129 to ¥172.139 constitutes one pip.

Spreads in Forex Trading

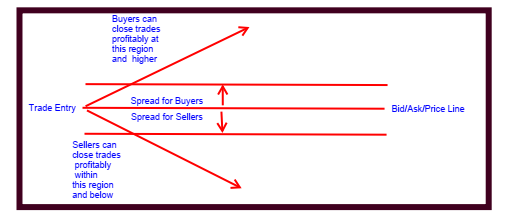

A spread is a deviation between the selling and buying prices for any quoted pairs.

Brokers allow traders to sell or buy at slightly lower or higher than

Therefore, even opening and closing trades at the opening values will cost traders pips equal to the spread provided.

Spreads are a portion of earning-charges for traders for using the platform.

Traders should go for platforms/brokers offering best spreads or lowest.

Lots in Forex Trading

Currency pairs trade in standard batches known as lots. On most occasions, a standard lot comprises 100,000.00 units of currency.

For accommodative reasons, brokerage platforms allow traders to open positions on mini-lots and micro-lots. In finer details, those are 10,000 and 1000 currency units, respectively.

Traders can work with a lot as little as 0.1 to as high as 40. Also, every position opens in line with margin requirements for every broker. More so, the individual trader’s risk appetites matter. However, the fundamental elements of successful forex trading build on winning pips with ease.

Market Movers in Forex

Although forex markets are driven by the equilibriums between supply and demand forces, actors need to master some significant triggers and calendars that vary from time to time for successful trading. Actors or significant variables that force prices to move within forex markets are the market movers.

Here are three key actors with critical points of effects on the markets:

Central Banks

Currency supply is affected by the volumes in circulations for each. Central banks affect several strategies that cause shifts in equilibrium.

For instance, quantitative easing allows more money to flow into the hands of the public. When more money sits with the public, supply increases, and its value falls. The reverse to quantitative easing, deployed via other monetary policy decisions, holds. Interest rates are among the several sets of tools that central banks deploy in controlling the national economy.

Traders require understanding the consequential effects of central bank decisions, whose results are felt across all stakeholders.

News reports

Investors are very sensitive. Whenever actors like commercial banks feel safe within an economy, investments flourish with capital inflows. Any news with poor outlooks triggers capital outflows too.

Smart forex traders keep tabs on news happenings with significant force on the forex prices. They make friends with sites like the forexfactory or the economic calendar.

Traders should note the significant nexus between central bank reports and decisions with variables like production, inflation, GDP, employment, and retail markets.

Market Sentiment

Market sentiments are simply the reactions of economic actors to various news items. Some significantly sensitive factors force prices of forex downwards or upwards. It’s common to encounter markets reacting to both forces, and those results in choppy markets.

Generally, market sentiment narrows down to the general feelings and perceptions of traders regarding announcements. It’s always a huge task to try to predict price shifts from the news. However, smart traders can pick issues from the general sentiments and trade accordingly.

Forex Trading brings in a considerable investment opportunity with more than 6.0 trillion clocking for daily trade volumes. Traders who master the trends and can manage risks excel in forex trading.

Parting Note

Forex trading has become more popular with the rise of access to the internet. Aside from accessing Forex platforms via desktops, traders can go mobile via iOS and Android applications.

| You May Like: Trade bitcoin, which is more volatile than forex pairs, using CFDs on BTCC to make a quick profit. Up to 2,000 USDT deposit bonus available now. NOTE: BTCC Accepts USDT Deposit Only! |