Ways to Buy Gold Futures in a Pandemic

Suppose you’re like me and love to trade assets that offer opportunities as an inflation hedge, leverage on speculative advantages, or just looking out for options that are external to fixed income assets and traditional equity. In that event, you may want to lean towards trading gold futures.

In this post, we’ll go over the fundamentals of gold futures contracts and how you can get started with trading them.

Some points to consider

As a trader/investor, you may want to opt for a gold futures contract if you look to add gold to your portfolio.

Following the futures route does not require that you get the yellow metal’s physical delivery, plus you get to leverage your purchasing power.

Unlike mutual funds or ETFs, there are no management fees on futures contracts.

Also, note that you’ll have to roll-over your gold futures positions to avoid physical gold delivery.

| You May Like: Trade Bitcoin futures or Ethereum futures to make a quick profit due to the volatility of Cryptocurrencies. |

So, what is a gold futures contract?

It is an agreement bound by law between two parties to transact on gold at a set price at a future date.

Again, as mentioned in the introduction, gold futures are often used as a hedge against risks that come with volatility on a physical gold transaction.

As a speculator/trader, you get to take part in the gold futures market without any obligation to hold the physical gold.

When trading gold futures, a trader can take one of two directions, either a buy-long position where he accepts gold delivery. The second position is a short-sell direction where the trader delivers the gold.

Advantages of trading gold futures

A common reason most investors go into gold futures is the size of financial leverage that comes with it.

Also, gold futures are flexible compared to trading the physical commodity, as they are traded at central exchanges.

Trading gold futures on leverage gives you access to a high market value product at a fraction of what it’s worth. Futures trading is generally executed at a performance margin at way less capital compared to the physical market.

With leverage, an investor gets a higher risk to reward on their investment.

Let’s look at an example where you control 100 troy ounces using one futures contract of gold.

Say the market trades at $700 per ounce, which translates to a contract valuation of 70,000USD = 700USD X 100 ounce. Following the exchange margin rules, where the 4,050USD is required to control a single contract, so with just 4,050USD, you get to control 70,000USD of gold.

There is no counterparty risk to traders participating in gold futures on exchanges as the exchange clearing service takes buyer or seller position depending on the current scenario. The risk of defaulting by any participant is reduced to the lowest.

Gold Futures contract specification

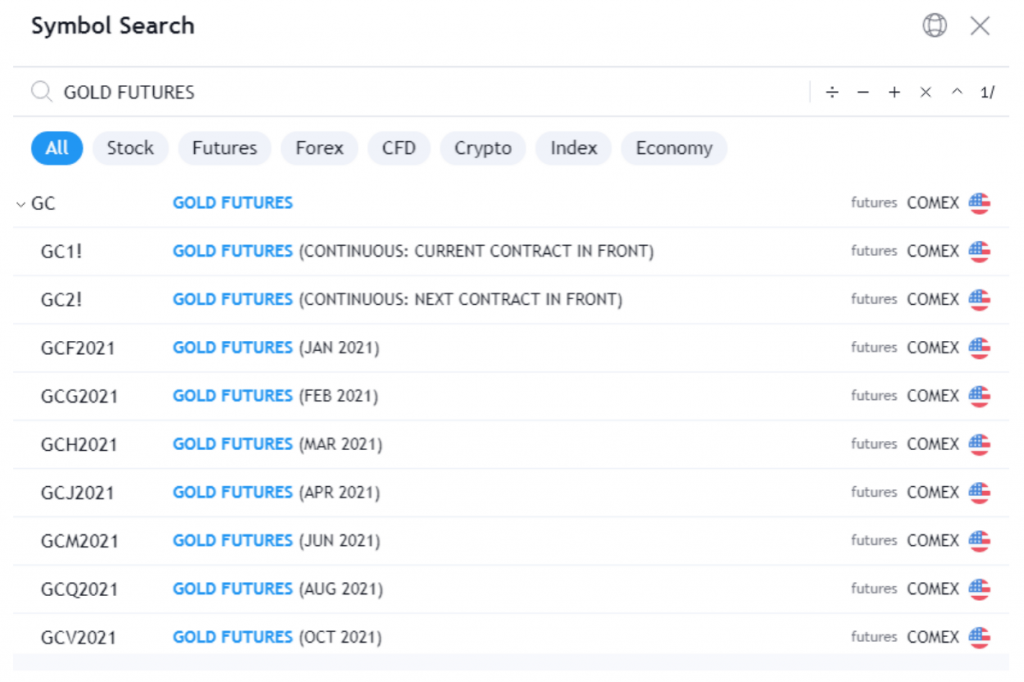

The COMEX and eCBOT are the Two major exchanges to trade gold futures contracts, with two on eCBOT and one on COMEX.

You can only trade mini contracts on eCBOT, but trade 100 troy-ounce contracts on both eCBOT and COMEX exchange.

Trading Gold Futures

Since gold is traded in USD and cents an ounce, let’s consider an example where a trader buys gold while trading at 700USD an ounce, at a contract value of 70,000USD = 700USD X 100 ounces.

So, taking a by-long trade on gold at an asking price of 700USD and later sell at 710USD earns the trader 1000USD = 710USD – 700USD = 10USD; (10USD X 100ounces).

If the gold price dropped to 690USD at expiration, the trader would have to take a loss of 1000USD.

Gold futures have a minimum tick movement of 10cents, meaning the ticks increase by an increment of 10 cents, even though there may be more comprehensive price ranges.

Participants of Gold Futures Market

Miners, manufacturers, jewelers, and not forgetting bank vaults would use gold futures to hedge against adverse volatile price fluctuations in the spot market. So, the gold futures market provides a central marketplace for buyers and sellers of the commodity.

A correlation between the spot and futures market makes it possible for a jeweler to hedge on the gold price.

A jeweler may decide to buy a gold futures contract, locking the price of gold in anticipation of a price hike in the future.

If the price did surge as expected, the jeweler would have protected her investment, avoiding the risk of buying gold at such a high price.

On the other hand, if the gold futures price slumped or stayed in a range, then the jeweler would have lost on the long gold futures contract but would buy gold at a lower price at the cash market.

Contrary to taking a hedge position, speculators such as CTAs-Commodity trading advisors, hedge funds, and private investors do not care about having a gold commodity’s physical delivery.

They instead try to profit from the price fluctuations.

Speculators of gold futures contracts do so on different time horizons. They include scalpers who hold trades for a short term, day traders who close their transactions on or before the end of the day, and swing traders who hold their positions for a more extended period.

All your trades will not always go as planned when speculating, so make sure you consider implementing a proper position sizing, risk, and money management technique when trading gold futures.

| You May Like: Trade Bitcoin futures or Ethereum futures to make a quick profit due to the volatility of Cryptocurrencies. |