How to Buy More Bitcoin Cash (BCH) Using Leverage

The rise of Bitcoin cash traces a timeline from August 2017. Miners, through concurrence, performed a hard fork on Bitcoin to steer away from Segwit propositions and its heavy needs in transaction processing resources and time that takes.

The first half of month 3 of quarter 3 of 2020 records BCH at position seven.

What Is Bitcoin Cash (BCH) Leverage & Margin Trading?

Economics 101 tells us that resources are always scarce in comparison to our lists of limitless wants.

So, what’s the relationship between your trading for BCH contracts while working with margin and leverage?

Here’s a simple explanation:

First, every trader must have capital – either from their sources, borrowing, or cleverly a mix of both.

The simplest explanation of leverage allows a trader to prospect on a large contract size with low equity commitment. Practically, platforms offer you bands with lower and upper limits, which you can multiply or leverage your initial margin within.

Therefore, a trader only commits a portion of the initial margin to a definite number of multiples of the prospect earnings per contract.

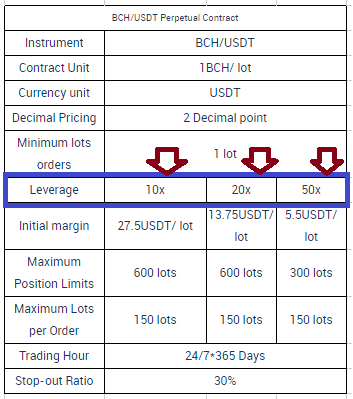

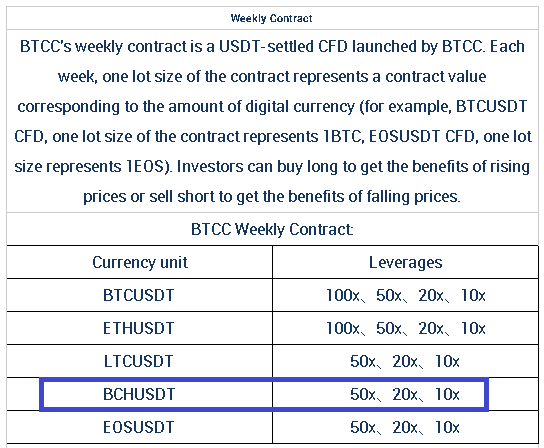

About the above image, BTCC.com allows you to make choices of the number of multiples you make on your margin commitments. When you take on BCH contracts, you get the lowest offer as 10X and the highest as 150X.

Leveraged trading is risky, but equally and most lucrative in done right. Leveraging allows professional traders to navigate high risky CDFS across the board and win more than they lose.

Leveraged trading is by appearance simple, just some mouse-clicks, but bear in mind that the click to commit opens your position with a potential risk corresponding to the number of X’s you commit.

And here’s the catch, leverage trading is not a task you master with a single glance. The truth is it takes time.

Over the internet, you’ll find numerous tutorials, online and offline classes to help you master risk mitigation via leveraging.

In my own words, I’d refer to leverage trading as a massive opportunity for professional snipers in the trading foray. There’s an opportunity for super-profiting, only if you do it right.

Here are a few hints to steer your thinking in the right direction.

First, how do you place your trades? If you commit more than two percent of the equity in the trading account to open positions for BCH/USDT contracts, that’s slightly high.

Professionals act like excellent and super-confident snipers. A quick analysis of the graphs and curves should be apparent if you are to place a trade on not.

In my initial days, I was lucky to fall into the hands of a great mentor – here is a piece of advice I’ve held dearly all along: Trade via demos, and if you can double your returns confidently, go live.

However, it’s not a must-follow rule. All markets and our professional approaches to risks are as many as we are. Volatility and risks are two constants traders must master all along.

The bottom line: risks are not equal to the losses. Smart speculation sees beyond failures.

Bear in mind that soldiers get into war with knowledge that they may lose everything – including life. Therefore, what matters isn’t the war. What matters is the more profound question of readiness. Smart enough, if you lose trades lesser than you win, you are the correct soldier/trader to leverage.

Scenarios with Leverage Ratio and Trading

Initial Margin and Margin Requirements- BCH/USDT

The initial margin is the minimal commitment to open position or place an order. Other circles refer to it as the initial deposit.

When trades go against your speculation, you receive a margin call.

Margin calls imply you have two options for your open position.

- One would be to close the position as soon as possible.

- The second would be to deposit funds into your account to hold the positions.

Remember that the deposits you make should remain above your minimum margin requirements. Only in rare extremes, you can purposely support the losses. If you have multiple positions open, close some. Closing them reduces obligations and helps to free the equity commitment to help you facilitate holding onto a position.

Benefits of using leverage

Leverage is only borrowing to trade. In the contemporary world, borrowing is a widespread model. Talk of taking mortgages for houses, financing for business assets, among other deals.

Within trading circles, leveraging presents around the number of times of multiples. Platforms allow you to magnify the initial margin towards your contract’s entire value you envisage per trade.

First, leveraging allows traders to save on tax deductions. Typically, authorities offer relief to traders across the board by allowing them leeway to trade without bother of tax cuts.

Second, and on an extensive scale, leveraging allows traders to magnify the probable returns.

Ordinarily, trading without leverage is impractical.

Therefore, the leveraging upwards enables opportunity magnification. And entirely, it’s the ability to make the extra gains that make the entire speculation industry so lucrative.

Caution: Opportunity goes with interest obligations. And in trading, the leveraging power is simply a powerful tool, which you must deploy tactfully. It conforms to the adage that- rights come with responsibilities, period.

The strategy for trading BCH using leverage

Every winning and professional trader has handy rules that they follow. Over time, they become accustomed to mastering the trends and can share summaries in winning strategies.

If you take on BCH/USDT contracts under BTC.com, ensure you meet and exceed the following three minimums, which should also form critical pillars to your trading.

- Diversify Risks: Platforms offer many assets for you to consider. Coupling the diversification with many choices, do not commit all your capital at once. Master the discipline and monitor a certain manageable number of trades at a go.

Ideally, if you plan to do a lot size equal to one, tame the greed. You can start by taking 0.1 or 0.2 lot-sizes for ten and five times, respectively. Well, it takes time, but it’s worth it to steer you off the over-trading mess.

- Always trend with the trend. This one is straightforward; never get to buy into the idea that you can only bear in a bullish trend. Give yourself an easy mind. Candlesticks are best for mastering the trends.

Over time, market actors sense trend reversions by merely looking at the behaviors of candlesticks.

On the same lines of thought, patience pays. If you know most of your winning trades happen within either bear or bull markets, take your time, a market can never go in one direction forever.

In online trading, what goes up must always come down, at one time or the other.

- Manage your losses all along. Being a professional and experienced trader is a relative term.

Bottom-line is trading is as easy as pressing the order button. But, you have to ensure that your winning trades outdo your losing ones. Analyze your past performance, or better get in someone to help you figure out things by broadening your mind map.

Brief guide – Trading BCH with leverage

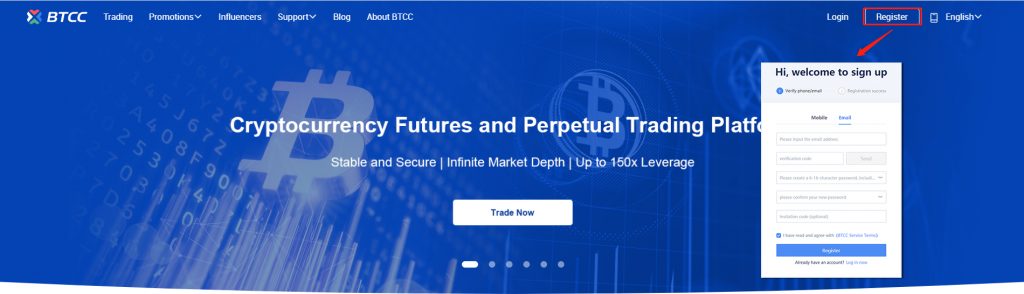

Trading BCH on BTCC is not an opportunity that’s not miles away to attain.

First you need to open a free account on BTCC.com and put down some USDT to your accout. The deposit amount can be as low as 0.5 USDT. Note: BTCC only support USDT deposit currently, if you don’t have USDT this article, What is Tether (USDT), and How to Buy It?, may help you.

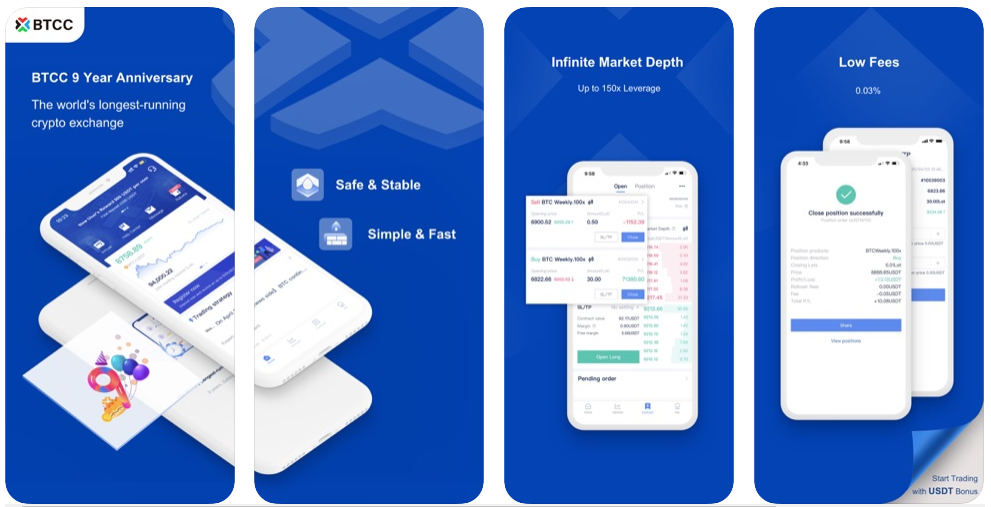

Also, BTCC has its iOS APP and Android APP so you can trade on the go.

Here’s what BTCC offers for BCH enthusiasts:

- First is daily contracts

- Second, is the weekly contracts

- The third is the perpetual contracts.

Please take note that the highest leverage cap is 150X for BCH positions.

Here’s a view of the schedule for BCH weekly contracts with settlement in USDT

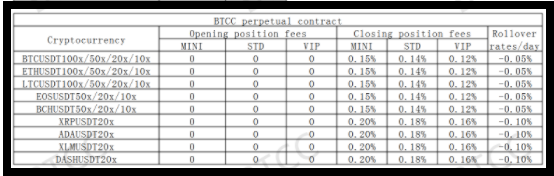

Better still view the BCH perpetual contract information here:

There’s one great reason that should spike your interest trading on BTCC. They do not blow their own trumpet, yet they rank among the top exchanges.

More so, BTCC holds on to the real purpose of crypto- anonymity by standing with the lowest Know Your Customer policy standards.

All you must do is verify your email or phone number, and your journey to trading on BTCC starts.

Mobile platforms are best if you are on long term engagements away from PCs like while on frequent travel.

Ideally, the BTCC mobile interface is pretty enough, giving you an almost similar interface with that on your PC – of course, with tweaks to help you access the same metrics more compactly.