How to Invest in Oil Futures

One of the major commodities that have propelled human civilization and global economies is crude oil.

Trading oil futures is one right way to speculate on the ebb and flows of crude oil price, apart from buying in oil Exchange Traded Funds and oil stocks.

Oil futures are derivative products, meaning their value is derived from the underlying price of crude oil.

A holder of oil futures has the right to trade crude oil (long or short) in units of a thousand barrels at a specified price with an expiration date.

Do you feel that the oil price will go up within a time interval, based on some strategy, then you can buy oil futures and look to sell at a date you project it to start slowing.

To get started with trading oil futures, you’ll need a regulated broker that’ll give you access to trade the product and, of course, a well-backtested trading strategy.

So, how do you buy oil futures?

- Get an understanding of the oil market Fundamentals.

- Come up with a strategy from a Historical backtest of the oil futures price.

- Choose a Broker/Exchange and Set up a Trading Account

| BTCC offers cryptocurrency futures trading (bitcoin futures, ethereum futures, litecoin futures, and more), enabling you to leverage crypto’s strong volatility to make a quick, heavy profit. |

Get an understanding of the oil market Fundamentals.

Trading oil futures, to be honest, is not for the faint of heart. The oil market can be very volatile, generally because of several fundamental factors.

Such factors include global demand, production, reserves, and ongoing research in green/renewable energy, OPEC decisions, and geopolitical interests.

Come up with a strategy from a Historical backtest of the oil futures price.

There are so many ways you can develop a trading strategy these days.

You can follow the machine learning and statistical analysis path by gathering and modeling relevant historical data that are indirectly or directly correlated to the crude oil market for insights and market bias.

What you’re looking for here is some form of causality.

Such data can be weather data, crude oil inventory data, and the vanilla crude oil price; the list goes on.

Another way to develop strategies is by deploying technical analysis like technical indicators, trend lines, and chart patterns on the crude oil price charts.

Such strategies can either be trend following or mean-reverting.

A simple Trend Following Strategy on the Brent Crude Oil Futures March 2021 (ICEEUR:BRNH2021)

The uptrend from the daily chart of the Brent Crude Oil Futures March 2021 was confirmed after the Relative Strength Index RSI entered overbought the (Level-70) on November 10, 2020, and continued to trade above the RSI’s Level-30, after an earlier bullish engulfing pattern.

Another crucial ingredient to consider in your trading strategy development is deploying the right risk and money management plan.

Money management concepts like the fixed fractional money management strategy can help with asset allocation and scaling up your trade capital.

Ensuring that a stop-loss order is set will help you avoid losing more than your maximum risk exposure per trade.

A trading strategy that gives a higher reward to risk ratio says 3X and an above-average win rate will guarantee consistent profits in the long term.

Haven discovered an edge and trading strategy for the crude oil futures market; you can proceed to carry out a forward test on a virtual demo account provided by a futures trading broker/exchange.

Choose a Broker/Exchange and Set up a Trading Account

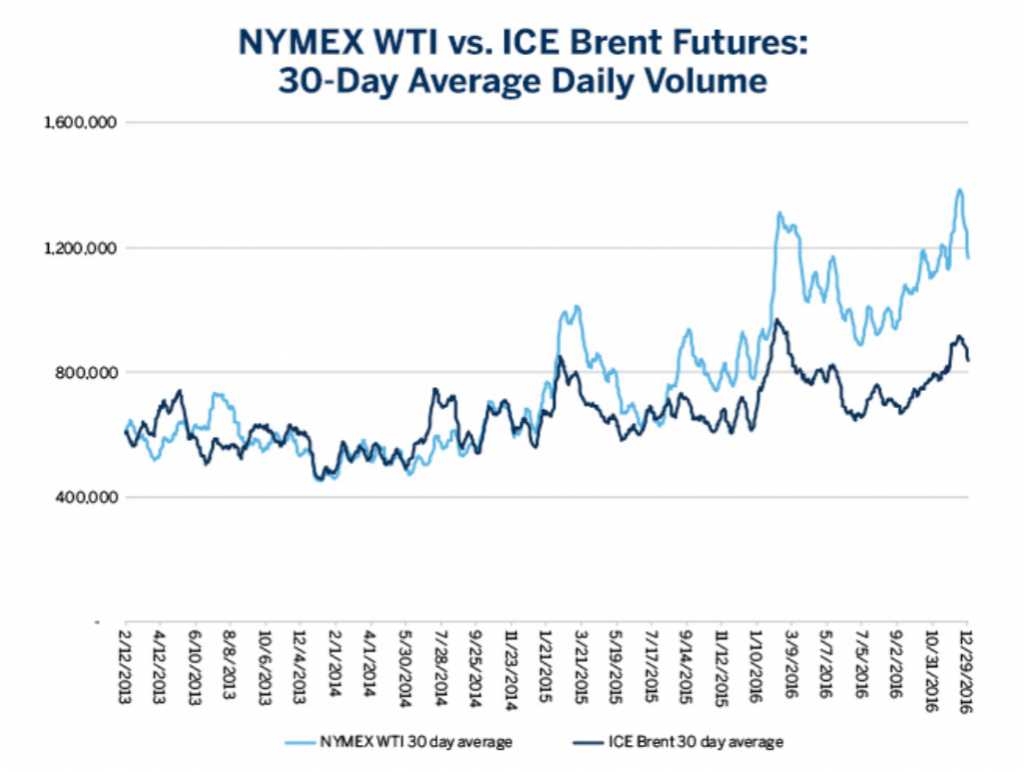

The Chicago Mercantile Exchange CME crude oil futures contract with ticker (CL) is the most traded, and you can get started on TD Ameritrade’s ThinkorSwim trading platform.

Each oil futures contract represents a thousand barrels of WTI – West Texas Intermediate crude oil.

Though most oil futures contracts are settled by cash, they can also be physically settled as specified by the futures contract’s seller.

Delivery of physical oil is made to Cushing, Oklahoma, even though oil contracts are mostly cash-settled.

You can also trade the Brent crude on the ICE – Intercontinental Exchange for (1000) thousand barrels.

Trading oil futures on brokerage platforms mostly requires approval, and you might be given permission to go ahead with trading oil futures or denied access based on your level of experience and understanding of the risks involved.

Following your broker’s successful approval, you will have to deposit a 2% to 5% cash equivalent of the futures contract, know as a performance bond. It is done to ensure you have the financial capacity to hold the futures contract.

Next, you need to provide an initial and maintenance margin amount to open a trade, which may vary depending on your deposit balance and the futures contract’s price.

Conclusion

Getting started with oil futures trading requires that you have a substantial minimum deposit compared to trading other assets.

Although it’s easy to click the buy or sell button on a trading platform, the actual process of analyzing the underlying crude oil market requires in-depth knowledge and research into the macroeconomic drivers and chart patterns of crude oil price.

Short term holding strategies can benefit from the huge swings in the oil market, and brokers like Interactive Brokers offer low requirement on margin for day trading.

Deep pocket investors can also hold and profit from mid to long-term positions on oil market trends and stomach huge swings prevalent in the oil market.

| BTCC offers cryptocurrency futures trading (bitcoin futures, ethereum futures, litecoin futures, and more), enabling you to leverage crypto’s strong volatility to make a quick, heavy profit. |