Bitcoin Leverage & Margin Trading: How to Do It Right in 2021

Updated on Mar 9, 2021.

Bitcoin prices swing in value, and if you are a smart trader, you can reap big.

In the history of BTC, 2017 was an epic year. Why? BTC sprung from $900 to a $20,000 all-time high. And since March 2020 there was another stronger upside growth of BTC price, from $5022 to the peak price of $56,284!

Trading crypto is a big opportunity, and all you require is the right mindset and the correct timing. Most forex brokers provide crypto-assets as part of portfolio diversity. And better still, allow traders opportunities to reap from their efforts and experience and market shifts.

Let’s dig deeper

- Explanations of the Bitcoin leverage and margin trading

- Getting more out of the BTC bullish cycle with leverage

- Possibilities of shorting the BTCUSDT

- Chart patterns/market structures to look out for when shorting the BTC on leverage

- Reducing your trade holding time when shorting in a bull market

- Practicing sound risk management by only investing a fixed percentage of your capital

Explanations of the Bitcoin leverage and margin trading.

Bitcoin leverage arises when traders take advantage of loan capital arrangements from the platforms.

In the end, both the trader and the platform owner gain from the high returns arising from a trade.

In actual terms, a trader with a verified account taking on BTC leveraging relies on margins levels the broker provides. And they vary across brokers.

The provision of leveraging and margining allows traders to take advantage of minute shifts and position their lot sizes to get reasonable returns. Trader’s capital and eventual returns grow faster with the model.

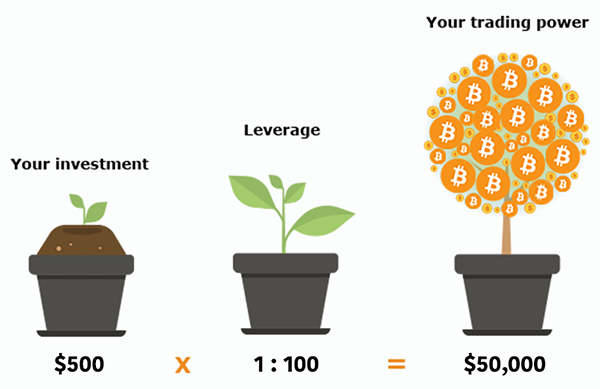

In better words, leveraging helps traders with small capital (margins) to qualify for trade positions requiring significant capital, as traders with actual capital for similar huge positions.

| You May Like: Go For A Free Account In Seconds On BTCC And Try Your First Bitcoin Leverage Trading. The Investment Threshold Is As Low As 0.5 USDT. |

Consider BTC Leverage and Margin Trading by way of an Illustration:

You want to purchase 10 Bitcoins, and each goes at the rate of $10,000.

To open a position to take on that trade on a traditional exchange: you require ten times $10,000 (10*$10,000) (Assume zero charges /commissions.

If BTC value shifts upwards with 5%, your 10 BTC will carry a value of $10,500 each.

Suppose you sell each (10 BTC @ a profit of $500) you net in a total of $5,000 from an initial investment ($ 10,000).

In reality, you are working with 1:100 leverage.

Recall, you’d have to finance 1% of the entire $100,000 position, which is $1,000 for the broker to allow you to open the trade. Even as you carry on with trade and BTC value fluctuates to the case above (5% upwards), you still rake in the profit amounting to $5,000.

That’s how leveraging works for you, even at considerably low costs and your profiting multiplies many times, giving a trade it’s worthiness.

Note: As a trader, you must have minimal capital, the margin. Brokers on varying terms allow you to leverage many times upwards.

Most standard brokers offer you leverage levels ranging from 1:10 to 1: 10,000 units of currency.

From a broader perspective, bursting past the BTC leveraging circles, authorities enforcing margin ranges are common. It’s a common safeguard to help stakeholders maintain interests within commonly acceptable and guided fronts.

Getting more out of the BTC bullish cycle with leverage

As cited earlier, there are techniques to doing this right. The level of leverage you take should be directly proportional to your trading experience and risk tolerance.

In addition to that, your trading leverage should also be inversely proportional to the time frame you’re considering for identifying the market structure and chart patterns.

It’s recommended to trade higher leverage from 10X and higher on lower time frames like the 1Min and 5Min time frames from experience.

We’ll recommend you start with a 5X leverage with the daily time frame as the minimum time frame, also as a way to get your feet wet.

We’ll consider both scenarios, starting with the higher Daily time frame and lower 5X leverage; then, we’ll finish off with a combination of the lower 1min time frame and higher 50X leverage.

Trend Trading Bitcoin Leverage with Leverage on the daily Time Frame using a 5X Leverage

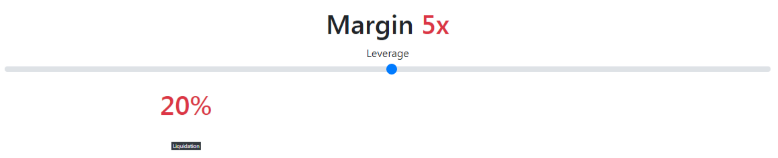

Some of you may wonder why we think a 5X leverage is optimal to trade the BTCUSDT on a daily time frame.

To answer that, it’s because the BTCUSDT moves on average 5% to 10% daily, and an account that’s leverage by 5X will get liquidated at a 20% slump or rise in the Bitcoin price.

Considering the daily chart overview of the BTCUSDT perpetual futures contract on the BTCC crypto exchange. You’ll observe that the crypto pair is clearly in a bull market as it first exited the oversold area and entered the overbought zone.

The next step is to scale into the uptrend by waiting for a price correction to the ten-daily moving average as illustrated above.

By taking 5X leverage on a 10,000USD account, your account gets buffered to 50,000USD.

So a 10% move on the BTCUSDT that would typically give you a return of 1000USD now gives you 5000USD with leverage.

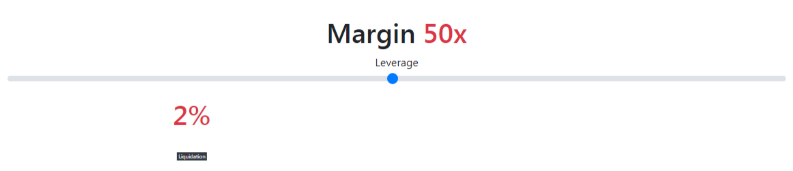

Divergence Trading Bitcoin with Leverage on the 1Min Time Frame using a 50X Leverage

Unlike the daily time frame that shows vast BTC swings that can be up to 10%, the 1Min time frame moves by an average of 0.1% to 1.5%.

Trading the 1min time frame can be tricky. Divergence patterns are quite reliable for spotting reversal points, and when used in combination with other price patterns, we can get reliable results.

The chart below illustrates a hidden bullish divergence that sends the BTCUSDT up by 1.18%, risking a 0.74% drop.

A 1000USD investment here with no leverage would give a return of

11.8USD. Meanwhile, the same 1000USD capital with a 50X leverage would give a 590USD profit.

Do you have a high-risk appetite? Then you may want to consider a 50X leverage after scanning for divergence setups on the 1Min time frame.

Possibilities of shorting the BTCUSDT

When you trade Bitcoin with leverage, new possibilities such as short-selling, which were not possible on the spot market, are unlocked.

Plus, the possibilities of scaling up your capital, short-selling Bitcoin can serve as a hedge to your spot BTC holding in a bear market.

With short-selling, you can wager on a likely slump in the Bitcoin price, and if you’re right with your forecast, you make a profit.

Chart patterns/market structures to look out for when shorting the BTC on leverage

The following chart patterns and market structures are our best picks when trading the BTCUSDT.

Divergence Patterns

Divergence patterns are flagged when we compare the price chart (main window) to any oscillator attached to the (sub-window) and notice a difference in the price and oscillator structure.

Divergence patterns are of two variants, being the regular divergence and the hidden divergence.

A regular divergence shows a change in trend, from a bullish trend to a bearish trend or a bearish trend to a bullish trend.

A hidden divergence confirms the continuation of a bullish or bearish trend.

Regular Bullish Divergence

Regular Bearish Divergence

Hidden Bullish Divergence

Hidden Bearish Divergence

Breakout or Breakdown of Inside-Bar Candlestick patterns

Inside-bar patterns are a combination of two candlesticks with the first candlestick AKA mother bar is longer than the child bar, and the child bar’s high and low are enclosed within the high-low range of the mother bar.

A price close above or below the child bar of an inside-bar candlestick pattern signals a buy or sell order.

Reducing your trade holding time when shorting in a bull market

Shorting assets like stocks and cryptocurrencies have the likelihood of unlimited losses if the upside momentum persists. As a result, you have to put a time limit to how long you want to stay in the short sell trade, especially in a bull market.

We mentioned the advantage of shorting Bitcoin in a bear market like the 2018 crypto winter, allowing you to profit from one of the most extended price slumps of the BTCUSDT.

Shorting the BTCUSDT is familiar to the bear market; however, it can also be profitable in a bull market if deployed correctly.

Consider these points if you want to short-sell Bitcoin in a bull market.

- Identify a bearish reversal chart pattern like a bearish divergence on either the daily or weekly time frame. Then, move to a lower 4hour time frame to spot another bearish signal that supports the daily chart’s bearish pattern.

- Finally, set a maximum holding time that you would like to hold the trade for where you are ok with locking in your profit or taking a minimal loss if the transaction does not move in your direction.

- You can also opt for the weekly Bitcoin futures contract here on the BTCC crypto exchange, as it automatically handles the time holding constraint for every open long or short position.

Practicing sound Money Management and Risk management

Here we’ll recommend a combination of fixed fractional money management on your entire net-worth and investing a fixed percentage of your fractional capital in a single trade.

Now, how does this work?

Ok, let’s assume you have a total of 10,000USDT (entire net-worth) to invest in the cryptocurrency market. Following the fixed fractional money management approach, you can allocate 20% of the 10,000USDT (2000USDT) for Bitcoin margin trading.

Doing this protects your account from a total wipe-out in case of massive price swings known as flash crashes that can be over 50% in some cases.

After putting aside the 2000USDT for margin trading, the next step is to risk only 5% of the 2000USDT (100USDT) on every trade as you’ll be applying leverage of about 50X and taking not more than one transaction per signal.

Let’s simplify the process:

(Start Here) 10,000USDT -> 2000USDT -> 200USDT -> 100USDT

So with a 100USDT and a 5X leverage, you get to trade 500USDT on the 1Min time frame as recommended earlier.

Still following capital allocation in our example, it is best if you did not risk more than 100USDT per signal generated targeting a 1% move in the Bitcoin price, and stop trading for the day if you lose two trades (200USDT) in a single day.

Finally, Go For A Free Account In Seconds On BTCC And Try Your First Bitcoin Leverage Trading. The Investment Threshold Is As Low As 0.5 USDT.