How to Buy More Ripple (XRP) Using Leverage

Leverage trading of Ripple (XRP) allows you to open positions with larger incomes than one would with capital on any ordinary exchange.

For one to leverage, there’s the mechanism of borrowing funds to trade. In ordinary circumstances, no financier is available to offer you the funds. But the fact remains; you require the margin for you to open positions to your advantage at any time.

Leverage platforms, therefore, allow traders to gain from the volatility of the values of Ripple at any time.

Market volatility always presents positions for XRP traders to take advantage of. The downside with leverage is that traders lose significantly as much as they would gain- in case a trade goes against them.

However, professional and established traders do not cower from the volatility, and the intriguing bit is, they keep winning trades much more than they lose. Therefore, we can say, for you to be an established XRP trader, you have to master using the double-edged sword- in better words -leveraging.

XRP Trading Platforms

As cryptocurrencies keep soaring into their second decade, margin and leverage trading have also increased. One of the best entrants into the market is the XRP crypto-futures via BTCC.com.

Pro-Points XRP Trading With Leverage

- Traders win big by the ability to open positions that are many times in multiples of the margin they commit.

- Leverage traders have opportunities to win and earn from slight movements in prices.

- Traders win either way- selling or buying when prices fall or rise, respectively.

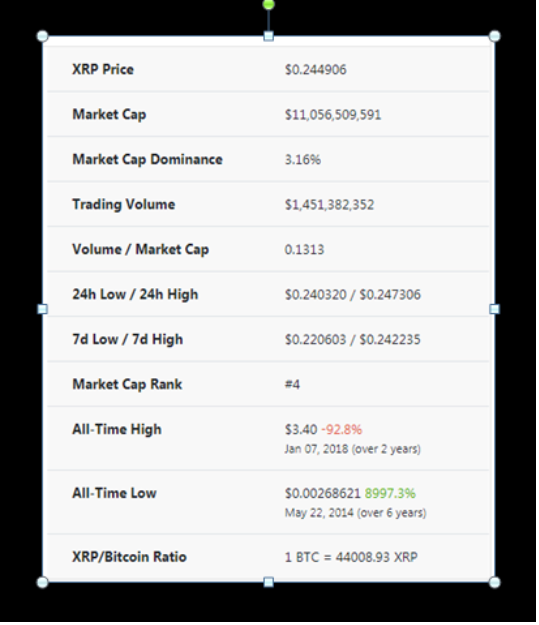

Ripple sits at position four, according to coingecko.com, which ranks digital assets by market capitation.

The advantages of investing in XRP futures contracts over in the XRP coins

Many crypto-analysts give speculators on Ripple a big future. And it’s, therefore, a key opportunity for both upcoming and well-established traders.

Here’s a quick refresh of the advantages of investing in both Ripple as cryptocurrency and its futures.

Affordability

As at the opening of quarter 4 of 2020, Ripple trades at $0.242941 per coin. That’s very low if you compare it against the prices prevailing through yar2018. Therefore, you stand chances of raking in a good number of XRP and hold on to them until the prices go high. It’s a natural occurrence across many investment fronts. There’ll come a time when Ripple won’t retail at such low values. And the bullish run will also have similar and cascading effects for stakes on XRP futures.

Traders have a high chance of reaping from gains in value into the future. Remember, Bitcoin had a similar curve when the coins were going for just a few bucks. The ideal situation is to have a more significant, optimistic, yet low-risk opportunity.

Ripple Offers Solutions Plus Creates More Opportunities

Ripple’s blockchain is the ultimate solution for institutions dealing with heavy financial transactions. Aside from creating avenues for capital channels, Ripple facilitates liquidity balancing across fiat and crypto-economies.

The newest entry into the arena is staking, and XRP futures are a massive opportunity for those with a masterly of speculation. With leverage, this brings on board added advantages across the board (from solopreneurs to institutional investors)

Values with cryptocurrencies are variables. The value fluctuations hit coil holdlers hard, contrary to stakes for XRP futures. Holding the coins means your value stake is never constant. If you trade on XRP futures, you get an opportunity to gain by speculation. Speculators have leeways to stay away from choppy markets and join in the trends and get good returns for it.

Ripple Has an Overall Good Score for Market Cap

Ripple scores more than 5% in the market when we compare it to Bitcoin. Therefore, comfortably sitting in the top 5leading digital-assets. Its market is growing, and with XRP futures coming into the picture. There’s more to gain with respect to resistance from unforeseen dips in market prices. XRP is maturing into a digital asset with sensitivity to standard market variables like gold does.

XRP Futures Mean More

Speculators find XRP futures among the risk-mitigating mechanisms available via BTCC.com. It means Ripple is here to stay. Ripple has fully-fledged departments helping entrench the agendas across global economies.

Brief Guide- Trading XRP Futures With Up to 150X Leverage on BTCC

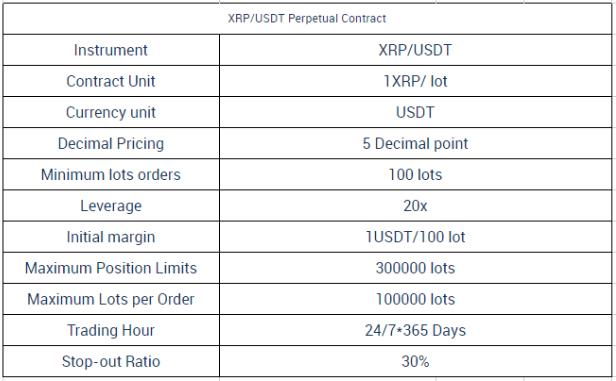

BTCC covers you at all timelines. You can stake on XRP futures on the following schedules:

- Daily

- weekly

- Perpetual contracts.

There are virtually limitless opportunities with opening positions with up to 150X of leverage on BTCC. And this suits you for all categories- daily or weekly or perpetual contracts.

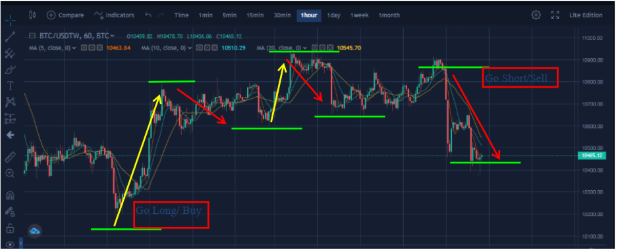

Trading on BTCC has a somewhat predictable feature. If you take time, you’ll notice the trend reversal points which create opportunities for entering positions (Buy and sell)

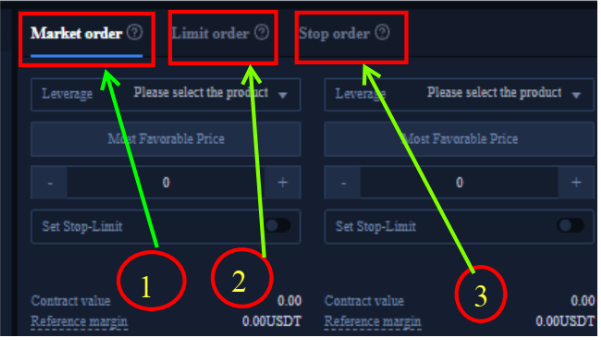

Suitable Orders to Make You Returns on BTCC

Virtually, there’s no reason you should go broke with XRP futures on BTCC.

- One, market orders help you get into a position in real-time. And it’s best when markets are trending.

- Second, Limit orders help you whenever you anticipate trend reversals. Look out for the breakouts and pin-bars with long tails to place your position.

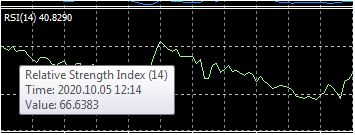

- Thirdly, stop orders help you when you are sure of trend escalation to a specific limit. And any position within the extremes will put you into profitable closes. For both stops and Limits, work with other indicators like Oscillators and the relative strength index (RSI).

| Do your first XRP futures trading on BTCC today. The deposit is as low as 2 USDT. And if your first deposit is over 500 USDT, you will get up to 2,000 USDT bonus. |