Trading Bitcoin (BTC) vs. Other Available Commodity Options?

- Why bitcoin over other commodities?

- What are the benefits of trading Bitcoin futures?

- Comparison of Bitcoin vs. other commodities.

Traders are always looking forward in finding such available financial assets which they can trade for making profits – the making money being the basic aim of their trading. Factors that tend to impact the decision for choosing a particular asset for trading includes the volatility offered, the prospects involved, the costs associated with trading, platform of brokers offered, past-performance with historic data availability and correlations to moving capital markets globally.

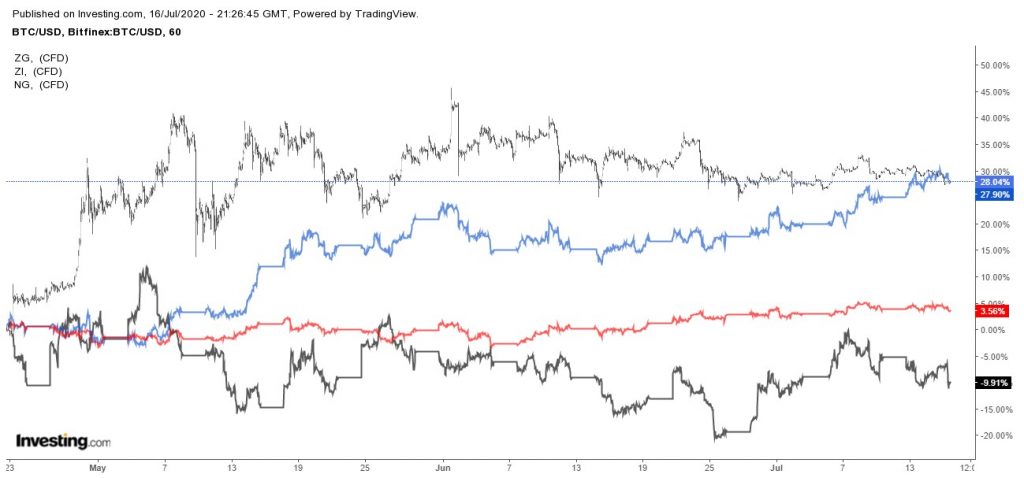

Apart from the currency trading (the Forex), there are many available assets that have future trading available globally. These include the CRUDE (WTI, Brent), Gold, Silver and Natural Gas as amongst the most commonly traded commodities globally. Let us make a 3-YEAR comparison of the Bitcoin with these commonly traded commodities:

The above comparison of Bitcoin is prepared with comparison to Gold Futures (red colour), Silver Futures (blue colour), WTI futures (yellow colour) and Natural Gas futures (black colour). Having compared them all to Bitcoin, let’s be honest. None of them come even close to the Bitcoin’s movement during the previous few years.

Some people may argue that now that the Bitcoin has risen, the volatility of Bitcoin tends to be lesser. To compare that, let’s analyze a shorter time-frame:

Comparing the last 18-months on the chart, we still see that the Bitcoin has won in the volatility offered to the traders to mint money through their trades.

Having Bitcoin win in the volatility point, let us now compare other aspects to “what makes Bitcoin the right asset for trading”:

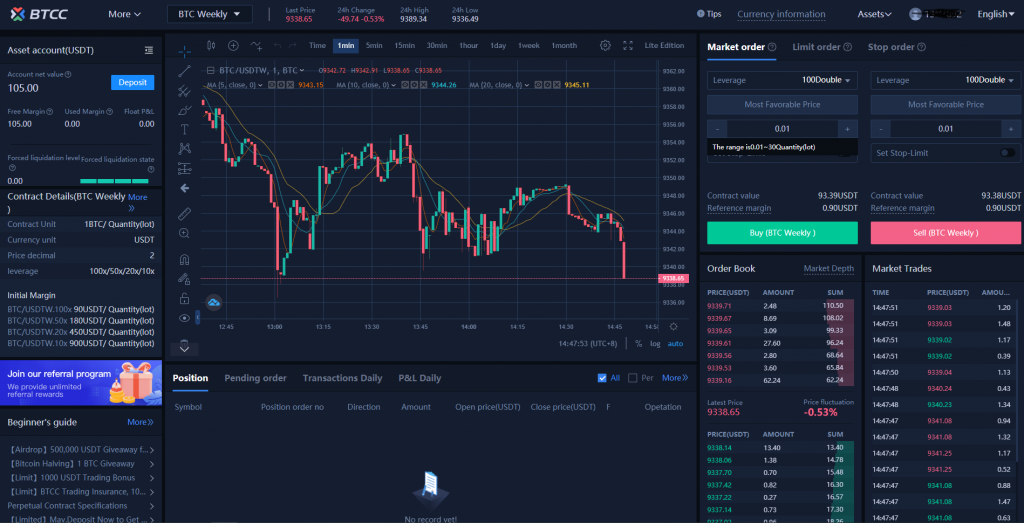

The platforms: There are various platforms available through the globe which can be used for owning and trading a Bitcoin. Whether you are looking to trade or own the Bitcoin, it is as easy as ABC for opening an account with platforms such as BTCC.com (BTCC has a signup process which takes less than 30 seconds!) On the other hand, if you have to trade futures of commodities, you are to open an account with brokers which is a long-procedure requiring many steps.

The prospects: Bitcoin moves on a supply-demand rule and as the situation changes and a buyer’s/seller’s side tends to take strength, the price moves accordingly. With world moving towards the digitalization, digitization and virtual currencies, Bitcoin holds a strong perspective of replacing as a medium of exchange for many business terms.

Available historical data: The data available for Bitcoin is too common and available for everybody. Many of the platforms are also offering graphical data with charting tools for traders to pick their trades easily.

Correlation to Capital Markets globally: Drawing out correlations for Bitcoin, to surprise Bitcoin tends to have correlations with many other commodities and indices of the world! If someone knows how to trade technically, the correlation can actually lead the trader to earn many good trades based on the forecasted movements of the capital markets!

Associated costs: With too many competitors having entered the field around the globe, the competition seems to be intensifying and the trading platforms are now offering trading at a very low price! The contract costs of future trading options are even lower.

The liquidity: An important aspect that the trader considers before entering any particular commodity or asset is the liquidity that the market holds, making the entry and exit easier. The more the liquidity, the easier it is for the trader’s orders to be filled. Convenience is the game of attraction for traders and liquidity in the market is a very important aspect. With traders all around the world playing-out their trades, the Bitcoin market has enough liquidity to easily take orders worth billion dollars in a single hour!

Considering all the factors above, the Bitcoin takes a lead on most of the factors that a trader would consider before taking into account which asset to trade. But, most important of all the “volatility” is what keeps the Bitcoin into the game. Let’s discuss the volatility of Bitcoin further:

Bitcoin’s volatility on the hourly chart for the last two months is right in front of you. Is there anything further left to confirm based on facts and figures provided?

Volatility is the trader’s friend. The more volatile an asset is, more are the opportunities available for minting money for the traders. Be the long-side or the short-side, trader is concerned with the movement of the highest capacity to take his position for! What more of a volatile asset would you find to trade?

Given that Bitcoin also has future contract options available at a petty low cost globally where you can take as much leverage as a 100x to trade (BTCC provides a 100x leverage on the future contracts for trading) where perpetual delivery is also available now.

Additionally, have you thought about storage costs? Given that you want to take delivery of the asset (let’s say the contract expires), what would you do? You can’t store Crude, Gas, or gold/silver stacked into your homes, right? There would either be a problem with the storage or the security costs. But, Bitcoin? Secure wallets that could fit into your pockets are enough to allow you to store your Bitcoin assets!

If you are looking to trade Bitcoin, you might want to check the BTCC! It takes lesser than 30 seconds to open an account with them, give you more than 9 pairs to trade for future contracts, allowing you more than 100x to leverage out your trades.

You can start trading with as low as a $100 for trading. Not just that, you are to receive a $1,000 signup bonus. Is this an opportunity you would want to miss?

Disclaimer: There are risks attached in investing, trading and speculating. With hefty gains, there is always a risk of losing your money given that you are not adequately taking care of it. It is still the right attitude to ensure that you follow safety measures which could include using technical entries, stop loss(es) and targeted exits. Understanding leverage is significant. Consulting your independent financial advisor before entering into any commercial trade may remain an excellent option to consider.