VIRTUAL Price Gains 15% Amid Continued AI Agents Hype

Technical indicators like RSI and BBTrend show that bullish momentum remains, but signs of cooling suggest potential resistance ahead. The strength of VIRTUAL price current trend in the coming days will determine whether it reclaims $5 or faces a correction to key support levels like $3.73.

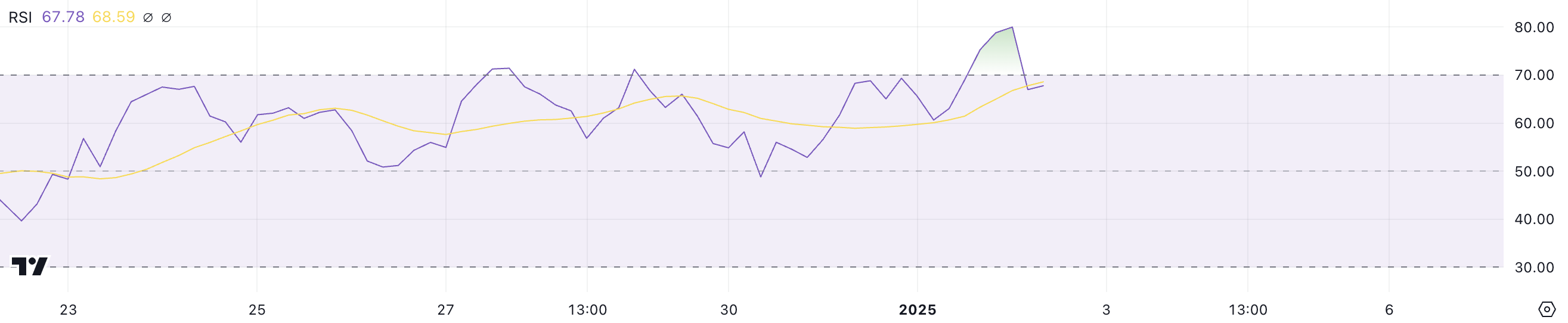

VIRTUAL RSI Is Close to Overbought

VIRTUAL Relative Strength Index (RSI) has cooled off from its recent overbought level of 80 and is now at 67.7. This shift indicates that while the intense buying pressure has subsided, bullish momentum remains strong as the hype around artificial intelligence on crypto continues strong.

An RSI of 67.7 places VIRTUAL just below the overbought threshold of 70, signaling that the asset is still in a bullish phase but approaching a level where caution might be warranted as it nears potential resistance.

The RSI is a momentum indicator that measures the speed and strength of price movements on a scale from 0 to 100. Readings above 70 indicate overbought conditions, often signaling a potential pullback, while readings below 30 suggest oversold conditions and the possibility of a recovery.

With RSI at 67.7, it suggests that the VIRTUAL price may still have room for short-term gains but could face increased selling pressure if the RSI climbs back into the overbought zone.

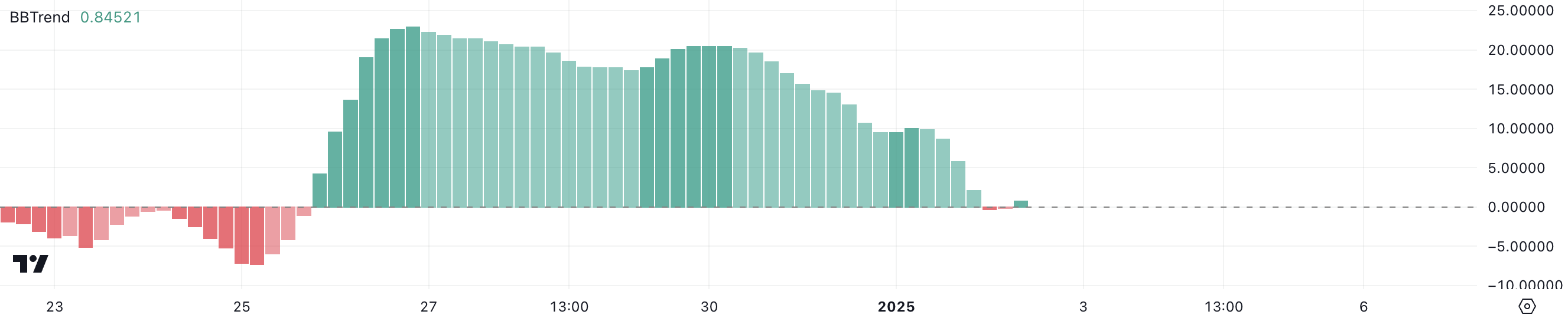

VIRTUAL BBTrend Sits Below Recent Levels

VIRTUAL BBTrend was positive and strong between December 25 and January 1, reaching a monthly high of 22.9 on December 26. However, the indicator turned negative on January 2, dropping to -0.34, before recovering slightly to its current level of 0.48.

This shift suggests that while bullish momentum has diminished, the recovery back into positive territory indicates that selling pressure may be easing, allowing for potential stabilization in the short term.

The BBTrend, derived from Bollinger Bands, measures the strength and direction of a trend. Positive values indicate upward momentum, while negative values suggest downward momentum. With VIRTUAL’s BBTrend now hovering at 0.84, it signals a modestly positive but weak trend, implying that while the market sentiment has not fully turned bearish, there isn’t enough strength to drive a significant rally.

In the short term, this could mean that VIRTUAL price may consolidate or see only limited upward movement unless stronger momentum builds to reinforce a clearer trend direction.

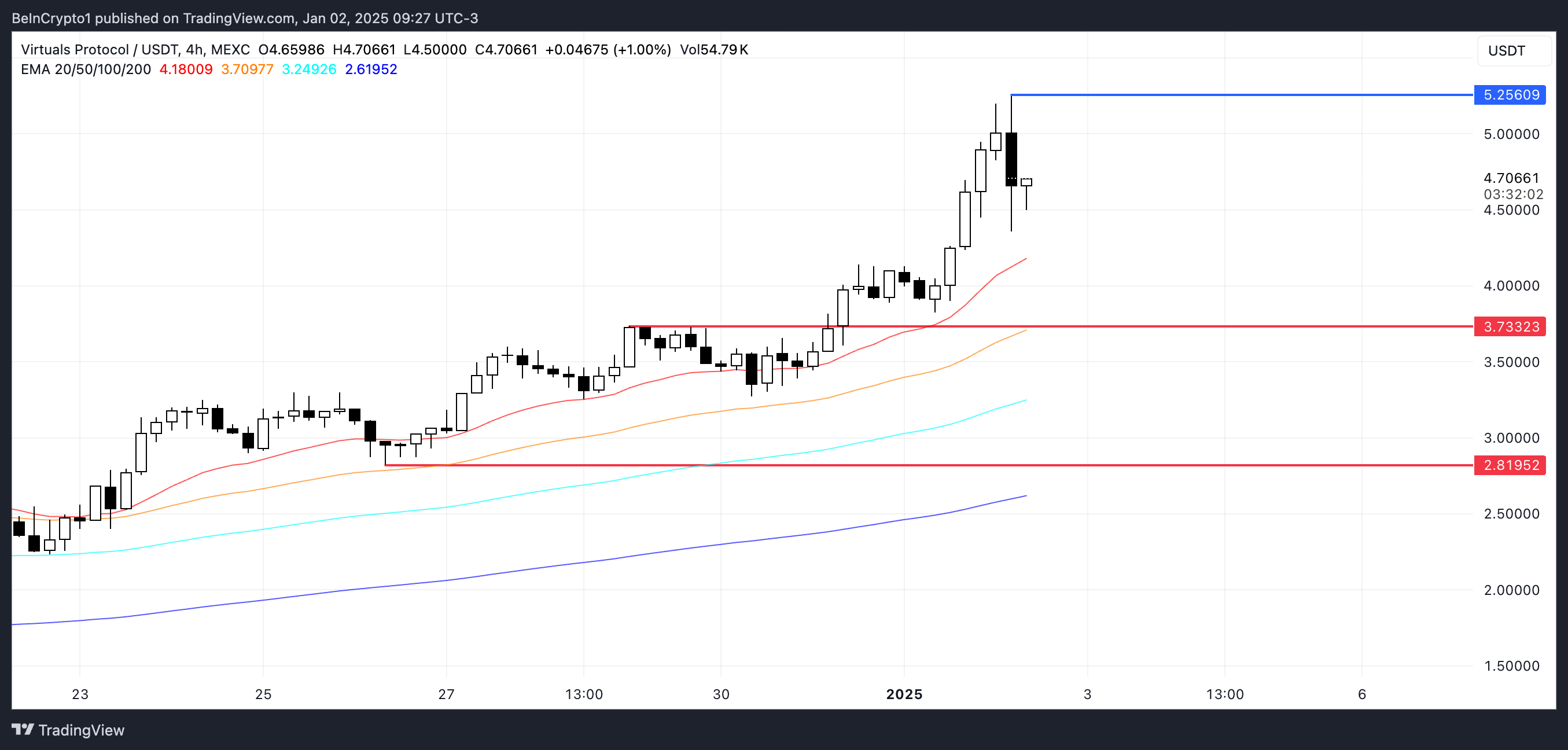

VIRTUAL Price Prediction: Will It Recover $5 Levels?

VIRTUAL price has been setting new all-time highs over the past few days, surpassing $5 for the first time on January 1, 2025.

If the current uptrend strengthens, VIRTUAL price could reclaim the $5 level and potentially test higher targets around $5.25, signaling continued bullish momentum. Such a move would further cement VIRTUAL as the biggest AI crypto in the market.

However, as indicated by the BBTrend, the current uptrend shows signs of losing strength, raising the possibility of a reversal. If a correction occurs, VIRTUAL price could test the support level at $3.73, and failure to hold this support could lead to a sharper decline toward $2.81.