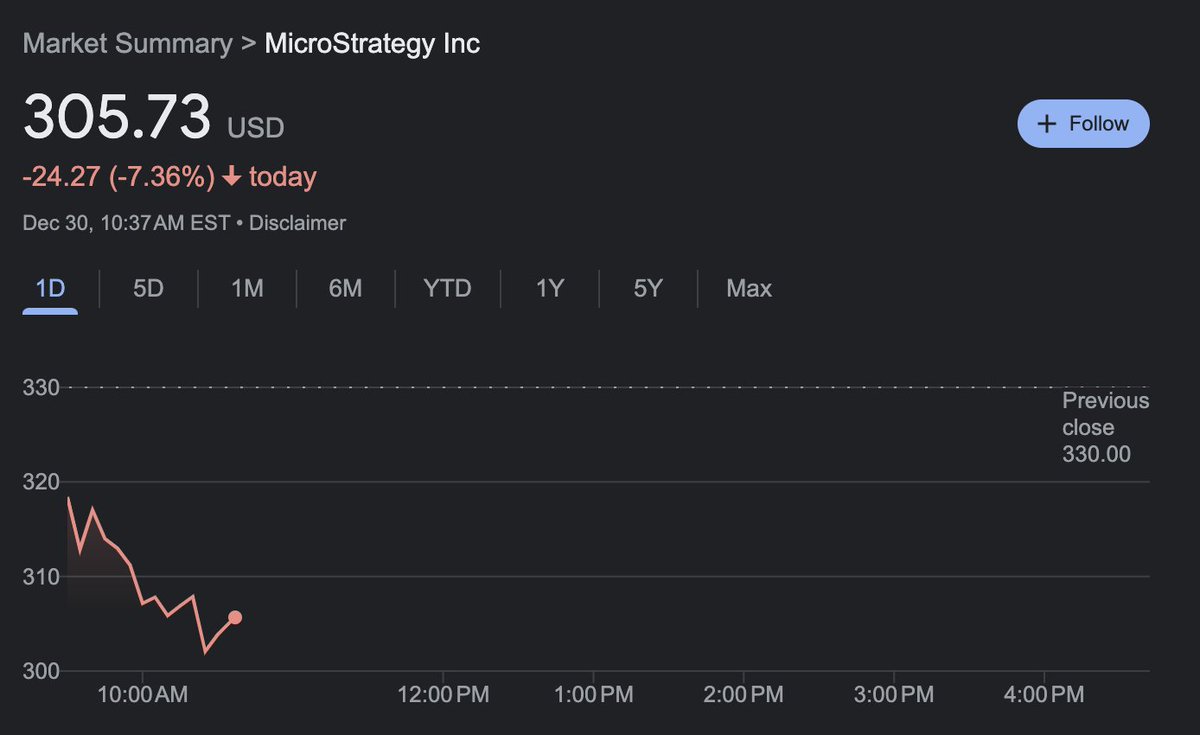

MicroStrategy acquires 2,138 more Bitcoins as its stock and BTC both continue tumbling

MicroStrategy is at it again, like clockwork, even as market correction deepens. The company just dropped $209 million to scoop up 2,138 more Bitcoins. This is week eight of their nonstop Bitcoin shopping spree.

The SEC filing shows that MicroStrategy paid an average of $97,837 per Bitcoin between December 23 and December 29, when prices slid from their all-time highs of over $108,000.

While the company is laser-focused on Bitcoin, its stock price is not feeling the love. MSTR has tanked 45% in the past month. In that same timeframe, Bitcoin itself is up about 1%.

Michael Saylor, MicroStrategy’s co-founder and chairman, seems hell-bent on making MicroStrategy synonymous with Bitcoin. And why not? The company’s obsession has helped push its market cap past $80 billion, even landing it a spot on the Nasdaq 100 Index. Oh, it has been an outstanding year for MicroStrategy.

The company plans to raise $42 billion over the next three years by selling stock and issuing convertible debt. In just two months, it’s already hit two-thirds of that target. At this rate, they’ll likely smash through their capital goals well ahead of schedule.

But here’s the twist: Hedge funds are jumping into the mix, using MicroStrategy’s convertible bonds for some financial acrobatics. They’re buying bonds and shorting the company’s shares, playing the volatility game and betting big on chaos.

Meanwhile, MicroStrategy is asking shareholders for permission to issue more Class A common and preferred shares. Bitcoin, on the other hand, is consolidating NEAR the bottom of its one-month range. December’s returns were a modest 4.8%, and January’s are shaping up to be similar at 3.3%.

Ethereum did alright too, climbing 30% in Q4, while Bitcoin posted a solid 48% gain. But the current market is anything but exciting, and the numbers suggest things might stay quiet until February.

Meanwhile, options traders are showing some interest in the long game. Calls for March are seeing strong demand, with a flurry of 120k-130k contracts bought just last week. But for now, the short-term market feels like it’s on pause.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.