Learn

Support

- USDT-M Perpetual FuturesTrade futures contracts settled in USDT

- USDT-M Perpetual Futures ProBETATrade futures contracts settled in USDT

- Coin-M Perpetual FuturesTrade futures contracts settled in cryptocurrency

- Demo Trading100,000 USDT virtual fundPractise trading USDT-margined and coin-margined futures

- Trading ArticlesRead all the guides about futures trading

Scan to Download App

Download Options

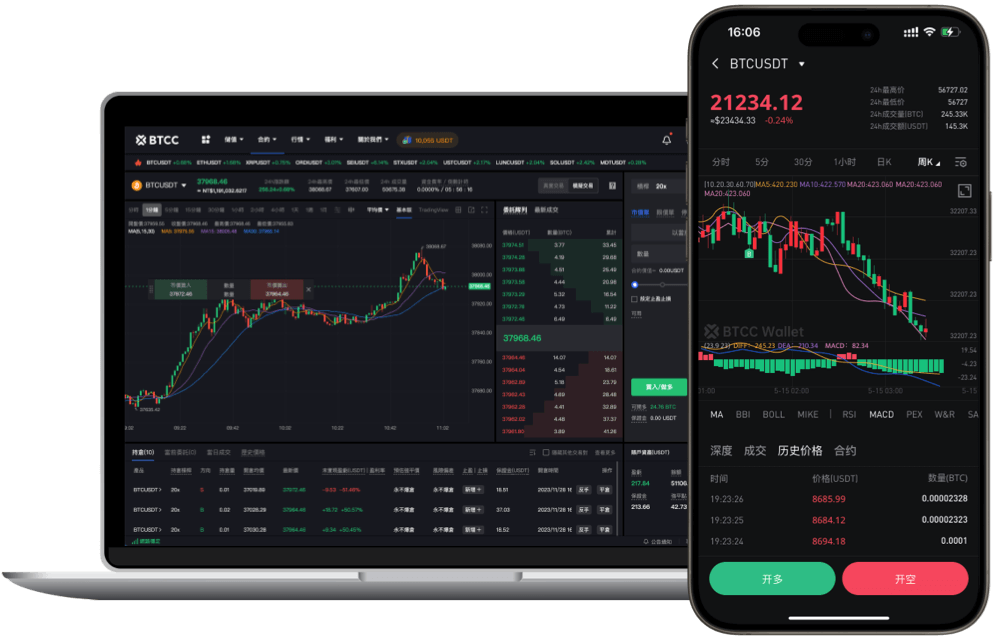

Futures Trading

Popular derivatives with up to 500x leverage. Go long or short based on market trends, offering profit opportunities as long as there is volatility.

Spot trading

Trade Cryptocurrencies Freely

Copy Trading

Make large gains with little capital.

Trade anytime, anywhere

Why choose BTCC

Exchange for a better future

Latest news

Need help?

BTCC Academy

Get all the latest crypto trading information you need to know for free.

Support Centre

See our FAQs for more information about fees, futures trading, and more.

Live Chat

Our dedicated specialists are here 24/7 to answer any questions you may have.

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved