Recommended

How to Trade Litecoin (LTC) Futures on BTCC

For nearly immediate and cheap monetary transactions, Litecoin (LTC) is the cryptocurrency of choice. LTC is built on an open-source cryptographic system that allows for decentralized creation and transfer. In October 2011, the Bitcoin block was forked in a way that would become the Litecoin blockchain. That’s why the Litecoin protocol is so similar to Bitcoin‘s.

What is Litecoin (LTC) Futures

To buy or sell Litecoin at a specified future date and price is to enter into a Litecoin Futures contract. The value of the futures contract is based on the price of Litecoin, the underlying cryptocurrency. As a result, the value of a Litecoin futures contract follows the value of Litecoin rather closely.

Therefore, futures trading is an alternative to buying and selling the underlying cryptocurrency (aka spot trading). It is possible to make a profit in spot trading by purchasing Litecoin at a cheap price and then selling it when its value rises. However, you can only make money with this transaction if the price of Litecoin is rising. Spot trading is unavailable, however, during a down market. Further, in spot trading, you cannot use leverage.

Futures trading for Litecoin has a number of advantages over spot trading, including the option to long or short the cryptocurrency and to gain access to leverage.

| Download App for Android | Download App for iOS |

Why Trade Litecoin (LTC) Futures

- Contracts for the purchase and sale of a predetermined quantity of Litecoin (LTC) at a predetermined future price and on a predetermined future date and time are known as “Litecoin futures.”

- In this way, you can learn about Litecoin without ever having to buy any.

- Futures provide Litecoin holders the opportunity to protect themselves from price fluctuations.

Why Trade Litecoin (LTC) Futures on BTCC

To trade LTC futures, you can choose BTCC crypto exchange.BTCC was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone.

We specializes in crypto futures contract trading, offering perpetual futures contracts. The maximum leverage offered by BTCC for daily futures contracts is 150x. The vast variety of futures offered by BTCC accommodates the trading habits and objectives of both novice and seasoned traders.We offer the USDT-margined futures and Coin-margined futures . Users can trade futures using USDT or cryptos like BTC, ETH, and XRP. And Large orders of up to 300 BTC can be executed at the top price levels.

Here are the main advantages of using the BTCC crypto exchange to trade LTC futures:

- Largest variety of futures: Daily and Perpetual futures

- Flexible leverage from 10x to 150x

- Lowest trading fees 0.03%

- Industry-leadingmarket liquidity

- Plenty of campaigns to win exciting rewards

| Download App for Android | Download App for iOS |

How to Trade Litecoin (LTC) Futures on BTCC

STEP 1: Open the webpage of BTCC futures trading

STEP 2: Choose the type of LTC futures

STEP 3: Select the order types

STEP 4: Choose the level of leverage

STEP 5: Choose the lot size

STEP 6: Set take profit and stop loss targets

STEP 7: Choose the price direction: Buy when you are bullish, Sell when you are bearish

STEP 1: Open the webpage of BTCC futures trading

Register a free account at BTCC in seconds, and make your initial deposit. You can start to trade with the minimum deposit of 2 USDT. If your deposit amount is greater than 500 USDT, you can receive up to 2,000 USDT bonus.

STEP 2: Choose the type of LTC futures contract

Select the weekly contract or perpetual contract of LTC at the top of the page.

STEP 3: Select the order type

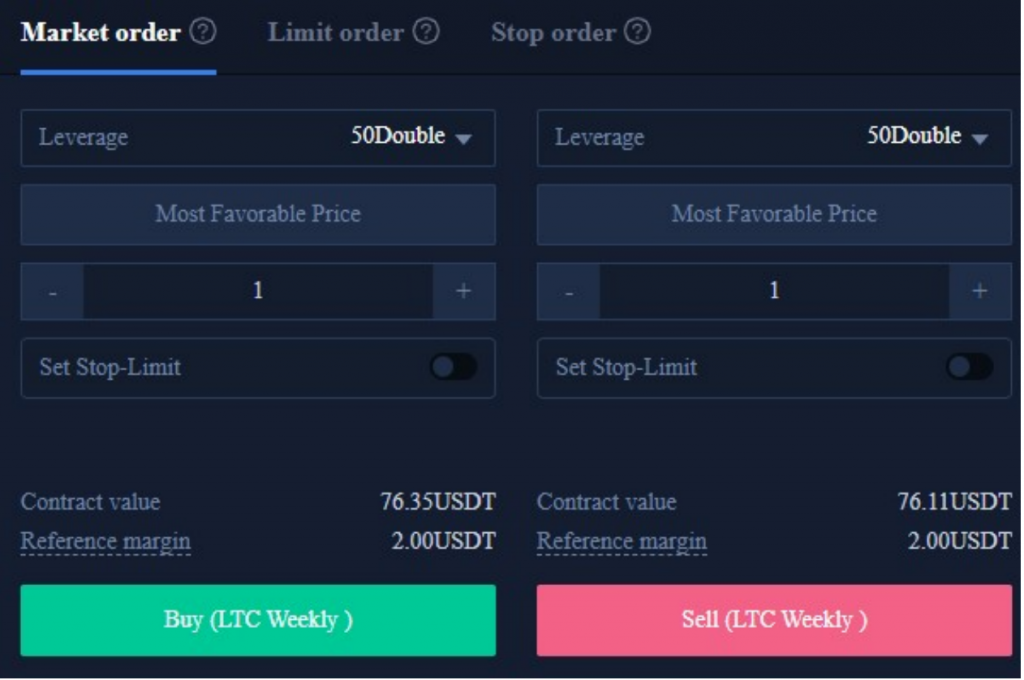

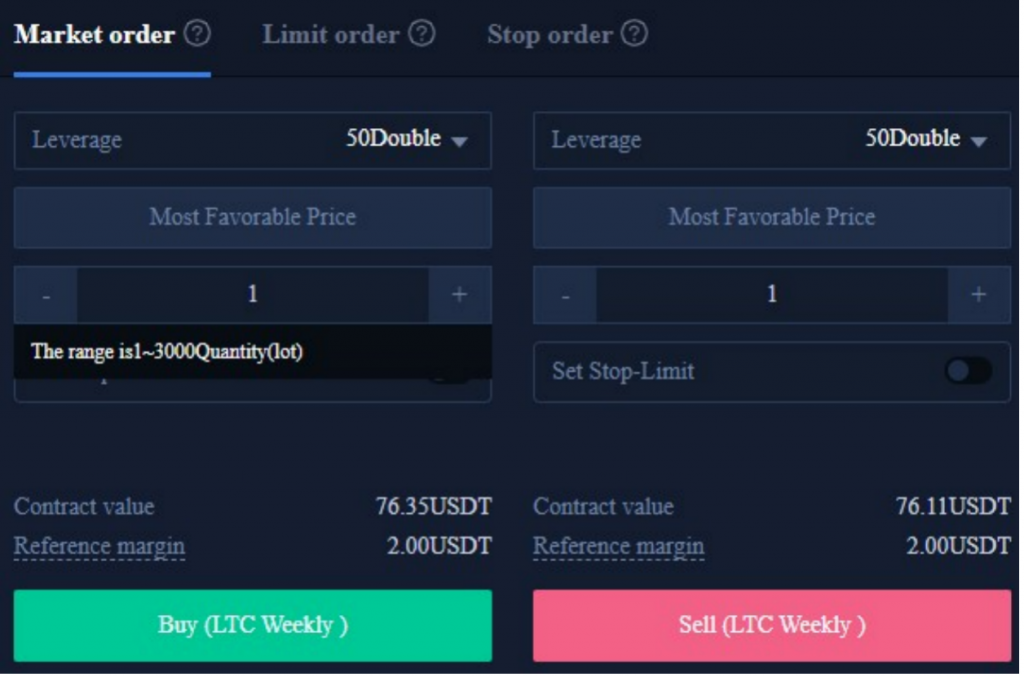

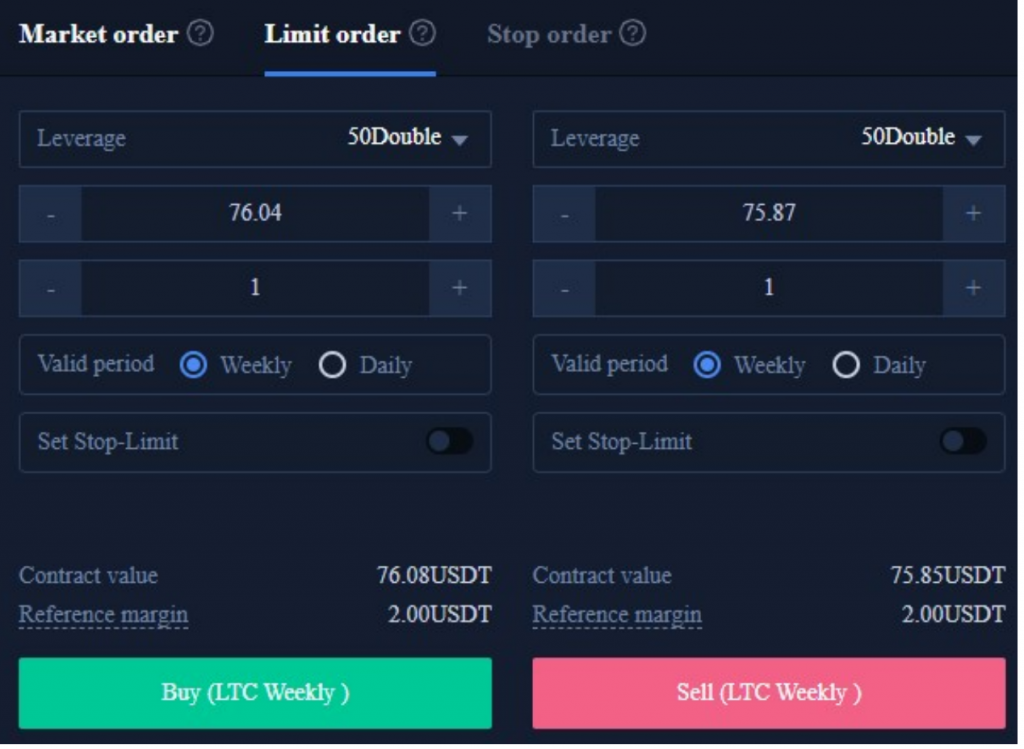

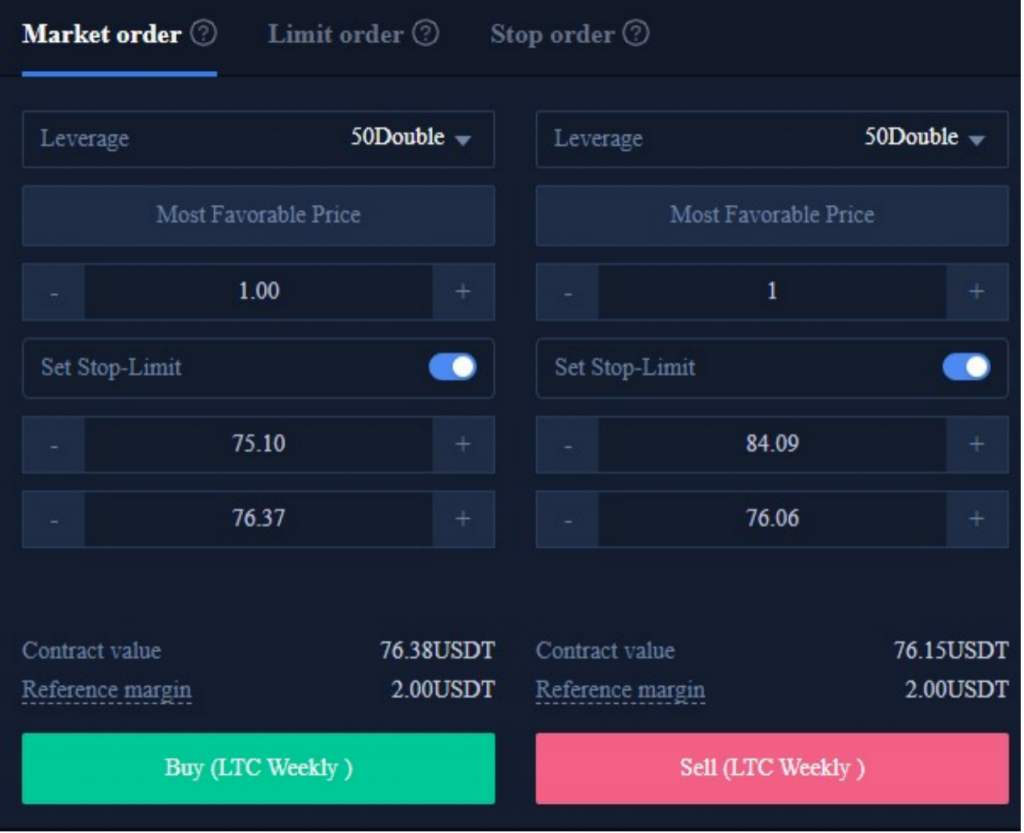

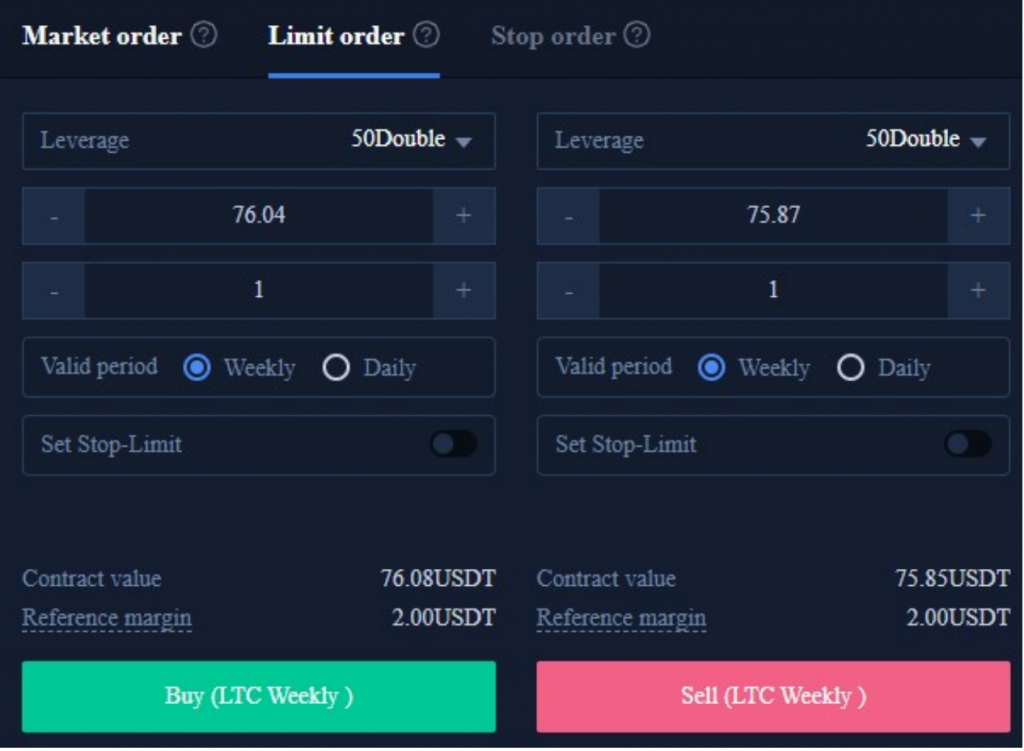

Select the order types for LTC at the top right of the page. The order types at BTCC included market orders, limit orders and stop loss orders.

- Market orders: Users place orders at the best current price to execute buy or sell order instantly.

- Limit order: A limit order is a type of order set by the trader to buy or sell at a specified price level or better. The buy order will be executed at the limit price or a lower one, while the sell limit order will be executed at the limit price or a higher one. The limit order can be seen by the market, which has given the opportunity for market participants to fill the buy or sell order.

- Stop order: A stop order, also known as the stop-loss order is a type of order set by the trader to buy or sell at a specified price level. The order will be executed automatically after a certain price level has been reached.

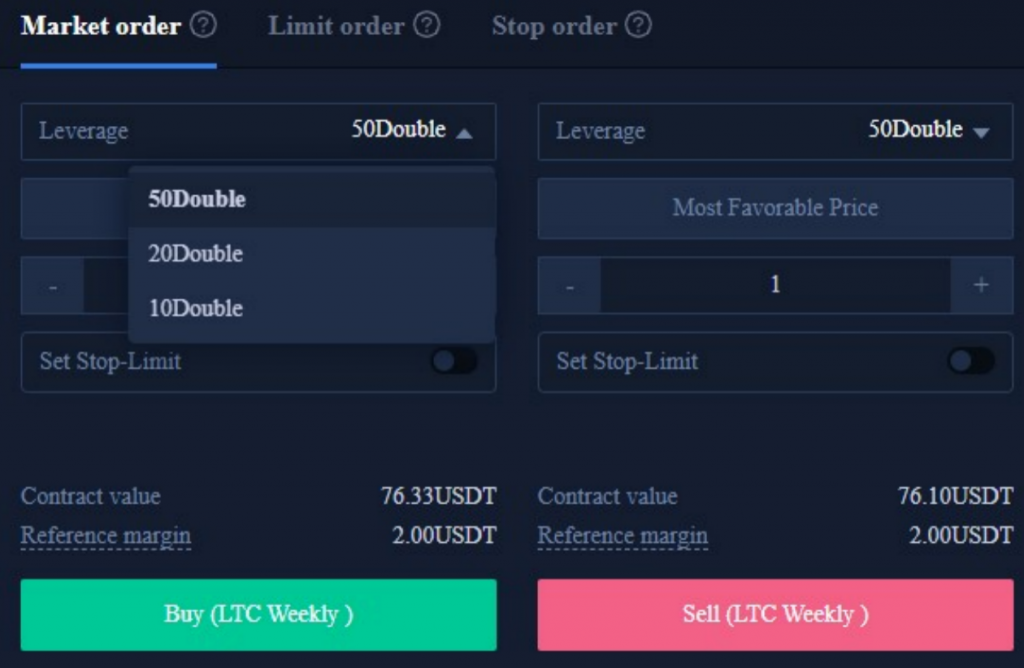

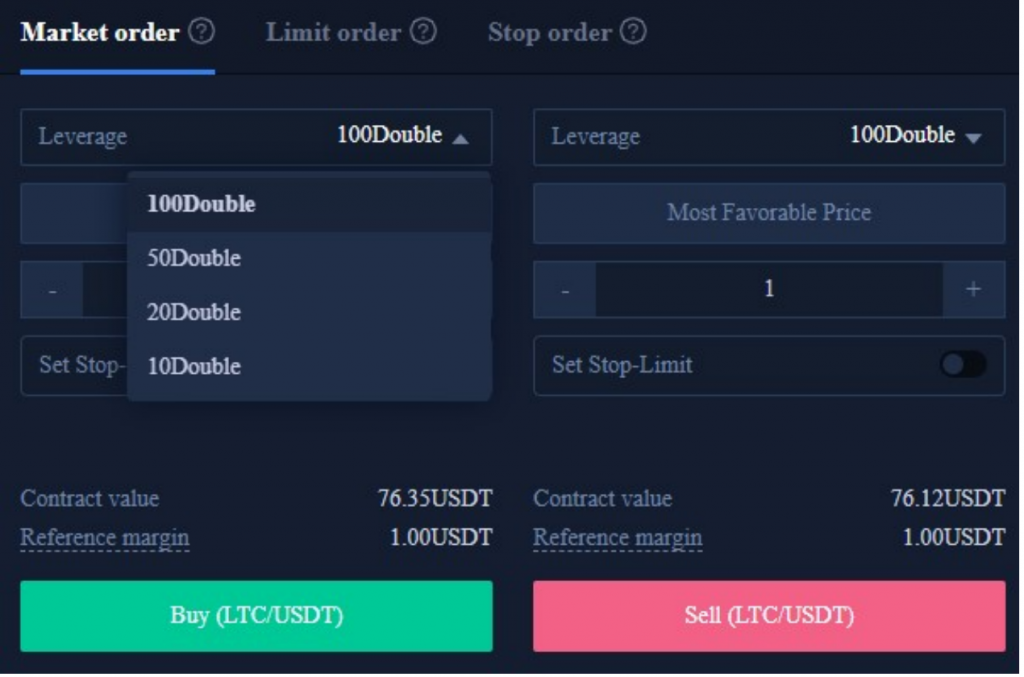

STEP 4: Choose the level of leverage

You can adjust the level of leverage based on your need. For example, the leverage of LTC’s weekly contract included 10x, 20x, 50x, and up to 100x leverage.

STEP 5: Choose the lot size

Trader can select the lot size based on his need, and the lot size of LTC futures ranged from 1 to 3000 lots. Below are contract values from real-time data and insurance fund for reference.

STEP 6. Set take profit and stop loss targets

Market orders, limit orders and stop orders can used to set stop-profit and stop-loss price targets. The difference is that market orders can be executed immediately at the best current price, while limit orders and stop orders can only be executed at the price within a day or during the week.

STEP 7. Choose the price direction: Buy when you are bullish, Sell when you are bearish

After setting up the basic data information, users can choose to buy (open long) or sell (sell short) after entering their desired price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the LTC order is completed.

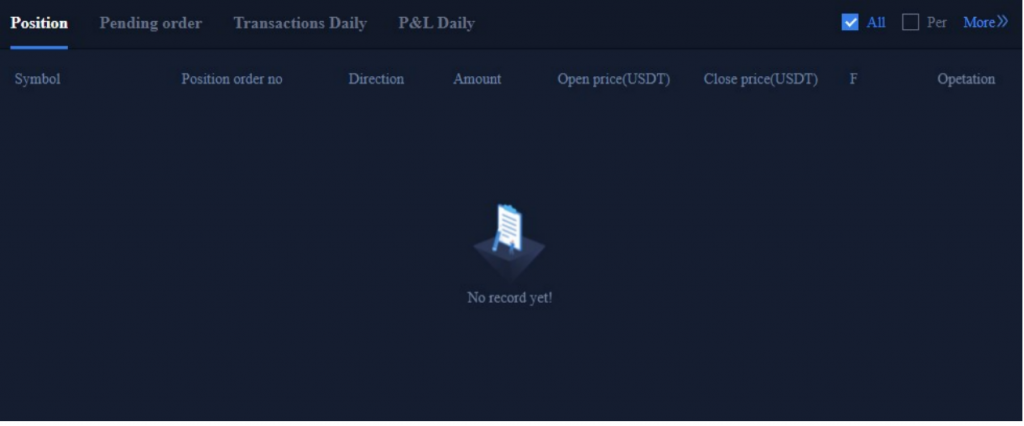

After the contract order is completed successfully, you will be notified at the bottom of the position page; if there is no contract order to be executed, it will be displayed at the bottom of the pending order page.

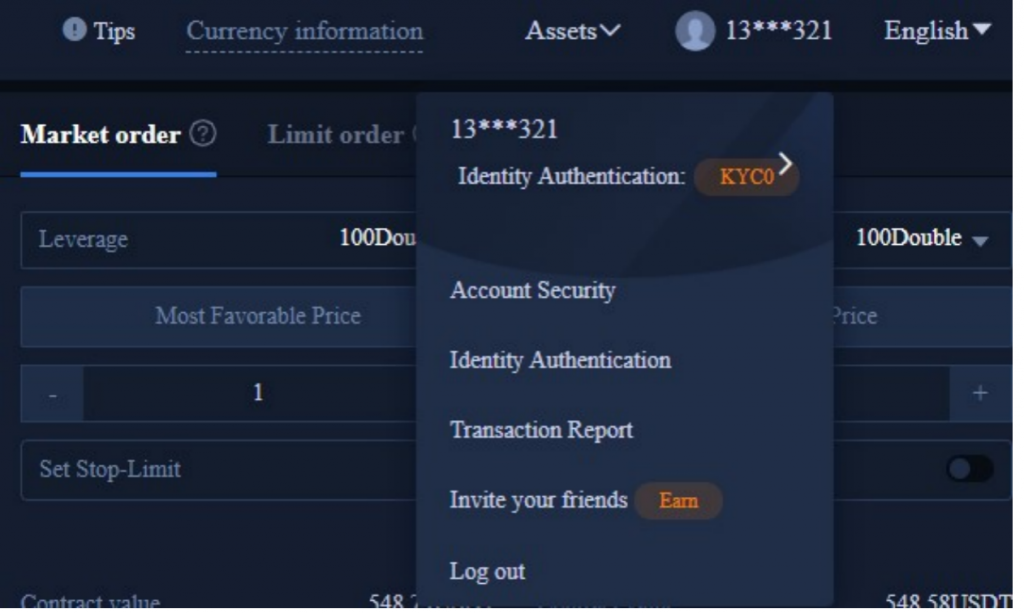

For more orders information, you can click on the futures trading report at the top right of the page to view.

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

ADA Cardano Price Prediction 2025, 2030

Algorand Price Prediction 2030

MANA Coin Price Prediction 2030

HBAR Price Prediction 2022, 2025, 2030

Stellar Lumens (XLM) Price Prediction 2030

Algorand (ALGO) Price Prediction 2022, 2025, 2030

Apecoin Price Prediction 2022, 2025, 2030

CRO Crypto Price Prediction 2025

XRP Price Prediction 2022, 2025, 2030

Solana (SOL) Price Prediction 2022,2050, 2030

Ethereum Price Prediction 2022, 2025, 2030

Aave (AAVE) Price Prediction 2023,2025, 2030: Will AAVE Recover from Crypto Crash?

ETC Price Prediction 2025-2030: Will Ethereum Classic Go Up?

MATIC Price Prediction 2030: Is Polygon Crypto a Good Investment?

Terra Classic (LUNC) Price Prediction 2022,2025,2030: Will LUNC Reach $1?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- [email protected]

- [email protected]

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*