Recommended

The Best Alternative to Kraken for Crypto Futures Trading

Cryptocurrency futures trading has greatly revolutionized how investors invest in cryptocurrencies. It has given investors the chance of investing in cryptocurrencies without the need to own the actual crypto coins/tokens. Also, investors can use crypto futures to hedge current spot positions without the need to invest cryptocurrencies.

The ability to hedge using crypto futures, in particular, provides traders with immense advantages considering how volatile the cryptocurrency markets can be. Through hedging, investors can lock in profits when trading.

However, to trade crypto futures, you will have to find a futures exchange that offers the crypto futures contracts you are looking to invest in. Different futures exchanges offer futures trading for different cryptocurrencies, with the most common being Bitcoin futures trading and Ethereum futures trading.

As the cryptocurrency futures industry continues to grow, the number of exchanges offering cryptocurrency futures has also increased considerably. Initially, the only exchanges that were known to offer futures trading were CBOE and CME, whose platforms were quite complicated especially for beginners.

There are currently exchanges with user-friendly platforms that offer futures trading. Below are the best two futures trading exchanges:

1. BTCC

BTCC was launched in 2011 as BTCChina before rebranding to BTCCand was China’s first futures and Bitcoin exchange. Its headquarters are in Hong Kong and it has other offices in the United Kingdom as well as in other parts of the world.

It received the recognition of being the world’s second-largest bitcoin exchange by volume in 2014.

Since its launch, BTCC has been offering cryptocurrency futures trading for over 9 years. It is known for its easy to use platform and wide variety of futures contracts to choose from.

Trade on BTCC with 10 FREE USDT.

Sign up today to redeem your bonus.

| Download App for Android | Download App for iOS |

2. Kraken

Kraken is a US-based crypto exchange that was launched in 2011. It was first launched as a cryptocurrency to fiat trading platform before including cryptocurrency futures trading.

Since its founding, it has made several acquisitions including the American Coinsetter, the Dutch CleverCoin, the Canadian Cavirtex, Interchange, the CryptoWatch, the Cryptofinance.ai, and Bit Trade.

It is also known to provide pricing information to the Blomberg terminal.

Comparing BTCC and Kraken – Why Choose BTCC for Crypto Futures Trading?

BTCC and Kraken have been in the market for the same amount of time since they were both launched in the same year, 2011. And although their trading platforms are almost similar, their features are different.

Below is a comparison of the features of the two exchanges:

- Offered cryptocurrency futures

BTCC offers Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, EOS, Cardano (ADA), Stellar (XLM), and Dash (DASH) futures while Kraken only offers Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple futures.

- Leverage

BTCC offers leverages of 10x, 20x, 50x, 100x and 150x while Kraken only offers leverages of 10x and 50x. This means BTCC offers higher leverages than Kraken and it would require fewer funds to hold larger trades in BTCC compared to Kraken.

- Expiration date

BTCC offers Daily, Weekly, and perpetual futures contracts while Kraken offers Perpetual, Monthly, Quarterly, Semiannual futures contracts. Kraken lacks the daily and weekly short term crypto futures contracts.

- Contract size

The contract size in BTCC is equal to the USD equivalent of one unit of the underlying cryptocurrency; if it is a Bitcoin futures contract for example, then the contract size is 1BTC per lot. In Kraken however, the contract size is 1USD per lot for all futures contracts expect for the Ripple (XRP) where the contract size is 1XRP per lot.

- Stop out ratio

The Stop out ration in BTCC is 30%; meaning that your futures contract is liquidated when you lose 70% of the amount you used to open the trade (collateral).In Kraken, the stop out ratio is 40%.

BTCC gives you a better chance for your contract to redeem itself in case of a trend reversal in the market prices compared to Kraken. The stop-out level of about 40% used by Kraken is quite high.

- Settlement method

Both Kraken and BTCC offer cash settlements of the collateral assets once the futures contracts expire.

- Trading fees (trading and closing fees)

BTCC does NOT charge an opening fee on all types of futures contracts. It charges a closing fee of between 0.06% and 0.18% per lot size depending on the contract expiry and account type for perpetual contract transactions. These fees are charged on the amount (in USD) used to open the contract.

Kraken, on the other hand, charges a maker and a taker fee for the futures contracts. The taker pays the taker fee while the maker receives a rebate stipulated as the maker fee. Both the taker and marker fees are calculated as a percentage of the notional order value for a matched trade. The taker fee is 0.075% while the maker fee is -0.02%. Kraken also charges an addition rollover fee after every 4 hours that order remains open. The rollover fee is between 0.01% and 0.02% depending on the underlying cryptocurrency.

Comparing the two, BTCC is cheaper for trading short futures contracts while Kraken is cheaper for trading long futures contracts. This is because the trading fee in BTCC is based on the closing price; meaning the lower the price of the collateral cryptocurrency the lower the trading fee.

Let us take an example of two traders A and B. Trader A chooses to trade in BTCC and trader B chooses to trade in Kraken

If trader A chooses to open a weekly futures contract of 10 lots of BTCUSDT100x (meaning using the leverage of 100x) and later decides to close 3 lots of the positions and the price of the BTCUSDT was 10,000USDT at the time of the closer of the 3 lots, the closing fee = 3 x 10000 x 0.06% = 18USDT. (Since the closing fee for a weekly BTCUSDT contract is 0.06%).

It is also worth noting that in BTCC the number of futures contracts purchased or the price of the contracts at the time of opening is not considered when calculating the trading fee. If it were considered it would mean 10BTCs, which would translate to 100,000 contracts if the price was $10,000 at the time of opening the contract.

If trader B chooses to open a 10,000 Bitcoin-USD (USD/XBT) contracts and the price of USD/XBT is 10,000 USD, the notional value of this trade in BTC terms would be 1XBT (Bitcoin-USD), which is calculated as 1 / Trade Price x Quantity.

The taker who is Trader B, in this case, would pay 0.075% of 1XBT which would be 0.00075XBT that would translate to $7.5.

For every 4 hours, an addition (0.01% x10, 000) = $1 would be charged, meaning the longer the contract stays open, the more expensive it becomes.

- Overnight fees (especially for weekly and perpetual contracts)

BTCC does not charge overnight fees for weekly futures contracts. It, however, charges a 0.05% overnight fee for perpetual contracts.

Kraken does not have an overnight fee. It charges a rollover fee every 4 hours.

| Download App for Android | Download App for iOS |

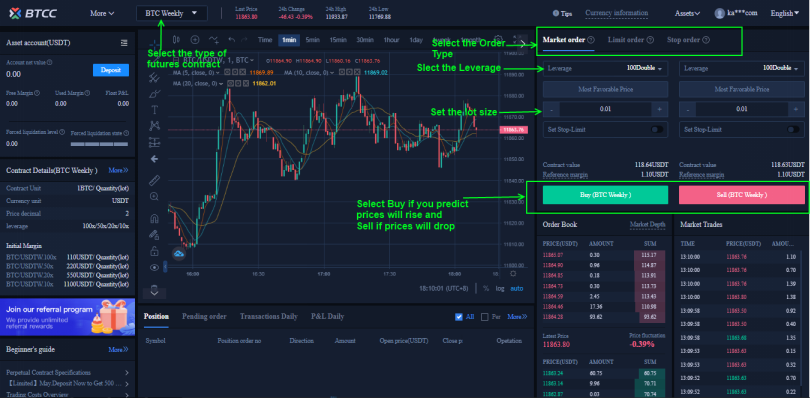

How to Trade Crypto Futures on BTCC

Trading on BTCC is easy. To start, you will require to register for an account.

Once you have an account, you should proceed to fund the account through bank wire or credit cards. It only accepts USD deposits.

Once you fund your account, you can go ahead to open a futures contract of your choice. However, before opening a futures contract, you should choose the type of contract (either daily, weekly or perpetual contract). Choose the order type (Market, limit or stop order and go ahead and set the leverage, the lots and activate stop-limit level (if you want to use it).

For the limit and stop orders, you will have to set the valid period of either weekly or daily.

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*