Recommended

Amazon stock price prediction 2023, 2025: Is Amazon a good stock to buy?

If you’re looking for the Amazon stock price prediction and want to know what the price of Amazon stock will be in 2023, 2025 and beyond, you’re in the right place. In this article, we will dive into the Amazon stock forecast for both short term and long term.

In 2022, the Amazon stock price was slashed in half amid risk-off sentiment and fears of a global recession.

Rumours of massive layoffs taking place at the e-commerce giant have materialised as the retail giant’s CEO, Andy Jassy, confirmed that the company plans to let go more than 18,000 employees, the biggest reduction in Amazon’s workforce in its history.

Is this a signal that Amazon expects to take a stronger hit as the global recession unfolds, or are the layoffs simply a necessary step to stimulate business performance? Here we take a look at Amazon stock forecast and news driving the AMZN stock price.

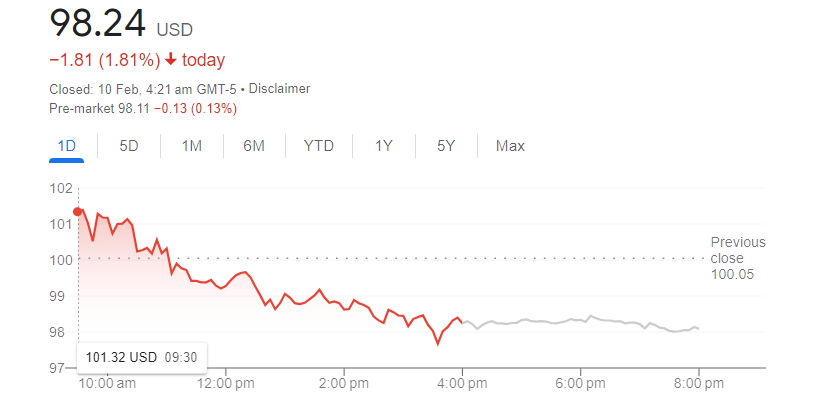

Amazon stock chart

| Download App for Android | Download App for iOS |

A brief glance at Amazon

The company was founded in 1994 by entrepreneur Jeff Bezos. He recognised the e-commerce potential of the fast-growing internet.

Amazon was originally an online bookselling platform – being able to list all titles online gave the company an advantage over in-person booksellers who had to print long and expensive paper catalogues. In its early years, Amazon famously operated out of Bezos’s garage in Bellevue, Washington.

The firm officially debuted in October 1995, and in two months was earning $20,000 a week in sales. On 15 May 1997, the company went public at $18 a share, listing on the Nasdaq.

However, it would be several years before Amazon would turn a profit. In the fourth quarter of 2001 – amid the bursting of the dot com bubble that saw the destruction of many e-commerce companies – Amazon posted a profit of $5m.

The company would continue innovating over the following years, launching products and services, including two-day membership delivery Amazon Prime in 2005, electronic reading device Amazon Kindle in 2007, and electronic voice assistant Echo & Alexa in 2016.

Amazon also branched out into music and film with Amazon Music and Amazon Instant Video.

How is Amazon stock traded in 2022?

Amazon stock is currently trading at the levels not seen since the March 2020 market turmoil. The stock has enjoyed a bull run in 2021, reaching a record $188.65 intraday high on 13 July.

2022, however, has painted a different picture, with the war in Ukraine, soaring inflation and aggressive monetary tightening seeing AMZN stock losing 50% in the year.

Amazon reported the third quarter of 2022 results on 28 October. Net sales increased 15% to $127.1bn, compared to $110.8bn year-on-year. Excluding the $5.0bn of the unfavourable foreign exchange rate impact, net sales increased 19% compared to a year ago.

Operating income fell to $2.5bn from $4.9bn, while net income decreased to $2.9bn, or $0.28 per diluted share, compared to $3.2bn, or $0.31 per diluted share.

Third quarter 2022 net income included a pre-tax valuation gain of $1.1bn included in non-operating income from the investment in Rivian Automotive.

| Download App for Android | Download App for iOS |

Amazon stock forecast amid massive layoffs

In the press release confirming Amazon’s plan to lay off 18,000 employees, Jassy encouraged investors:

“These changes will help us pursue our long-term opportunities with a stronger cost structure; however, I’m also optimistic that we’ll be inventive, resourceful, and scrappy in this time when we’re not hiring expansively and eliminating some roles.”

Market participants reacted negatively to the announcement, with the AMZN stock price falling 2.37% on the day.

AJ Bell investment director Russ Mould said in a note shared with Capital.com that even though the workforce reduction is the biggest in history, it becomes a “drop in the ocean” when viewed in the context of the 1.5 million total Amazon employees. He added:

“It’s also important to consider where the cuts are being made. They are mostly in areas like human resources as well as its Amazon Go and Amazon Fresh physical stores, and the latter represent something of an experiment for the company.”

Mould pointed out that the retail giant is likely to focus on its core e-commerce and Amazon Web Services cloud operations, noting that the announcement will be viewed positively by the shareholders as it signals higher returns.

“Still, these job cuts represent a significant increase on previously outlined levels. It shows Amazon is taking the current economic challenges seriously. As is often the case, the news was pleasing to shareholders who will prize any efficiencies which can increase their slice of the returns generated by the business.”

Amazon stock price prediction: US recession fears hurt the stock

In late April 2022, Amazon’s stock fell 14% on the day the company released its financial results for the first quarter of 2022. Back then, the company reported a $3.8bn net loss due to a $7.6bn markdown of its investment in Rivian (RIVN), the electric vehicle startup in which the company has a large stake.

The stock price has not recovered with the US Federal Reserve (Fed) bringing interest rates to 4.25%-4.5% at the December meeting. The aggressive monetary tightening coupled with the war in Ukraine has turned global investor sentiment sour, raising concerns about the US recession.

Amazon is a large e-commerce business with revenues primarily coming from its North American business. The performance of the US economy is highly relevant to determine how the company will perform financially in the future.

“Powell remained adamant, as we have noted, that he expects to maintain a significantly restrictive policy stance until incoming data support a high degree of confidence that inflation will fall to 2% on a sustained basis”, analysts from S&P Global commented in a December note.

“Indeed, not a single FOMC participant expects to start cutting interest rates before 2024, in contrast to investor expectations that rate cuts could begin as early as next September.”

Meanwhile, around 30% of the global economy could be poised to enter a recession according to the International Monetary Fund (IMF), while the largest three economies in the world – the US, China, and the European Union – will be growing at a slower rate compared to 2022.

| Download App for Android | Download App for iOS |

Amazon stock price prediction 2023, 2025 and beyond

According to data compiled by TipRanks as of February 10, the consensus analyst forecast for Amazon stock price was bullish. A total of 35 out of 39 analysts rated the stock as a buy, while four gave it a hold rating.

The consensus Amazon stock price prediction for the next 12 months stood at $145.87 a share. Meanwhile, the highest Amazon stock forecast for 2023 was $192 and the lowest was at $103.

Analysts have been lowering their price targets for Amazon in the past year. According to data from MarketBeat, UBS Group, Evercore ISI, JPMorgan & Chase, and Piper Sandler have been among the firms to slash their 12-month Amazon stock forecasts from November 2022 to January 2023.

Among the algorithm-based forecasting services, Gov Capital was holding a bearish short-term Amazon stock predictions stock based on an analysis of multiple technical indicators.

The website anticipated the stock to trade at $129.735 in December 2023. Their Amazon stock forecast for 2025 was more bullish, expecting shares to be valued at $406.624 by the end of the first semester, closing the year at $425.046.

The forecaster was far more optimistic about Amazon’s long-term future, predicting that the stock could hit $893.525 five years from now.

Amazon stock price prediction: conclusion

Please note that analysts’ and algorithm-based Amazon stock forecast can be wrong and should not be used as a substitute for your own research. Stock markets remain volatile and shaped by the constant changes in economic and market events.

It’s essential to always conduct your own due diligence before trading, looking at the latest news, a wide range of commentary, fundamental and technical analysis.

Keep in mind that past performance does not guarantee future returns, and never trade more money than you can afford to lose.

FAQs

Is Amazon a good stock to buy?

According to data compiled by TipRanks as of 10 February, the consensus analyst forecast for Amazon share price was bullish. A total of 35 out of 39 analysts rated the stock as a buy, while 4 gave it a hold rating.

No one can say for sure. The consensus Amazon stock forecast for the next 12 months is $145.87, according to the analyst views compiled by MarketBeat as of 10 February. Meanwhile, the highest Amazon stock price forecast for 2023 was $192 while the lowest stood at $103. Keep in mind that analysts’ forecasts can be wrong and should not be used as a substitute for your own due diligence.

What will Amazon stock be in 2025?

The 45 anaylsts offering Amazon stock prediction 2025 have a median target of $290, with a high estimate of $310, and a low estimate of $230 for 2025.

Read More:

Amazon Stock Price Prediction 2023, 2025 and Beyond

NIO Stock Forecast 2025, 2030: Is NIO a Good Stock to Buy?

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Core DAO Airdrop is Now Available, How to Claim It?

How to Delegate CORE Coin on Core Testnet Validator

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Moon Bitcoin Review – Your Best Chance to Get Free Bitcoins

Will Shibarium Burn Remove 111 Trillion SHIB Annually?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Ethereum Price Prediction 2025-2030

HBAR Price Prediction 2025, 2030

ADA Cardano Price Prediction 2025, 2030

Wild Cash App by Hooked Protocol: Answer Quiz to Earn $HOOK

Metamask Airdrop – To Get $MASK Token For Free?

Cardano Futures Guide: Trade ADA Perpetual Futures on BTCC

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*