Recommended

Coinbase Stock Forecast 2023, 2025

In this article, we will explore the Coinbase share price history and technical analysis, and dive into the future Coinbase stock forecast 2023 and 2025.

Coinbase stock price has risen in the first few days of the year. The stock surged to a high of $44.17, the highest point since December 13, 2022. It has spiked by over 42% from the lowest level in 2023, making it one of the top-performing tech stocks in the industry. This growth has been helped by the remarkable comeback of cryptocurrencies and the rising hopes of a Fed pivot. The shares also surged after the company announced the second round of layoffs.

Coinbase share price history

Coinbase Global, Inc, became a publicly-traded company in mid-April 2021. At that point, its share price was at a record high of $429.12 as demand for cryptocurrencies was soaring.

Between mid-May and mid-October 2021, it was range-bound between $260.93 and $208.62. Granted, it momentarily rose above the range’s upper border to a three-month high in mid-August.

The subsequent breakout had Coinbase stock price rally to a seven-month high in November 2021 before recording a trend reversal that has continued this year. The stock plunged to an all-time low of $40 in May. After attempting to recover, the stock crashed again and retested the lowest point as the crypto sell-off intensified.

2022 was been a terrible year for the Coinbase stock price. It started the year at $260, making it a bonafide crypto blue-chip stock. The shares then tumbled and reached an all-time low of $35 in December 2022. This decline happened as the Federal Reserve intensified its battle against inflation by hiking interest rates by over 400 basis points. It also declined as the prices of most cryptocurrencies collapsed.

2023 has been a better year for the company as the stock has rebounded to a high of $43.

| Download App for Android | Download App for iOS |

Coinbase stock news

Coinbase is the leading US cryptocurrency exchange. Notably, it has been under pressure this year as cryptocurrency prices collapse. Historically, Coinbase has had a close correlation with cryptocurrencies.

The stock is trading at its lowest level on record. The decline happened as investors focused on the collapse of FTX and Alameda Research. Investors believe that the sell-off could lead to contagion in the crypto industry. This week, the company’s CEO warned that the firm’s losses will likely double as the industry reels. Further, the sell-off of fintech stocks like PayPal, Robinhood, and Block has contributed to Coinbase’s performance.

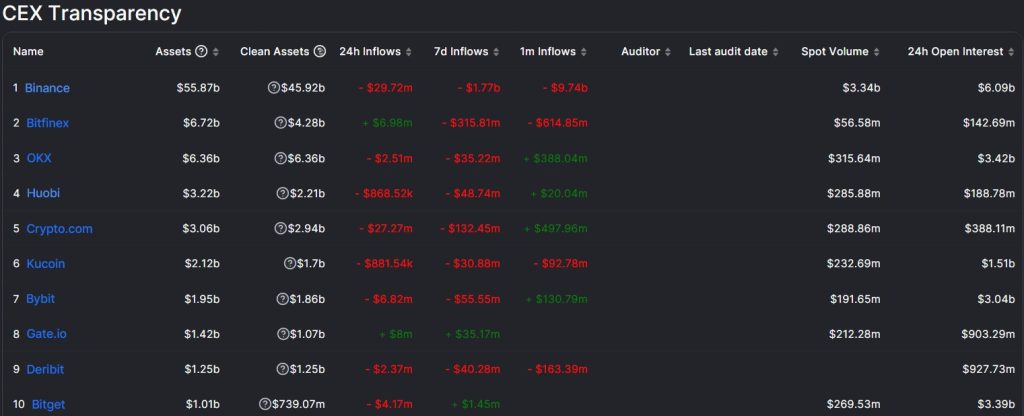

There have been several Coinbase news recently. First, the company has struggled as the number of customers using its platform dropped. In the past, crypto exchanges do well when prices are rising and vice versa. They attract more users who want to take advantage of rising prices. The chart below shows crypto exchanges have seen significant outflows recently.

Second, the company has been forced to implement layoffs in a bid to conserve cash. In June, the firm said that it was cutting 1,100 jobs. It then followed these layoffs with another 60 job cuts in November. In January, the company announced that it will lay off 10% of its staff.

Third, Coinbase published mixed financial results. Its third-quarter revenue crashed by double-digits from where it was a year earlier. Revenue declined to $600 million It also moved to a loss-making area as it lost $545 million.

Another major Coinbase news is that the company delisted several coins in its wallet citing low usage. Some of the now-delisted coins are bitcoin cash, ethereum classic, ripple, and stellar.

What is the market cap of Coinbase ?

Market capitalization is a crucial parameter in evaluating a firm’s valuation. It is attained by multiplying the outstanding shares with the firm’s share price. According to Yahoo Finance, Coinbase has a market capitalization of $9.9 billion. At its peak, the company was valued at over $50 billion.

| Download App for Android | Download App for iOS |

Coinbase stock forecast: Is Coinbase stock a good investment?

Coinbase Global has been on downward momentum since late last year. Even then, there are several reasons that substantiate its placement as a good investment.

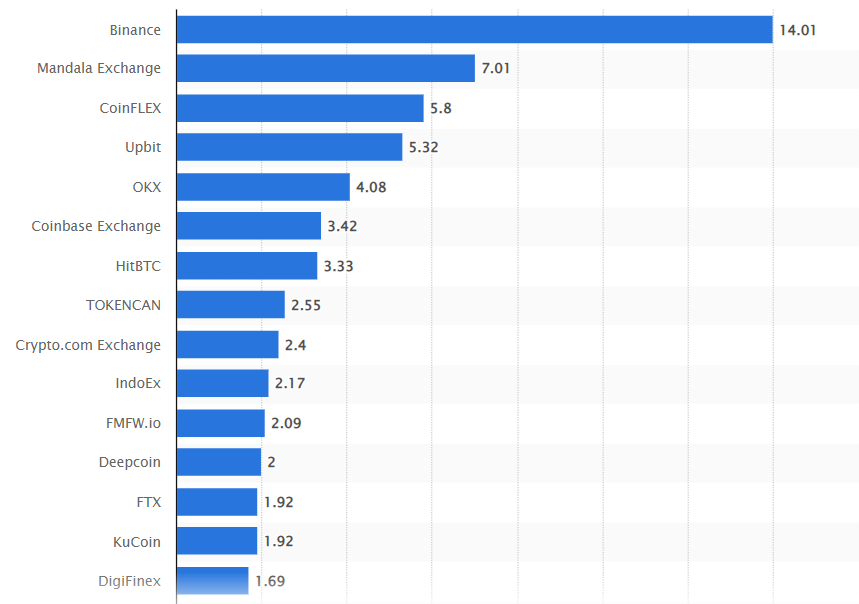

Coinbase market share

To begin with, the firm is still one of the leading cryptocurrency exchanges in the world. As shown on the chart below, it ranks sixth in terms of daily trading volumes. While other firms may enter the scene in the coming years, Coinbase will likely remain one of the popular entities, both in the US and worldwide.

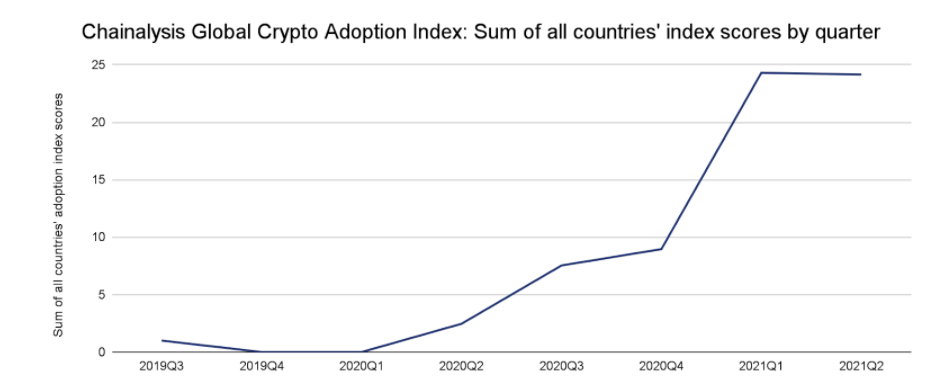

Cryptocurrency adoption rate

The crypto adoption rate has sky-rocketed in the recent past. According to the Chainalysis Global Crypto Adoption Index for 2021, the score was at 24 by the end of the year’s second quarter. In comparison, it was at 2.4 a year earlier. In 2020, the adoption rate surged by 881% and 2300% between Q3’19 and Q2’21.

Is Coinbase stock profitable?

In Q3’21, Coinbase Global, Inc. missed earnings and revenue estimates. Besides, amid the recent market sell-off, its share price has declined significantly in recent months. After seeing robust profitability in 2021, the company moved into a loss this year.

Coinbase lost $429 million in the first quarter of the year followed by $1 billion in the second quarter. This loss then narrowed to $544 million in Q3 as the situation improved. However, this improvement will not last for long as the situation has worsened in the past few weeks.

| Download App for Android | Download App for iOS |

Coinbase stock forecast 2023

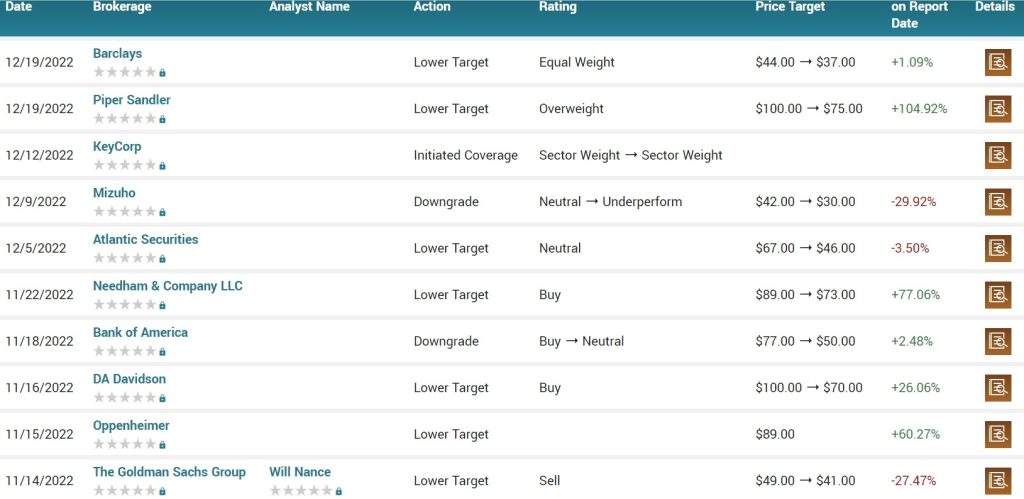

Analysts have been relatively bearish on the Coinbase share price for a while. Those at Atlantic Securities expect that the shares will be between $67 and $46. Similarly, analysts at Barclays, Needham, Bank of America, DA Davidson, and Oppenheimer have all lowered their estimates. The most accurate analysts were Goldman Sachs, who predicted that it will drop to $41. As shown below, most analysts have downgraded the stock.

Turning to the daily chart, we see that the Coinbase stock price has been in a strong bearish trend in the past few months. It is trading at a pivotal role since it has struggled to move below this level several times this year. The shares have moved below all moving averages. It has also formed an inverted head and shoulders pattern. In price action analysis, this pattern is usually a bearish signal.

Therefore, the stock will likely continue falling in 2023 as sellers target the key support level at $20. This means that it could drop by about 50%.

Coinbase stock forecast 2025

According to Wallet Investor, Coinbase stock price prediction for 2025 is rather bearish. The firm expects the crypto exchange’s share price will have collapsed by 2025. They believe that the company’s shares will be trading at about $0.00001, meaning that they expect that it will have gone bankrupt by then.

We believe that Wallet Investor’s Coinbase stock price prediction 2025 is not accurate since it assumes that the company will be bankrupt by then. It also expects that Bitcoin and other cryptocurrencies will be worth nothing. While the stock price could be much lower by then, we believe that it will be in the $5 to $20 range.

Read More:

Is Ethereum a Good Buy in 2023?

Bitcoin Futures Trading for Beginners

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Coin Real Or Fake?

Luna Classic Price Prediction: Will Luna Classic Reach $1?

LUNA Classic Burn: Will LUNC Burn Its Supply?

Shibarium Burn: Will the Burn Remove 111 Trillion SHIB Annually?

Bonk Airdrop: Where to buy Bonk crypto

Gasoline Price Prediction: What Will It Be In Five Years?

NIO Stock Forecast 2025, 2030: Is NIO a Good Stock to Buy?

ADA Cardano Price Prediction 2025, 2030

Ethereum Price Prediction 2025-2030

HBAR Price Prediction 2025, 2030

CRO Crypto Price Prediction 2025: Will CRO Coin Reach $1?

Metamask Airdrop – To Get $MASK Token for Free?

Leverage in Crypto Trading: Something You Need to Know

Best Crypto Leverage Trading Platform for 2023

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*