Recommended

Euro to Dollar Forecast 2023 and Beyond: What’s the Future of EUR/USD?

If you’re looking for the future euro to dollar forecast and want to know what the euro dollar exchange rate will be in 2023 and beyond, you’re in the right place. In this article, we will dive into the EUR/USD forecast for both short term and long term.

Over the past three months, the Euro (EUR) to US dollar (USD) exchange rate has risen 10% due to a moderate improvement in economic sentiment in the Eurozone and a slowing interest rate hikes by the US central bank, which has reduced the greenback’s attractiveness as a safe haven.

A softening of the Fed’s policy in mid-December supported the euro – both the European Central Bank (ECB) and the US Federal Reserve (Fed) have reiterated their resolve in tackling inflation, saying there are more rate hikes to come.

As of 31 January 2023, EUR/USD was trading at $1.09, its highest level in nine months.

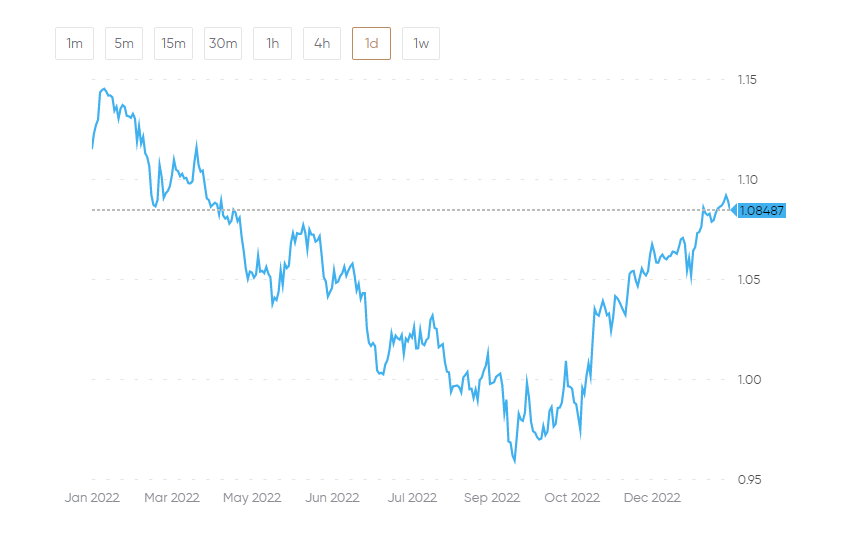

EUR/USD exchange rate chart

Here we look at the factors driving the currency pair and the EUR/USD forecast for 2023 and beyond. What lies ahead for euro to dollar, as it continues to trade around the parity level?

| Download App for Android | Download App for iOS |

How did euro to dollar perform in 2022?

After falling from $1.2275 at the start of 2021, EUR/USD started 2022 at $1.1375. The pair rose to a high of $1.1495 in early February before steadily dropping to a low of $1.0380 on 13 May – a level last seen in January 2017.

From that low point, the price rose to $1.0790 at the start of June before taking another peg lower to $1.04. EUR/USD briefly breached parity on 13 July 2022, as markets reacted to US inflation figures. That was followed by an immediate rebound that sent the pair back above $1.0100.

On 5 September, the pair dipped below the $0.99 level for the first time in two decades as Russia shut down its main gas pipeline to the EU, further destabilising the economic outlook in the eurozone.

EUR/USD then went on a brief rally influenced by the ECB’s interest rate decision on 8 September, which sent the ECB’s three key interest rates – on main refinancing operations, the marginal lending facility and the deposit facility – to 1.25%, 1.50% and 0.75% respectively.

The pair peaked at $1.0317 on 12 September 2022 before sharply declining to trade at around parity.

It briefly rose back over the $1 mark on 16 September and for the next few days, before falling below parity once again. On 27 September 2022 EUR/USD fell to its lowest point of the year so far at $0.95892. However, it rebounded again a month later, rising back above parity on 26 October.

The ECB’s interest rate decision on 27 October did little to support the euro, with the currency falling below parity up until 3 November.

A weaker dollar and falling US Treasury yields drove EUR/USD back up to trade around the $1.06 level in mid-December. However, the pair benefited from a general dollar weakness as inflationary pressures in the US continued to ease, while the ECB lifted interest rates by 50 basis points (bps) as expected on 15 December, reiterating that more hikes will follow and outlined plans for quantitative tightening.

The euro to dollar pair began 2023 at $1.0703 and continued rising throughout the month of January, reaching above the $1.09 level for the first time since April 2022.

The fresh Purchasing Managers’ Index (PMI) data for December showed private sector activity in the Euro area shrank at the slowest pace in four months, which could suggest the impending recession in the EU could be less severe than previously anticipated.

What has been driving EUR?

Inflation and slowing growth

The Russian invasion of Ukraine has hurt demand for the euro. The war in Eastern Europe has hit the eurozone economy hard and dampened the economic outlook significantly.

Europe relies heavily on Russian energy – oil and gas – and food from Ukraine. The war, along with Western sanctions on Moscow, has sent energy and food prices spiralling. Exports have been blocked, and the West is attempting to reduce its reliance on Russian oil and gas, with the EU approving a phased-in ban on Russian oil products over the coming six months.

The result has been inflation in the region rising to record levels, while simultaneously hurting the growth outlook.

Euro area inflation, as measured by consumer prices, fell to 9.2% year-over-year (YOY) in December – down from 10.1% in November.

Energy prices have been a major contributor to the rise in inflation – having the highest annual rate in December (25.5% compared with 34.9% in November), followed by non-energy industrial goods (6.4%, compared with 6.1% in November).

Russian energy crisis

The euro dipped below the 99-cent mark on 5 September as Russia ramped up the continent’s energy crisis by shutting off its main gas pipeline to Europe, Nord Stream 1, thus setting the stage for a cold winter ahead in the region.

The gas halt “is another blow to the European economic outlook, which has left the euro weak in the near term due to governance-related risks”, Piet Haines Christiansen, chief strategist at Danske Bank in Copenhagen, told Bloomberg on 4 September.

“At the same time, yet another stimuli package from Germany is an attempt to keep growth afloat, which makes inflation forecasting and the job for the ECB more tricky.”

Prior to the shutdown, Germany unveiled a relief plan on 4 September worth about €65bn.

Finland has also said it would stabilise its power market with a $10bn ($9.95bn) relief programme. On 3 September, Sweden announced $23bn in liquidity guarantees for its utility firms as it seeks to fend off a broader financial crisis.

“This has had the ingredients for a kind of a Lehman Brothers of the energy industry,” Finnish economic affairs minister Mika Lintila said on 4 September.

Finland’s prime minister Sanna Marin said during a news conference: “The government’s programme is a last-resort financing option for companies that would otherwise be threatened with insolvency.”

Hawkish ECB

Rising inflation has pushed the ECB to adopt a more hawkish stance. In an ECB meeting in June, the bank made the unusual step of pre-committing to interest rate hikes in July and September.

However, the EUR remains under pressure, mainly because of the deteriorating outlook for the eurozone economy. Despite the recent softening of its monetary policy stance, the Fed, which has so far been more aggressive in implementing contractionary monetary policy, can be said to exert more influence over the EUR/USD rate than the ECB.

“Monetary policy in the US still drives the euro more at this stage than the European Central Bank does,” Dirk Schumacher, head of Europe macro research at Natixis, explained to the Financial Times on 14 July. “The Fed is the main driver of the euro.”

On 21 July, the ECB raised all three key interest rates by 50bps for the first time in over a decade, exceeding market expectations and breaking its own guidance for a 25bp move.

At its next meeting on 8 September, the bank adopted an even more hawkish stance, choosing to ramp up all three key interest rates by 75bps – a move that mostly fell in line with market expectations.

The bank raised interest rates by a further 75bps at its meeting at the end of October. The move, widely expected by markets, marked the second increase of this kind in a row and brought borrowing costs up to their highest level since the beginning of 2009. The ECB refinancing rate is now 2%, the deposit rate is 1.5%, and the marginal lending rate is 2.25%.

The ECB raised the three rates by 50bps during its last monetary policy meeting of 2022 on 15 December, marking a fourth rate increase – the rise took the deposit facility to 2%, the refinancing rate to 2.5% and the marginal lending to 2.75%, a level not seen in 14 years.

According to a press release by the ECB, the bank will continue to take aggressive measures to fight inflation, which could indicate potential support for the euro:

“The Governing Council today decided to raise the three key ECB interest rates by 50 basis points and, based on the substantial upward revision to the inflation outlook, expects to raise them further. In particular, the Governing Council judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations.”

| Download App for Android | Download App for iOS |

What has been driving the US dollar?

Safe haven

The US dollar has been steadily strengthening across the board. The US dollar index (DXY), which measures the USD versus a basket of currencies, has rallied close to 9% this year, peaking at 114 in late September.

The USD has benefited from its safe-haven status as demand for the greenback rose following Russia’s invasion of Ukraine.

Since then, safe-haven flows have largely continued as fears of slowing global growth and stagflation have ramped up, despite a recent pullback triggered by a potential slowing of the monetary contraction cycle in the US.

While Europe could be more likely to experience a recession than the US, given its proximity to the war in Ukraine and its dependence on Russian gas, there is also a rising possibility of a recession across the Atlantic.

Fed’s hawkish stance

The dollar has also benefited from a hawkish Federal Reserve, particularly in comparison to the ECB.

As inflation in the US rose to a 40-year high, the Fed quickly ended its bond-buying programme and started a rate-hiking cycle. In March’s Federal Open Market Committee (FOMC) meeting the Fed raised interest rates by 25bps, followed by a 50-point hike in May.

The Fed then raised interest rates by a further 75bps in four consecutive meetings on 16 June, 27 July, 21 September and 2 November, lifting the benchmark overnight borrowing rate to a range of 3.75%–4%.

In a press conference on 21 September, Federal Reserve chair Jerome Powell reiterated that the US central bank would continue to “move [their] policy stance purposefully” in order to achieve 2% inflation, adding that he anticipated “ongoing increases will be appropriate”.

Powell’s speech came across as a direct sign of the Fed’s intent to bring inflation in the US under control, further boosting the dollar against most major rivals and denting the market’s appetite for other safe-haven assets, such as gold and silver.

On 14 December, however, the Fed slowed down its pace of rate hikes, boosting the overnight borrowing rate by half a percentage point, taking it to a targeted range between 4.25% and 4.5% – a move that was widely expected by markets. The Fed also indicated that it expects to keep rates higher through next year, with no reductions until 2024.

As Greg McBride, chief analyst at Bankrate, told CNBC:

“We still have a long way to go. We could see a meaningful drop in inflation in 2023, and still only be halfway to where we need to be by this time next year.”

The USD could potentially start to ease lower once peak inflation has passed in the US. CPI most recently came in at 7.1% YOY in November – the “smallest 12-month increase since the period ending December 2021”, according to the US Bureau of Labor Statistics.

The figure indicates a slowdown of inflation in the US, but the rate of price increases still remains way off the Fed’s target, meaning the end of the monetary contraction cycle could still be some time away.

Euro to dollar forecast: 2023 and beyond

As inflation and recession fears escalate, and with central bank action very much in focus, let’s look at where analysts’ EUR/USD forecasts are.

In a foreign exchange analysis from 16 January, ING Group’s Chris Turner, Francesco Pesole and Frantisek Taborsky revised up the EUR/USD forecast for 2023-2024:

“Bearing in mind the importance of EUR/USD in driving FX trends globally, we no longer feel we can justify a sub-consensus profile over the coming years. Instead, we expect EUR/USD to work its way back to medium-term fair value, now around the 1.15 area.

“In terms of a quarterly profile this year, a good proportion of the year’s EUR/USD gains could come in the second quarter when we expect US core inflation to fall sharply, allowing the short end of the US yield curve to adjust lower too.”

ING’s adjusted EUR/USD forecasts projecting the pair to trade at:

- $1.00 by Q2, Q3 and Q4 2023.

- $1.02 in Q1 2024

- $1.10 by Q4 2024.

In his Daily FX Update from 18 January, Shaun Osborne, chief foreign exchange strategist at Scotiabank, commented:

“The EUR sunk yesterday following reports that the ECB could downshift to smaller (25bps) rate hikes in March, after a 50bps hike at the February meeting. The tone of the report, based on unnamed “sources”, looked completely at odds with the hawkish twist that emerged at the Dec policy decision and the indications (endorsed by a number of other policy makers since) that “significant” rate hikes (i.e. 50bps) over the next 2 or 3 meetings were likely. Indeed, Villeroy commented this morning that he was “surprised” by the report and that President Lagarde’s Dec guidance remains valid. These remarks have helped lift the EUR but it’s not obvious that a “go slow” on rate hikes would hurt the EUR anyway.”

Technically, Osborne was neutral on the pair, saying: “The EUR snapped higher overnight from the low’s seen late yesterday around 1.0770. There is solid support for the EUR in the sub-1.08 range but the EUR is clearly having trouble extending gains through the upper 1.08s. This is the fourth time the EUR has failed to advance beyond 1.0875 since last Thursday. The technical odds favour gains amid a strong upwards trend and bullish trend momentum. I think EUR gains to extend to the 1.1000/50 range shortly.”

The latest euro to dollar forecast from analysts at Citibank Hong Kong was fairly optimistic, predicting a six to 12-month rise to was $1.15 that could be maintained long term.

In a recent overview of the euro to dollar outlook, Capital.com analyst Piero Cingari opined:

“Economic data came in stronger than expected, the ECB continued to send hawkish signals, and fears of a severe recession are fading… The euro has recently welcomed better-than-expected economic statistics, thus improving the macro picture for 2023.”

| Download App for Android | Download App for iOS |

Euro to dollar forecast: Algorithm-based projections

Algorithm-based website Wallet Investor’s euro to dollar forecast predicted the pair falling in the next 12 months – as of 18 January, the service expected the pair to fall to trade at an average of $1.071 by the end of the year.

In a longer-term projection, Wallet Investor’s euro to dollar forecast for 2025 had the pair potentially dropping further to $1.028 by December that year.

The EUR/USD forecast for 2023 from AI Pickup was far more bullish. The website saw the pair averaging a rate of $1.17 this year and continuing to rise the following years, reaching $1.29 in 2024 and $1.37 in 2025. However, the platform’s euro to dollar forecast for 2030 saw it falling to $1.16, before edging up to $1.19 in 2031.

Remember that analysts and online forecasting sites can and do get their predictions wrong. It is always best to carry out your own research and weigh the latest market trends and news, technical and fundamental analysis, and expert opinion before making any investment decisions. Never invest money you cannot afford to lose.

Euro to Dollar Forecast FAQs

Why is EUR/USD going up?

The EUR/USD pair has been rising in recent months as the euro continues to benefit from improved sentiment in the eurozone and expectations of a slowing US Federal Reserve rate hike cycle.

Is the euro likely to get stronger in 2023?

The direction of the euro could depend on whether the gap between economic growth and interest rates in the US and Europe continues to widen.

Is now a good time to buy euro?

At 1.09 versus the dollar, the euro has appreciated by 14% from its lows. In our view, recent good news is already baked into the price. Long term, the US dollar may have further room to depreciate, but for now, we would be cautious in chasing the euro higher unless the European fundamentals improve further.

Read More:

Top AI based Cryptocurrencies to Watch Out in 2023

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

When Will Pi Coin Launch: Pi Network Phase 4 Release Date

Pi Coin Price Prediction 2025: Will Pi Coin Be Worth Anything?

Luna Classic Price Prediction: Will Luna Classic Reach $1?

How to Stake LUNC: Everything You Need to Know

Wild Cash App by Hooked Protocol: Answer Quiz to Earn $HOOK

Hooked Protocol Price Prediction: How High Can HOOK Coin Go?

Shibarium Burn: Will the Burn Remove 111 Trillion SHIB Annually?

Metamask Airdrop – To Get $MASK Token For Free?

HBAR Price Prediction 2025, 2030

CRO Crypto Price Prediction 2025: Will CRO Coin Reach $1?

NIO Stock Forecast 2025, 2030: Is NIO a Good Stock to Buy?

Best Aptos Wallets for You to Store Aptos Coin

Bitcoin Futures Trading for Beginners

Is Ethereum a Good Buy in 2023?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*