Recommended

Gold Price Forecast & Predictions for Next 5 Years: Will Gold Continue to Go Up?

Gold prices corrected below $2,000 per ounce in mid-February, but they recovered in early March and reached a new record high of $2,450.05 in May.

Since the US central bank maintained its benchmark rate steady in June, the Federal Reserve’s interest rate cut is yet to be announced, which has caused the gold price rally to stop. Another obstacle for the yellow metal came from China’s central bank pausing its purchases of the metal in May, which had previously helped to boost the demand for physical gold.

Conversely, growing geopolitical tensions in Europe and the Middle East keep gold prices from falling much more. As of June 25, the price of gold was roughly $2,326 per ounce, which is 5% less than its record high from May. This year, it has increased by almost 13% already.

Will the current gold rise last the remainder of the year? We provide a long-term gold price estimate from top market analysts and look at important elements influencing the price projection for 2024 and beyond. and Will the gold price maintain bullish momentum as investor sentiment shifts to risk-off, and what’s the long-term outlook for the yellow metal? Here we take a look at the gold price predictions for next 5 years.

Key Takeaways

- In 2023, despite rising interest rates, the price of gold has been sustained by strong central bank purchases.

- It is now anticipated by analysts that the Fed will start cutting rates once or twice in September.

- Long-term support for gold prices is anticipated from central banks and China, which have strong physical demand.

- China may become more of a gold consumer if US-China tensions were to rise.

Gold Spot Price Chart

Gold

| 1 Day | 5 Days | 1 Week | 1 Month | 6 Months | Year to date | 1 Year | 5 Years | All time |

| 1.12% | -0.95% | -2.13% | -0.99% | 13.04% | 27.18% | 28.24% | 77.40% | 12605.13% |

Key data points

| Volume | Previous close | Open | Day’s range |

| 349071.00 | 2623.61000USD | 2594.18000USD | 2589.66500-2631.92000USD |

(Data from OANDA)

| Download App for Android | Download App for iOS |

Gold Price Technical Analysis

For the time period you have chosen, this guide shows an overview of technical analysis in real time. The most widely used technical indicators, including pivots, oscillators, and moving averages, form the basis of the Gold Spot/US dollar report.

Oscillators

| Name | Value |

| Relative Strength Index (14) | 46.18453 |

| Stochastic %K (14, 3, 3) | 12.17985 |

| Commodity Channel Index (20) | -112.18188 |

| Average Directional Index (14) | 15.24915 |

| Awesome Oscillator | -18.38693 |

| Momentum (10) | -9.72000 |

| MACD Level (12, 26) | -8.90993 |

| Stochastic RSI Fast (3, 3, 14, 14) | 13.38808 |

| Williams Percent Range (14) | -72.12038 |

| Bull Bear Power | -54.45939 |

| Ultimate Oscillator (7, 14, 28) | 34.51869 |

(Data from OANDA)

Moving Averages

| Name | Value |

| Exponential Moving Average (10) | 2634.26949 |

| Simple Moving Average (10) | 2650.50700 |

| Exponential Moving Average (20) | 2643.22169 |

| Simple Moving Average (20) | 2644.30000 |

| Exponential Moving Average (30) | 2646.77599 |

| Simple Moving Average (30) | 2636.17783 |

| Exponential Moving Average (50) | 2641.78276 |

| Simple Moving Average (50) | 2669.37880 |

| Exponential Moving Average (100) | 2592.92477 |

| Simple Moving Average (100) | 2607.55560 |

| Exponential Moving Average (200) | 2474.86416 |

| Simple Moving Average (200) | 2472.41515 |

| Ichimoku Base Line (9, 26, 52, 26) | 2640.34500 |

| Volume Weighted Moving Average (20) | 2641.6128550104 |

| Hull Moving Average (9) | 2587.12730 |

(Data from OANDA)

Pivots

| Pivot | Classic | Fibonacci | Camarilla | Woodie | DM |

| S3 | 2198.98667 | 2424.40667 | 2588.35950 | 2310.81000 | |

| S2 | 2424.40667 | 2510.51711 | 2609.02300 | 2423.83250 | |

| S1 | 2537.37833 | 2563.71623 | 2629.68650 | 2536.23000 | 2480.89250 |

| P | 2649.82667 | 2649.82667 | 2649.82667 | 2649.25250 | 2621.58375 |

| R1 | 2762.79833 | 2735.93711 | 2671.01350 | 2761.65000 | 2706.31250 |

| R2 | 2875.24667 | 2789.13623 | 2691.67700 | 2874.67250 | |

| R3 | 3100.66667 | 2875.24667 | 2712.34050 | 2987.07000 |

(Data from OANDA)

What Affects Gold Price??

First, let’s examine the elements that will influence the 2024 gold price outlook before we get into the predictions of analysts.

US Rate Cut Is Still Crucial

Since last year, gold’s primary driver has been the prospect of an interest rate drop by the United States. The Fed has been unmoved thus far, despite the fact that other G7 nations have begun a rate-cutting cycle.

With two rate cuts in March and June, Switzerland brought its benchmark interest rate down to 1.25% from 1.75% in December 2023, making it the leading developed nation to lower rates. The ECB, Sweden, and Canada have all done the same.

In the meanwhile, the Federal Reserve has maintained the target range for the federal funds rate at 5.25% to 5.50% at the meeting on June 12, citing solid economic growth, and the rate has been unchanged for seven consecutive meetings.

In a note on June 20, Hynes and Kumari of ANZ Research stated:

U.S. monetary policy has lagged behind that of Europe. Until there are more tangible indications that inflation is on a steady path lower, Fed members have been wary. Since US interest rates are the main factor influencing asset allocation around the world, this might postpone the increase in commodity demand from investors.

Now that the Federal Reserve has met in June, experts only expect one or two rate cuts beginning in September. July 30–31 is the day of the Federal Open Market Committee (FOMC) meeting.

According to BMI, a nation and industry risk analysis organisation under Fitch Solutions, the likelihood of a rate cut in July has been eliminated by improved May employment data, even though the Fed has the ability to begin easing monetary tightening.

Regardless of the climate of high interest rates, the US job market has maintained its resilience. According to the Bureau of Labour Statistics (BLS), the United States added 272,000 jobs in May, which is a significant increase from 165,000 in April. This number above analysts’ estimates, as stated on June 7th. Payrolls were expected to advance by 185,000 according to economists surveyed by Reuters.

BMI now expects the Fed to decrease interest rates by 5.00% by year-end, up from 4.75% previously, reflecting the more cautious stance taken by the officials.

According to BMI, “We think that the loosening cycle will kick off in September, consistent with market pricing (61.5% probability) following the release of May’s solid inflation data.” The Fed is expected to keep cutting rates steadily until 2025, when they will take a step back from

end of the year, the funds rate will drop to 3.00%.

According to ANZ Research, the Federal Funds Rate is expected to reach 5% by the end of 2024 after two 25-basis-point (bps) rate cuts in September and December. The company plans to lower the rate by 150 basis points (bps) in 2025, with the goal of reaching 3.50% by December of that year.

As stated by Hynes and Kumari: A 500 basis point reduction is quite improbable given the present federal funds rate of 5.5%. Our present projections indicate a 200bp reduction by the year 2025’s end. This bodes well for commodity markets in the next years, although a gentle tailwind.

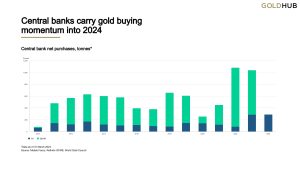

Strong Central Bank Purchases Anticipated

Despite a decrease in purchases recorded in March, central banks are expected to keep buying gold to strengthen their reserves this year in the face of economic concerns and geopolitical threats.

World Gold Council (WGC) statistics issued on June 3 shows that nett gold purchases by central banks returned to 33 tonnes in April from a revised nett of 3 tonnes in March. This comes as a surprise, considering China has halted its purchases. The World Gold Council reports that China’s gold holdings decreased in April by 2 tonnes compared to 5 tonnes in March and 12 tonnes in February.

In the next twelve months, 29 out of 70 central banks surveyed by the World Gold Council (WGC) for their 2024 Central Bank Gold Reserves (CBGR) study plan to raise their gold reserves. This is the most amount that the industry group has seen since the study started in 2018.

WGCF stated in the poll:

“Rising inflation and increased crisis risks in the financial markets, as well as the need to rebalance gold holdings to a more preferred strategic level, are the primary drivers of the planned purchases.”

The demand for gold by central banks increased to 289.7 tonnes in Q1 2024 from 286.2 tonnes in Q1 2023.

Uncertainty About Geopolitical Tensions

Geopolitical tensions, such as the battle in the Middle East between Israel and Hamas and Russia’s conflict in Ukraine, are projected to last well into 2024, according to analysts.

Few indicators have emerged that the battles would soon come to a close.

At least forty-five people were murdered in an Israeli airstrike on a displaced persons camp in the Gazan city of Rafah on May 26. The attack drew international outrage, especially from Israel’s key ally, the United States. The assault has ratcheted up the heat on Israel and Hamas to settle their differences amicably.

The US President Joe Biden-proposed three-pronged strategy to end the Gaza conflict was approved by the UN Security Council on June 10. But with Israeli Prime Minister Benjamin Netanyahu vowing to destroy the Palestinian Hamas movement, the agreement’s fate appears to be getting farther and further away. According to Reuters, Netanyahu has gone as far as firing his military cabinet as a result of the deepening tensions within the party.

In an interview with Techopedia on 12 April, Ariston Tjendra—an independent commodities analyst based in Jakarta—said.

As a result of all the pressures, players are looking for safe investments. Major financial institutions, including national banks, to purchase physical gold.

U.S.-China relations are expected to remain high, if not escalate, and there will be continuing crises in Europe and the Middle East.

Trade disputes, espionage allegations, China’s territorial claims in the South China Sea, and the US’s support for Taiwan, an island with democratic governance that China asserts as its own, have all contributed to a long history of poor relations between the world’s two biggest economies.

To safeguard American businesses and employees from “China’s unfair trade practices,” the Biden administration has imposed steeper duties on a wide range of Chinese-made goods, such as electric vehicles (EVs), semiconductors, batteries, solar cells, steel, and aluminium. The two countries’ trade tensions could get worse as a result of this approach.

Tensions are anticipated to rise in the next US presidential election in November, particularly if the Republican nominee, former President Donald Trump, is re-elected. Tariffs on all Chinese goods would be increased by 60% per Trump’s proposal.

On May 10, Hynes and Kumari of ANZ Research stated:

If the 60% tax goes into effect, the People’s Bank of China (PBoC) may have even more incentive to reduce its holdings in US Treasuries. The Chinese yuan and financial markets are quite sensitive to any worsening of trade hostilities. There may be a strong argument for China to eventually expand its official gold reserves due to geopolitical and economic uncertainty.

| Download App for Android | Download App for iOS |

Gold price prediction 2024

Due to extremely bullish sentiment at the start of the year due to high geopolitical fears, the gold price projection for 2024 and the gold price prediction for today both appear to be fairly favorable.

Gold was in a downtrend by year’s end 2022, with prices falling below the $1650 mark. But as the year turned, investors flocked back to the gold market, driving prices up to the $2,000/oz range in 2023 and beyond.

Given the recent spate of bank scandals that have sent shockwaves through the financial markets, gold is likely to maintain its allure in 2024. Credit Suisse, First Republic, and Silicon Valley Bank are all part of this group. Also, fraud in the cryptocurrency market has been discovered, with the most prominent perpetrator being the now-defunct FTX. This has resulted in a surge in desire for gold that has not been witnessed in a while.

Most large funds and rich investors are increasing their exposure to gold as a hedge against economic uncertainty, since the precious metal has a history of holding its value when circumstances go rough. The fact that many global central banks, including the Federal Reserve, are still having trouble combating inflation through interest rate hikes has only made matters worse.

Because of this, default fears have become real, and as a result, most traders are looking to hedge their bets in the bond and gold markets. It appears that Gold is currently making every effort to break out to the upside and reach new, higher highs, and 2024 is likely to remain incredibly unpredictable.

Despite the irony, gold was appealing because of the past money printing. Investors were enticed by the dollar’s debasement, but since the US dollar is strengthening, gold is being utilized as a hedge against wealth loss, leading to a rise in both the US dollar and gold.

As with most currencies, the US dollar might take a major hit from inflation. Even Nevertheless, gold was the first money, so it stands to reason that it will remain popular. It wasn’t until the 1970s and 1980s that inflation was this severe on a global scale. Gold did well throughout that time period, so it does serve as a partial template.

Gold price prediction 2025

The consensus view is that money will keep flowing into the gold market. The purchasing of gold by central banks will, on its own, maintain pricing power. By 2025, the majority of experts expect gold prices to have risen to well over $3,000 per ounce.

It would appear that there is a great deal of momentum, as the market only reached the $2,000/oz price in March 2023. It may be difficult to move much above $2,000, despite the fact that other analysts are far more enthusiastic.

Once we break through that level, though, a short squeeze could occur, leading to very higher prices by 2025 and, by 2030, without a doubt.

| Download App for Android | Download App for iOS |

Gold price predictions for next 5 years

| Analyst | Gold Price Forecast for the Next 5 Years |

| Wahyu Laksono | $2,550 – $3,000/oz |

| Lukman Leong | $3,000/oz |

| Ibrahim Assuaibi | $2,200/oz |

| ING | 2026: $2,240 |

| Fitch Ratings | 2026: $1,7002027: $1,600 |

Due to the intricacy and unpredictability of the factors that influence gold prices, few analysts have offered predictions for the next five years on the metal’s price. Nonetheless, they continue to believe that gold’s price will rise in the long run.

After projecting $2,300 per ounce of gold in 2025, ING anticipated a small decline to $2,240 per ounce in 2026.

Fitch Ratings raised its 2026 gold price forecast from $1,600 in March to a lower level of $1,700 in a report released on June 18. In 2027, gold prices are expected to stay low, trading at $1,600/oz.

There was no gold price prediction for 2030 from the rating agency. Amid the cycle, though, it predicted that gold would be worth $1,500/oz.

Gold’s potential price range of $2,550 to $3,000/oz, as predicted by Traderindo’s Laksono, remains unchanged. What did he say?

In five years, a lot can happen, including major economic catastrophes around the world. There is good reason to be bullish about gold.

In the next five years, Lukman Leong predicts that gold prices might reach $3,000, echoing Laksono’s optimistic prediction. What did he say?

There will be long-term effects of short-term variables like de-dollarization, geopolitical worries, and demand from China.

The sources did not offer gold price forecasts for the following decade due to the high degree of uncertainty in making such a long-term prediction.

According to independent commodity analyst Ariston Tjendra of Jakarta, the long-term course of the gold rate will be determined by the severity of the correction the metal undergoes in the next few years.

In a phone interview with Techopedia on April 12, Tjendra stated:

Gold may return to the middle of its price range or stay in its high range. In the aftermath of the COVID pandemic, however, neither the global political climate nor economic development have showed any indications of improvement. Debts and inflation are causing problems for a number of nations. The allure of gold will endure so long as governments face the problem of inflation.

When we extend our view into the future, we can see that the gold price prediction chart for the next decade is looking good for the asset. Considering the impending financial catastrophe, the popular consensus is that the value of gold will only rise.

The global financial crisis of 2008 serves as an exemplar, according to Dohmen Capital Research. As the crisis escalated, credit became more difficult to obtain, and a flight to cash from all assets began, the price of gold fell by 31%. Those bulls who were unaware that a credit crisis would lead to a precipitous decline in all assets felt the agony of that. At the bottom, though, it opened up a fantastic opportunity for purchase.

Although gold price patterns have been largely bullish over the longer term, there has been some consolidation over the past few of years. Having said that, it’s hard to conceive that Gold won’t continue to increase over the next decade, given the confluence of so many negative factors.

Several factors should be considered in a gold commodity forecast, including the fact that many banks worldwide will be seeking protection, the fact that some of the most important central banks from the BRICS+ will be buying gold at an astronomical rate, and the many reasons to expect gold prices to continue rising.

Is Gold a Good Investment?

When times are tough, whether economically or politically, people have always looked to gold as a safe haven investment. Just like the pricing of other commodities, gold prices will also rise and fall.

The majority of the experts consulted for this piece projected that gold prices will continue to climb in the years to come.

Gold prices, according to Trading Economic statistics, have been rising gradually over the last decade, albeit they do fluctuate like other commodities.

| Download App for Android | Download App for iOS |

Gold price predictions for next 5 years: Conclusion

Gold prices have more room to run as global banks struggle and the U.S. Federal Reserve renders another interest rate decision, potentially breaking all-time highs — and staying there.

Some investors may opt to keep some exposure to gold in their portfolio for diversification, as a hedge against a fall in stocks and bonds.

However, please note that analysts’ and algorithm-based gold price forecasts should not be used as a substitute for your own research and and due diligence. Commodity markets remain volatile and shaped by the constant changes in economic and geopolitical events.

It’s essential to always conduct your own research before trading, looking at the latest news, a wide range of commentary, fundamental and technical analysis.

In closing, BTCC exchange is a perfect choice for those who want to diversify their investments to include stocks, commodities and cryptocurrencies. Apart from large crypto selection, BTCC also supports tokenized futures, allowing users to trade commodities and stocks futures with USDT. The platform is highly recommended due to its favourable attributes such as extremely low fees, user-friendly interface, excellent customer support, and robust security measures with no reported hacks or security breaches to date.

In order to trade GOLD/USDT on BTCC, you need to first register an account. And you need to have some USDT in your crypto wallet, or you can directly buy it on BTCC. Once you have USDT, you can trade GOLDUSDT Perpetual Contracts on BTCC with a leverage up to 150x. The transaction is safe, cheap, and fast with VERY easy steps.

FAQs

Is it a good time to buy gold?

If your goal is to use gold as security, timing is less important than for the speculative approach, as this is a longer term strategy. If you agree with the view that gold’s value as part of a portfolio is to guard against shocks to other investments, then any time would be a good time to buy gold.

Is gold still a good investment 2023?

Yes. Some experts think gold prices will continue rising as inflation persists and the economy remains uncertain.

Will gold rate decrease in coming days?

From gold’s price chart, its initial support is found at the $1920 price level. It is crucial for buyers to defend this support because a breach below this level could lead to further declines, potentially pushing the gold price below $1900.

How much has gold price risen over the last year?

In 2022, the price of gold stayed flat, increasing only slightly by 2%.

Will gold go up in the next 5 years?

Fitch Solutions’ gold price predictions for next 5 years predicted that the gold bullion would fall beyond 2023 as the global economy would recover and the Russia-Ukraine war would resolve, while algorithm-based price forecasting service WalletInvestor was bullish in their predictions, seeing the metal trade at $2,026 in 2025 and rise to $2,257 by January 2028.

What will gold be in 2023?

ANZ Research forecasts gold to trade at $2,000 at the end of 2023 and accelerate to $2,075 by September 2024, citing a pause of Fed’s interest rate hiking cycle and weaker USD as the primary reason for the upgrade.

What is the gold price prediction for 2025?

According to Goldman Sachs, the commodities bull market observed in the past year will likely continue into 2023 and beyond. Indeed, the investment bank holds that the commodities supercycle will last for about 10 years. Based on this narrative, gold price is expected to reach a new all-time high of $2,200 per ounce by 2025.

What will gold price be in 2030?

Due to the existing inverse correlation, a feasible gold price prediction 2030 is founded on US dollar movements. Given that the gold price has risen about 60% over the past eight years, a 50% surge is feasible assuming the bull market will continue for the next eight years. In this case, the gold price forecast for 2030 will be for the precious metal to hit a high of about $2,700 per ounce.

What factors affect gold price?

The price of gold is driven by a number of factors, mainly including the strength of the U.S. dollar, physical and investment demand for the precious metal, and the health of the global economy. Gold is seen as a safe-haven asset, which rises during times of economic uncertainty, and is used by some investors as a hedge against inflation.

| Download App for Android | Download App for iOS |

Where to Trade Crypto Futures?

You can trade crypto futures on BTCC Now. Over 300 USDT-margined perpetual trading pairs are available for users to trade, including many popular altcoins and meme-coins.

You can deposit and receive up to 10,055 USDT now when you sign up and verify your account on BTCC Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

About BTCC

BTCC is a leading cryptocurrency trading platform that is distinguished by its ability to balance the simplicity of use with advanced features. It provides a comprehensive educational program through the BTCC Academy, 24/7 customer support, and robust security to both novices and experts. BTCC is a top choice for digital asset investors due to its emphasis on user contentment, which fosters a secure and informed trading environment across a variety of cryptocurrencies.

BTCC is one of the few exchanges in the market that offers high-leverage options for investors and concentrates extensively on futures trading. Users have access to more than 300 USDT-margined perpetual trading pairs, which encompass numerous prominent altcoins and meme-coins. Additionally, the platform has recently implemented spot trading to facilitate novice users who may not be acquainted with futures trading.

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*