Recommended

16 Best Crypto Exchanges in Australia Review & Buying Guide in 2024

Australia has experienced remarkable growth in cryptocurrency adoption and trading. According to Statista, as of August 2023, the number of cryptocurrencies in circulation has increased significantly, reflecting the growing interest in digital assets within the country. This surge is indicative of the increasing awareness and acceptance of cryptocurrencies among Australians.

Moreover, cryptocurrency regulations in Australia have evolved to provide a clear legal framework for trading and taxation. The Australian Taxation Office (ATO) treats cryptocurrencies as assets and subjects them to capital gains tax, further legitimizing their use. In addition, the government has shown interest in regulating the crypto industry, exemplified by the Digital Assets Bill 2022 proposed by Senator Andrew Bragg.

The openness of Australian banks to cryptocurrency further underscores its growing importance. While these banks have limitations on certain crypto transactions, they have recognized the significance of digital assets in the financial landscape.

In this evolving landscape, cryptocurrency exchanges serve as crucial platforms, connecting investors with a wide array of digital assets and providing liquidity to the market. They enable secure and efficient trading, making it accessible to a broader audience.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

Factors to Consider When Choosing an Exchange

Choosing the right cryptocurrency exchange is crucial for a safe and seamless trading experience. Here are the key factors to consider when selecting a crypto exchange:

- Jurisdiction and Regulation: Before diving into any exchange, ensure it operates within your jurisdiction. Regulations vary by country and state, so it’s essential to use an exchange that complies with your local laws. Using an exchange outside your jurisdiction can lead to legal complications and limited access to services.

- Security Measures: Security should be a top priority. Look for exchanges with robust security features like two-factor authentication (2FA), cold storage for funds, and a strong track record in safeguarding user assets. Cryptocurrency theft is a real concern, so choose an exchange that takes security seriously.

- Fees and Costs: Exchanges charge various fees, including trading fees, withdrawal fees, and deposit fees. Compare fee structures among exchanges to find the most cost-effective option for your trading habits. Keep an eye out for hidden fees that can significantly impact your overall costs.

- Available Cryptocurrencies: Different exchanges offer varying selections of cryptocurrencies. Ensure the exchange you choose supports the coins or tokens you want to trade or invest in. A broader range of supported cryptocurrencies provides more opportunities for diversification and investment strategies.

- User Interface and Experience: The user interface plays a significant role in your trading experience. A user-friendly platform with intuitive navigation and responsive customer support can make trading more accessible and enjoyable. Test the platform’s usability and ensure it meets your preferences.

- Customer Support: Prompt and helpful customer support is invaluable, especially when you encounter issues or have questions. Check for exchange reviews that mention the responsiveness and effectiveness of their customer support team.

- Liquidity: Liquidity is the ease with which you can buy or sell an asset without affecting its price significantly. Opt for exchanges with high liquidity in the cryptocurrencies you intend to trade. Higher liquidity often leads to tighter spreads (the difference between buying and selling prices) and faster execution of orders, enhancing your trading experience.

- Reputation and Trustworthiness: Research the exchange’s reputation and track record. Look for user reviews, ratings, and any history of security breaches or operational issues. A reputable exchange with a proven track record of reliability and trustworthiness is more likely to provide a secure and stable trading environment.

- Mobile App Availability: Check if the exchange offers a mobile app. In today’s fast-paced world, having access to your cryptocurrency portfolio and the ability to trade on the go can be invaluable. Ensure the mobile app is user-friendly and provides essential features.

- Educational Resources: Consider exchanges that provide educational resources such as articles, tutorials, or webinars. These resources can be especially helpful for beginners looking to expand their knowledge of cryptocurrencies and trading strategies.

- Insurance Coverage: Some exchanges offer insurance coverage for digital assets held on their platform. This insurance can provide an added layer of protection in case of security breaches or unforeseen events. Understand the extent of insurance coverage offered by the exchange.

- Ease of Account Setup: Evaluate how straightforward the exchange’s account registration and verification process is. A seamless on-boarding process can save you time and frustration, especially if you’re new to cryptocurrency trading.

By considering these factors, you can make a well-informed decision when choosing a cryptocurrency exchange that aligns with your trading goals, preferences, and risk tolerance. Remember that thorough research and due diligence are essential steps before entrusting your funds to any exchange.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

Top Crypto Exchanges in Australia

Australia’s crypto landscape boasts several trusted exchanges. Australia’s accommodating stance toward blockchain technology and cryptocurrencies has allowed Australians access to most international cryptocurrency exchanges. This regulatory openness, combined with the growth of the crypto community, has paved the way for a vibrant ecosystem of exchanges, making it essential for traders to carefully consider their options. Whether you are a beginner or an experienced trader, there’s a top crypto exchange in Australia tailored to your needs, ensuring that you can securely explore the world of digital assets.

Our analysts have meticulously studied and compiled a list of the top cryptocurrency platforms in Australia to help you get started with digital assets. The following are the best and most dependable options:

- eToro – Australia’s Top Overall Crypto Exchange

- Kraken – The most liquid Australian exchange

- CoinSpot – Best Beginner Exchange in Australia

- Bybit – Best Exchange for Crypto Derivatives

- SwyftX – Best SMSF Crypto Exchange

However, this should not be taken as granted as far as financial advice is concerned. We also recommend you to do your own research before you decide to go with any particular exchange.

| Broker | Rating | Fees | Regulated By | Ease of use |

| eToro | 5/5 | 0.75% | CySEC | 4.9 out of 5 stars |

| Kraken | 4.2/5 | 0.26% for takers and 0.16% for makers | FinCEN | 4.3 out of 5 stars |

| Binance Australia | 4.5/5 | 0.1% for makers and 0.14% for takers | AUSTRAC | 3.5 out of 5 stars |

| KuCoin | 4.2/5 | 0.10% | FSC Seychelles | 3.8 out of 5 stars |

| Luno | 4.2/5 | Maker fee is 0.10%, and the taker fee is 0.14%. | AUSTRAC. | 4.4 out of 5 stars |

| Coinbase Australia | 4.4/ 5 | 0.14%, (maker fee) and the taker fee is 0.30%. | AUSTRAC | 4.3 out of 5 stars |

| Bybit | 4.3/5 | Maker fee is 0.01%, and the taker fee is 0.075%. | FSC of Seychelles | 4.4 out of 5 stars |

| Coinspot | 4.3/5 | 0.1% | AUSTRAC, ASIC | 4.4 out of 5 stars |

| MEXC Global | 4.2/ 5 | Makers 0.04%, takers 0.06%. | AUSTRAC | 3.8 out of 5 stars |

| Cointree | 4.3/ 5 | 0.5%–0.9% maker/taker | AUSTRAC | 4.4 out of 5 stars |

| Coinstash | 4.1/5 | 0.1% to 0.05% | ADCIA | 4.5 out of 5 stars |

| Swyftx | 4.3/5 | 0.6% | AUSTRAC | 4.4 out of 5 stars |

| Independent Reserve | 4.5/5 | 0.50% – 0.02% | AUSTRAC | 4.3 out of 5 stars |

| BTC Markets | 4.4/5 | 0.10% to 0.05% | AUSTRAC | 4.4 out of 5 stars |

| CoinLoan | 4.4/5 | 0.20% to 0.02% | FinCEN | 4.5 out of 5 stars |

| Crypto.com | 4.6/5 | 0.14% – 0.04% maker/taker fee | MAS, FCA, SEC, AUSTRAC, OSC, CCC, VAMLA | 4.5 out of 5 stars |

1. eToro – Australia’s Top Overall Crypto Exchange

eToro is a user-friendly online trading platform that caters to both beginners and experienced investors. It provides a unique social trading experience, allowing users to not only trade various assets but also to follow and copy the strategies of successful traders.

An insight into eToro:

- Sign-up: To begin, sign up for an eToro account, which is a quick and straightforward process.

- Verification: Verify your identity as part of the security measures. This ensures the safety of your account.

- Depositing Funds: Make your initial deposit. eToro offers multiple funding methods to choose from, making it convenient for users.

Features of eToro

- Social Trading: One of eToro’s standout features is its social trading platform, which allows you to follow and copy the trades of experienced investors. This is a great way for beginners to learn and potentially profit.

- Asset Variety: eToro offers a wide range of assets to trade, including cryptocurrencies, stocks, commodities, and more.

- User-Friendly Interface: The platform is designed with beginners in mind, offering an intuitive and easy-to-navigate interface.

- Demo Account: eToro provides a free demo account for practice trading, allowing you to get comfortable with the platform before risking real money.

Fees

While eToro offers a user-friendly experience, it’s essential to be aware of the associated fees:

- Spreads: All trades on eToro are subject to a spread, which is the price differential between the purchase and sell of an item. The spread for the majority of cryptocurrencies is normally about 0.75%.

- Conversion fees:eToro charges a fee for converting fiat currencies into cryptocurrencies. The fee is typically around 0.5%.

- Withdrawal Fees: The fee is typically around 0.1%

- Inactivity Fee: eToro charges an inactivity fee if you don’t log in for 12 months.The fee is $5 per month.

Regulation & Licensing

eToro is a regulated and licensed platform, providing a sense of security for its users:

- CySEC: eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European financial regulations.

- FCA: It is also regulated by the Financial Conduct Authority (FCA) in the UK, enhancing its credibility.

- ASIC: For Australian users, eToro is regulated by the Australian Securities and Investments Commission (ASIC).

eToro is a beginner-friendly trading platform with a social trading twist. Its regulation and variety of assets make it an attractive option for those looking to venture into the world of online trading. However, users should be mindful of the associated fees and stay updated with the latest fee structures on the eToro website.

| Download App for Android | Download App for iOS |

2.Kraken – The most liquid Australian exchange

Kraken is a well-established cryptocurrency exchange that caters to both beginners and experienced traders. Known for its reliability and range of supported assets, Kraken provides a solid platform for those looking to enter the world of crypto trading. Below, we’ll explore Kraken in more detail, highlighting its fees and regulation & licensing.

An insight into Kraken:

Kraken was founded in 2011, making it one of the oldest cryptocurrency exchanges in the industry. Its longevity is a testament to its credibility and commitment to providing a secure trading environment. Here’s what you need to know:

Features of Kraken

- Asset Variety:Kraken offers a wide range of cryptocurrencies for trading, including popular options like Bitcoin (BTC), Ethereum (ETH), and many others.

- User-Friendly Interface:The platform is designed with a user-friendly interface, making it accessible for beginners while offering advanced features for experienced traders.

- Security:Kraken places a strong emphasis on security, employing industry-standard practices to protect users’ funds.

Fees

Understanding the fee structure is crucial when using Kraken. Here are the key fee-related points:

- Trading Fees:Kraken’s trading fees are competitive and vary based on your trading volume. They start at 0.26% for takers and 0.16% for makers and can decrease further with higher trading volumes.

- Deposit and Withdrawal Fees:Kraken does not charge fees for depositing fiat currencies or cryptocurrencies.

- Withdrawal fees: Kraken charges withdrawal fees for cryptocurrencies. The withdrawal fees vary depending on the cryptocurrency. For example, the withdrawal fee for Bitcoin is 0.00005 BTC.

- Margin trading fees: Kraken charges margin trading fees for both opening and closing positions. The margin trading fees are based on the amount of leverage you use. For example, if you use 2x leverage, the margin trading fee is 0.02%.

- Funding fees: Kraken charges funding fees for both long and short positions. The funding fees are calculated every hour and are based on the supply and demand for the underlying cryptocurrency.

Regulation & Licensing

Regulation and licensing are vital for the safety of your investments. Kraken takes this seriously:

- US Regulation:Kraken is registered as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN) and complies with U.S. regulations.

- Global Reach:Kraken’s commitment to regulatory compliance extends internationally, making it a trusted choice for users worldwide.

Kraken’s adherence to regulatory standards enhances its credibility, making it a suitable option for both beginners and experienced traders.

3. Binance Australia

Binance Australia is a branch of the global cryptocurrency exchange Binance, tailored to serve the Australian market. It provides a platform for buying, selling, and trading a variety of cryptocurrencies. Here’s a guide to Binance Australia, including information on fees and regulation & licensing:

An insight Binance Australia:

Binance Australia offers a user-friendly platform for crypto enthusiasts and traders. While its global parent company, Binance, is known for its extensive offerings, Binance Australia focuses on providing a secure and regulated environment for Australian users.

Features of Binance Australia

- Asset Variety:Binance Australia supports a range of cryptocurrencies, allowing users to trade popular assets like Bitcoin (BTC), Ethereum (ETH), and more.

- User-Friendly Interface:The platform is designed to be accessible for beginners, with an easy-to-navigate interface that caters to both novice and experienced traders.

- Security:Binance Australia prioritizes the security of its users’ funds and follows strict security protocols.

Fees

Understanding the fee structure is essential for managing your investments on Binance Australia. Here are the key fee-related points:

- Trading Fees:Binance Australia’s trading fees are competitive and vary depending on your trading volume. They typically start at 0.1% for makers and 0.14% for takers and can decrease with higher trading volumes.

- Withdrawal fees:Binance Australia charges cryptocurrency withdrawals. Withdrawal costs differ by coin. Bitcoin withdrawals cost 0.000005 BTC.

- Deposit and Withdrawal Fees:Binance Australia charges fiat deposits. Fiat currency influences deposit fees. Deposit fees for AUD are 0.1%.

- Staking fees:Binance Australia charges for several cryptocurrencies. The cryptocurrency’s staking costs vary. The Cardano staking charge is 0.15%.

- Margin Trading Fees:Binance Australia imposes margin trading fees for opening and closing positions. The leverage you utilize determines margin trading fees. The margin trading cost for 2x leverage is 0.02%.

Regulation & Licensing

Regulation and licensing are vital to ensure a safe and compliant trading experience. Here’s the regulatory information for Binance Australia:

- Regulatory Compliance:Binance Australia operates in compliance with Australian financial regulations, ensuring that it follows the country’s laws and regulations regarding cryptocurrency trading.

- User Protection:Regulatory oversight provides added security and protection for users, making Binance Australia a reputable choice for cryptocurrency trading within Australia.

All in all, Binance Australia is a pretty trustworthy and reputable casino in Australia.

| Download App for Android | Download App for iOS |

4.KuCoin

KuCoin is a prominent cryptocurrency exchange known for its wide selection of cryptocurrencies and user-friendly features. For those in Australia looking to enter the world of crypto trading, KuCoin is an appealing choice. Here’s a detailed overview, including information on fees and regulation & licensing:

An insight to KuCoin:

KuCoin, often referred to as “The People’s Exchange,” has gained popularity for its accessible platform and extensive range of supported cryptocurrencies. Here’s what you need to know:

Features ofKuCoin

- Cryptocurrency Selection:KuCoin stands out with over 700 supported cryptocurrencies, offering one of the broadest arrays of altcoins among centralized exchanges.

- User-Friendly Interface:The exchange is designed with user convenience in mind, making it suitable for both beginners and experienced traders.

- Community-Focused:KuCoin has cultivated a strong user community and offers features like staking and trading bots, contributing to its appeal.

Fees

Understanding the fee structure is crucial when trading on KuCoin. Here are the key fee-related points:

- Trading Fees:KuCoin offers competitive trading fees, with maker and taker fees starting as low as 0.10%. These fees can vary depending on your trading activity and KuCoin Shares (KCS) holdings, which can further reduce trading costs.

- Margin Trading Fees:KuCoin charges margin trading fees for opening and closing positions. The leverage you utilize determines margin trading fees. The margin trading cost for 2x leverage is 0.02%.

- Staking Rewards:KuCoin imposes staking fees for some coins. Staking fees vary by cryptocurrency. Cardano’s staking fee is 0.15%.

- Withdrawal fees:There are no deposit fees at KuCoin, however, KuCoin imposes cryptocurrency withdrawal fees. Withdrawal costs differ by coin. Bitcoin withdrawals cost 0.000005 BTC.

Regulation & Licensing

KuCoin’s commitment to regulatory compliance is vital for users’ peace of mind:

- Global Presence:KuCoin operates internationally, including in Australia, and adheres to local regulations. It prioritizes the security and legal compliance of its services.It is registered with the Financial Services Commission (FSC) of Seychelles as a Digital Asset Exchange (DAE).

- Customer Support:KuCoin is known for its exceptional customer support, ensuring that users receive assistance and information regarding regulatory matters.

KuCoin’s commitment to regulatory compliance and strong customer support makes it a suitable choice for crypto trading in Australia.

5. Luno

Luno is a cryptocurrency exchange that offers services to users in Australia and globally. Here’s a brief overview with a focus on fees and regulation & licensing:

An insight into Luno:

Luno provides a platform for buying, selling, and trading cryptocurrencies, catering to both beginners and experienced users. Here’s a snapshot:

Features of Luno

- Cryptocurrency Selection:Luno supports a variety of cryptocurrencies, allowing users to trade popular assets.

- User-Friendly Interface:The platform is designed to be user-friendly, making it accessible for beginners.

- Global Presence:Luno operates in several countries, including Australia, providing a global reach.

Fees

Understanding the fee structure is crucial when using Luno. Here are key fee-related details:

- Trading Fees:Luno charges trading fees, which can vary based on factors like your trading activity and volume. The maker fee is 0.10%, and the taker fee is 0.14%.

- Staking fees: Luno imposes staking fees for some coins. Staking fees vary by cryptocurrency. For instance, Cardano staking costs 2.5%.

- Withdrawal fees: Luno imposes cryptocurrency withdrawal fees. Withdrawal costs differ by coin. Bitcoin withdrawals cost 0.000005 BTC.

- Deposit fees: Luno charges fiat currency deposits. Deposit fees vary per fiat currency. The deposit charge for AUD is 0.75%.

- Instant Buy/Sell fees: Luno spreads all Instant Buy/Sell transactions. The spread averages 1.5%.Regulation & Licensing.

Luno’s regulatory compliance ensures user security:

- Global Regulation:Luno complies with regulations in various countries, including Australia, to maintain a secure and legal trading environment. Luno is also registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Luno is a widespread exchange accepted worldwide for its brand and user-friendliness.

| Download App for Android | Download App for iOS |

6. Coinbase Australia

Coinbase is a well-established cryptocurrency exchange that caters to users in Australia and across the globe. Below, we provide an informative overview, highlighting fees and regulation & licensing:

An insight into Coinbase:

Coinbase is a secure online platform designed for buying, selling, transferring, and storing various cryptocurrencies. Key points include:

Features of Coinbase

- Cryptocurrency Variety:Coinbase offers access to a diverse range of cryptocurrencies, making it suitable for both beginners and experienced traders.

- User-Friendly Interface:The platform is known for its user-friendly interface, making it accessible to those new to the crypto space.

- Global Presence:Coinbase operates globally, including in Australia, providing its services to users in multiple countries.

Fees

Understanding Coinbase’s fee structure is crucial for users. Here are the primary fee-related details:

- Trading Fees:Coinbase’s advanced trading platform features trading fees ranging from 0.14%, (maker fee) and the taker fee is 0.30%. depending on your trading volume.

- Margin Trading Fees: Coinbase charges margin trading fees for opening and closing positions. The leverage you utilize determines margin trading fees. The margin trading cost for 2x leverage is 0.02%.

- Staling Fees: Coinbase charges staking fees for some coins. Staking fees vary by cryptocurrency. A 1% staking fee is charged for Cardano.

- Withdrawal Fees: Coinbase charges cryptocurrency withdrawal fees. Withdrawal costs differ by coin. Bitcoin withdrawals cost 0.000005 BTC.

- Deposit fees: Coinbase charges fiat currency deposits. Deposit fees vary per fiat currency. The deposit charge for AUD is 1%.

- Coinbase Pro Fees: Fees for Coinbase Pro, a separate exchange, are lower. Coinbase Pro maker and taker fees are 0.04% and 0.05%, respectively.

Regulation & Licensing

Coinbase prioritizes regulatory compliance and user security:

- Global Compliance:Coinbase Australia registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC). It complies with regulatory requirements in various countries, including Australia. This ensures a secure and legal environment for cryptocurrency transactions.

- Feature-Rich Platform: Coinbase offers a range of features, including crypto staking and borrowing, providing users with diverse options while adhering to relevant regulations.

In summary, Coinbase Australia is a reputable cryptocurrency exchange known for its extensive coin offerings and user-friendly interface.

7. Bybit – Best Exchange for Crypto Derivatives

Bybit is a cryptocurrency margin exchange that has gained prominence in the Australian market. Here’s an informative overview, including details on fees and regulation & licensing:

An insight into Bybit:

Bybit is a Australia-based trading platform specializing in cryptocurrency derivatives. Key highlights include:

Features of Bybit

- Margin Trading:Bybit is known for cost-effective margin trading, allowing users to trade BTC/USD and ETH/USD pairs with leverage of up to 100x.

- Crypto Derivatives:The platform offers crypto derivatives, which are contracts that grant the right to buy or sell crypto assets at predetermined future dates and prices.

Fees

Understanding the fee structure is essential when using Bybit Australia. Here are key fee-related points:

- Cost-Effective Trading:Bybit is renowned for providing cost-effective margin trading options, making it attractive to traders seeking leverage. The maker fee is 0.01%, and the taker fee is 0.075%.

- Margin Trading Fees:Bybit charges margin trading fees for opening and closing positions. The leverage you utilize determines margin trading fees. Margin trading fees are 0.05% for 10x leverage.

- Staking Fees:Bybit doesn’t charge staking fees.

- Withdrawal Fees:Bybit charges cryptocurrency withdrawals. Withdrawal costs differ by coin. Bitcoin withdrawal fees are 0.000006 BTC.

Regulation & Licensing

Bybit’s commitment to regulatory compliance and user security is noteworthy:

- Fast-Growing Exchange:Bybit is one of the fastest-growing cryptocurrency exchanges, offering up to 100x leverage and tight spreads.

Bybit is notable for its trustworthiness as per the review by many users.

| Download App for Android | Download App for iOS |

8. Coinspot – Best Beginner Exchange in Australia

Coinspot is a well-established cryptocurrency exchange based in Australia. Here’s a detailed overview, including information on fees, regulation, and licensing:

An insight into Coinspot:

Coinspot is a user-friendly Australian cryptocurrency exchange known for its accessibility, making it suitable for both beginners and experienced traders.

Key highlights include:

Features of Coinspot

- User-Friendly Interface:Coinspot offers a straightforward and intuitive platform, making it ideal for beginners in the crypto space.

- Diverse Cryptocurrency Selection:Users can access a wide range of cryptocurrencies, allowing for diversified trading and investment options.

Fees

Understanding the fee structure is crucial when using Coinspot. Here are the key fee-related points:

- Low Fees:Coinspot boasts competitive fees starting at 0.1%, which is considered low in the industry.

- 1% Fee for Specific Transactions:A 1% fee applies to instant buy and sell transactions, as well as take profit, stop loss, and recurring orders. Additionally, some external wallet transfers may incur standard bank transfer fees.

If you buy $100 in Bitcoin, you’ll pay $0.10 in trading costs. If you buy 1 Bitcoin, you will be charged 1% of the Bitcoin price, which is now $41,000.

AUD deposits and withdrawals are free for POLi, PayID, and direct deposits. However, BPAY deposits cost 0.9% and cash deposits 2.5%. Cards are charged 2.58% for withdrawals.

Buying an NFT for $100 costs $0.90 since NFT fees are 0.9% of the trade value.

Regulation & Licensing

Coinspot is a reputable Australian cryptocurrency exchange, known for its commitment to security and compliance. It is licensed by the Australian Transaction Reports and Analysis Centre (AUSTRAC) and registered with the Australian Securities and Investments Commission (ASIC).

Coinspot is a user-friendly cryptocurrency exchange in Australia offering a diverse range of cryptocurrencies. Its competitive fee structure and adherence to regulatory standards make it a popular choice among traders and investors in the region.

9.MEXC Global

MEXC Global is a prominent cryptocurrency exchange offering a wide range of crypto-related products and services in Australia. Here’s an informative overview, including details on fees, regulation, and licensing:

An insight to MEXC Global:

MEXC Global is known for its comprehensive suite of crypto-related offerings. It specializes in innovative derivatives products and offers a diverse selection of altcoins and trading markets, including spot, margin, leveraged Exchange-Traded Funds (ETFs), and futures. Key highlights include:

Features of MEXC Global

Wide Selection of Altcoins: MEXC Global stands out for its extensive range of altcoins, providing traders with various investment options.

- Innovative Derivatives:The exchange offers innovative derivatives products, allowing traders to explore advanced trading strategies.

- Diverse Trading Markets:MEXC Global caters to different trading preferences, including spot, margin, leveraged ETFs, and futures markets.

Fees

Understanding the fee structure on MEXC Global is essential for traders. Here are key fee-related points:

- Spot trading fees:Makers pay 0.20% for limit orders and takers pay 0.02% for market orders.

- Margin trading fees:Makers 0.04%, takers 0.06%.

- Futures trading fees:Makers 0%, takers 0.01%.

- Withdrawal fees:Withdrawal fees vary depending on the cryptocurrency being withdrawn. For example, the withdrawal fee for Bitcoin is 0.0003 BTC.

- Deposit fees:Deposit fees vary by payment type. For instance, credit card deposits cost 3.5%.

Regulation & Licensing

MEXC Global is subject to supervision from AUSTRAC, the Australian Transaction Reports and Analysis Centre.

MEXC Global is a reputable cryptocurrency exchange in Australia, known for its wide range of altcoins, innovative derivatives, and diverse trading markets.

| Download App for Android | Download App for iOS |

10.Cointree

Cointree is a popular cryptocurrency exchange in Australia that simplifies the process of buying and selling over 240 cryptocurrencies. With a user-friendly interface and a strong focus on security, Cointree provides a convenient platform for both beginners and experienced traders. Here’s an informative overview of Cointree, including details on fees, regulation, and licensing:

An insight to Cointree:

- Wide Range of Cryptocurrencies:Cointree offers access to a vast selection of cryptocurrencies, allowing users to diversify their portfolios.

- User-Friendly Interface:The exchange boasts an elegant and user-friendly interface, making it easy for traders to navigate and execute transactions.

- Strong Security Measures:Cointree takes security seriously, employing end-to-end encryption for personal information, two-factor authentication, and holding an SSL certification. Importantly, the platform has never experienced a security breach.

Fees:

Understanding the fee structure on Cointree is crucial for managing your trading costs. Here are key points regarding fees:

- Trading fees:Cointree charges 0.5%–0.9% maker/taker. Makers supply liquidity to the market with limit orders, while takers remove it with market orders.

- Deposit fees:Cointree does not charge for AUD or cryptocurrency deposits. A 0.9% fee is charged for BPAY deposits.

- Withdrawal fees:Withdrawal costs differ by coin. Bitcoin withdrawals cost 0.0005 BTC.

Regulatory Compliance

Cointree operates in compliance with AUSTRAC regulations, demonstrating its commitment to adhering to Australian crypto exchange standards.

Registration and Account Verification

Getting started with Cointree involves registering and verifying your account. Here’s what you need to know:

- Account Types:Cointree offers different account types, with a basic account available for new users to familiarize themselves with the platform. To deposit funds and engage in trades, users need to register for one of the platform’s account types.

Cointree is a trusted and regulated cryptocurrency exchange in Australia, known for its wide range of supported cryptocurrencies, robust security measures, and user-friendly interface.

11. Coinstash

Coinstash is a well-established cryptocurrency exchange in Australia, known for its simplicity and accessibility to both beginners and experienced traders. Here, we delve into the world of Coinstash, highlighting its unique features, fee structure, and regulatory compliance:

An insight to Coinstash:

User-Centric Platform: Coinstash prides itself on being built by investors, for investors. Since its inception in 2017, it has focused on creating a user-friendly environment for crypto trading.

Features ofCoinstash

- Extensive Coin Selection:With over 1,000 coins available, Coinstash offers a broad range of cryptocurrencies for users to buy, sell, and trade.

- Low Fees:Coinstash boasts competitive fees, making it an attractive choice for cost-conscious traders.

Fees

Understanding the fee structure is essential for managing your expenses on the platform:

- Spot Trading Fees:Coinstash levies a maker/taker fee ranging from 0.1% to 0.05%. Limit orders are used by makers to increase market liquidity, whereas market orders are used by takers to decrease market liquidity.

- Margin Trading Fees:Coinstash charges a maker/taker fee for margin trading that ranges from 0.025% to 0.0125%.

- Futures Trading Fees:Coinstash levies a maker/taker fee ranging from 0.01% to 0.005%.

- Withdrawal Fees:Payout costs differ based on the cryptocurrency being withdrawn. The withdrawal cost, for instance, is 0.0005 BTC for Bitcoin.

- Deposit Fees:Coinstash does not charge any fees for deposits of cryptocurrency or Australian Dollars (AUD).

Regulation and Licensing

There is no Australian financial authority that regulates Coinstash. It does, however, belong to the Australian Digital Currency Industry Association (ADCIA), a self-regulatory body for Australian cryptocurrency exchanges.

Coinstash’s user-centric approach, competitive fees, and commitment to safety make it a valuable option for those looking to enter the world of cryptocurrency trading in Australia. Whether you are a beginner or an experienced trader, Coinstash provides a reliable platform to explore the crypto market.

| Download App for Android | Download App for iOS |

12.Swyftx – Best SMSF Crypto Exchange

Swyftx is a prominent cryptocurrency exchange in Australia, known for its user-friendly interface and robust security measures. Here, we explore Swyftx in detail, shedding light on its unique features, fee structure, and regulatory compliance:

An insight to Swyftx:

Swyftx was founded in 2017 and is one of the largest cryptocurrency exchanges in Australia. Swyftx offers a variety of features, including spot trading, margin trading, and staking.

Features of Swyftx

- User-Friendly:Swyftx stands out for its intuitive and beginner-friendly platform, making it an excellent choice for those new to cryptocurrency trading.

Fees

Understanding the fee structure is crucial for managing your crypto investments:

- Flat Trading Fee: Swyftx offers a competitive flat trading fee of 0.6%, making it cost-effective for both beginners and experienced traders.

- Free AUD Deposits:Swyftx provides the convenience of free AUD deposits when using bank transfers, PayID, or other specified methods.

- New Customer Bonus: As an incentive for new users, Swyftx offers a $20 Bitcoin bonus upon signing up and verifying their identity, making it an attractive option for those looking to start their crypto journey.

Regulation and Licensing:

Swyftx is registered with AUSTRAC, Australia’s financial intelligence agency, ensuring it operates within the country’s legal framework.

- Security and Certification: Swyftx prioritizes the safety of its users’ assets and information:

- ISO 27001 Certified:Swyftx holds ISO 27001 certification for information security, demonstrating its commitment to safeguarding user data.

Swyftx is an excellent choice for cryptocurrency enthusiasts in Australia, offering an easy-to-use platform, competitive fees, and strong regulatory compliance.

13. Independent Reserve

Australian customers seeking for a safe, licensed exchange with a large selection of cryptocurrencies and affordable fees might consider Independent Reserve. Additionally, it is a wise alternative for those seeking first-rate customer service.

An insight into Independent Reserve:

Independent Reserve is an Australian cryptocurrency exchange. It was established in 2013 and is one of Australia’s oldest and most recognized cryptocurrency exchanges. Independent Reserve provides a number of services, including spot trading, margin trading, and over-the-counter trading.

Features of Independent Reserve

- Numerous cryptocurrencies are offered.

- elevated liquidity

- Comparable prices

- easy user interface

- fantastic customer service

Fees

- Trading Fees:Independent Reserve imposes a maker/taker fee of 0.50% – 0.02% on all trades. Makers increase liquidity to the market by placing limit orders, whereas takers drain liquidity from the market by placing market orders.

- Withdrawal fees:Withdrawal fees vary according to the coin being withdrawn. The withdrawal cost for Bitcoin, for example, is 0.0005 BTC.

- Deposit fees:Deposit fees are removed for deposits made by POLi, OSKO, BPAY, and bank transfer. There is, however, a 1% deposit fee for deposits made by credit or debit card.

Regulation & Licensing

- This exchange is Australian Transaction Reports and Analysis Centre (AUSTRAC) regulated;

- It is also Australian Securities and Investments Commission (ASIC) registered

In general, Australian customers seeking for a safe, regulated exchange with a wide selection of cryptocurrencies and reasonable fees can consider Independent Reserve.

14. BTC Markets

BTC Markets is an Australian-based cryptocurrency exchange. It launched in 2013 and is one of Australia’s oldest and most recognized cryptocurrency exchanges. BTC Markets provides a number of services, such as spot trading, margin trading, and futures trading.

An insight intoBTC Markets:

Here are some other factors to consider when choosing BTC Markets:

- The required minimum deposit is $200.

- The minimum withdrawal amount is ten dollars.

- Payment methods available on the exchange include bank transfer, POLi, OSKO, and credit card.

- BTC Markets provides a customer support service that is available 24 hours a day, seven days a week by live chat, email, and phone.

Features of BTC Markets

- A wide range of cryptocurrencies are available.

- Liquidity is abundant.

- Fees that are competitive

- Interface that is simple to use

- Excellent client service

Fees:

- Trading fees:BTC Markets charges a maker/taker fee ranging from 0.10% to 0.05%. Makers increase liquidity to the market by placing limit orders, whereas takers drain liquidity from the market by placing market orders.

- Withdrawal fees:Withdrawal fees vary according to the coin being withdrawn. The withdrawal cost for Bitcoin, for example, is 0.0005 BTC.

- Deposit fees:Deposit fees are removed for deposits made by POLi, OSKO, BPAY, and bank transfer. There is, however, a 1% deposit fee for deposits made by credit or debit card.

Regulation & Licensing

- Regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC)

- Registered with the Australian Securities and Investments Commission (ASIC)

Overall, BTC Markets is a wonderful option for Australian users seeking for a secure and licensed exchange with a large selection of cryptocurrencies and low fees. It is also a terrific option for users who want a user-friendly interface and excellent customer service. However, before selecting any cryptocurrency exchange, you should conduct your own investigation.

| Download App for Android | Download App for iOS |

15. CoinLoan

CoinLoan is an Australian-based cryptocurrency exchange. It was created in 2017 and is now one of the world’s largest bitcoin loan services. Spot trading, margin trading, loan, and staking are among the features available on CoinLoan.

An insight into Coinloan:

Here are some additional details about Coinloan which can give you a brief idea about this exchange:

- The required minimum deposit is $100.

- The minimum withdrawal amount is 10 dollars.

- Payment methods available on the exchange include bank transfer, credit card, and debit card.

- CoinLoan provides a customer support service that is available 24 hours a day, seven days a week by live chat, email, and phone.

Features ofCoinloan

- Crypto Lending and Borrowing: CoinLoan allows users to earn interest by lending out their crypto assets stored in their CoinLoan wallet. It also enables borrowing fiat loans against crypto assets.

- Wide Range of Supported Assets: Users can earn interest on a variety of assets, including traditional cryptocurrencies, stablecoins, and fiat currencies. Some of the supported currencies include Euro (EUR), USD Coin (USDC), Bitcoin (BTC), Paxos Standard (PAX), Litecoin (LTC), and more.

- Ease of Use: The platform is designed to be user-friendly, making it accessible to both beginners and experienced users.

- Built-in Exchange: CoinLoan provides a built-in exchange, allowing users to trade cryptocurrencies conveniently.

- Multiple Platform Access: CoinLoan offers access through web and mobile versions, including Android and iOS, ensuring users can manage their digital assets on the go.

- Membership Tiers: While there is a limitation on free withdrawals, users in higher membership tiers can enjoy more than one free withdrawal per month.

- CLT Token Staking: To attain the highest interest rates, users have the option to stake CLT tokens.

Fees:

- Trading Fees:CoinLoan charges a maker/taker fee ranging from 0.20% to 0.02%. Makers increase liquidity to the market by placing limit orders, whereas takers drain liquidity from the market by placing market orders.

- Withdrawal Fees:Withdrawal fees vary according to the coin being withdrawn. The withdrawal cost for Bitcoin, for example, is 0.0005 BTC.

- Lending fees:CoinLoan charges an annual lending cost of 8% – 12%. Borrowers pay lenders interest in the form of a lending fee.

- Staking fees:CoinLoan imposes a staking fee that ranges between 10% and 20% of the staking income. The staking charge is the percentage of rewards taken as a service fee by CoinLoan.

Regulation and licensing

CoinLoan is registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB).

Overall, CoinLoan provides a comprehensive platform for crypto lending, borrowing, and earning interest, with a focus on security and regulatory compliance.

16. Crypto.com

Crypto.com is a popular cryptocurrency exchange and platform that provides a range of services for users in Australia and around the world. Here’s an overview of Crypto.com, highlighting its features, fees, and regulatory information:

An insight into Crypto.com:

Crypto.com is a user-friendly cryptocurrency exchange and app that caters to both beginners and experienced traders. It offers a wide range of cryptocurrencies for buying, selling, and trading.

Here are some key features:

Features of Crypto.com

- User-Friendly Interface:com is known for its intuitive and easy-to-use interface, making it accessible for beginners.

- Cryptocurrency Variety:Users can access a diverse range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and many more.

- Mobile App:The Crypto.com mobile app is a convenient way to manage your crypto portfolio on the go, available for both Android and iOS.

Fees

Understanding the fees associated with a cryptocurrency exchange is crucial for users. Crypto.com has a fee structure that includes:

- Spot trading fees:com charges a 0.14% – 0.04% maker/taker fee. Makers increase liquidity to the market by placing limit orders, whereas takers drain liquidity from the market by placing market orders.

- Margin trading fees:com charges a 0.1% – 0.01% maker/taker fee.

- Futures trading fees:com charges a maker/taker fee ranging from 0.08% to 0.02%.

- Withdrawal fees:Withdrawal fees vary according to the coin being withdrawn. The withdrawal cost for Bitcoin, for example, is 0.0005 BTC.

- Deposit fees:Deposit fees differ based on the payment method chosen. For example, credit card deposits are subject to a 3.5% deposit fee.

Regulation & Licensing

Here are some of the licenses and regulations that Crypto.com has obtained:

- Monetary Authority of Singapore (MAS):com is a licensed Payment Institution (PI) and Digital Payment Token (DPT) Service Provider in Singapore.

- Financial Conduct Authority (FCA):com is a registered cryptoasset firm in the United Kingdom.

- Securities and Exchange Commission (SEC):com is a registered Money Services Business (MSB) with the SEC in the United States.

- Australian Transaction Reports and Analysis Centre (AUSTRAC):com is a registered Digital Currency Exchange Provider (DCEP) in Australia.

- Ontario Securities Commission (OSC):com is a registered Virtual Asset Trading Platform (VTAP) in Ontario, Canada.

Crypto.com is also a member of a number of self-regulatory organizations, including:

- Cryptocurrency Compliance Cooperative (CCC):The CCC is a self-regulatory organization for cryptocurrency exchanges and other cryptocurrency businesses.

- Vigilance Group of Anti-Money Laundering Analysts (VAMLA):The VAMLA is a self-regulatory organization for cryptocurrency exchanges and other cryptocurrency businesses in Singapore.

All these suggest that Crypto.com is a very trustworthy and reputable exchange and it is definitely worth a try.

| Download App for Android | Download App for iOS |

Tips for Successful Trading

Successful trading in the financial markets requires a combination of knowledge, discipline, and a well-thought-out strategy. Here are practical tips to enhance your trading experience, with an emphasis on risk management, staying updated with market trends, and using security features:

- Develop a Trading Plan: Before you start trading, create a comprehensive trading plan. This plan should include your financial goals, risk tolerance, entry and exit strategies, and position sizing. Stick to your plan to avoid impulsive decisions.

- Risk Management: Never risk more than you can afford to lose. Use stop-loss orders to limit potential losses on each trade. Diversify your portfolio to spread risk across different assets.

- Stay Informed: Keep yourself updated with the latest news and developments in the financial markets. Market sentiment can change rapidly based on news events, so being informed is crucial.

- Technical and Fundamental Analysis: Utilize both technical and fundamental analysis. Technical analysis involves studying price charts, while fundamental analysis considers economic indicators, news, and financial reports. Combining these approaches can provide a well-rounded view of the market.

- Continuous Learning: Trading is a learning process. Continuously educate yourself about trading strategies, tools, and market psychology. Consider using demo accounts to practice without risking real money.

- Use Security Features: If you’re trading on an online platform, take advantage of security features like two-factor authentication (2FA) to protect your account from unauthorized access.

- Monitor Emotions: Emotional control is essential. Fear and greed can lead to impulsive decisions. Stick to your plan and avoid making trades based solely on emotions.

- Position Sizing: Determine the appropriate size for your positions based on your risk tolerance and the size of your trading account. Overleveraging can lead to significant losses.

- Review and Adjust: Regularly review your trading performance. Analyze what worked and what didn’t. Adjust your strategy accordingly.

- Record Keeping: Maintain a trading journal to record your trades, strategies, and outcomes. This helps you learn from your experiences and improve over time.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

Future of Crypto Exchanges in Australia

The future of crypto exchanges in Australia holds both potential growth and challenges as the landscape continues to evolve. With increasing interest in cryptocurrencies, these platforms play a vital role in facilitating digital asset trading and investment.

In terms of growth, Australia has witnessed a surge in demand for cryptocurrencies, driven by factors such as increased adoption by businesses, heightened investor interest, and the growing popularity of decentralized finance (DeFi) applications. This presents significant opportunities for crypto exchanges to expand their user base and market share.

However, challenges exist within the regulatory framework governing crypto exchanges. The Australian government has been actively working towards implementing regulations that promote consumer protection and mitigate risks associated with money laundering and terrorism financing. These regulatory developments aim to strike a balance between fostering innovation while ensuring compliance with legal requirements.

One notable development is the introduction of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations for cryptocurrency exchanges. These measures require exchanges to implement robust customer identification processes and transaction monitoring systems to prevent illicit activities.

While regulation enhances trust in the industry, it also poses challenges for smaller or emerging players who may struggle with compliance costs or meeting stringent operational requirements. Striking an appropriate balance between regulation and fostering innovation will be crucial for sustaining the growth trajectory of crypto exchanges in Australia.

Moreover, keeping pace with technological advancements is essential as security threats continue to evolve alongside new financial instruments like non-fungible tokens (NFTs). Crypto exchanges must prioritize cybersecurity measures to protect user assets from potential breaches or hacking attempts.

Overall, although facing regulatory hurdles amidst evolving market dynamics, crypto exchanges have ample room for growth in Australia’s expanding cryptocurrency ecosystem provided they navigate through compliance obligations effectively while addressing emerging security concerns.

| Download App for Android | Download App for iOS |

FAQs

What are the best crypto exchanges in Australia for 2023?

The best crypto exchanges in Australia for 2023 include eToro (Australia’s Top Overall Crypto Exchange), CoinSpot (ideal for beginners and value), Kraken (The most liquid Australian exchange), Bybit (Best Exchange for Crypto Derivatives) and Swyftx (highly recommended platform).

What should I consider when choosing a crypto exchange in Australia?

When choosing a crypto exchange in Australia, consider factors like payment methods, ease of use, fees, trading features, and user reviews. Coinspot and Swyftx are top choices for beginners due to their user-friendly interfaces.

Which Australian crypto exchange is best for day traders?

Binance is the best Australian crypto exchange for day traders, offering a wide variety of cryptocurrencies and advanced trading tools. It has the highest trading volume and is accessible in many countries.

Are there trusted cryptocurrency exchanges in Australia?

Yes, there are trusted cryptocurrency exchanges in Australia, including Swyftx, Coinspot, Binance, Digital Surge, and Coinjar. These exchanges are required to register with AUSTRAC, ensuring regulatory compliance and safety.

Is buying cryptocurrency in Australia safe?

Yes, buying cryptocurrency in Australia is safe and well-regulated. The Australian Securities and Investments Commission (ASIC) and the Australian Transaction Reports and Analysis Centre (AUSTRAC) oversee crypto exchanges to ensure safety and compliance.

Conclusion

Australia’s crypto exchange landscape offers a range of options for individuals looking to engage in digital asset trading. While there are several reputable platforms available, it is crucial for users to conduct thorough research and consider factors such as security measures, user experience, fees, and regulatory compliance before choosing the best exchange that aligns with their needs.

By selecting exchanges that prioritize customer protection and follow robust security protocols, users can participate in cryptocurrency markets with confidence while adhering to legal requirements. It is advisable to stay informed about regulatory developments and industry trends as they continue to shape the landscape of crypto exchanges in Australia.

| Download App for Android | Download App for iOS |

Where to Trade Crypto Futures?

Now you can trade Bitcoin (BTC) futures on BTCC. BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. BTCC is a crypto exchange offering users liquid and low-fee futures trading of both cryptocurrencies and tokenized traditional financial instruments like stocks and commodities.

BTCC offers exclusive bonus for new users. Sign up and deposit on BTCC to get up to 10,055 USDT in bonuses. Meet the deposit targets within 30 days after successful registration at BTCC, and you can enjoy the bonus of the corresponding target levels. Find out what campaigns are available now: https://www.btcc.com/en-US/promotions

iOS QR Code Android QR Code

How to Trade Tether (USDT) on BTCC

- Mobile App

-

- 1. Download the BTCC App via App Store or Google Play

- 2. Register and verify your account, or log in to your BTCC account.

- 3. Tap ‘Buy Crypto’.

- *Please note that only verified users are eligible to buy crypto on BTCC.

- 4. Enter the amount you would like to buy in USDT.

- 5. Select a service provider and proceed to payment.

| Download App for Android | Download App for iOS |

How to Trade Crypto Futures on BTCC ?

To trade Crypto Futures on BTCC, follow these simple steps:

- Create an account

Go to the BTCC website and fill out the registration form with the necessary details. Finish the checks to make sure you’re in line with the stock exchange’s rules.

- Deposit funds

Fund your BTCC wallet once your account has been created and verified. You can fund your BTCC account with a number of different cryptocurrencies and fiat currencies.

- Navigate to the crypto trading section

You can begin trading on the BTCC platform as soon as your account has been funded. Find the crypto exchange rate, which is written as crypto/Bitcoin (BTC) or crypto/US Dollar (USDT) depending on the other pairs available.s.

- Choose your trading type

Both spot trading and futures trading are available through BTCC. If you want to purchase or sell crypto tokens at the current market price, you may want to investigate spot trading. If you’d rather trade crypto with leverage and speculate on its price movements, you can do so with crypto Futures.

- Place your trade

After deciding which type of deal you want to make, you can enter the amount of crypto you like to buy or sell, as well as your preferred price (if necessary). If everything checks out, go ahead and make the deal.

- Monitor and manage your trades

Be sure to monitor your crypto holdings on the BTCC exchange. To limit losses and protect gains, you can use stop-loss and take-profit orders. It is also important to keep up with the latest crypto market trends and news if you want to successfully trade this cryptocurrency.

Before becoming involved in any kind of trading, make sure you’ve done your homework. Due to the extreme volatility of the cryptocurrency markets, it is crucial to have a well-defined trading strategy and risk management framework in place. To successfully trade crypto on the BTCC market and take advantage of the chances it provides, follow these procedures and keep yourself updated.

BTCC Bonus

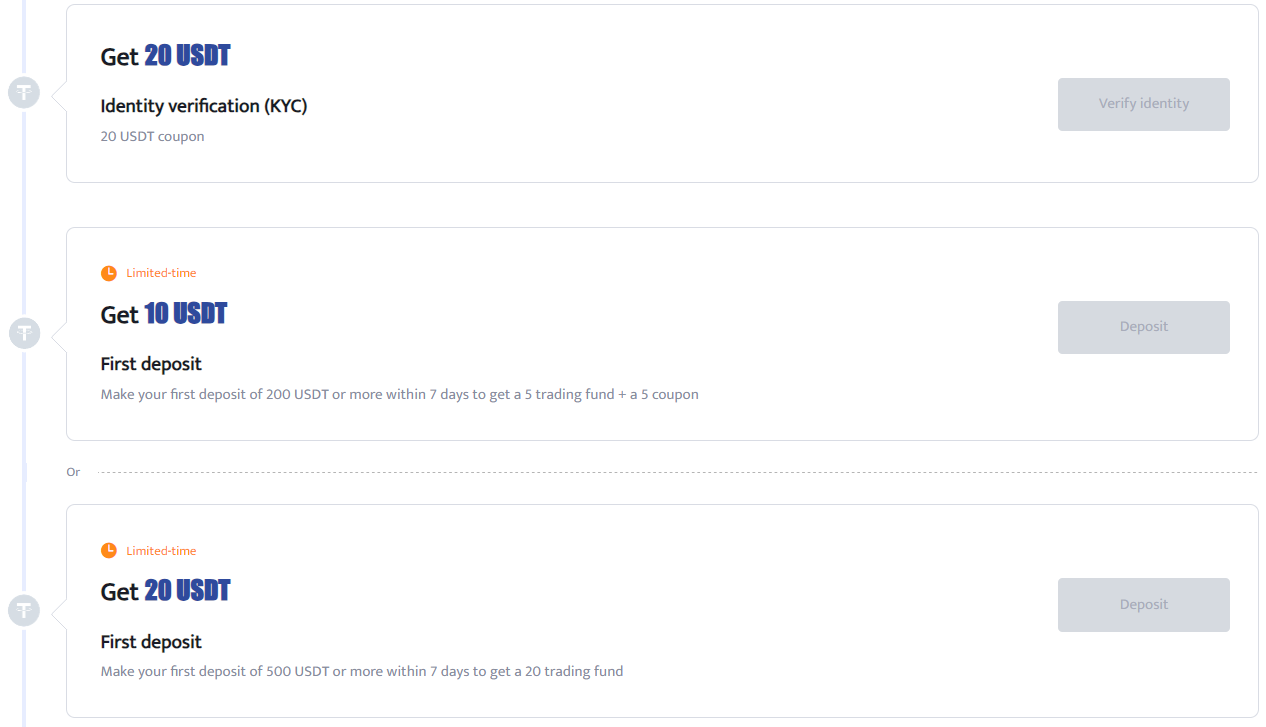

BTCC bonuses apply to different categories of users. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

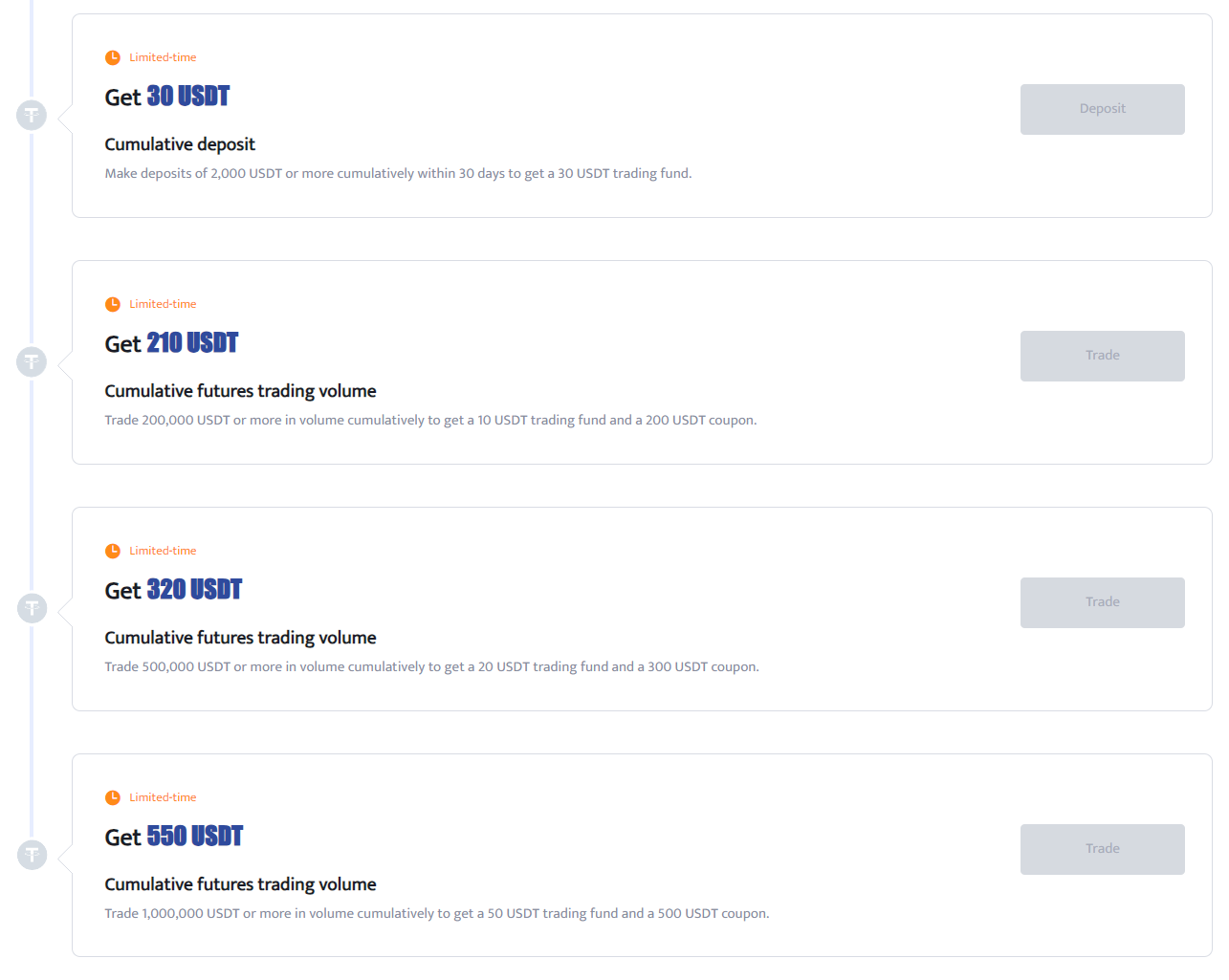

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

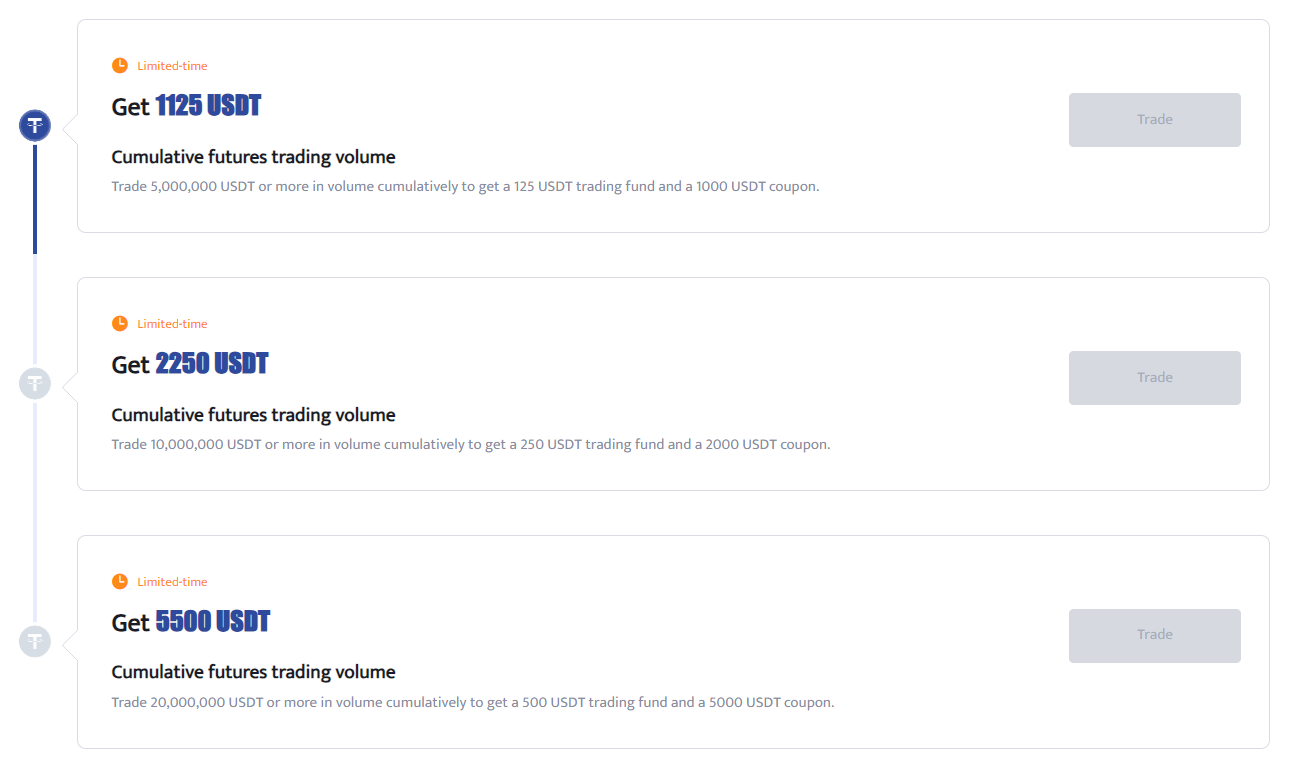

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

| Download App for Android | Download App for iOS |

Why Trade Crypto Futures on BTCC

To trade Crypto futures, you can choose BTCC crypto exchange.BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. Over 11 years of providing crypto futures trading services. 0 security incidents. Market-leading liquidity.

Traders may opt to trade on BTCC for a variety of reasons:

- Secure:safe and secure operating history of 11 years. Safeguarding users’ assets with multi-risk management through the ups and downs of many market cycles

- Top Liquidity:With BTCC’s market-leading liquidity, users can place orders of any amount—whAVAXer it’s as small as 0.01 BTC or as large as 50 BTC—instantly on our platform.

- Innovative:Trade a wide variety of derivative products including perpetual futures and tokenized USDT-margined stocks and commodities futures, which are innovative products invented by BTCC.

- Flexible:Select your desired leverage from 1x to 150x. Go long or short on your favourite products with the leverage you want.

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

Look More:

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (TRX) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Binance Review 2023: Is Binance Safe?

Crypto.com Review 2023: Is Crypto.com Safe?

eToro Review 2023: Can eToro be Trusted?

KuCoin Review 2023: Is KuCoin Safe?

OKX Review 2023: Should You Choose OKX Exchange?

Huobi Global Review 2023: Is Huobi Global Safe?

CEX.IO Review 2023: Is CEX.IO Safe?

Uphold Review 2023: Is Uphold Safe?

Poloniex Review 2023: Is Poloniex Safe?

Coinbase Review 2023: Is Coinbase Better Than Binance?

7 Best Crypto Exchanges in Canada Review & Buying Guide

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*