Recommended

7 Best Crypto Exchanges in Canada Review & Buying Guide

You’re part of the 40% of Canadians intrigued by cryptocurrency. But you’re unsure where to start, right? Don’t worry! We’ve got your back. We’ve reviewed the 7 best crypto exchanges in Canada just for you. This detailed guide will equip you with key insights to choose what’s best for you. So, let’s dive in and help navigate your journey into the thrilling world of cryptocurrency!

7 Best Crypto Exchanges in Canada

If you’re seeking to safeguard your assets, Bitbuy emerges as the top choice in the crypto market. For those of you mindful of costs, NDAX stands out with its low fees, while Wealthsimple shines as Canada’s best homegrown platform for trading stocks and ETFs. Looking globally, Kraken offers advanced crypto exchange options and Uniswap earns high marks as the best decentralized crypto exchange.

- Bitbuy – Top Choice for Safeguarding Your Assets

- NDAX – Best Low Fees Crypto Exchange

- Wealthsimple – Best Homegrown Canadian Platform for Stocks & ETFs

- Kraken – Advanced Trading Crypto Exchange with Global Access

- Uniswap – Best Decentralized Crypto Exchange

- VirgoCX – The Premier Platform for Automated Trading

- Newton – Best Crypto Platform with a Cheap Spread

Below is our quick overview and ratings of all seven best crypto exchanges in Canada.

| Broker | BTCC rating | Fees | Regulated By | Ease of Use |

|

★ 5.0 /5

Top Choice for Safeguarding Your Assets |

2%

Trading fees for both buys and sells |

FINTRAC | ⭐⭐⭐⭐⭐ |

|

★ 4.6 /5

Best Low Fees Crypto Exchange |

0.2%

Fix Trading Fee |

FINTRAC | ⭐⭐⭐⭐ |

|

★ 4.5 /5

Best Homegrown Canadian Platform for Stocks & ETFs |

1.5 – 2%

Crypto Trading Fee |

FINTRAC | ⭐⭐⭐⭐ |

|

★ 4.5 /5

Advanced Trading Crypto Exchange with Global Access |

0.16%

Maker fees 0.26% Taker fees |

FINTRAC FinCEN FCA |

⭐⭐⭐⭐ |

|

★ 4.3 /5

Best Decentralized Crypto Exchange |

0.30%

Maker & Taker Fee |

Operates through Smart Contracts | ⭐⭐⭐ |

|

★ 4.2 /5

The Premier Platform for Automated Trading |

0 – 0.5%

Transaction fee |

FINTRAC | ⭐⭐⭐⭐ |

|

★ 4.0 /5

Best Crypto Platform with a Cheap Spread |

0.40% – 0.74%

Spread fee |

PIPEDA & FINTRAC | ⭐⭐⭐⭐ |

Bitbuy’s a top choice for safeguarding your assets, given its robust security measures and dedicated customer support. As the best Canadian cryptocurrency exchange platform, it provides not just a secure way to trade, but also an easy-to-navigate interface that simplifies complex financial terminologies.

Founded in 2016 by Adam Goldman and Ademar Gonzalez, Bitbuy has grown exponentially. With more than 300,000 active users today, it stands out as a leading crypto trading platform in Canada. It’s backed by strong investors like Cypherpunk Holdings – a testament to its credibility in the crypto space.

What separates Bitbuy from other exchanges is their commitment to user security and transparency. They employ advanced SSL technology and cold storage solutions for funds protection. Additionally, they conduct regular third-party audits to ensure system integrity.

A key feature of Bitbuy is its dedication to customer service – they’re always ready to assist you with your queries or concerns about crypto transactions. Plus, their educational resources are comprehensive enough even for beginners who want to delve into the world of cryptocurrency.

So why choose Bitbuy? It combines crucial elements that every trader looks for: security, usability, reliable customer support and transparency. Moreover, it caters both expert traders seeking advanced features as well as newcomers wanting simple trading experiences.

| Features | Details |

| Services available | Cryptocurrency buying and selling |

| Regulated by | FINTRAC |

| Cryptocurrencies available | 25+ |

| Fees | Deposit fee of 0.5 to 1.5% per credit card

Variable transfer fees 0.5% transaction fee |

| Customer service | Email

Online ticket |

| Ease of use | ⭐⭐⭐⭐⭐ |

| Our rating | 4.8/5 |

Top Features

You’re sure to appreciate the top features of Bitbuy, which include its user-friendly interface, advanced trading tools, competitive transaction fees, and a variety of payment methods. As one of the best crypto exchanges in Canada, Bitbuy caters to both beginners and experienced traders with an easy-to-navigate platform that simplifies complex crypto terminologies.

Bitbuy’s security measures are among their standout aspects. They utilize cold storage and multi-signature wallets for your digital assets’ utmost protection. These high-tech measures safeguard against cyber thefts and hacks, making it a top choice for securing your assets in the world of crypto exchanges in Canada.

Now let’s talk about transaction fees – nobody likes them high! Fortunately, Bitbuy offers competitive rates. Its low taker fees mean you can maximize your trades without eating into your potential profits. It’s all part of what makes Bitbuy the best crypto exchange Canada has to offer.

Customer service is another area where Bitbuy shines brightly. Their dedicated team is always ready to assist you with any queries or concerns you have – ensuring smooth sailing as you navigate through your crypto journey.

Lastly, Bitbuy provides multiple payment methods for convenience. You can choose from Interac e-Transfer, wire transfers or bank transfers to deposit and withdraw funds easily. This flexibility is just another reason why it stands out among other crypto exchanges in Canada.

Fees to Consider

It’s important to bear in mind the various fees associated with Bitbuy, which include deposit, withdrawal, trading, and staking charges. As you search for the lowest fee crypto exchange or aim to buy crypto with the cheapest fees, these are some of the key fees to consider.

Firstly, there is a zero-fee policy on deposits regardless of whether you use Debit Card, Interac e-Transfer, Wire Transfer or Cryptocurrencies. This lack of charge gives Bitbuy an edge as it allows you to start trading without any upfront cost.

When it comes to withdrawals though, there’s a slight difference based on your choice of method. If you opt for Interac e-Transfer or Wire Transfer withdrawals, a 1.5% fee applies. However, if you choose Crypto withdrawals, then the charges depend on the specific type of currency selected.

Trading fees are another aspect to keep an eye on. They’re capped at 2% for both buys and sells on the exchange which is quite competitive in comparison with other platforms out there.

For Pro traders who trade frequently and in large volumes, Bitbuy offers different maker and taker fees depending upon your volume traded across four different tiers ranging from below $250k up till $5m+. The more substantial your trade volume is; lower will be your trading costs.

Finally don’t forget about staking services! Bitbuy offers this service in six different coins from ETH to NEAR but do note that commission rates vary between 25-28%.

Regulation & Licensing

Understanding the regulations and licensing of Bitbuy can give you peace of mind as a trader, knowing that they’re compliant with Canadian financial laws. As one of the top crypto exchanges in Canada, Bitbuy has taken substantial steps to ensure they meet all regulatory standards.

Firstly, Bitbuy is registered as a Money Services Business (MSB) under the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This registration signifies their commitment to strict anti-money laundering (AML) and know-your-customer (KYC) laws. These measures are crucial in protecting you from fraudulent transactions or scams within this Canada crypto exchange.

Furthermore, Bitbuy’s operations are supervised by the Ontario Securities Commission (OSC), which oversees capital markets within Ontario. This supervision guarantees that Bitbuy follows relevant securities laws and regulations thereby fostering a secure trading environment for you.

Bitbuy’s compliance with FINTRAC and the OSC makes it one of the best regulated platforms among other crypto exchanges in Canada. It shows their dedication not only towards offering transparent trading but also adhering to legal frameworks imperative for maintaining trust between traders and cryptocurrency exchanges.

Bitbuy Pros & Cons

Pros:

- Secure and Reliable

- Canadian Focus

- Easy Account Creation

- Variety of Funding Methods

- Wide Range of Cryptocurrencies

- Insurance coverage

Cons:

- Limited Availability in global crypto space

- Accepts only one fiat – CAD

- Withdrawal fees

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

2.NDAX – Best Low Fees Crypto Exchange

NDAX sets itself apart by offering some of the lowest fees among digital asset trading platforms. As one of the best crypto trading platforms in Canada, it’s a sought-after option for traders who prefer to keep most of their earnings. Its competitive edge doesn’t just lie in its affordability but also in its outstanding customer service.

| Features | Details |

| Services available | Cryptocurrency buying and selling |

| Regulated by | FINTRAC |

| Cryptocurrencies available | 25+ |

| Fees | Zero Deposit fee

$4.99 bank withdrawal fee 0.2% fixed trading fee |

| Customer service | Email

Live Chat Online ticket |

| Ease of use | ⭐⭐⭐⭐ |

| Our rating | 4.6/5 |

Top Features

Let’s delve into the top features that make NDAX a remarkable platform for trading digital assets. As one of the best cryptocurrency exchanges in Canada, it offers unlimited access to 14 top crypto coins, including Bitcoin and Ether. Whether you’re a beginner or an experienced trader, you’ll find its trading features versatile and user-friendly.

Unlike many other platforms on the list of crypto exchanges in Canada, NDAX offers free deposits. They don’t charge any fees when you load your account with funds, making it more economical for regular traders. There are multiple order types available like market, limit and stop loss orders giving you full control over your trades.

Competitive rates are another asset of NDAX – they maintain low withdrawal fees ensuring that more of your profits stay with you. It’s also recognized as the best platform to buy Bitcoin in Canada because users can link their bank accounts for easy buying and selling of digital currencies.

NDAX goes beyond just transactions; it provides tools for technical analysis such as trendlines and timeframes through TradingView integration. This feature is particularly beneficial for advanced traders who want to track coin performance and forecast price movements.

NDAX operates under Canadian financial authorities’ regulatory framework—FINTRAC—guaranteeing its legitimacy as a money service business (MSB). Furthermore, excellent customer support via email, live chat and phone makes trading even easier.

With these key features presented clearly and concisely, there’s no doubt why NDAX stands out among other crypto exchanges in Canada.

Fees to Consider

You’ll want to take into account the various fees associated with using the NDAX platform, such as the standard trading fee and specific withdrawal charges for different cryptocurrencies. As one of the best crypto exchanges in Ontario, NDAX offers a standard trading fee of 0.20%. This flat rate remains consistent regardless of your trade volume.

When you’re trading crypto in Canada, especially on NDAX, it’s vital to factor in these costs. For instance, fiat withdrawals come with a flat fee of $25. This encourages you to make high-volume withdrawals instead of frequent smaller ones.

Moreover, there are unique fees applied based on the type of cryptocurrency you’re withdrawing. Bitcoin commands a charge of 0.000399 BTC while Ether incurs a cost of 0.0099 ETH. If Litecoin is your preferred currency, anticipate a deduction of 0.0499 LTC per withdrawal.

Other notable charges include Cardano at 3 ADA, EOS at just 1 EOS and Dogecoin at a mere 10 DOGE per transaction. Stellar users will see an approximate deduction of about 8 XLM and Ripple faithfuls should budget for around 3 XRP per withdrawal.

Understanding these fees is crucial when selecting your crypto exchange platform because they can significantly impact your overall profitability and experience when trading crypto in Canada.

Regulation & Licensing

It’s vital to remember that NDAX is fully licensed and regulated by the Canadian government, ensuring utmost legitimacy and asset protection. As someone interested in crypto Canada, this should be a key consideration. When you trade with NDAX, you’re not stepping into grey areas of legality or risking your assets on an unregulated platform.

NDAX possesses a Money Services Business (MSB) license from the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This isn’t just a fancy title; it’s proof that they comply rigorously with Canadian anti-money laundering (AML) and Know Your Customer (KYC) regulations.

NDAX Pros & Cons

Pros:

- Competitively low trading fees

- Instant ID verification process

- Free deposits with no fees charged

- Supports advanced trade orders

- 24/7 customer support

- Offers a large selection of digital assets

Cons:

- Available only to Canadian residents

- Accepts fiat payments in Canadian Dollars only

- Does not allow trading of crypto derivatives

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

3. Wealthsimple – Best Homegrown Canadian Platform for Stocks & ETFs

Wealthsimple, a platform that’s made quite a name for itself in the Canadian stocks and ETFs market. It has even established itself as one of the best crypto apps in Canada.

Launched in 2014 by co-founders Michael Katchen and Rudy Adler, Wealthsimple has grown significantly over the years. This upstart broker was initially created to make investing simple and accessible for everyone, regardless of their financial knowledge or wealth. The platform quickly caught investors’ attention due to its user-friendly interface and innovative features.

Wealthsimple garnered substantial backing from experienced investors early on, with Power Financial Corporation becoming an initial key investor. Its total active users have surged past 1.5 million as it continues to offer services that meet diverse investment needs.

Apart from being a trusted player in stocks and ETFs, Wealthsimple is also carving out a niche in the cryptocurrency sector. In August 2020, they introduced Wealthsimple Crypto – making them not just a leading crypto broker in Canada but also providing one of the best platforms to buy crypto in Canada.

Wealthsimple Crypto allows you to buy and sell Bitcoin and Ethereum right within your account’s application – no extra accounts or wallets needed! While it still only supports these two cryptocurrencies at present time, its sleek design coupled with security measures like cold storage makes it an attractive option for both newbies and seasoned traders alike.

| Features | Details |

| Services available | Stocks, ETFs & Cryptocurrency trading |

| Regulated by | FINTRAC |

| Cryptocurrencies available | 25+ |

| Fees | USD Account fee ($10)

1.5-2% Crypto trading fee 1.5% conversion fee (CAD to USD) |

| Customer service | Email

Live Chat Phone Support Online ticket |

| Ease of use | ⭐⭐⭐⭐ |

| Our rating | 4.5/5 |

Top Features

Wealthsimple’s top features include commission-free trades for stocks, ETFs, options, and cryptocurrency on major Canadian and US exchanges. This makes it a cost-effective option for investors who are primarily focused on stocks and ETFs. Additionally, Wealthsimple Plus members benefit from no foreign exchange fees for USD trades.

Customer support is another strong feature of Wealthsimple. You can reach them through live chat, phone, or email 7 days a week. The availability of a Virtual Assistant 24/7 also adds convenience and accessibility for users.

Mobile app users appreciate the ease and simplicity of the app. However, some have reported speed issues and expressed a desire for more features. While Wealthsimple provides basic stock research tools, it does not offer advanced charting or third-party analysis. So if you require these advanced features for your investment strategy, you may need to consider other platforms.

In terms of reliability, no major outages have been reported recently with Wealthsimple. However, occasional speed issues have been mentioned by users.

Fees to Consider

You’ll need to consider the various fees associated with using Wealthsimple, as they can impact your overall trading costs. When learning how to trade crypto in Canada, it’s vital to understand these costs. The primary fee for crypto trading accounts is a 1.5-2% Operations Fee per transaction. This fee gets applied via a spread on bid/ask prices when buy/sell orders execute.

For example, let’s say you want to buy $100 of Bitcoin and the trading spread is 1.5%. In that case, you’ll shell out an additional $1.50 for the transaction – it’s that simple! But remember, this only covers crypto trades; other securities come with their own set of fees.

Trading listed US & Canadian securities? You’re in luck because there are zero commissions! Opening or closing an account won’t cost you anything either nor will deposits/withdrawals via Bank Transfer (EFT). Electronic statements & trade confirmations and even inactive accounts come without any charges attached!

However, some fees might pop up depending on your activities. There’s a 1.5% Foreign Exchange Fee when converting between CAD and USD. Should you venture into options trading, be prepared to pay contract fees starting at US$2 and early exercise fees going up to US$45.

Other miscellaneous charges include a USD Account fee ($10), wire transfer services ($30), and broker-assisted phone trades ($45). But don’t fret; most of these can be avoided if you stick to trading Canadian securities through the app.

Regulation & Licensing

It’s crucial to understand that Wealthsimple operates under strict regulation and licensing requirements set by the Canadian government, ensuring a secure environment for your cryptocurrency trading. Unlike other platforms like Kraken Ontario, Wealthsimple is overseen by FINTRAC, Canada’s regulatory body for anti-money laundering and counter-terrorist financing.

As a registered Money Services Business (MSB), they’re required to follow stringent regulations. They’ve put into place robust security measures for protecting user funds, much like you’d find with crypto futures in Canada or even leveraged trading platforms.

One of these measures includes cold storage for most user funds. This means your cryptocurrencies are kept offline in “cold” wallets, making them inaccessible to hackers. In addition, multi-factor authentication (MFA) provides an extra layer of security on your account.

Wealthsimple Pros & Cons

Pros:

- Zero-fee trades for stocks and ETFs

- User-friendly mobile app

- Instant deposits of up to $1,500 (or $5,000 for Wealthsimple Plus subscribers)

- Fractional shares allow investment in major companies without paying full stock price.

- Trading of 50+ cryptocurrencies

- Member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF) for legitimacy and protection.

Cons:

- Limited securities available for trading (stocks, ETFs, options, and cryptocurrency only)

- Few research tools compared to other platforms

- 1.50% conversion fee for buying/selling US securities (unless subscribed to Wealthsimple Plus)

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

4. Kraken – Advanced Trading Crypto Exchange with Global Access

Kraken’s standing as an advanced trading platform with global access has made it a popular choice among crypto enthusiasts worldwide. With its roots dating back to 2011, Kraken is one of the oldest and most respected cryptocurrency exchanges in existence today. Its strong reputation is backed by a robust investor base that includes companies such as Hummingbird Ventures, Blockchain Capital, and Money Partners Group.

Now, you might be wondering – is Kraken available in Canada? The answer is yes! It’s part of the lineup of top-notch crypto apps Canada residents can access for their digital asset transactions. In fact, it boasts over four million active users globally and counting – proof of its universal appeal.

A key feature that sets Kraken apart from other platforms is its advanced automated trading platform. This high-tech functionality allows users to set specific parameters for trades to happen automatically – a major asset if you’re looking for an automated trading platform Canada offers within its borders.

As part of your journey into the world of cryptocurrency trading in Canada or anywhere else globally, consider incorporating Kraken into your strategies. Its sophisticated tools are designed not just for experienced traders but beginners too who aspire to master digital asset management effectively. So go ahead and seize the opportunity offered by this remarkable exchange.

| Features | Details |

| Services available | Cryptocurrency buying and selling |

| Regulated by | FINTRAC

FinCEN FCA |

| Cryptocurrencies available | 56+ |

| Fees | 1.5% purchase fee on altcoins

0.9% purchase fee on stablecoins |

| Customer service | Email

Live chat Online ticket |

| Ease of use | ⭐⭐⭐⭐ |

| Our rating | 4.5/5 |

Top Features

Having explored Kraken as a globally accessible advanced trading crypto exchange, let’s dive into its top features. These qualities make it one of the best apps to buy cryptocurrency in Canada.

Firstly, with Kraken, you’ve got access to over 50 cryptocurrencies. This vast selection provides plenty of options for investment and diversification. Whether you’re looking to trade Bitcoin or explore emerging altcoins, Kraken’s got you covered.

Kraken supports six fiat currencies including CAD. So, for Canadians, it simplifies the process of buying and selling cryptocurrencies directly using your local currency. No need to worry about complex forex conversions.

One major feature that stands out is Kraken’s margin and futures trading option offering up to 4x leverage. This means you can potentially amplify your profits (or losses) by borrowing additional funds.

For high-volume dealers seeking personalized service, there’s the Over-the-Counter (OTC) one-on-one service – a unique feature not commonly found on all platforms.

Whether you’re a beginner wanting a straightforward way to purchase crypto or an experienced trader looking for advanced tools, Kraken satisfies both needs with its easy-to-use interface and Pro platform respectively.

On-the-go management of trades is made possible through the user-friendly mobile app – arguably one of the best crypto wallets in Canada because of its security and ease-of-use.

Speaking of security, rest assured knowing that Kraken is safe & reliable with no recorded hacks ever! It also offers high liquidity ensuring your transactions are completed at desired prices. Lastly, customer support is available round-the-clock alongside educational resources for continuous learning.

Fees to Consider

It’s important to consider the various fees associated with using Kraken, which include trading fees, withdrawal and deposit charges for both fiat and cryptocurrencies. You should be aware that many fiat deposit methods are free, while others may incur a maximum fee of $10. Fiat withdrawal fees differ according to the method used but they all come at a cost except for ACH.

Trading on Kraken isn’t without its costs either. If you’re buying a cryptocurrency like Bitcoin using a stablecoin such as USDT through an instant buy option, expect to pay a trading fee of 1.5%. Buying different stable coins using fiat or another stable coin incurs a slightly lower fee at 0.9%.

Now let’s talk about Kraken Pro trading discounts – this could be your saving grace if you’re planning high-volume trades over time. With these discounts in place, maker and taker fees can decrease based on your 30-day trading volume. They start at 0.16% for maker fees and 0.26% for taker fees but can drop as low as zero.

Regulation & Licensing

It’s worth noting that Kraken operates under strict regulations from several financial authorities worldwide, ensuring a secure and trustworthy environment for its users. In Canada, they’re regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This means they must comply with anti-money laundering (AML) and know-your-customer (KYC) rules. These regulations are designed to prevent illicit money flow, safeguarding both you as a user and the broader financial ecosystem.

Kraken isn’t just regulated in Canada; it also follows stringent regulations from the Financial Crimes Enforcement Network (FinCEN) in the United States. This further proves their dedication to maintaining high regulatory standards. So when you’re trading crypto on Kraken, rest assured knowing your activities are being monitored for safety against fraudulent practices.

Over in the United Kingdom, Kraken is licensed by the Financial Conduct Authority (FCA), which adds another layer of trustworthiness to its platform. Having an FCA license shows a firm’s commitment providing safe services to users like you who engage in crypto trading.

Kraken Pros & Cons

Pros:

- Large selection of cryptocurrencies available for trading.

- Low fees for active traders

- User-friendly interface for new traders

- Offers high-quality educational guides and tools

- Provides options for leverage and margin trading

- Excellent phone and chat support.

Cons:

- Limited options for funding accounts

- Margin trading only available for Ontario residents who meet certain requirements

- High minimum deposit requirements that may discourage new traders.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

5. Uniswap – Best Decentralized Crypto Exchange

Uniswap is a leading decentralized exchange known for its innovative features and strong investor backing. Born out of the Ethereum blockchain in 2018, Uniswap is a pioneer in automated liquidity provision on Ethereum that’s set the standard for DeFi projects globally.

Uniswap was launched by Hayden Adams with substantial guidance from Ethereum creator Vitalik Buterin. It received funding from prominent investors including Paradigm, Andreessen Horowitz, and Union Square Ventures. This solid backing reflects not just faith in the platform but also in its potential to revolutionize crypto transactions.

What sets Uniswap apart? Its unique protocol allows users to trade directly with smart contracts on the Ethereum network. This eliminates the need for intermediaries, reduces costs, and increases transaction speed. Furthermore, it employs an Automated Market Maker system which enables liquidity providers rather than order books to determine asset prices.

| Features | Details |

| Services available | Swap tokens or earn interest with liquidity mining |

| Regulated by | Operates through Smart Contracts |

| Supported Wallets | Metamask, WalletConnect, Coinbase Wallet, Fortmatic, Portis |

| Fees | Withdrawal Fee 0.000079

Taker Fee 0.30% Maker Fee 0.30% |

| Customer service | Online ticket |

| Ease of use | ⭐⭐⭐ |

| Our rating | 4.3/5 |

Top Features

Uniswap’s top features certainly make it stand out in the crowded DeFi space. Its automated market-making model lets you trade tokens without relying on a centralized order book, giving you more control and flexibility. This means you can trade a wide variety of Ethereum-based tokens including ERC-20 and ERC-721, opening up an array of options for your crypto portfolio.

You’ll find Uniswap to be user-friendly, no matter your experience level with cryptocurrency trading. It’s as simple as Google’s search box—easy to use yet capable of delivering vast information at your fingertips. It also boasts robust liquidity, reducing the chance of prices fluctuating too dramatically during larger swaps.

One unique feature is its Initial Liquidity Offerings (ILOs), which allow projects to raise funds and create markets for their new tokens. This could potentially present lucrative opportunities if you’re looking to diversify your investments further.

True to the spirit of decentralization, Uniswap isn’t controlled by any central authority—you retain full control over your assets at all times. Plus, it offers reasonable fees compared to other decentralized exchanges making it even more attractive for users like yourself.

Being open source allows anyone to audit and verify its functionality—an essential aspect when dealing with digital assets. Lastly, Uniswap acts as an NFT aggregator; this means you have access to various NFTs from top marketplaces all within one platform—a great advantage if you’re keen on exploring this emerging asset class.

Fees to Consider

When considering Uniswap, there are several types of fees to keep in mind that can impact your trading experience. The network fee is one such cost that fluctuates depending on the chosen network. For instance, if you opt for ETH, it’s generally more expensive than using Polygon (MATIC) or other networks.

A swap fee is another charge you’ll encounter when trading on Uniswap. It can range from 0.01%, 0.05%, 0.3%, up to a maximum of 1%. This percentage might seem negligible but could add up when dealing with significant amounts.

If you’re looking to purchase crypto via MoonPay on Uniswap, you should be aware of their specific purchase fees as well: card purchases attract a 4.5% fee while bank transfers cost just 1%. However, there’s a minimum charge of $3.99 regardless of the transaction method.

Now let’s put these numbers into perspective by comparing them with a centralized exchange like Coinbase Advanced which charges a hefty 0.6% for market orders if your monthly trading volume is less than $10,000.

While Uniswap’s trading fees compare favorably in this case, don’t forget about those pesky Ethereum network gas prices during high usage periods which could make swaps costly on Uniswap.

On the bright side though – remember you can always switch over to faster and cheaper networks like Polygon. So always keep an eye out for these variables and plan your trades strategically to minimize costs and maximize returns.

Regulation & Licensing

Navigating the regulatory landscape of DeFi platforms like Uniswap can be a bit tricky due to its evolving nature. Unlike traditional exchanges, Uniswap operates through a network of smart contracts, which are self-executing agreements that carry out token swaps based on preset rules. This decentralized operation eliminates the need for intermediaries and custodial services, giving you direct control over your crypto assets.

Being part of the burgeoning DeFi sector, Uniswap is open-source and permissionless. You just need an internet connection and a compatible digital wallet to start trading. However, remember that while it doesn’t require traditional regulatory licenses, this doesn’t mean it’s completely free from oversight.

Various regulatory bodies may have jurisdiction over different aspects of these platforms. For instance, investor protection and anti-money laundering measures could come under scrutiny. So it’s crucial for you to understand and comply with any regulations applicable in your location when using Uniswap or similar platforms.

Uniswap Pros & Cons

Pros:

- Enables decentralized exchange of digital assets

- Smart contracts enable efficient and cheaper asset trading

- Users can earn UNI by holding their cryptocurrency

- Decentralized governance allows anyone to participate

- Uniswap supports any digital token adhering to the ERC-20 standard

- Users can create new markets or swap assets via existing markets

Cons:

- Only supports Ethereum-compatible cryptocurrencies

- Users need ETH to pay transaction fees

- Requires a compatible, self-hosted wallet

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

6. VirgoCX: The Premier Platform for Automated Trading

It’s clear that VirgoCX has solidified its reputation as a premier platform for automated trading. When it comes to choosing the best crypto trading platform Canada has to offer, VirgoCX is a remarkable option. It’s not just about their user-friendly interface or cutting-edge technology, but also their commitment to providing a safe and reliable environment for all traders.

Founded in 2018 by Adam Cai, VirgoCX has grown rapidly due to its deep understanding of digital currencies and blockchain technology. The platform boasts a robust security system that protects users from potential cyber threats while ensuring seamless transactions. And with over 20 cryptocurrencies available on their platform, traders have a wide range of options at their fingertips.

The success of VirgoCX can also be attributed to its strong team of investors who believe in the company’s vision. These investors include prominent names such as NGC Ventures and Consensus Lab who are known for supporting innovative financial technologies worldwide.

As for active users, VirgoCX prides itself on having thousands of satisfied customers who use their services daily. This high number attests to the trustworthiness and efficiency of the platform.

| Features | Details |

| Services available | Cryptocurrency buying and selling

OTC Direct platform NFTs |

| Regulated by | FINTRAC |

| Cryptocurrencies available | 60+ |

| Fees | Transaction fees from 0 to 0.5%. |

| Customer service | Email

Live Chat |

| Ease of use | ⭐⭐⭐⭐ |

| Our rating | 4.2/5 |

Top Features

Let’s dive into the top features of VirgoCX that set this platform apart, making it the best Canadian cryptocurrency exchange. These include its industry-leading technology, efficient payment gateway, and impressive security measures.

VirgoCX is powered by the advanced VirgoTrade technology, offering you a seamless trading experience with API connectivity. This high-level tech support positions the platform as a frontrunner in the crypto trading world. You can buy, trade or sell major stablecoins like Gemini Tether, USD Coin & Paxos Standard effortlessly.

Navigating your way through financial transactions can be complex; but not on VirgoCX. The platform offers an efficient payment gateway for fiat currencies. It’s partnered with reputable payment partners to facilitate swift international and domestic withdrawals and deposits.

Security is paramount when dealing with digital currencies. Notably, VirgoCX goes above and beyond to guarantee user account safety. Leveraging multi-signature and offline crypto wallet technology ensures your assets are secure at all times. Furthermore, 90% of users’ funds are held in cold wallets while fiat currencies are deposited in trusted financial establishments across Canada and the US.

VirgoCX isn’t just about automated trading; it also provides unmatched customer service around the clock – a multilingual support team ready to assist you whenever needed.

Compliance is key in financial dealings; hence VirgoCX is fully regulated under FINTRAC rules ensuring complete transparency in operations.

It’s clear that these top-notch features make VirgoCX stand out amongst other platforms as one of the finest exchanges for cryptocurrency enthusiasts across Canada.

Fees to Consider

While VirgoCX offers free CAD deposits and withdrawals, don’t forget that they make their profit through trading fees which can be higher than other platforms. As a broker, VirgoCX buys crypto and sells it to you at a slightly elevated price compared to the market rate. This difference in price is known as the spread, and it’s where this crypto trading platform Canada makes its money.

The spread varies depending on the asset’s price when you execute your trade. You’ll see this information before confirming any transactions on VirgoCX so keep an eye out for it. Free crypto deposits are another feature of this exchange, but remember the trading fees might offset these cost-free transactions.

So what does this mean for you? Simply put, while you may not pay deposit or withdrawal fees, your actual cost could be hidden within your trades themselves. The ‘free’ tag might seem appealing initially but don’t let that distract you from understanding how much each trade is actually costing you.

Regulation & Licensing

VirgoCX’s commitment to regulation and licensing, evident in its MSB registration with FINTRAC, ensures a secure trading environment that adheres to Canadian laws. As an integral part of the crypto exchange Canada landscape, their continued compliance provides you with confidence that your trading activities are both legal and protected.

They’ve adopted effective anti-money laundering (AML) and know your customer (KYC) policies, demonstrating a robust approach towards maintaining transparency and integrity. These measures help safeguard against fraudulent activities while ensuring users’ financial transactions are traceable. By complying with these regulations, VirgoCX is not only protecting itself but also providing you a safer platform for digital currency trading.

VirgoCX Pros & Cons

Pros:

- Zero trading fees for buying and selling crypto assets

- Trade over 60 cryptocurrencies instantly

- Available in all Canadian provinces and territories

- No fee for CAD deposits using bank transfer

- Compliant with PIPEDA, registered with FINTRAC, and licensed by CSA

- Approximately 80% of crypto assets held in cold storage with Coinbase Custody

Cons:

- Credit and debit card deposits incur a fee

- Recommended to move assets to a non-custodial wallet to reduce counterparty risk

- Lack of Information on Fiat Payment Solutions

- Limited customer support options (only email and live chat available)

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

7.Newton – Best Crypto Platform with a Cheap Spread

Newton, known for its low spread, is yet another platform that’s caught the attention of crypto traders. As one of the best Canadian crypto exchanges, it has a robust history that’s worth exploring. Since its inception in 2018 by CEO Dustin Walper after his previous company was acquired, Newton has grown exponentially and now boasts over 100,000 active users.

Unlike other platforms, Newton doesn’t make money on spreads but generates revenue from tiny markups on buy or sell orders. This approach makes it an appealing option for those looking to maximize their returns. It also offers a user-friendly interface suitable for both beginner and experienced traders alike.

In terms of investors backing this venture, there are several noteworthy names involved with Newton. White Star Capital led the initial seed round investment in 2018 and continues to be a significant investor today. Other prominent players include DV Chain & CMT Digital who have helped fuel the growth and expansion of this trading platform.

| Features | Details |

| Services available | Cryptocurrency buying and selling |

| Regulated by | PIPEDA & FINTRAC |

| Cryptocurrencies available | 60+ |

| Fees | 0.40% to 0.74% spread

0% CAD funding 0% CAD withdrawal |

| Customer service | Online ticket |

| Ease of use | ⭐⭐⭐⭐ |

| Our rating | 4.0/5 |

Top Features

Transitioning from discussing why Newton is known as the best crypto platform with a cheap spread, let’s delve deeper into its top features, making it one of the best crypto exchanges in Canada.

First and foremost, Newton offers you an opportunity to buy cryptocurrencies at significantly lower fees than most other platforms. It’s not just about affordability; it’s also about ease of use. With a highly intuitive user interface and well-designed mobile apps available on both Android and IOS platforms, trading has never been more convenient. The sleek design and easy-to-read dark theme charts make tracking your investments a breeze.

But what really sets Newton apart as one of the best crypto exchange Canada provides is its wide selection of cryptocurrencies coupled with no trading fees and impressively low spreads. This means you have a wealth of options without worrying about hidden charges eating into your profits.

The introduction of Newton Pro beta takes things up another notch by offering advanced features like limit orders, transfers, order books, and more. Once fully released, this promises even tighter spreads and higher liquidity – perfect for those seeking to maximize their trading potential.

Finally, don’t overlook Newton’s referral program – a great way to earn while helping others get started in the world of cryptocurrency investing. You can easily find your unique referral link in settings to start earning $25 for each referral who trades over $100.

Fees to Consider

When considering the platform, it’s important to keep in mind there are some fees you’ll need to account for. Newton, a Canada crypto exchange, has an appealing fee structure that can greatly benefit your trading activities. They don’t charge for fiat deposits or withdrawals which means you’re not losing any money when funding your account with Canadian dollars or when it’s time to cash out.

One of the striking things about this Canada crypto exchange is that they also waive network fees up to $5 when making crypto withdrawals. In periods of high network traffic where fees can get steep, this feature comes in handy. However, be aware that if the network fee exceeds $5, you’ll have to cover the difference.

Another advantage of Newton is its zero commission policy and lack of trading fees. This allows you more freedom and flexibility in making trades without worrying about extra costs eating into your profits.

However, it’s worth noting that while there are no direct trading fees on this platform, Newton does apply what is known as a ‘spread’. This is essentially a small difference between buying and selling prices which can range from medium to high depending on market conditions.

Regulation & Licensing

Regulation isn’t just a piece of paper; it’s a testament to the platform’s commitment to operate within legal boundaries and meet industry standards. This brings us to Newton, one of the top contenders for being the best cryptocurrency exchange in Canada. Newton stands out due its meticulous adherence to regulatory compliance and licensing.

Newton is fully licensed as a crypto exchange in Canada, which means it conforms to stringent industry standards. It strictly adheres to the Personal Information Protection and Electronic Documents Act (PIPEDA). Compliance with this act ensures your personal information is handled securely, reinforcing trust in their platform.

But they don’t stop there; Newton also holds registration with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). By complying with FINTRAC regulations, they actively deter illicit activities on their platform while maintaining stringent anti-money laundering measures.

These credentials provide reassurance that your funds and data are safeguarded against potential threats. Therefore, by choosing Newton or any regulated entity as your go-to crypto trading platform, you’re not just investing in cryptocurrencies but also peace of mind.

Newton Canada Pros & Cons

Pros:

- Access to cryptocurrencies not available elsewhere

- Low fee structure with Surge Pricing

- Automatic execution of limit orders

- Offers low spreads and high liquidity

- Strong security features and partnership with PLAID

- Beginner-friendly user interface

Cons:

- Limited number of currencies available for trade

- Verification times can be slow

- Only available to Canadian citizens and permanent residents

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

What to look for in the Best Crypto Exchanges in Canada?

In navigating the cryptosphere, you’ll want to consider a few essential factors in choosing the top-notch crypto exchange that suits your trading needs in Canada. You should pay close attention to the trading fees charged, how intuitive and user-friendly the interface is, the methods of account financing available, as well as how secure their cold storage for account security is. Atop these basic considerations, it’s equally crucial to assess if they offer advanced crypto trading features that can help maximize your profitability and stay abreast with market trends.

Trading fees

Understanding trading fees is key when you’re choosing the best Canadian crypto exchange for your needs. These fees, divided into maker, taker, and withdrawal charges, can significantly affect your profitability. Maker and taker fees revolve around adding or removing liquidity from an exchange’s order book. You’ll incur a maker fee when you place a limit order that doesn’t get immediately filled. Conversely, executing an order that matches an existing one will attract a taker fee. Withdrawal fees apply when transferring digital assets to external wallets.

Intuitive interface

An intuitive interface isn’t just a nice-to-have, it’s crucial for both novice and seasoned traders when using a digital currency platform. As you dive into the world of cryptocurrencies, an easily navigated, user-friendly design can significantly reduce your learning curve while boosting comfort levels. For advanced traders, swift access to sophisticated tools is key to efficient strategy execution.

When assessing crypto exchanges in Canada, pay attention to simplicity—a cluttered interface could hinder your trading activities. Smooth navigation with clear menus and icons ensures you find needed information swiftly. Don’t overlook accessibility; make sure the platform is compatible across devices. Remember, an intuitive interface isn’t just about aesthetics—it’s pivotal in enhancing your trading efficiency and overall experience.

Account Financing

After exploring the user-friendliness of different crypto exchanges, let’s delve into account financing. It’s a crucial aspect you should consider when choosing an exchange. Now, why is it essential? Well, it determines how easily you can fund your account and start trading.

Some exchanges offer numerous payment methods such as bank transfers, credit/debit cards, and even PayPal. Others might limit you to specific options. You’ll want an exchange that doesn’t just provide convenience but also keeps transaction fees low.

Moreover, look for platforms that process transactions quickly so your funds are readily available for trading. Remember, in the fast-paced world of cryptocurrency trading, timing is everything.

Lastly, ensure the platform maintains high-security standards to protect your investments from potential threats or hacks. Your financial security should always come first in your selection process.

Cold Storage Account Security

You’ve got to prioritize cold storage account security when dealing with digital assets, as it’s your best line of defense against potential hackers and thieves. It’s vital in the Canadian crypto scene, where exchanges are increasingly targeted. By transferring your assets from the exchange to a personal wallet, you’re taking control of your private keys and adding a safeguard layer.

Storing these keys offline or in ‘cold storage’ offers increased protection since they’re inaccessible via internet connections. Another security measure is two-factor authentication (2FA), which requires additional verification for transactions, making unauthorized access even tougher. So don’t underestimate cold storage account security; it’s a critical strategy for protecting your investments in this volatile yet potentially lucrative market.

Advanced Crypto Trading Features

When you’re digging deeper into the world of cryptocurrency trading, it’s essential to understand and utilize advanced features like robust charting tools, diverse order types, and an Over-The-Counter (OTC) desk to maximize your profit potential. Charting tools help you analyze historical price data with precision, identify trends, and make accurate predictions about future market movements. Diverse order types such as stop-loss or take-profit orders allow you to execute trades at specific prices automatically, maximizing profits while minimizing risks.

An OTC desk offers increased liquidity and faster execution times for large-scale trading outside traditional exchange order books. By leveraging these advanced features on a trusted platform, you can unlock new opportunities in the dynamic crypto landscape.

Licensed to Operate

It’s crucial that you’re selecting a cryptocurrency exchange that’s licensed to operate, as this assures compliance with industry regulations and offers higher security for your investments. A licensed exchange adheres to strict rules, undergoes audits, and ensures transparency in its operations. This not only provides legitimacy but also safeguards your crypto assets from potential risks.

Most reputable exchanges also offer robust asset protection measures like cold storage, which involves storing digital assets offline in secure wallets to thwart cyber attacks. Some even provide insurance coverage for certain losses. When choosing an exchange in Canada or elsewhere, prioritize those registered and licensed to operate. This way, you can invest with confidence knowing your funds are well protected in the volatile crypto market space.

Custody Options

While ensuring your chosen crypto exchange is licensed to operate in Canada is a vital step, it’s equally important to consider the custody options available. In the crypto world, ‘custody’ refers to how your digital assets are stored and safeguarded. Canadian exchanges offer two main types: custodial and non-custodial. Custodial exchanges keep and protect your funds for you.

They’re user-friendly but often limit transferring coins off-platform for security reasons. Non-custodial platforms, on the other hand, give you full control of your funds, allowing transfers to private wallets or other exchanges. Experienced traders who prioritize security typically favor this option. It’s crucial that you weigh these options carefully against your risk tolerance and security preferences before diving into the crypto market in Canada.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

Benefits of Using FINTRAC-Registered Exchanges

You’ll appreciate the security and dependability that comes with using FINTRAC-registered exchanges in Canada, not to mention the additional services like staking opportunities, crypto credit cards, margin trading, spot trading, and OTC desks. As a registered Money Services Business (MSB), these exchanges meet rigorous regulatory standards set by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). They incorporate stringent anti-money laundering (AML) and know-your-customer (KYC) practices to protect your funds and personal information.

Moreover, these exchanges offer lucrative staking opportunities. By simply holding specific cryptocurrencies in your wallet on the exchange, you can earn passive income. This is a smart way for investors to generate returns from their held crypto assets without actively participating in volatile market trades.

Another attractive feature of some FINTRAC-registered exchanges is their offering of crypto credit cards. This innovative service allows users to spend digital assets just like traditional money—offering an easy conversion from virtual currency into real-world purchasing power.

For those who are more advanced traders or institutions needing large volume transactions, margin trading, spot trading, and over-the-counter (OTC) desks are available on certain platforms. These features cater specifically to your needs for strategic financial leveraging or private high-volume trades.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

Risks of Using a Crypto Exchange

As you dive deeper into the world of cryptocurrency, it’s imperative to be cognizant of the nuanced risks associated with using a crypto exchange. You’re likely aware of cybersecurity breaches and scams, but remember the adage “Not your keys, not your crypto,” highlighting the inherent risk when your assets are held by exchanges. Issues such as lack of consumer protection, transaction limits on trading platforms and even the risk of frozen accounts further add to these complexities.

Cybersecurity breaches and scams

Cybersecurity breaches and scams are unfortunately rife within the crypto space, making it critical for you to select exchanges with robust security measures. Despite stringent security protocols, hackers manage to exploit vulnerabilities, leading to unauthorized access and loss of funds.

Phishing scams are another prevalent threat where scammers impersonate legitimate exchanges or send deceptive emails. You’re tricked into revealing sensitive information like login credentials or private keys – a direct gateway for scammers to control your assets. Storing your crypto assets on an exchange holds significant risks too. If hacked or shut down, you risk losing all your funds without recourse. It’s essential to understand these cybersecurity threats and take proactive steps ensuring safe participation in the crypto market.

Not your keys, not your crypto

Remember, the mantra ‘Not your keys, not your crypto’ emphasizes that if you’re not in control of your private keys, then you don’t truly own your digital assets. When you store cryptocurrencies on a centralized exchange like those operating in Canada, they hold the keys, not you. It’s risky because exchanges can be hacked and funds stolen.

Moreover, relying on an exchange’s security could backfire if they suffer a breach or shut down. Cases exist where users lost their coins when exchanges suddenly closed. To avoid this risk, consider using hardware wallets or cold storage options to keep your private keys offline. In essence, true ownership of digital assets means holding the private keys yourself. Stay informed and careful; remember it’s your hard-earned money at stake!

Lack of consumer protection in crypto exchanges

You’re stepping into a world dominated by the lack of consumer protection when dealing with crypto exchanges, and that’s something you’ve got to grapple with. Unlike traditional banking, there’s no mandatory insurance or strict asset management laws protecting your funds. You’re exposed to significant risks like hacks and security breaches without a safety net for recovery. In this precarious landscape, it’s critical that you take extra precautions such as using cold storage or hardware wallets.

Remember, convenience comes at a cost in this market; centralized exchanges may offer easy access but also pose inherent vulnerabilities. It’s crucial to educate yourself about potential threats and proactively secure your assets against the unpredictability of the crypto world.

Transaction limits on crypto trading platforms

Having examined the lack of consumer protection in crypto exchanges, it’s essential to now consider transaction limits on these platforms. Like any financial institution, crypto trading platforms impose certain restrictions on the amount of cryptocurrency you can buy or sell within a specific period, be it daily, weekly or monthly.

These limits serve as a bulwark against fraudulent activities and illegal transactions while ensuring compliance with AML and KYC regulations. Additionally, they help manage liquidity and market volatility by preventing sudden price fluctuations caused by large trades. So whether you’re an active trader or looking to invest significantly, understanding your platform’s transaction limits is crucial in shaping your strategies and managing your transactions effectively in the ever-evolving crypto market.

Risks of frozen accounts on exchanges

It’s important to recognize the risks associated with frozen accounts on exchanges as it can unexpectedly disrupt your trading activities and access to funds. This can happen due to suspicious activity, violation of exchange policies, or legal issues, leaving you unable to execute transactions or withdraw funds.

The impact can be severe if you heavily rely on the exchange for your crypto holdings. You may not be able to transfer funds to a personal wallet or another exchange, disrupting strategies and potentially causing financial losses if asset values decrease during the freeze. To mitigate these risks, hold only a trading balance on the exchange and move funds regularly to a personal wallet or secure cold storage. Stay updated on exchange policies and maintain good security practices.

Potential asset delistings on centralised exchanges

Delistings on centralised exchanges can pose significant risks for you as an investor, impacting your ability to trade certain cryptocurrencies and potentially leading to financial losses. Various reasons such as low trading volumes, lack of liquidity, regulatory concerns or security issues can trigger these delistings. Consequently, the value of the delisted asset might experience a sharp decline due to eroded market confidence.

This situation could result in considerable financial loss if you’re holding the delisted asset. To mitigate this risk, consider diversifying your investments across multiple exchanges. Staying informed about cryptocurrency listing statuses and monitoring news from exchanges also helps anticipate potential delistings. Understanding these risks equips you with better strategies in navigating the volatile landscape of cryptocurrency trading.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

Best Bitcoin and Crypto Wallets in Canada

As you navigate the dynamic world of cryptocurrency, understanding the best wallets for your digital assets is vital. You’ll be introduced to some top-tier wallets available in Canada such as Zengo, a keyless crypto wallet offering high security; BitBuy and CoinSmart, both Canadian-based platforms that provide an easy-to-use interface for buying and selling cryptocurrencies; Coinbase, a popular international platform known for its broad range of supported coins; and Ledger Nano S, a hardware wallet that offers unparalleled security by storing your assets offline. This discussion will give you an unbiased analysis based on market trends, financial forecasts and factual reporting to help you make informed decisions about managing your crypto portfolio effectively.

1.Zengo

Zengo’s user-friendly interface and advanced security measures make it a popular choice for crypto enthusiasts in Canada. You can easily navigate through the options and perform transactions with ease, whether you’re a beginner or an experienced trader. Zengo offers a streamlined and efficient way to manage your crypto assets, supporting a wide variety of digital currencies.

When it comes to security, Zengo doesn’t cut corners. It uses multiple layers of encryption, multi-signature technology, and secure key management to safeguard your funds. Plus, its cutting-edge security protocol further boosts the protection of your personal information.

Key Specs:

- User-friendly Interface

- Advanced Security Measures

- Supports Multiple Cryptocurrencies

Pros:

- Easy Navigation

- Strong Security Features

- Wide Variety of Supported Cryptos

Cons:

- Not as Known as Some Other Wallets

- No Built-in Exchange Features

- Limited Customer Support Options

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

2. Coinbase

Coinbase Wallet’s a top pick for those seeking a secure, user-friendly mobile wallet to handle their digital assets. Its compatibility with both Android and iOS devices makes it accessible to a broad range of users. With an emphasis on security, Coinbase uses advanced measures such as biometric authentication and encrypted private keys to protect your funds.

The control you have over your private keys, which are stored locally on your device, adds another layer of security. Plus, the flexibility offered by Coinbase Wallet is exceptional; you can store and manage popular cryptocurrencies such as Bitcoin and Ethereum along with numerous other digital coins. This allows you to diversify your crypto portfolio easily.

Key Specs:

- Standalone mobile wallet

- Advanced security features

- Compatibility: iOS & Android

Pros:

- High-security measures

- User-friendly interface

- Wide variety of supported digital assets

Cons:

- No built-in exchange feature

- Dependence on device security

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

3.CoinSmart

For Canadian investors, CoinSmart’s Wallet is a reliable option for managing and trading digital assets with its comprehensive set of features. It offers the convenience of seamlessly connecting your wallet to your exchange account, making transfers between the two platforms smooth and hassle-free. Its dedication to security ensures that your funds are protected from unauthorized access.

The wallet employs strong encryption protocols and multi-factor authentication, so you can rest assured that your assets are secure. Moreover, CoinSmart utilizes cold storage; most of your cryptocurrencies are kept offline in secure systems which significantly decreases the risk of cyber attacks or hacks.

Key Specs:

- Seamless integration with CoinSmart exchange

- Strong encryption protocols

- Multi-factor authentication

- Cold storage for majority of cryptocurrencies

Pros:

- High level of security

- Convenient fund management

- Robust feature set

Cons:

- Limited to Canadian users

- Requires account on CoinSmart exchange

- Learning curve may be steep for beginners

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

4. Ledger Nano S

Switching to the Ledger Nano S Wallet, it’s a secure hardware wallet that’s not connected to the internet, making it less likely to be hacked or stolen. It offers robust security and supports over 1,500 digital currencies. This flexibility allows you to manage a diverse portfolio from one place – perfect if you’re involved in various crypto markets. Its built-in display enhances transaction security, giving you the chance to physically review and approve transactions before execution. And don’t worry about losing your device; a secure recovery phrase ensures you can regain access to your funds on a new device.

Key specs:

- Offline storage

- Supports over 1,500 cryptocurrencies

- Built-in display for transaction verification.

Pros:

- Increased security from hacking/theft

- Support for multiple currencies gives portfolio flexibility.

Cons:

- Requires physical interaction for transaction approval (may be inconvenient)

- Possibility of device loss or damage still exists despite recovery options.

Frequently Asked Questions

What is the best Canadian crypto exchange?

BitBuy’s your best bet when it comes to Canadian crypto exchanges due to its vast range of cryptocurrencies, user-friendly interface, robust security measures, and top-notch customer support. It allows you to trade popular cryptos like Bitcoin, Ethereum, and Litecoin. Even if you’re a novice or an experienced trader, BitBuy’s platform is designed for easy navigation and seamless trading experience.

Your funds are safe with two-factor authentication and cold storage solutions in place. You don’t have to worry about the risk of losing your investment due to security breaches. And if you encounter any issues or have queries, BitBuy’s customer support promptly addresses them. So for reliable crypto trading in Canada, consider BitBuy as your go-to platform.

What’s the cheapest crypto exchange in Canada?

For users who are seeking the most affordable option, Kraken stands out in Canada’s crypto market. It charges a meager 0.16% trading fee and even lower at 0.26% on spot trades. Impressive, isn’t it? But there’s more – if your trading volume is high enough, these fees could potentially drop to zero.

In addition to low fees, Kraken also boasts minimal spreads – often as little as 0.0003% on Bitcoin transactions. This makes it an incredibly cost-effective choice for your crypto trading needs. Remember, while considering which platform suits you best, always balance quality with affordability to make a sound financial decision in this dynamic cryptocurrency market landscape.

What’s the best altcoin exchange in Canada?

When it comes to altcoin trading, you might find Kraken or Newton to be your top picks, as they support a wide range of digital assets that Canadians are interested in. With over 100+ and 75+ cryptocurrencies respectively, they’re continually expanding their offerings to meet user demand.

Kraken boasts its own NFT library, an innovative feature that distinguishes it from other platforms. Newton’s appeal lies in its user-friendly interface and competitive pricing. Both exchanges have robust security measures ensuring your digital assets remain safe.

Watching market trends is key; these platforms regularly add trending altcoins. So whether you’re a seasoned trader or just starting out, choosing the right exchange can make all the difference. Be informed, stay updated, and choose wisely.

What is the safest crypto wallet in Canada?

You’re probably wondering about the safest place to store your digital assets in Canada, and that’s where Ledger Nano X comes into play with its unmatched security features. This hardware wallet has advanced biometric authentication, offering an extra layer of protection with facial recognition technology. It ensures that only you can access your funds, greatly reducing the risk of unauthorized access.

Not just that, Ledger Nano X uses strong encryption and secure chip tech to protect your private keys and transactions. Even if your device goes missing, you won’t lose ownership of your coins; they can be accessed on another Ledger device using a recovery phrase. Rest assured, by choosing Ledger Nano X as your crypto wallet in Canada, you’re securing peace of mind alongside your digital wealth.

What crypto exchanges are legal in Ontario?

In the realm of digital assets, it’s crucial to know that platforms like Bitbuy, NDAX, Kraken and VirgoCX are all legal to use in Ontario. These exchanges comply with Canadian and Ontario-specific regulations, ensuring their longevity in the Canadian crypto market. As you navigate through this complex world of digital currencies, understanding the legality and compliance of these platforms provides an extra layer of security.

These exchanges offer different features: Bitbuy is known for its user-friendly platform; NDAX stands out with a diverse selection of cryptocurrencies; Kraken impresses with advanced trading features; while VirgoCX boasts zero deposit fees. It’s essential to pick an exchange that best fits your needs while offering regulatory compliance for peace of mind.

Is cryptocurrency legal in Canada?

Yes, it’s completely legal to buy, sell and trade cryptocurrency in Canada. The country has implemented robust regulations governing its use to ensure a secure trading environment. If you’re operating a crypto exchange, you’re required to register as a Money Service Business with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This obliges you to adhere to strict anti-money laundering and know-your-customer policies.

Can the CRA track cryptocurrency?

Despite cryptocurrencies often being promoted as anonymous, the CRA’s ability to track these trades and transactions isn’t entirely hindered. They obtain data from Canadian cryptocurrency exchanges through FINTRAC’s reporting requirements. Moreover, blockchain analysis tools aid them in tracing transactions back to their source. Yet, decentralized exchanges or mixing services offering higher privacy levels may pose a challenge for the CRA.

To avoid unwanted attention from the CRA, it’s crucial you report your crypto gains and losses accurately. This means keeping detailed transaction records and consulting with tax professionals specializing in cryptocurrency regulations. Also, ensure you choose a secure exchange employing robust measures like two-factor authentication and encryption to safeguard your assets and information.

Which Canadian banks allow cryptocurrency?

Several Canadian banks such as TD Bank, Scotiabank and RBC Royal Bank are now accepting cryptocurrency transactions, providing users with a plethora of payment options including credit cards, debit cards and Interac e-Transfers. This trend reflects the growing acceptance of cryptocurrencies in mainstream finance. However, you should note that they may have certain restrictions on types of transactions or specific cryptocurrencies supported. Always check their policies for clarity.

This development offers more flexibility in managing your digital assets, bridging traditional banking with the crypto market. Remember, this integration comes amidst volatile crypto market trends; therefore it’s crucial to stay updated on financial analysis and forecasting for informed decisions about your transactions.

| Download App for Android | Download App for iOS |

Where to Trade Crypto Futures?

Now you can trade Bitcoin (BTC) futures on BTCC. BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. BTCC is a crypto exchange offering users liquid and low-fee futures trading of both cryptocurrencies and tokenized traditional financial instruments like stocks and commodities.

BTCC offers exclusive bonus for new users. Sign up and deposit on BTCC to get up to 10,055 USDT in bonuses. Meet the deposit targets within 30 days after successful registration at BTCC, and you can enjoy the bonus of the corresponding target levels. Find out what campaigns are available now: https://www.btcc.com/en-US/promotions

iOS QR Code Android QR Code

How to Trade Tether (USDT) on BTCC

- Mobile App

-

- 1. Download the BTCC App via App Store or Google Play

- 2. Register and verify your account, or log in to your BTCC account.

- 3. Tap ‘Buy Crypto’.

- *Please note that only verified users are eligible to buy crypto on BTCC.

- 4. Enter the amount you would like to buy in USDT.

- 5. Select a service provider and proceed to payment.

| Download App for Android | Download App for iOS |

How to Trade Crypto Futures on BTCC ?

To trade Crypto Futures on BTCC, follow these simple steps:

- Create an account

Go to the BTCC website and fill out the registration form with the necessary details. Finish the checks to make sure you’re in line with the stock exchange’s rules.

- Deposit funds

Fund your BTCC wallet once your account has been created and verified. You can fund your BTCC account with a number of different cryptocurrencies and fiat currencies.

- Navigate to the crypto trading section

You can begin trading on the BTCC platform as soon as your account has been funded. Find the crypto exchange rate, which is written as crypto/Bitcoin (BTC) or crypto/US Dollar (USDT) depending on the other pairs available.s.

- Choose your trading type

Both spot trading and futures trading are available through BTCC. If you want to purchase or sell crypto tokens at the current market price, you may want to investigate spot trading. If you’d rather trade crypto with leverage and speculate on its price movements, you can do so with crypto Futures.

- Place your trade

After deciding which type of deal you want to make, you can enter the amount of crypto you like to buy or sell, as well as your preferred price (if necessary). If everything checks out, go ahead and make the deal.

- Monitor and manage your trades

Be sure to monitor your crypto holdings on the BTCC exchange. To limit losses and protect gains, you can use stop-loss and take-profit orders. It is also important to keep up with the latest crypto market trends and news if you want to successfully trade this cryptocurrency.

Before becoming involved in any kind of trading, make sure you’ve done your homework. Due to the extreme volatility of the cryptocurrency markets, it is crucial to have a well-defined trading strategy and risk management framework in place. To successfully trade crypto on the BTCC market and take advantage of the chances it provides, follow these procedures and keep yourself updated.

Why Trade Crypto Futures on BTCC

To trade Crypto futures, you can choose BTCC crypto exchange.BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. Over 11 years of providing crypto futures trading services. 0 security incidents. Market-leading liquidity.

Traders may opt to trade on BTCC for a variety of reasons:

- Secure:safe and secure operating history of 11 years. Safeguarding users’ assets with multi-risk management through the ups and downs of many market cycles

- Top Liquidity:With BTCC’s market-leading liquidity, users can place orders of any amount—whAVAXer it’s as small as 0.01 BTC or as large as 50 BTC—instantly on our platform.

- Innovative:Trade a wide variety of derivative products including perpetual futures and tokenized USDT-margined stocks and commodities futures, which are innovative products invented by BTCC.

- Flexible:Select your desired leverage from 1x to 150x. Go long or short on your favourite products with the leverage you want.

| Download App for Android | Download App for iOS |

BTCC Bonus

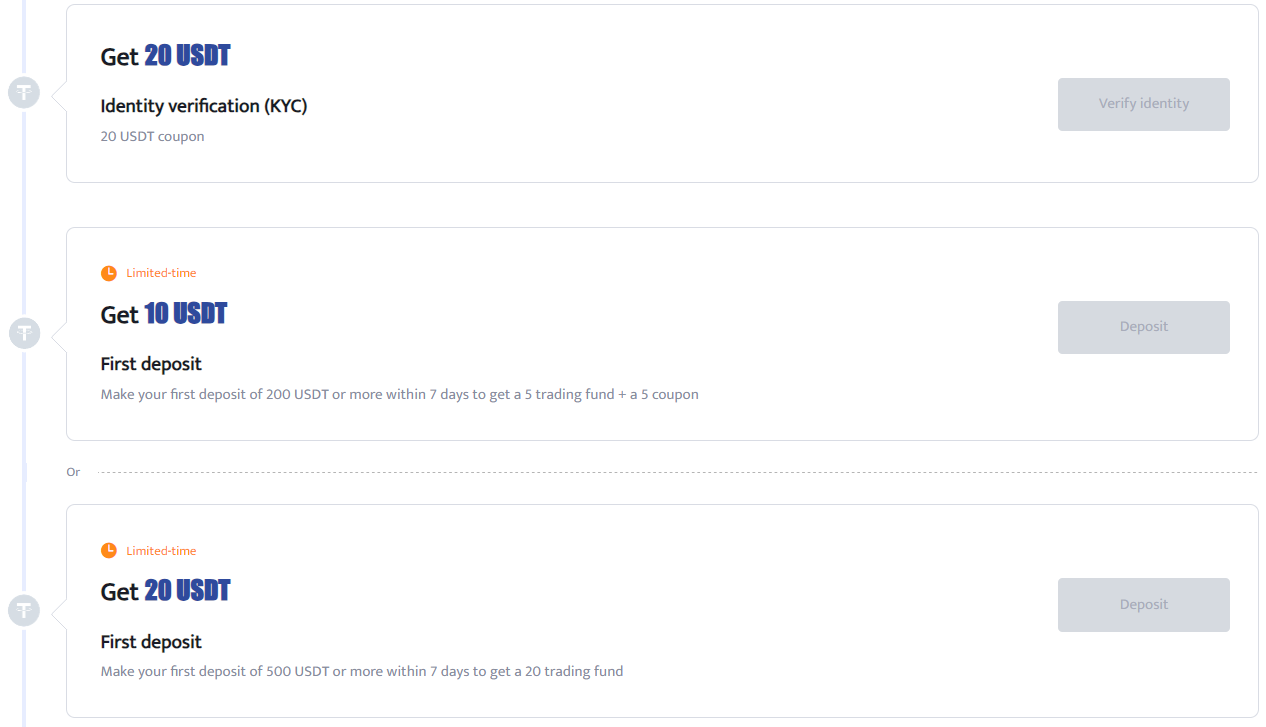

BTCC bonuses apply to different categories of users. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

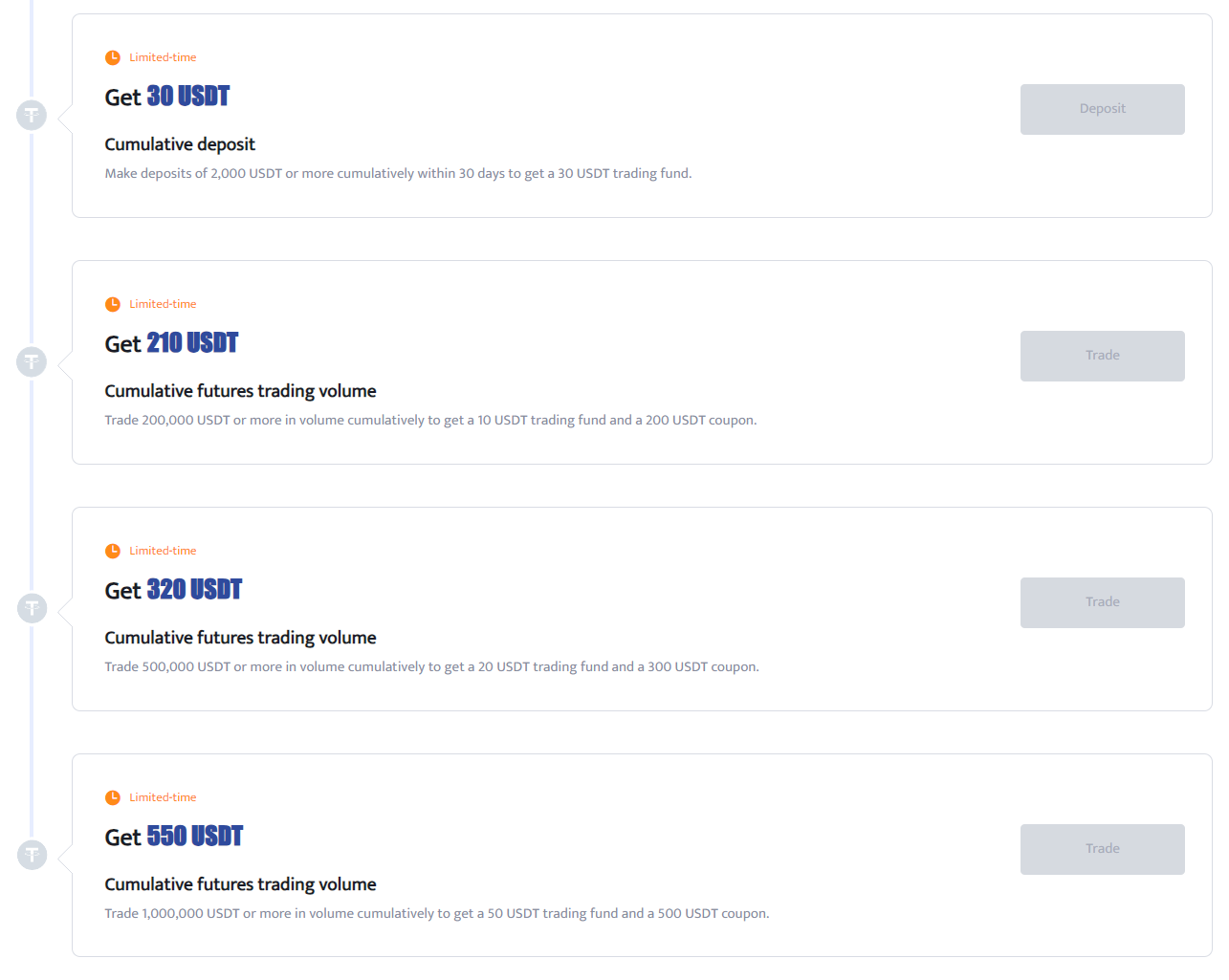

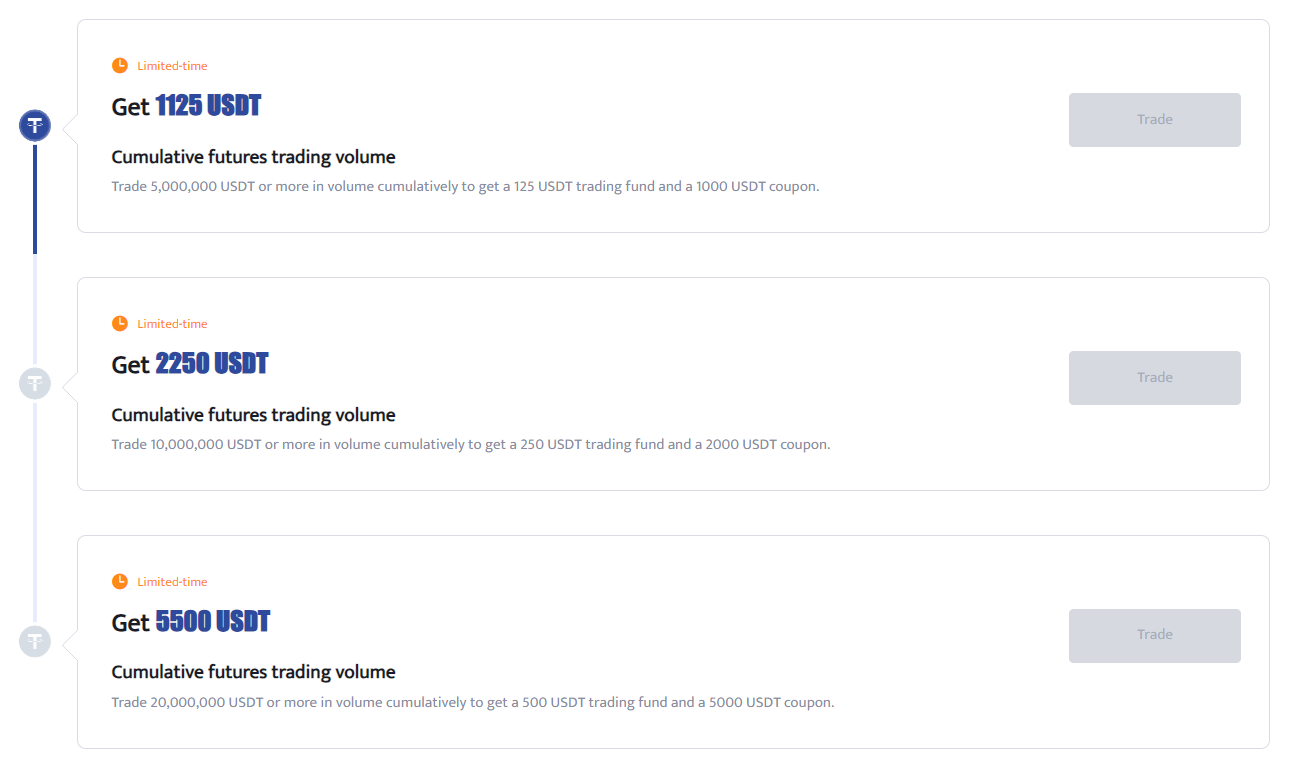

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

Look More:

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (TRX) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?