Recommended

Best Crypto Futures Trading Platforms 2023

Crypto futures trading has gained momentum among investors looking for novel methods to capitalize on the crypto market. This trading approach enables them to forecast a cryptocurrency’s future value and benefit from both its upward and downward movements. With numerous cryptocurrency futures exchanges now available, selecting the most suitable one can be a daunting task.

This article will outline the top 5 cryptocurrency futures exchanges, considering factors such as security, trading fees, liquidity, and user experience to help traders make well-informed choices. The following exchanges have been assessed:

- Binance – Best for Institutional Investors

- BTCC – Best Overall for Futures Trading

- Phemex – Best for Altcoin Pairs

- eToro – Best Multi-Asset Futures Platform

- DYDX – Best Decentralized Futures Platform

1. Binance

Binance is widely recognized as a leading global platform for both Bitcoin futures trading and crypto futures trading. The platform supports trading of various cryptocurrencies, including Bitcoin, Ethereum, Aptos, Solana, and hundreds of other assets, against Tether (USDT) with up to 125x leverage. Traders from all around the world can easily create a Binance Futures account within minutes and benefit from the best Bitcoin and crypto futures trading platform available on any exchange.

In addition to its extensive range of features, Binance also provides its users with high levels of security and liquidity, making it an ideal choice for institutional investors and retail traders alike. For more information, you can read our comprehensive Binance Review.

| Download App for Android | Download App for iOS |

2. BTCC

Founded in 2011, BTCC is one of the world’s longest-running exchanges with over 12 years of stable and secure operating history. It offers trading service in US, Canada, and many other countries in Europe.

BTCC is one of the best platforms for crypto futures trading. It is among the few exchanges that permit traders to speculate with up to 100x leverage for perpetual contracts. Apart from crypto futures, the platform also supports tokenized futures, allowing users to trade stocks and commodities futures with USDT.

It is regarded as the best futures exchange for digital assets due to their deep liquidity and minimal fee structure, beginning at 0.06% for both Taker Orders and Maker Orders. For additional details, you can refer to our comprehensive BTCC Review.

3. Phemex

Phemex is a new derivatives platform that has grown to over 5 million users since being launched in 2019. Their exchange offers deep liquidity on over 150 crypto pairs with up to 100x leverage on their secure and highly performant centralized trading platform. Phemex is widely regarded for its low fees, tight spreads and feature-rich exchange that includes staking, spot trading, options and more.

Another advantage of Phemex is that they do not require verification or KYC to register and trade. This means you can sign up with an email address and password and deposit stablecoins or other digital assets like Bitcoin and Ethereum to start trading.

| Download App for Android | Download App for iOS |

4. eToro

eToro is the world’s most extensive multi-asset brokerage platform, enabling traders to leverage trade a wide range of assets, including cryptocurrencies, stocks, commodities, and more. It is highly regarded for its low fees, speedy fiat currency deposits, and diverse asset selection.

One unique advantage of this platform compared to the other exchanges on this list is that it allows traders to trade crypto stock and ETF futures contracts. This means that traders can go long or short on stocks such as Coinbase, Robinhood, and Microstrategy, which are correlated with the price of crypto assets.

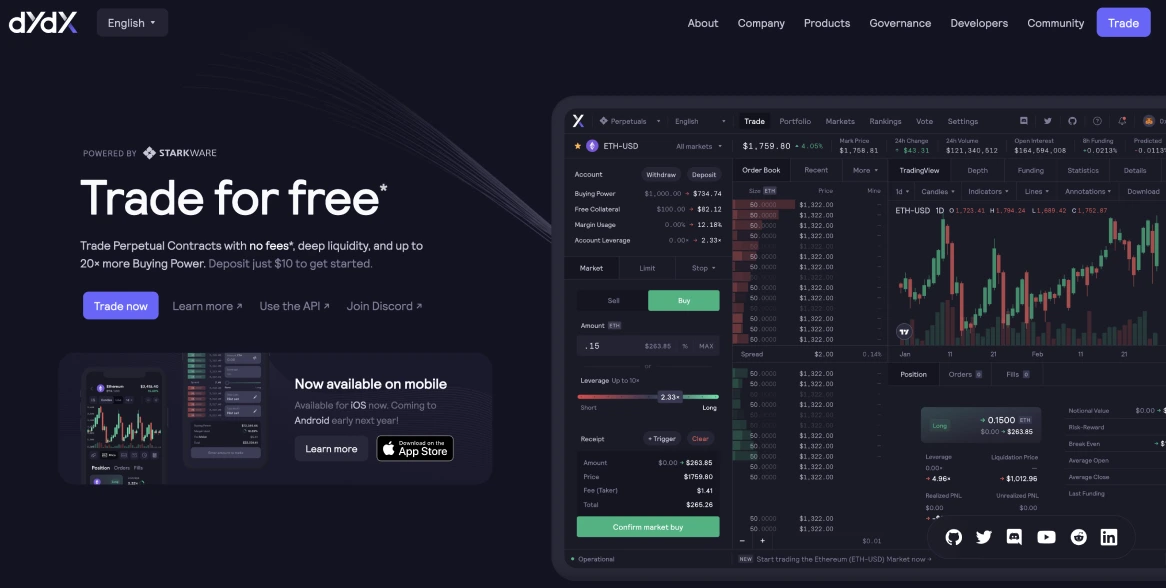

5. DYDX

Dydx is a decentralized finance (DeFi) platform built on the Ethereum blockchain. It provides a suite of financial products and services, including margin trading and borrowing, lending, and trading of crypto assets. The platform is designed to be transparent, secure, and accessible to a wide range of users, and it operates using a decentralized governance model, with users collectively making decisions about the direction and development of the platform.

The platform’s use of smart contracts and blockchain technology helps to ensure that transactions are secure, transparent, and tamper-proof. They have the deepest liquidity to trade the top crypto pairs like BTC, ETH, AVAX, NEAR, LUNA, ONE and many others.

| Download App for Android | Download App for iOS |

Should I Trade Crypto Futures?

Crypto futures offers two key advantages for digital asset investors and speculators. The most common reason for sophisticated and institutional investors is to hedge price risk. Derivatives contracts allow investors to mitigate the risk of a falling price by taking a short futures position. This will help mitigate losses by providing additional profit that hedges exposure from holding spot assets like BTC and ETH.

The other common reason is to speculate on price direction. Crypto leverage trading enables the opportunity for traders to truly speculate on the asset, even with up to 100x leverage if they are extremely confident.

How to Trade Bitcoin Futures on BTCC?

Bitcoin futures trading is easier than most beginners might think – all you need is a futures trading account.

You will not believe – creating an account on BTCC platform only takes 30 seconds to be functional. Check BTCC sign up guide to quickly register a free account and earn the special deposit bonus for new users.

Follow this four-step process to trade Bitcoin futures contract on BTCC after you registered:

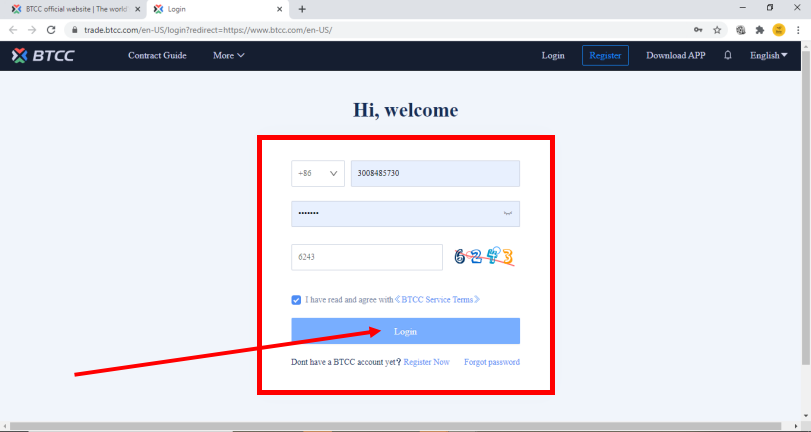

Step 1) Login into your account. This will open up the English version of the platform for your ease. Once you are in, press on the login option shown below:

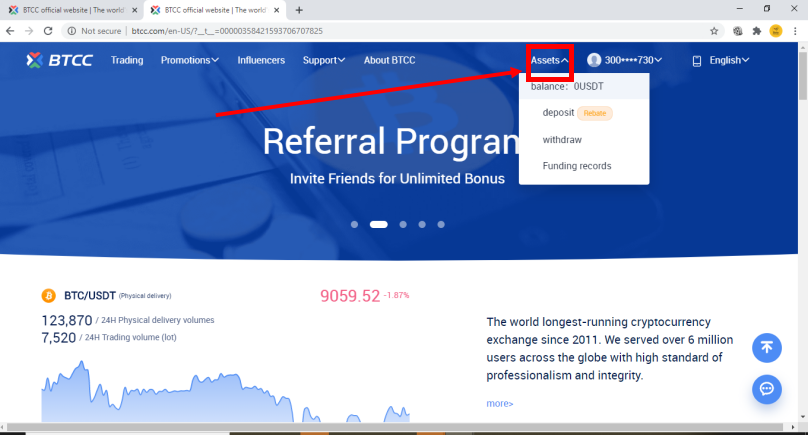

Step 2) Once you have logged in, you are on the platform. From here, you can check your assets and enter the trading screen, which will allow you to trade. For checking your assets or to make deposits/withdrawal, you can check the below snapshot:

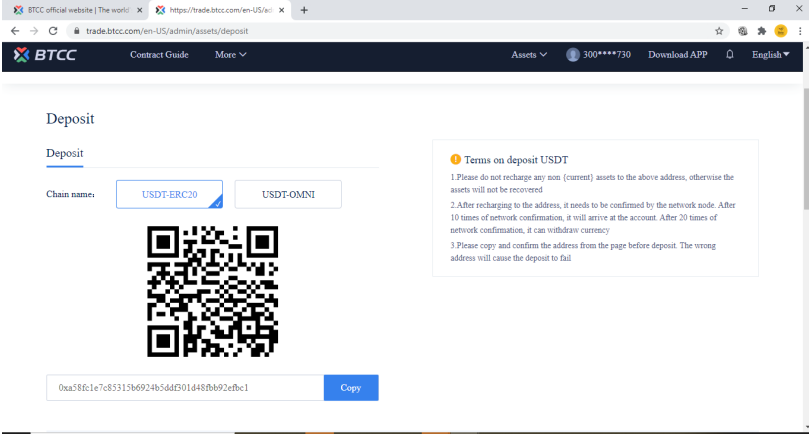

Once you press on it, a screen like this should open up for you which should allow you to make deposits as well. The depositing address may be used for the depositing purpose.

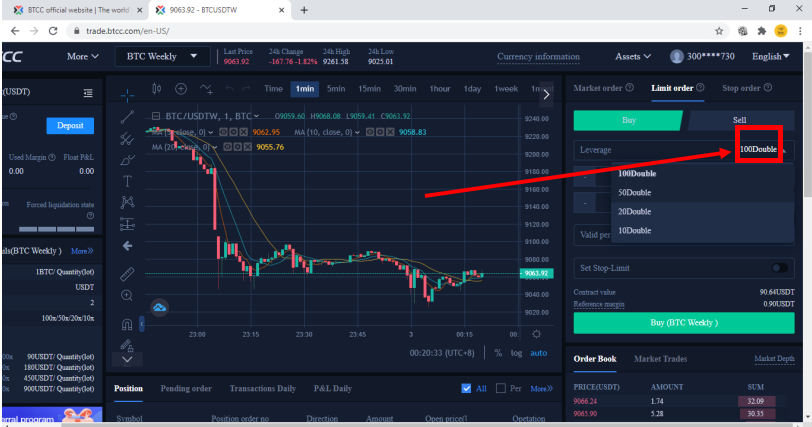

Step 3) Now, you are ready to get yourself on the trading platform. See how the trading screen looks like. The selection for x-times of leverage is marked for you to find.

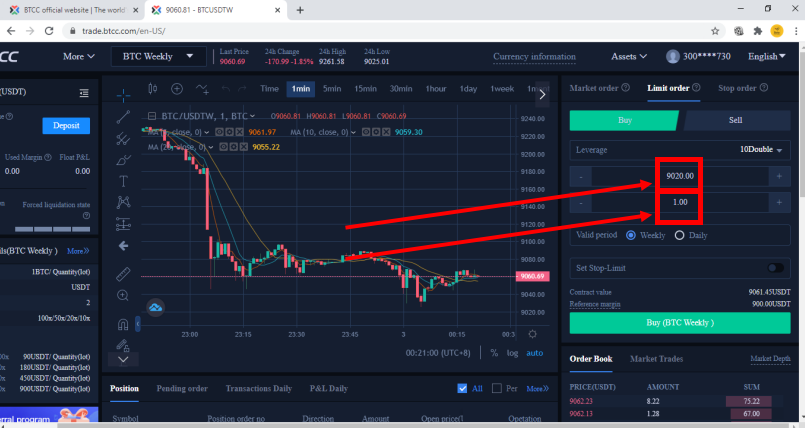

Step 4) Enter the price you are looking to enter into and the number of bitcoin futures contracts that you are willing to buy.

PRESS BUY! There you go. You are done!

| Download App for Android | Download App for iOS |

What is Leverage Trading in Crypto?

Leveraged trading in crypto is simply a way to borrow funds from a cryptocurrency exchange in order to add size to your trade. For example, with crypto leverage trading you can deposit $1,000 and take a trade with 10X leverage. This means that your overall trade positions is now $10,000.

However, with leverage in crypto comes risk. In the example provided above, if your trade was to go down 10% you would be completely liquidated and lose the $1,000.

Is It Legit to Trade Crypto Futures?

Trading crypto futures is generally legal in most countries and is treated similarly to trading cryptocurrencies. However, the legality and regulation of crypto futures can vary depending on the jurisdiction. In the United States, trading crypto futures is legal and regulated by the Commodity Futures Trading Commission (CFTC). The CFTC has classified crypto assets as commodities and has jurisdiction over futures and other derivatives based on these assets.

It’s important to note that while trading crypto futures is legal in the US and regulated by the CFTC, other countries may have different regulations and restrictions. As always, it’s advisable to check the laws and regulations in your specific country before engaging in any crypto trading activities, including trading crypto futures.

| Download App for Android | Download App for iOS |

Crypto Futures Trading Fees

Trading futures and derivatives contracts involves different fees than standard spot trading on traditional exchanges like Coinbase or Kraken. Here are some of the common fees and costs associated with trading cryptocurrency futures contracts.

1. Trading Fees: Much like spot trading, Bitcoin Futures contracts will typically charge a commission for

a buy or sell.

2. Funding Fees: Fees can apply for certain Bitcoin Futures contracts when you keep a contract open through a certain time period.

3. Extension Fees: Fees can apply if you extend a Bitcoin Futures contract beyond its close date.

4. Leverage Fees:When you are margin trading Bitcoin, you are borrowing money to use leverage on your trades. There is generally an interest payment attached to borrowing that money.

Conclusion

Crypto futures trading has become increasingly popular in recent years, and with so many futures exchanges now available, it can be challenging to determine the best option. This post evaluates the five best crypto futures exchanges, taking into account factors such as security, trading fees, liquidity, and user experience. BTCC is rated as the best overall futures exchange, while Binance is best for institutional investors, Phemex is best for altcoin pairs, eToro is best for multi-asset trading, and DYDX is the best decentralized futures trading platform.

|

Claim your BTCC 10 USDT Bonus |

Read More:

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

Gold Price Predictions for Next 5 Years

XRP Price Prediction $500: Can XRP Reach $500 Dollars?

Pepe Price Prediction 2023, 2025, 2030

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Ethereum Price Prediction 2025-2030

Arbitrum (ARB) Price Prediction 2023, 2025, 2030

What is PulseChain? When Will the Mainnet Be Launched?

Cardano (ADA) Price Prediction 2023, 2025, 2030

Gala (GALA) Price Prediction 2023, 2025, 2030

Core DAO Airdrop is Now Available, How to Claim It?

Core DAO (CORE) Price Prediction 2023, 2025, 2030

Polygon MATIC Price Prediction 2023, 2025, 2030

Stellar Lumens (XLM) Price Prediction 2023, 2025, 2030

Can Solana Reach $1,000? Solana Price Prediction

The Sandbox Price Prediction 2025, 2030

Blur Price Prediction 2023, 2025, 2030

Polkadot (DOT) Price Prediction 2023, 2025, 2030

Bitcoin SV (BSV) Price Prediction 2023, 2025, 2030

Algorand (ALGO) Price Prediction 2023, 2025, 2030

Silver Price Predictions for Next 5 Years

HBAR Price Prediction 2025, 2030

JasmyCoin (JASMY) Price Prediction

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*