Recommended

Bitcoin Futures Trading: A Guide for Beginners

This is a complete guide on Bitcoin futures trading for beginners. Find out how Bitcoin Futures work and learn how to get started trading Bitcoin Futures on BTCC, one of the best crypto futures trading platforms.

What is Crypto Futures Trading?

Futures trading is derivative contract to buy or sell an underlying asset at a future date at an agreed-upon price. In the case of bitcoin futures, the underlying asset would be bitcoin.

Crypto futures give investors the opportunity to bet on the future price of cryptocurrencies without having to actually own or handle it. It allow investors to hedge against volatile markets and ensure they can purchase or sell a particular cryptocurrency at a set price in the future. Of course, if the price moves in the opposite direction a trader wishes, they may end up paying more than the market price for the cryptocurrency or selling it at a loss.

Apart from crypto futures trading, the asset might also be individual stocks, commodities like oil, exchange-traded funds or a range of others. Futures contracts can be used by many kinds of financial players, including investors and speculators, as well as companies that actually want to take physical delivery of the commodity or supply it.

S&P 500 futures contract, for example, is a kind of stock futures investing.

| Download App for Android | Download App for iOS |

What are the Bitcoin Futures?

Bitcoin futures track the price movements of the world’s largest crypto, Bitcoin. It gives investors the opportunity to bet on the future price of Bitcoin without without having to actually own or handle it. Like traditional futures contracts, Bitcoin futures are legal contracts to buy or sell Bitcoin at a future date.

How Bitcoin Futures Trading Works

As with all other futures products, Bitcoin futures offer protection against volatility and adverse price movements. Also, it is a proxy tool for investors to speculate on the future prices of Bitcoin.

With a Bitcoin futures contract, you can take a long position if you expect the price of Bitcoin to rise. Conversely, you take a short position to reduce the impact of losses when the price of Bitcoin falls.

When investing for the long-term, Bitcoin may experience occasional bear markets as sentiments change. In this case, Bitcoin futures contracts can be useful to protect your Bitcoin investments against downside risk.

There are three main components to a Bitcoin futures contract:

– Expiration date: This refers to the date when the futures contract must be settled. In other words, one party has to buy, and the other has to sell at the pre-agreed price. It’s worth noting, however, that traders can sell on their contracts to other investors before the settlement date if they wish.

– Units per contract: This defines how much each contract is worth of the underlying asset and varies greatly between platforms. For example, one bitcoin futures contract on CME equals 5 U.S. dollars worth of bitcoin, whereasone bitcoin futures contract on Deribit equals 10 bitcoins.

– Leverage: To increase the potential gains a trader can make on their futures bet, exchanges allow users to borrow capital to increase their trading size. Again, leverage rates also vary from platform to platform. Binance allows users to supercharge their trades by up to 100x, and BTCC offers leverage rates up to 150x.

There are also two different ways Bitcoin futures contracts can be settled:

– Physically delivered: Meaning upon settlement, the buyer purchases and receives bitcoin.

– Cash-settled: Meaning upon settlement, there’s a transfer of cash (usually U.S. dollars) between the buyer and seller.

| Download App for Android | Download App for iOS |

Benefits of Bitcoin Futures Trading

- Leverage

Bitcoin futures contracts enable you to gain leveraged exposure to Bitcoin with only a fraction of its total cost. With leverage, you can magnify relatively small price movements to create profits that justify your time and effort.

- Flexibility

Bitcoin Futures offers the flexibility for non-Bitcoin holders to speculate on the price of Bitcoin and make quick profits. You can open a position in a Bitcoin futures contract with USDT, and any profits made will be settled in USDT.

- Liquidity

Bitcoin futures are among the most liquid markets in the crypto economy, with trillions in monthly volume. A liquid market is generally associated with less risk because there is always someone willing to take the other side of a given position and traders will incur less slippage.

- Diversified Portfolio

With Bitcoin futures, you have more options to diversify across trading strategies to generate more profits. Traders can now develop sophisticated crypto futures trading strategies such as short-selling, arbitrage, pairs trading, etc.

Types of Bitcoin Futures

There are many Bitcoin futures markets today, and at BTCC, we offer Bitcoin futures trading through two flagship products: Bitcoin Perpetual Futures and Bitcoin Daily Futures, both of which are designed to cater to the specific needs of users.

These contracts differ in 2 main factors: Expiration Date and Funding Rate.

- Expiration Date

Bitcoin futures daily contracts allow a trader to buy or sell BTC at a predetermined price on a certain date. In other words, daily futures contracts have a limited lifespan and will expire based on a future date.

On the other hand, Bitcoin futures perpetual contracts, as the name suggests, do not have an expiration date.

- Funding Rate

Bitcoin futures daily contracts do not carry a funding fee, whereas Bitcoin futures perpetual involves funding rate.

Funding Rates are periodic payments made to or by traders. Since perpetual futures contracts never settle, exchanges use the funding rates to ensure that futures prices and index prices converge on a regular basis. BTCC takes no fees from such funding rates as they happen directly between users.

| Download App for Android | Download App for iOS |

BTCC – One of the Best Crypto Futures Exchanges

Why trade Bitcoin futures on BTCC? Here are some key reasons.

- Safe & Secure

With over 11 years of stable and secure operating history, BTCC places strong emphasis on security, offering multiple measures to safeguard users from adverse market risks.

- High Liquidity & Volume

One of the largest crypto futures exchange by volume and open interest, dominating the derivatives sector with huge market share.

- High Leverage for Crypto Futures Trading

BTCC offers a wide range of popular trading pairs such as BTC/USDT, ETH/USDT, ADA/USDT with high leverage up to 100x.

- User-Friendly

Simple user-friendly interface and intuitive trading platform, ideal for both beginners and advanced users. It also offers a range of educational resources and market updates to help users expand their understanding of the crypto and trade more easily.

- One-Stop Trading Platform

BTCC also supports tokenized futures, allowing users to trade stocks and commodities futures with USDT. With the integration of spot and futures markets, BTCC offers a complete ecosystem to fully utilize crypto assets and manage portfolio risks.

How to Start Bitcoin Futures Trading on BTCC?

Bitcoin futures trading is easier than most beginners might think – all you need is a futures trading account.

You will not believe – creating an account on BTCC platform only takes 30 seconds to be functional. Check BTCC sign up guide to quickly register a free account and earn the special deposit bonus for new users.

Follow this four-step process to trade Bitcoin futures contract on BTCC after you registered:

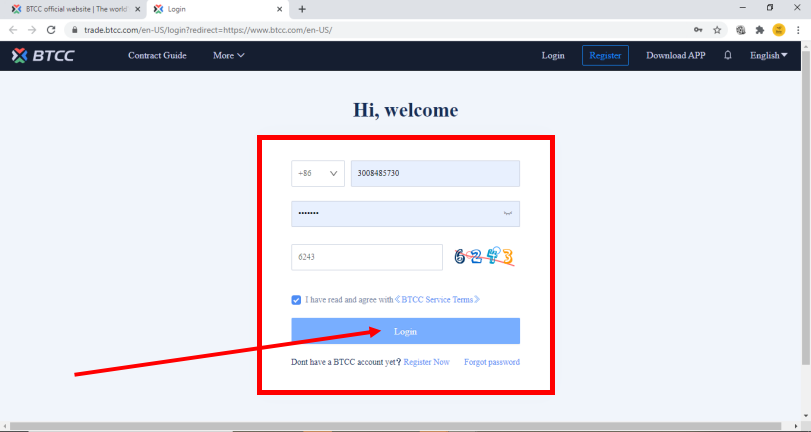

Step 1) Login into your account. This will open up the English version of the platform for your ease. Once you are in, press on the login option shown below:

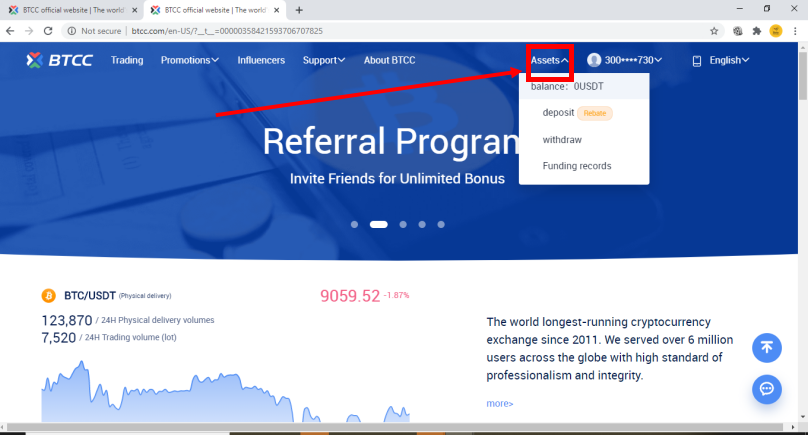

Step 2) Once you have logged in, you are on the platform. From here, you can check your assets and enter the trading screen, which will allow you to trade. For checking your assets or to make deposits/withdrawal, you can check the below snapshot:

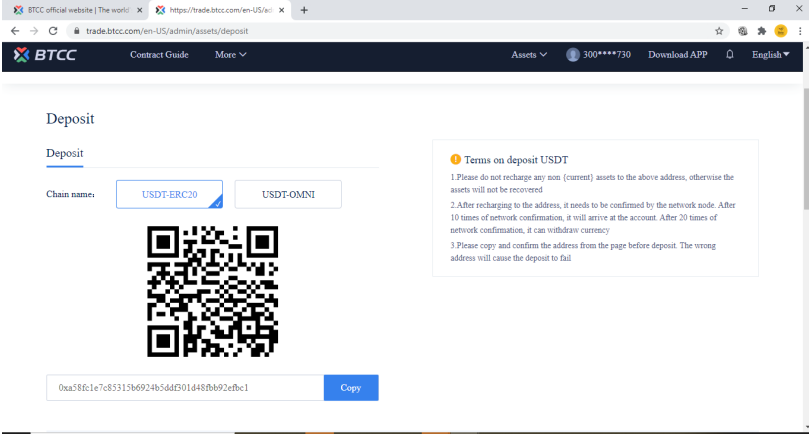

Once you press on it, a screen like this should open up for you which should allow you to make deposits as well. The depositing address may be used for the depositing purpose.

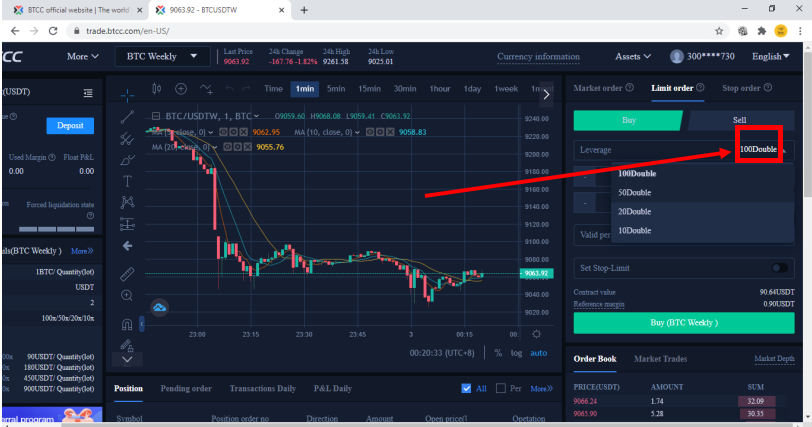

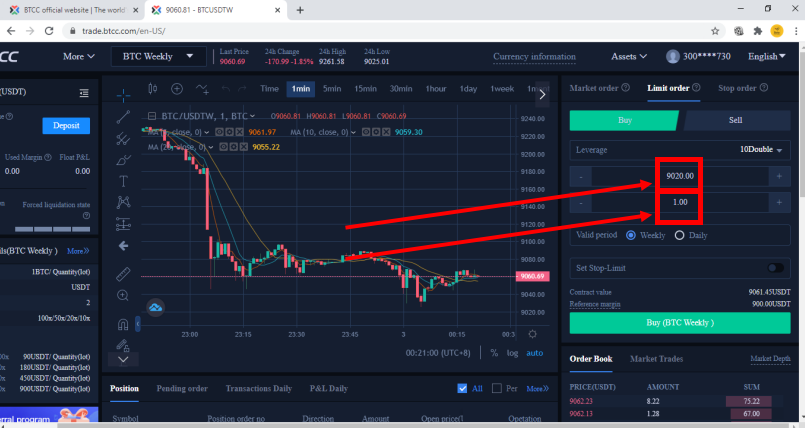

Step 3) Now, you are ready to get yourself on the trading platform. See how the trading screen looks like. The selection for x-times of leverage is marked for you to find.

Step 4) Enter the price you are looking to enter into and the number of bitcoin futures contracts that you are willing to buy.

PRESS BUY! There you go. You are done!

Check our other crypto futures guides below:

- Ether Futures Guide: Trade ETH Perpetual Futures on BTCC

- Cardano Futures Guide: Trade ADA Perpetual Futures on BTCC

- Ripple Futures Guide: Trade XRP Perpetual Futures on BTCC

- Litecoin Futures Guide: Trade LTC Perpetual Futures on BTCC

| Download App for Android | Download App for iOS |

Can You Invest in Bitcoin Futures?

Bitcoin futures is an exciting and fast-growing market that attracts trillions of volume and liquidity worldwide. When deciding whether Bitcoin futures are suitable for you, consider your risk tolerance and financial goals. Always do your own research before making any investment decisions.

Read More:

Crypto Futures Trading: Everything You Need To Know

What Are Crypto Perpetual Futures? A Guide for Beginners

Leverage in Crypto Trading: Something You Need to Know

Best Crypto Leverage Trading Platform for 2023

BTCC Sign up – How to Register an Account on BTCC

BTCC Discount: Participate in the Deposit Bonus Program to Earn 3,500 USDT

BTCC Referral Code: How to Earn Referral Rewards on BTCC?

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Will Shibarium Burn Remove 111 Trillion SHIB Annually?

HBAR Price Prediction 2025, 2030

Sofi Stock Price Prediction for 2023, 2025, 2030

Hooked Protocol Price Prediction 2023, 2025, 2030

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*