Recommended

Cardano Futures Guide: Trade ADA Perpetual Futures on BTCC Exchange

Here we’ll explain what Cardano futures are, and how to use leverage in futures to amplify your returns, as well as giving a detailed guide on how to trade ADA futures on BTCC exchange.

Interested in trading ADA futures on BTCC exchange?

ADA Futures Contracts Listed On BTCC Exchange

Cardano futures enable traders to take long (you profit when market goes up) and short positions (you profit when market goes down) on ADA. Futures have in-built leverage which acts as a multiplier to your returns. Currently, the following Cardano futures contracts are listed on BTCC Exchange.

ADA Futures Contract Details

| Description | Cardano Perpetual | |

| Contract Name | ADAUSDT | |

| Max. Leverage | 20x | |

| Margin Currency | USDT | |

| Contract Type | Perpetual Futures | |

| Download App for Android | Download App for iOS |

What is Cardano (ADA) Futures Trading?

Cardano (ADA) Futures is an agreement between two parties to buy or sell Cardano at a predetermined future date and price. The futures contract derives its value from the underlying cryptocurrency, Cardano in this case. Thus the price of a ADA futures contract moves broadly in sync with the price of ADA.

Trading futures is thus an alternative to actually buying or selling the underlying crypto (aka spot trading). In spot trading, you can make profit by buying Cardano low and selling it at a high price. This trade however works only in a bull market, i.e. when Cardano price is going up. However, in a bear market, there is no trade possible in spot trading. Furthermore, leverage trading is not possible in spot trading.

Trading ADA through futures offers several advantages over spot trading of ADA, namely ability to both long or short and get access to leverage.

Benefits of Cardano Futures Trading

Trade Profitably in All Market Conditions

You can profit from rising ADA price by going long CARDANO futures. And, when ADA price is falling, you can make profits by going short. This feature of futures trading enable you to navigate all types of market conditions profitably. Compare this with directly buying CARDANO. When price is falling, you can either sell your CARDANO or suffer losses. In spot trading, there is no way of profiting from falling prices.

Risk Hedging

If you are a HODLer, you can still use futures to mitigate price risk. Say, you hold ADA. You can mitigate the risks you face when CARDANO is falling by going short ADA futures. In this case, a short futures position acts as a downside protection by effectively locking the $ value of your portfolio without the need for selling your CARDANO. Judicious use of futures as hedge can make you a better and stronger HODLer.

Use Leverage to Amplify Returns

Leverage enables you to open positions that are bigger than your trading capital. If you can open a position that is 10 times bigger than your trading capital, then you have 10x leverage available to you. The maximum allowed leverage for ADA futures listed on BTCC Exchange is as high as 20x. There are two ways of thinking about leverage:

- Leverage as capital efficiency driver : For opening a position of a given size, higher the leverage lower the trading capital required. The leverage in spot trading is always 1x, while it is 3-4x in margin trading. This means futures is 20 to 100 times more capital efficient than spot or margin trading.

- Leverage as a returns amplifier : Because in a leverage trade position size is greater than the capital deployed, impact of prices moves gets magnified. The return on capital deployed is leverage times the price return. This means that you can amplify your trading gains the effective use of leverage.

If ADA increased from $0.26461 to $0.26792 your return would be equal to:

Advantages of ADA futures trading can be summarized as follows:

- Magnify returns through leverage

In-built leverage magnifies impact of ADA price moves on your return on capital.

- Trading both rising & falling markets

Long when bullish. Short when bearish. Trade all market conditions profitably.

- Trade more with less

Deploy the capital freed up by using leverage in other trading opportunities.

| Download App for Android | Download App for iOS |

How to Trade ADA Futures on BTCC?

Quick overview

- STEP 1: Open the BTCC margin trading interface

- STEP 2: Choose the type of ADA margin

- STEP 3: Select the ADA order type

- STEP 4: Choose the leverage

- STEP 5: Choose the lot size

- STEP 6. Set the take profit and stop loss price

- STEP 7. Choose price direction: Buy when bullish, Sell when bearish

STEP 1: Open the BTCC margin trading interface

Log in to the official website of BTCC.com and click Margin Trading on the main menu. Or directly enter the web version link: https://www.btcc.com/en-US/trade/perpetual/ADAUSDT, and log in at the upper right corner of the page.

If you have not opened an account with BTCC, click here to quickly register a free account and top up the initial amount. You can deposit at least 2 USDT for an attempt. If the deposit amount is greater than 500 USDT, you can receive up to 2,000 USDT bonus.

STEP 2: Choose perpetual contract ADA

Select ADA perpetual contract at the top of the page.

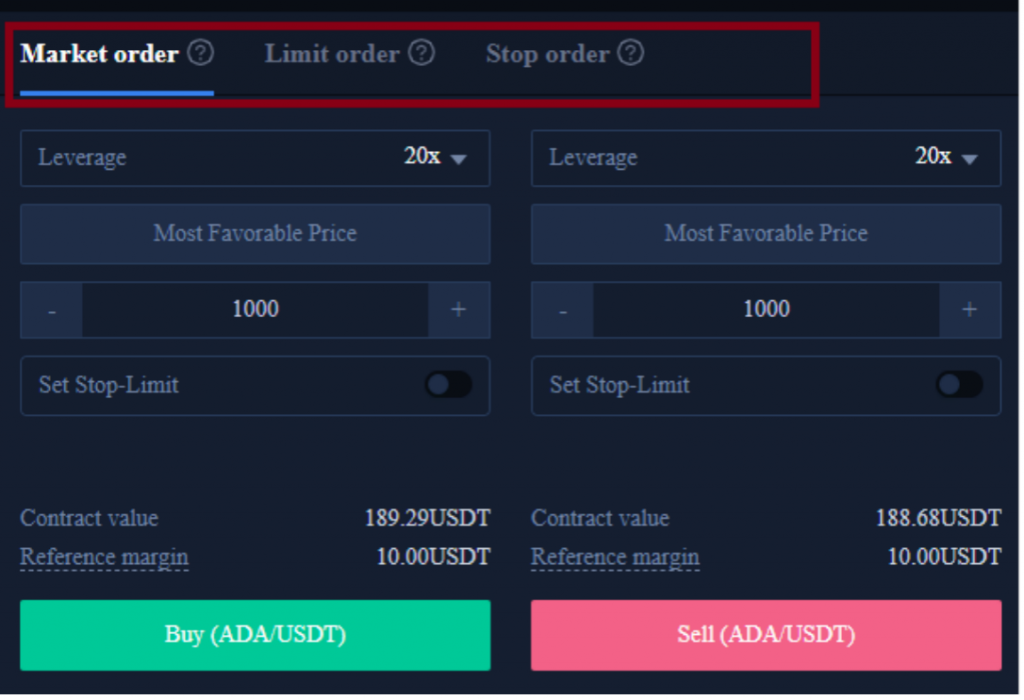

STEP 3: Select the ADA order type

Select the BTCC margin trading order type at the top right of the page. BTCC margin trading orders are divided into market orders, limit orders and stop loss orders.

- Market orders: Users place orders at the best price in the current market to achieve fast trading.

- Limit order: A limit order is used to copy the top/bottom, and refers to a buy/sell price set by the user. After the market reaches the limit price, the margin trading can be executed.

- Stop Order: A stop order is an advanced limit order, and users can customize a buy/sell price. After the market reaches the limit price, the margin trading can be executed.

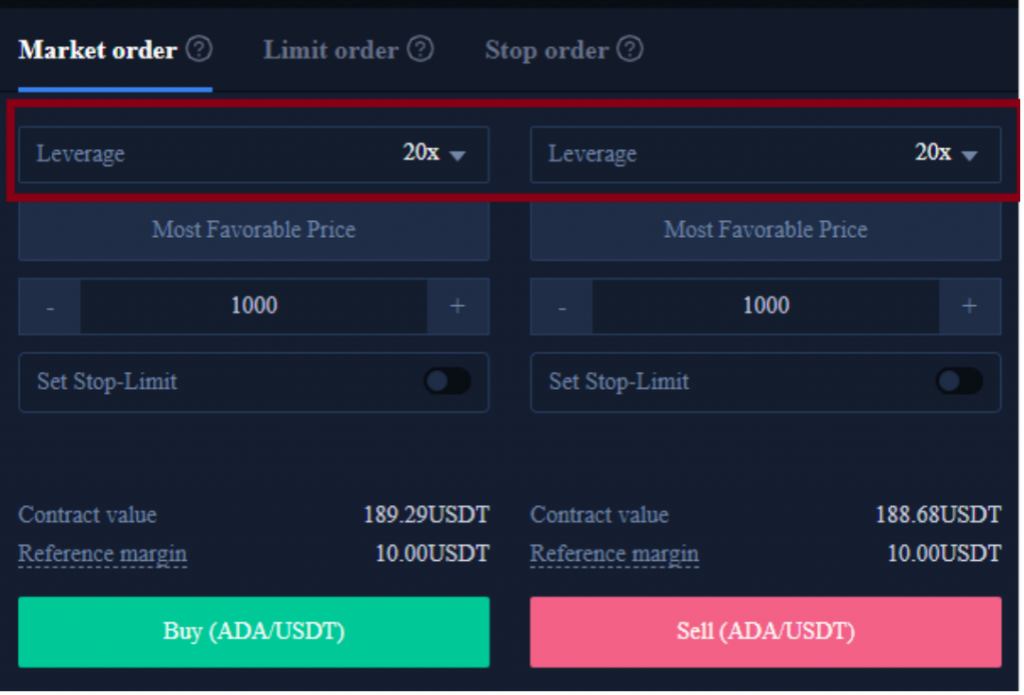

STEP 4: Choose the leverage

BTCC provides 20x ADA/USDT perpetual contract.

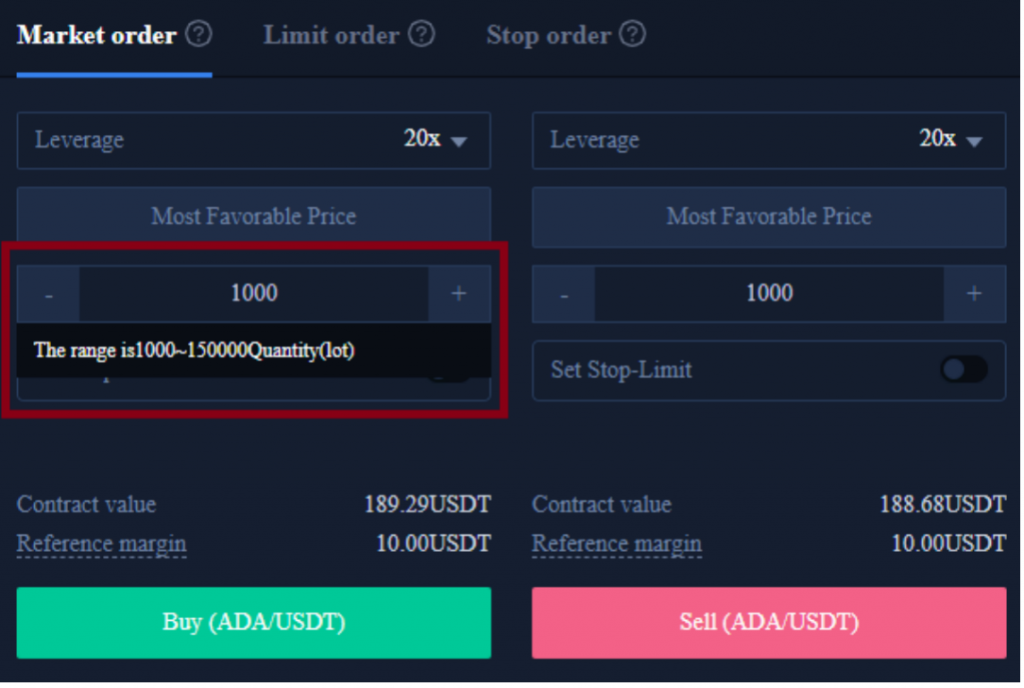

STEP 5: Choose the lot size

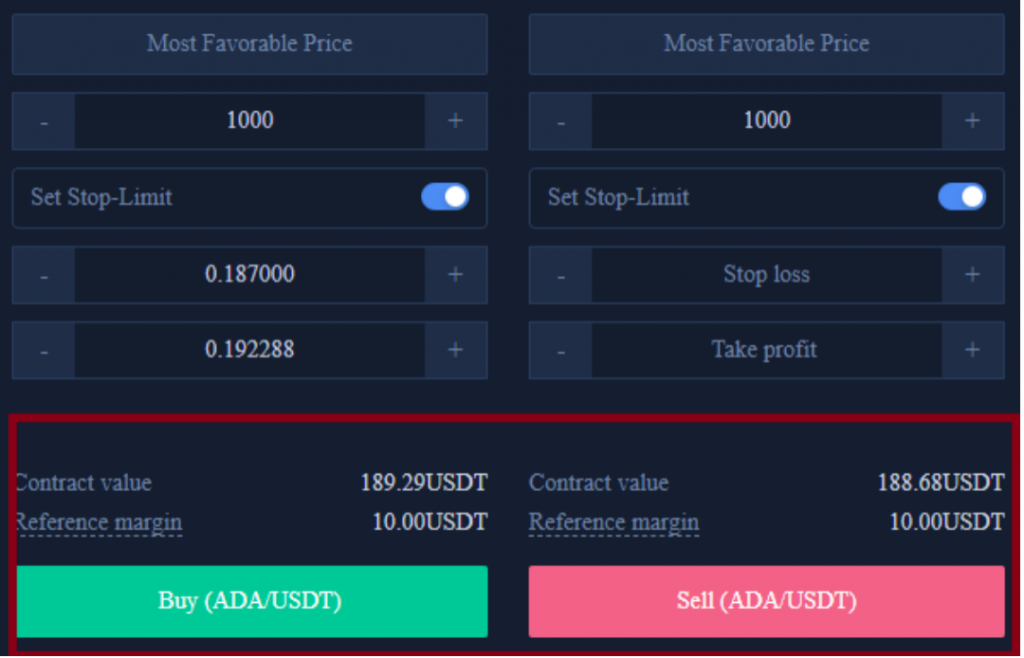

The ADA trading unit at BTCC allow users to choose the number of lots based on their investment situation, and the range can be selected from 1 to 1000 lots. There are real-time contract values and reference margins below.

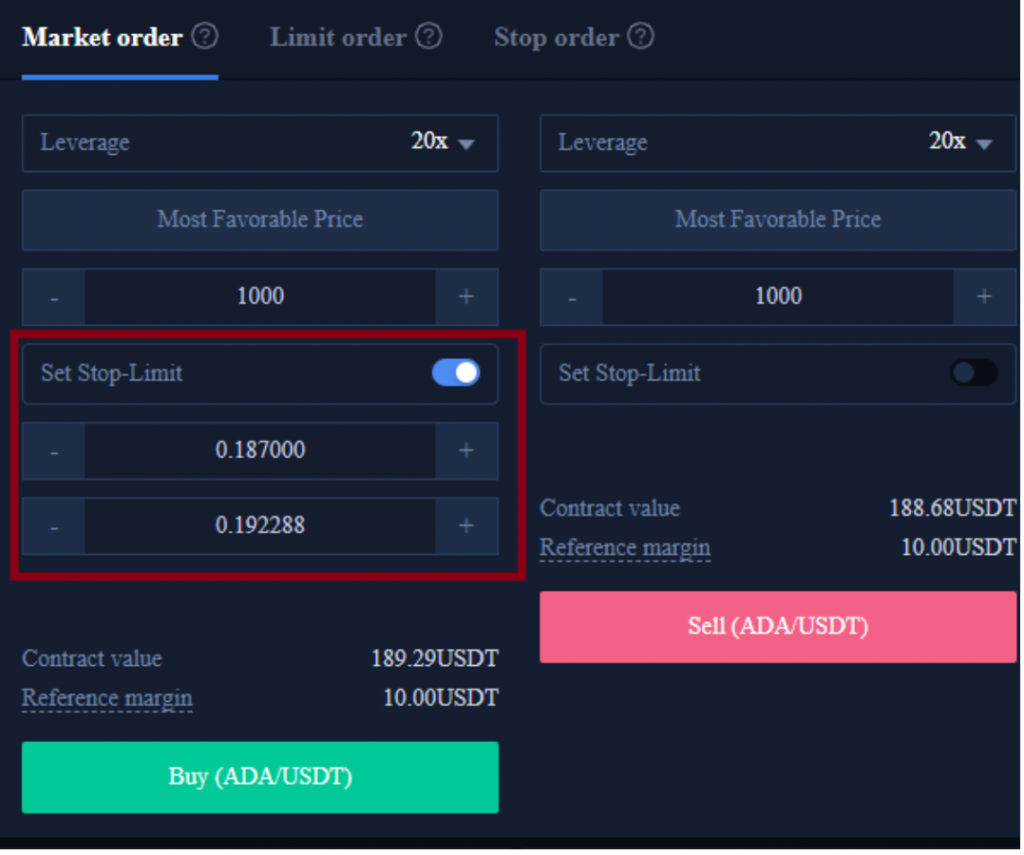

STEP 6. Set the take profit and stop loss price

Market orders, limit orders and stop orders all need to set a take-profit and stop-loss price. The difference is that market orders are executed immediately at the best price, while limit orders and stop orders need to be set for the same day or a week.

STEP 7. Choose price direction:Buy when bullish, Sell when bearish

After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the ADA order is completed.

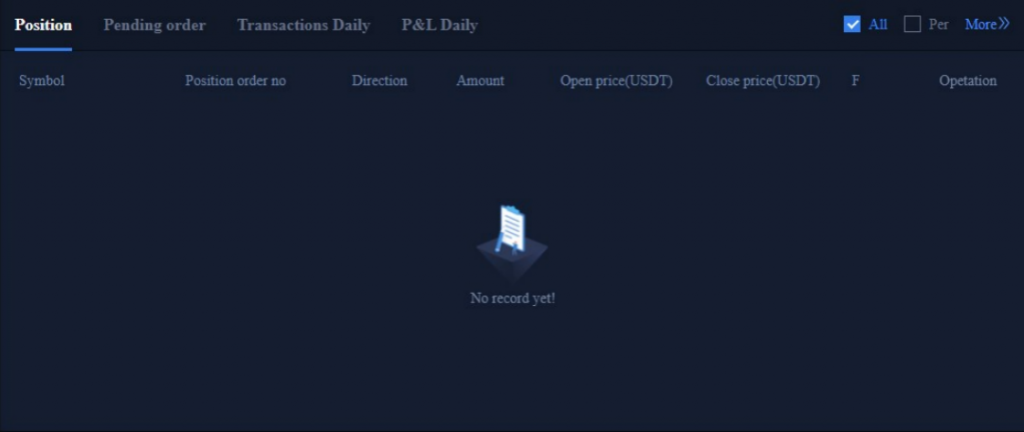

Finally, after the margin trading is completed, it will be displayed at the bottom of the position page; if there is no trading to be executed, it will be displayed at the bottom of the pending order page.

For more orders information, you can click on the margin trading report at the top right of the page to view.

At this point, you have completed the ADA margin trading. If you have further inquiries, please contact the online customer service.

Why Trade ADA Futures on BTCC Exchange

Safe & Secure

With over 10 years of stable and secure operating history, BTCC places strong emphasis on security, offering multiple measures to safeguard users from adverse market risks.

High Liquidity & Volume

One of the largest crypto futures exchange by volume and open interest, dominating the derivatives sector with huge market share.

User-Friendly

Ideal for beginners since it has a simple user interface. BTCC is a perfect choice for traders searching for the hot crypto futures with high leverage as the exchange supports a wide range of altcoins.

One-Stop Trading Platform

BTCC also supports tokenized futures, allowing users to trade stocks and commodities futures with USDT. With the integration of spot and futures markets, BTCC offers a complete ecosystem to fully utilize crypto assets and manage portfolio risks.

| Download App for Android | Download App for iOS |

BTCC Review: Conclusion

- Strict security measures to ensure the safety of user assets and safeguard users from adverse market risks.

- Supports a wide variety of popular trading tools and features.

- Simple user-friendly interface and intuitive trading platform.

- Allows users to earn rewards through various methods.

- Offers a range of educational resources and crypto updates for users, including guides, tutorials, and latest market analysis.

The process of trading futures with BTCC begins with registration and log in. New customers can now sign up here to get a welcome bonus of 10USDT, and complete the Know Your Customer verification to access all BTCC’s features and BTCC discount. Once verified, you can start your crypto trading now.

Read More:

ADA Cardano Price Prediction 2025, 2030

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Core DAO Launch Date: What is Core DAO Mainnet?

Core DAO Airdrop to Take Place on February 8

Moon Bitcoin Review – Your Best Chance to Get Free Bitcoins

Wild Cash App by Hooked Protocol: Answer Quiz to Earn $HOOK

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Will Shibarium Burn Remove 111 Trillion SHIB Annually?

Metamask Airdrop – To Get $MASK Token For Free?

Best Aptos Wallets for You to Store Aptos Coin

Amazon Stock Price Prediction: Is Amazon Expected to Go Up?

Silver Price Predictions for Next 5 Years

Bitcoin Futures Trading for Beginners

Is Ethereum a Good Buy in 2023?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- [email protected]

- [email protected]

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*