Recommended

Ethereum ETFs: When is Ethereum ETFs Approval Date?

Final deadlines for the U.S. Securities and Exchange Commission (SEC) to decide on spot Ethereum exchange-traded fund (ETF) proposals from VanEck and ARK are May 23 and May 24, respectively.

There has been talk that Ethereum ETFs may get the same treatment as the numerous spot Bitcoin ETFs that the SEC approved in January.

The rejection of VanEck’s spot ETH ETF application will most certainly lead to the rejection of other applications submitted later this year by Grayscale, Franklin Templeton, Invesco Galaxy, and BlackRock.

Investment firms are preparing for what could be a dismal outcome as the Eth ETF clearance date approaches, because the regulator has not yet signaled its preparedness to allow these products.

Optimism, however, caused Ethereum’s price to skyrocket on Monday afternoon, when esteemed Bloomberg analysts James Seyffart and Eric Balchunas raised their “odds” of acceptance from 25% to 75%.

Key Takeaways

- On May 23 and 24, the SEC will make its final ruling on the spot Ethereum ETF applications submitted by VanEck and ARK.

- Though there is also optimism, the investment community expects the Ethereum ETF approval decision to be denied.

- The SEC’s previous designation of Ethereum as a security and worries about the liquidity of its markets have led to skepticism about certification.

- Resubmitting documents in the event of a rejection might push out the launch date of the ETH ETF until late 2024 or early 2025.

- Should the SEC reject, it might run into legal issues akin to those it ran across with Bitcoin ETFs.

What are Ethereum Etfs?

Traders can benefit from the price fluctuations of Ethereum (ETH) or a group of cryptocurrencies that include Ethereum through Ethereum exchange-traded funds (ETFs), even if they don’t own ETH directly. An easy way to trade Ethereum without the hassle of buying, storing, and managing the cryptocurrency directly, these tokens are designed like standard exchange-traded funds (ETFs), where investors can purchase and sell shares on stock exchanges during the trading day.

Keep in mind that depending on the jurisdiction, you may only be allowed to purchase Ethereum ETFs that are deemed regulated financial instruments. Nevertheless, their accessibility could differ across nations.

| Download App for Android | Download App for iOS |

Fund Companies Engaged in Active Dialogue with SEC Before BTC ETFs

In the time leading up to the SEC’s approval of Bitcoin ETFs, the fund companies actively communicated with the regulator and provided numerous revised documents in response to their concerns.

The filing of spot Ethereum ETFs, however, has seen far less activity in this area. Many are expecting a disapproving order because of the lack of public participation.

Katherine Dowling, general counsel for Bitwise, told Bloomberg that “most people are universally expecting a disapproval order.” Bitwise applied for a spot-Ether ETF in March.

“You’re not seeing the types of public activities that you would see if there was going to be an approval.”

A research analyst at digital asset investment firm Fineqia International, Matteo Greco, recently stated that doubt regarding rapid clearance is fueled by concerns about the liquidity of ETH’s spot and futures markets, as well as its past designation as a security by the SEC.

If the files are denied, the issuers will have to resubmit them, which may delay approval until at least Q1 or Q4 of 2025, according to the analyst.

According to Greco, there’s also the possibility of “slow-playing” the S-1s while approving the 19b-4 files. In order to launch Spot ETH ETFs, the SEC needs to approve both the 19b-4s and the S-1s.

Spot ETH ETFs and other innovative products can be listed on national security exchanges like the NYSE and Nasdaq through the 19b-4s registration. When issuing new securities to the public, the first paperwork needed is the S-1.

In April, the value of Ether dropped about 20% due to the dwindling expectations of approval. Ethereum is a popular blockchain platform that allows users to create and run decentralized apps; its native coin is Ether.

SEC Chair Gary Gensler has hinted that the staking function of Ethereum, where users secure their tokens on the blockchain to verify transactions and gain rewards, might potentially subject Ether to the SEC’s authority as a securities regulator.

SEC’s Decision to Provide Clarity on its Position Regarding ETH ETFs

Whatever happens, the SEC’s decision will reveal its position on spot Ethereum ETFs. The regulator’s thoughts on these products can be better understood with this openness, even if issuers are gloomy about approval.

Dowling warned that there would be an opportunity for a response. Everything is simply speculation at the moment.

There can be legal action if the application is turned down. The August court victory of Grayscale Investments over the SEC was a driving force behind the January approval of spot Bitcoin funds.

Spot Bitcoin ETF approval “should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities,” Gensler warned the public in January.

“Furthermore, the approval in no way indicates the Commission’s stance on the regulatory treatment of other cryptocurrencies or the degree to which certain market participants in the cryptocurrency space are currently in violation of federal securities laws,” he went on to say.

| Download App for Android | Download App for iOS |

Anticipate Legal Routes for Digital Assets Under Gensler

Some experts have pointed out that the SEC could be setting a precedent that requires a literal court order to authorize any spot crypto product if it rejects Ether ETFs.

“Any advancement in the digital-asset space is going to have to come through the judiciary channels as long as Gary Gensler chairs the SEC,” Mark Connors, director of research at 3iQ Corp, told Morningstar.

Similarly, analysts at JP Morgan anticipate that the SEC would “face a legal challenge and eventually lose” prior to approving spot Ethereum ETFs. Considering Grayscale’s victory over the agency before to its acceptance of Bitcoin products, they implied that “the template is likely to be similar to Bitcoin” in their statement.

It should be mentioned that the SEC is currently facing criticism for its position on cryptocurrency. A month ago, Consensys, an Ethereum developer, took legal action against the SEC, claiming that the federal regulator had engaged in a “unlawful seizure of authority” over Ethereum.

Ethereum’s Legal Situation Affects ETF Prospects

Furthermore, ETH’s legitimacy is still up for discussion. No one ever questioned Bitcoin’s commodity character, even after the first ETF denials.

According to nterview with Anndy Lian, a government blockchain advisor and expert:

“BTC has been generally recognized as a commodity by various regulatory bodies, including the CFTC. However, the SEC has not provided a clear stance on ETH’s classification, and recent comments by SEC Chair Gary Gensler have not explicitly categorized ETH as a commodity, which adds to the uncertainty.”

Michael Saylor, co-founder of MicroStrategy and a Bitcoin maximalist, has added fuel to the fire by predicting that, upon the rejection of the spot ETH ETF in May 2024, it will become “very clear” that Ethereum is classified as a security and not a commodity.

Following that, you will realize that all of the underlying cryptocurrencies—Ethereum, BNB, Solana, Ripple, Cardano, etc.—are merely unregistered security tokens. “A spot ETF will never wrap any of them,” Saylor noted.

| Download App for Android | Download App for iOS |

When Will ETH ETF be Approved?

Although there is a general agreement that VanEck’s application would be rejected on May 23, 2024, insiders in the industry still think that a spot ETH ETF will be allowed in the end.

The lengthy process leading up to the approval of spot Bitcoin ETF serves as a point of comparison.

The SEC denied all applications that were submitted to it prior to its approval in January 2024. U.S. approval of spot Bitcoin ETFs was contingent upon crypto fund manager Grayscale’s victory in a case against the SEC.

Grayscale contended in its petition that spot Bitcoin ETFs can be traded honestly and without manipulation or fraud because of the oversight and regulation that BTC futures ETFs are subject to.

Market watchers now predict that spot ETH ETFs will face the same legal hurdles in their pursuit of SEC clearance.

According to a study by JPMorgan analysts, the SEC is likely to lose a court battle if it denies the approval of spot Ethereum ETFs. The report states that the template will likely be similar to Bitcoin, and that futures-based Ethereum ETFs are already approved.

ETH Price Prediction

Variability in Short-Term Prices

The market was anticipating that 2024 would see a significant increase in the price of ether due to encouraging news regarding spot ETH ETFs.

Since May 10, 2024, when expectations of ETH ETF approvals as early as May 2024 were crushed, the price of ETH has fallen by 24%.

Looking for additional market catalysts to play catch-up, the second-largest cryptocurrency will need them in 2024 as ETH continues to underperform large-cap peers like BTC, Solana (SOL), and BNB.

According to Lian, as the market responds to the news, “a rejection could lead to short-term price volatility and possibly a decrease in price,” as reported by Techopedia.

Lian chimed in:

“Even if the SEC rejects the spot ETH ETF, Ethereum may not run out of market catalysts. Other potential catalysts for a bull run could include technological advancements, increased adoption, further integration into DeFi, RWA, and the broader crypto market dynamics.”

In 2024, ETH will be the “Basket Case.”

Ethereum was referred to as the “basket case” of this crypto cycle by Markus Thielen, founder of 10x Research, elsewhere.

According to Thielen’s email note to investors, the research group was initially “very bullish” on Ethereum. However, they changed their mind after seeing a dramatic drop in Ethereum gas fees, which they interpret as indicating “nearly zero demand for transactions with ETH.”

As a result of rising on-chain Treasury rates (5.1%) and declining staking yield (2.9% on Lido as of writing), Thielen continued, “more people realize this,” and the demand for ETH will decrease.

“Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,”Thielen stated.

| Download App for Android | Download App for iOS |

Conclusion

Under Chair Gensler, the US SEC has taken a tough stance on the cryptocurrency business. Many well-known cryptocurrency businesses and individuals have been the targets of litigation launched by the securities regulator in the last year. These include CZ, Binance, Coinbase, Kraken, and Uniswap.

Perhaps the only way to see spot Ethereum ETFs through to 2024 is to follow a similar strategy to Grayscale’s litigation, which allowed for spot Bitcoin ETFs in the US.

How to Trade Crypto Futures on BTCC?

Now you can trade BTC on BTCC. BTCC supports a diverse selection of cryptocurrencies for trading. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. BTCC also offers products such as crypto, gold, and tokenized stocks to help investors rationally allocate their assets.

1. Register an Account

Join BTCC now and get up to 10,055 USDT when you deposit and trade. Click the button below to sign up now.

2. Deposit Funds

Once your account is set up, you’ll need to deposit funds into your BTCC account. BTCC may offer various deposit methods such as bank transfers, cryptocurrency deposits, or other payment options. Choose the method that works best for you and follow the instructions provided to deposit funds into your account. BTCC mainly offers USDT margin and future trading. Therefore, you need to buy USDT before trading.

3.How to trade BTC?

Here are the steps to trade BTC on BTCC

1) First, tap “Futures” on the website homepage

2) Select a product you would like to trade from the list here. BTCC currently offers daily and perpetual futures

3) Check time to settlement. The settlement time of these futures type is different, you can check the time for settlement for each product here.

4) After choosing product, you can decide whther you would like to buy or sell it. You only need to own USDT to trade USDT-margined futures. That is to say you can sell BTCUSDT futures without owing any BTC Coin.

5) Then select your order type, and choose your leverage.

If you choose Limit or SL/TP order, you will need to enter your order price here.

Enter the quantity or choose the percentage under the quantity field.

You can also set up stop loss or take profit targets to limit losses or maximise earnings.

6)After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

| Download App for Android | Download App for iOS |

BTCC FAQs

1.Can U.S. traders use the BTCC exchange?

Of course, BTCC accepts US traders on its platform. They can sell, purchase, or trade bitcoins in the excess marketplace using the BTCC exchange. And, of course, any USD deposits must be KYC-verified first.

2.What can you trade on the BTCC?

BTCC allows users to trade over 300 crypto futures, including USDT-margined and coin-margined options. Traders can use up to 225x leverage to enhance their trades. Furthermore, the site provides handy choices for both cryptocurrency and fiat deposits.

3.Is BTCC the ideal exchange for you?

If Bitcoin trading is your top priority, BTCC is definitely the finest exchange for you. This company has been focused on Bitcoin since 2011 and provides a user-friendly platform for all types of traders, both experienced and new.

4.Is the BTCC Exchange trustworthy?

BTCC has a 13-year track record of secure operations, with zero security problems. Along with this, it has adopted current security measures, making it a safer and more trustworthy environment than its contemporaries.

About BTCC

BTCC is one of the world’s oldest and most popular bitcoin exchanges. Bobby Lee created it in 2011, with its headquarters initially located in Shanghai, China. BTCC contributed significantly to the early development of the Bitcoin and cryptocurrency ecosystems.

BTCC initially concentrated on Bitcoin trading, but it gradually expanded its capabilities to cover other cryptocurrencies as well. The exchange allows users to purchase, sell, and trade numerous cryptocurrencies, including as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), among others.

BTCC has received recognition for its strong trading platform, liquidity, and security precautions. The exchange provides features such as spot trading, margin trading, and futures trading to accommodate various types of traders and investors. It gives consumers real-time access to market data, order books, and trading charts, allowing them to make informed trading decisions.

BTCC has undergone various alterations throughout the years in order to adapt to the changing regulatory landscape. It expanded its activities abroad, opening offices in other countries to serve a global customer base. However, cryptocurrency legislation and availability may differ based on jurisdiction.

As the cryptocurrency market evolves, BTCC remains a significant player in the industry, providing a variety of services and contributing to the growth and development of the crypto ecosystem.

| Download App for Android | Download App for iOS |

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

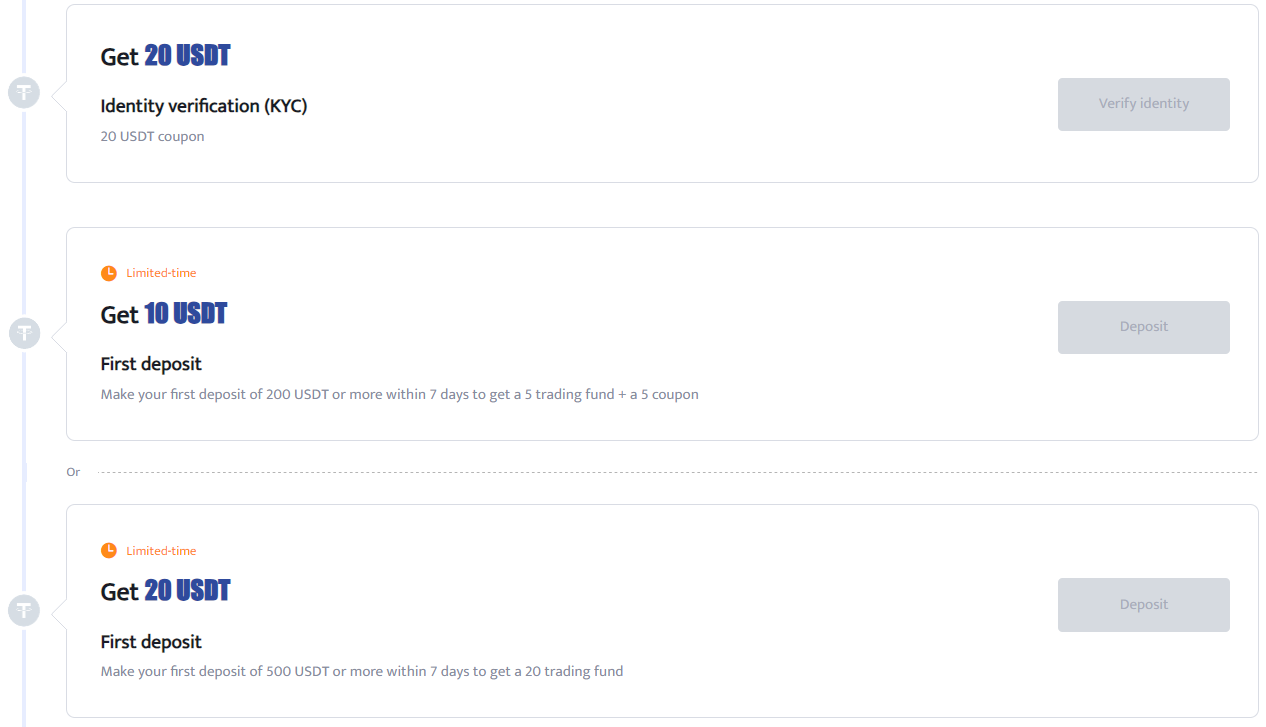

BTCC Bonus

BTCC bonuses apply to different categories of users. You can deposit and receive up to 10,055 USDT. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

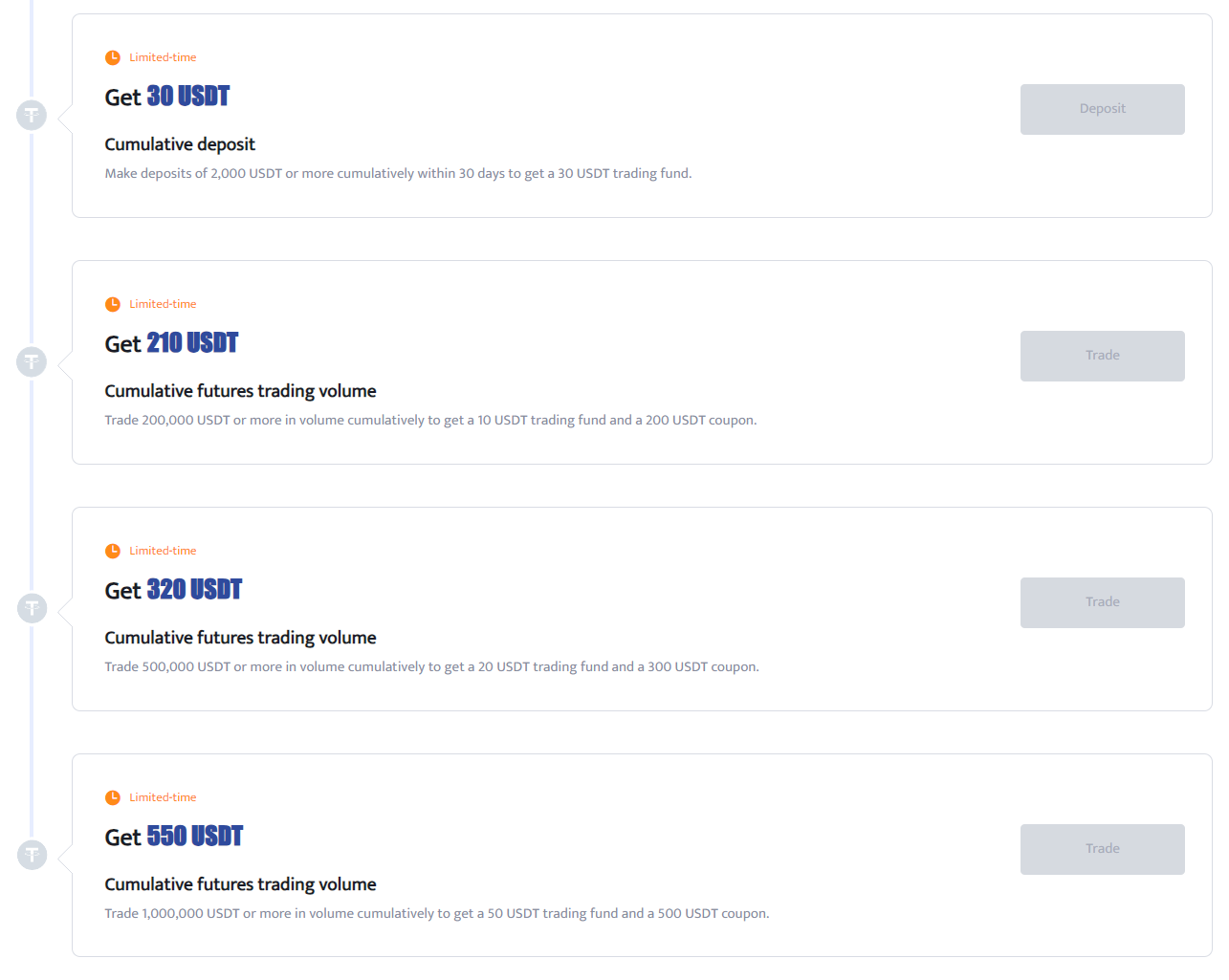

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

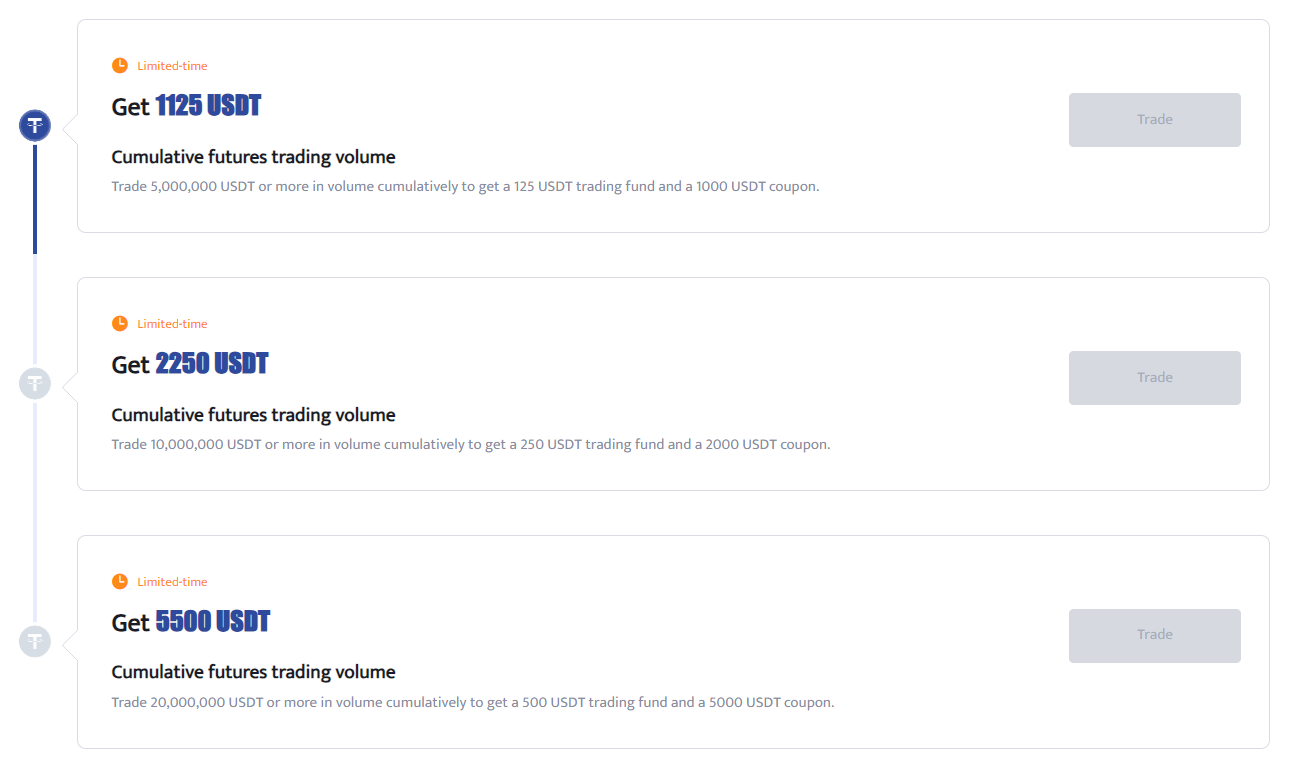

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*