Recommended

Solana Price Prediction -SOL Plummets to $12 As FTX Collapses

The Solana price forecast continues extremely bearish, with all major support levels on all timeframes being broken. Solana has declined by more than 40 percent in the past 24 hours and nearly 50 percent in the past week. The announcement of FTX‘s collapse has been catastrophic for Solana tokens and NFTs, and on-chain data indicates that additional losses are probable.

Solana’s ecosystem appears to be collapsing alongside FTX and Alameda, and data indicates that people are increasingly departing the chain in droves.

Connection Between Solana and FTX

Solana raised $300 million in 2021 from a wide range of private investors, including Alameda Research, through the sale of its native coin. Andreessen Horowitz was the lead investor in this round of fundraising. As a banker-owned company, Fried’s has maintained its Solana blockchain integration.

In March of 2022, FTX and CoinShares introduced an ETP based on the Solana platform. Everyone who staked their money on this revolutionary idea has now been paid back in full. To further its cryptocurrency goals, SOL also made a sizable investment in FTX. According to CoinDesk, the value of the firm’s SOL holdings as of December 31st, 2017 was $1.1 billion.

solana got really fucked up huh

— CryptoFinally (@CryptoFinally) November 8, 2022

Many people are concerned that the money that SBF and FTX have invested in Solana and its ecosystem will be wasted. The Solana blockchain’s performance issues have only made things worse.

According to the Solana network’s status monitor, the system is now functioning at a lower capacity than usual. Therefore, it appears that potential investors should proceed with caution when considering a purchase of Solana stock.

| Download App for Android | Download App for iOS |

Is it Time to Get Rid of Solana?

In the past 48 hours, Solana has plummeted, dropping to dangerously low levels. The recent occurrences between Binance’s and FTX’s CEOs have resulted in severe volatility and adverse sentiment in Solana’s price.

Ran Neuner, a crypto trader for CNBC, saw Solana leave. The market has recognized that CZ Binance presently owns 10% of the tokens, and in a statement released on November 9 he declared that he wanted to favor the BNB chain over the SOL chain.

Solana Whale (3oSE9CtGMQeAdtkm2U3ENhEpkFMfvrckJMA8QwVsuRbE) is in liquidation and currently has 2,450,418.5 SOL (worth over $51 million) in collateral and 44,871,609.6 USDC in debt. However, Solana is currently facing congestion due to the update of the oracle. pic.twitter.com/qJKMViJeQK

— Wu Blockchain (@WuBlockchain) November 9, 2022

As the price of Solana drops, whale investors are selling off their holdings and losing money. On November 9th, Wu Blockchain provided an example in which a whale was charged with a $44.8 million USDC debt while having 2.4 million SOL worth slightly more than $51 million in collateral. The minimum amount needed to liquidate the property at that address was $43 million.

Solana Price Prediction

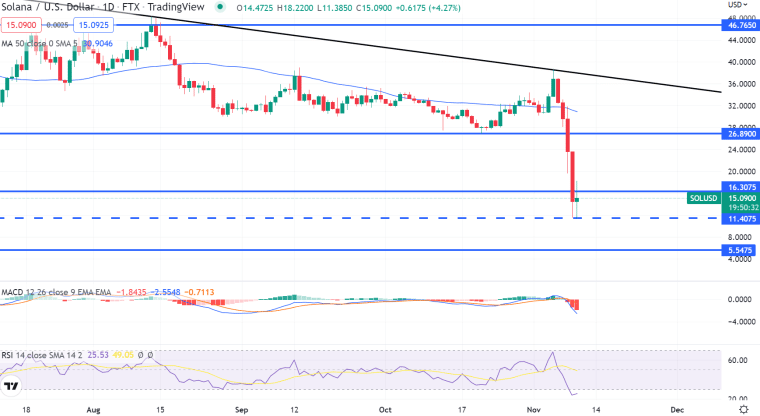

Solana is currently trading at $15.18 with a 24-hour volume of $4.9 billion. Solana has fallen by 40% in the last 24 hours. CoinMarketCap is now ranked 13th with a market valuation of $5.5 billion. There are now 362 331 154 SOL in circulation.

The SOL/USD pair has dropped below a key support level of $16.30. A potential continuation of the bearish trend in Solana has been signaled by a recent price drop below $30, the 50-day moving average.

An “three black crows” pattern has formed under Solana’s 50-day moving average, suggesting the decline is likely to continue. SOL might drop to $5.5 if sellers push it below its immediate support at $11.50.

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*