Recommended

Where and How to Buy Bitcoin – Best Platforms for Buying Bitcoin

It shouldn’t take you more than 10 minutes to complete the entire process of buying Bitcoin from the convenience of your own home. Getting started with Bitcoin is as simple as opening an account with a reputable broker, making a deposit, and specifying your desired stake.

This tutorial will teach you the fundamentals of buying Bitcoin so you can get started with the cryptocurrency with as little hassle and expense as possible, even if you’ve never done it before.

Where to Buy Bitcoin —Best Platforms for Buying Bitcoin

There are thousands of cryptocurrency trading sites that accept instant payment methods, answering the question of where to purchase Bitcoin online and how to get started in crypto in general. As a result, you can put your money into crypto the way you want for the long haul.

However, be aware of the fees charged by the platform in question and ensure that it is governed by a respectable financial authority. Bitcoin (BTC) is one of the most sought-after digital assets by crypto traders due to its high mining profitability in 2023.

Here we take a look at five different exchanges where you can get your hands on some Bitcoin right now.

| Download App for Android | Download App for iOS |

1.BTCC- Overall Best Place to Buy Bitcoin in 2023

Since the creation of Bitcoin (BTC) by Satoshi Nakamoto 14 years ago, countless crypto exchanges have emerged. However, only a handful have stood the test of time, and BTCC is one of the oldest in the sphere.

Launched in June 2011, BTCC is a crypto exchange offering users liquid and low-fee futures trading of both cryptocurrencies and tokenized traditional financial instruments like stocks and commodities.

Headquartered in the United Kingdom, BTCC claims to be dedicated to offering the masses reliable and accessible digital assets trading services and the company has maintained that vision over the past 11 years.

BTCC is also compliant with laid down laws. Over the years, it has secured regulatory licenses across several jurisdictions including the United States, Canada, and Europe.

Moreover, the platform has been offering secure, low-fee, and regulatory-complaint digital assets trading for the past 11 years. Accordingly, BTCC’s liquidity may have given it an advantage over its rivals in the Web3 ecosystem so far.

Why Trade Crypto Futures on BTCC

To trade Crypto futures, you can choose BTCC crypto exchange.BTCC was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. Over 11 years of providing crypto futures trading services. 0 security incidents. Market-leading liquidity.

Traders may opt to trade on BTCC for a variety of reasons

- Secure:safe and secure operating history of 11 years. Safeguarding users’ assets with multi-risk management through the ups and downs of many market cycles

- Top Liquidity:With BTCC’s market-leading liquidity, users can place orders of any amount—whether it’s as small as 0.01 BTC or as large as 50 BTC—instantly on our platform.

- Innovative:Trade a wide variety of derivative products including perpetual futures and tokenized USDT-margined stocks and commodities futures, which are innovative products invented by BTCC.

- Flexible:Select your desired leverage from 1x to 150x. Go long or short on your favourite products with the leverage you want.

| Download App for Android | Download App for iOS |

2.Binance – Popular Bitcoin Exchange with More Than 60 Markets

Binance was established in 2017 as a cryptocurrency trading platform. Over a hundred million users access the platform monthly, and daily trade volume is in the billions. You can use your Visa, Mastercard, or Discover card issued in the United States to buy bitcoins on Binance. However, the fee is steep at 4.5% of the whole transaction.

And if you use those cash to buy Bitcoin immediately, you’ll have to fork over another 0.5% in fees. However, spot trading commissions on Binance’s primary exchange are only 0.10 percent. Binance may be an excellent choice if you frequently deal in crypto-to-cryptocurrency pairs due to the high level of competition in this market.

The Binance platform in the United States currently supports over sixty different marketplaces. This encompasses a sizable variety of cryptocurrencies, including both well-known and lesser-known initiatives. Binance caters to experienced traders by providing both an over-the-counter service and a cutting-edge trading platform with superior analysis tools.

The transaction fees for buying Celo and other popular new cryptocurrencies like Terra Luna on this, one of the largest crypto exchanges in the market, are among the lowest you’ll find when compared to competitors like Coinbase and Kraken. If you want to learn more, check out our Binance review right now.

3. Coinbase – a Solid Bitcoin Wallet for Novices

Coinbase LogoIf you live in the United States and are looking for a simple way to acquire Bitcoin, one of the finest options is Coinbase. Because of Coinbase’s user-friendly design and lack of technical jargon, creating an account is a breeze. Once your identity has been confirmed, you can make free ACH transfers.

![Coinbase Review [2022] | Pros & Cons | Trade Cryptocurrencies](https://finbold.com/app/uploads/2021/04/Coinbase-Review-2021-Fees-Pros-Cons-Buy-Sell-Bitcoin-1024x683.jpg)

When the funds reach your Coinbase account, you can buy Bitcoin for a 1.49 percent fee. While this may seem steep, consider that Coinbase adds a nearly 4% commission when you use a debit or credit card to purchase Bitcoin. However, with this method, you can make a quick purchase of Bitcoin. If you’re looking for diversification, Coinbase has access to other digital currency exchanges. By 2023, you can do this in the comfort of your own home and have access to the market’s most undervalued cryptocurrencies.

One more reliable Bitcoin wallet is Coinbase. All users must complete a two-step verification process before they may access the platform. In addition, we store 98% of client funds in cold wallets and need an extra layer of authentication any time a user logs in from a new device or IP address. Check out our in-depth article on the top crypto cold wallets for additional information.

Coinbase now allows you to purchase Ethereum, Dogecoin, and other popular altcoins directly from your mobile device, thanks to its extensive support for these digital assets.

| Download App for Android | Download App for iOS |

4. Kraken – Trustworthy Cryptocurrency Exchange for Buying Bitcoin Using Bank Wire

Kraken is the last exchange worth thinking about if you want to buy Bitcoin. This online marketplace has been around since 2013, making it one of the longest running venues for its kind. Clients in the US can open an account quickly and easily and then wire funds from a domestic US bank. Withdrawals are the only function for which ACH is available. Kraken’s starting deposit requirement is tied to the financial institution you use.

In contrast to Etana Custody’s $150 minimum deposit, MVB Bank’s outgoing payment threshold is only $1. In any case, after your bank wire has been received in your Kraken account (typically within 0-1 business days), you can purchase Bitcoin at a fee of only 0.26%. Commissions are lower for high-volume traders. Kraken is compatible with more than fifty alternative digital currencies, including Bitcoin.

5. Webull – Buy Bitcoin From Just $1 with Webull

Webull is an easy-to-use trading platform for stocks, ETFs, options, and cryptocurrencies developed specifically for investors in the United States. Opening an account is quick and easy whether you trade online or with the Webull crypto trading app. In order to purchase Bitcoin, you will need to use an ACH transfer or wire money from your bank account.

Webull does not impose the typical trading commissions on its customers. However, spreads of 1 percent or greater must be taken into account. However, one of Webull’s most appealing qualities is its cheap minimum investment threshold of just $1 for Bitcoin purchases. Additionally, this holds true for all of the other cryptocurrencies that can be purchased with Webull.

| Download App for Android | Download App for iOS |

Is Bitcoin a Good Buy?

Bitcoin is often regarded as the most valuable cryptocurrency. Nonetheless, if you are debating whether or not to invest in Bitcoin at the moment, you should do your own due diligence before making any purchases.

The best method to enter the market is with a dollar-cost averaging strategy, which we explain in greater detail below, despite the fact that you may try to time the market properly. How much Bitcoin, though, do you recommend I purchase?

Another factor to keep in mind is that Bitcoin’s price volatility means you can expect to see drastic changes in value. Thus, Bitcoin robots are only for those with a high risk tolerance. Bitcoin CFDs enable you to speculate on the price movements of cryptocurrencies, and the finest crypto bots, like Bitcoin Prime, give you this opportunity. Now is a good time to read our comprehensive Bitcoin Prime review if you’re interested in learning more about Bitcoin robots.

The best defense against this is to adopt a buy-and-hold strategy, wherein you intend to maintain your BTC tokens for the foreseeable future. This will allow you to weather the storms of extreme volatility that frequently hit the bitcoin markets. Where, though, do you keep your Bitcoins after you’ve bought them? For more information on the industry-leading cold crypto wallet, read our review of the Ledger Nano X.

How to Buy Bitcoin?

Here we took BTCC as an example. You can start buying and selling Bitcoin futures in 7 steps. Now, we will walk you through step-by-step on how to trade Bitcoin weekly futures or perpetual contractsat BTCC.

- Visit BTCC.com and Click on the Trading Button to Enter the Trading Platform.

- Switch Between the BTC Weekly and Perpetual Contracts.

- Select Order (Market Order (Instant) or Pending Orders (Limit Order or Stop Order)

- Choose the Leverage That You Prefer to Trade and Afford the Risks

- Select Lot Size

- Set Stop Loss and Take Profit by Switching the S/L and T/P

- Click the Buy or Sell Button to Activate Your Order

1 – Visit BTCC.com and Click on the Trading Button to Enter the Trading Platform

Upon signing up and making a deposit into your trading account, you can go ahead and start the trading process by clicking the trading button on the BTCC official website.

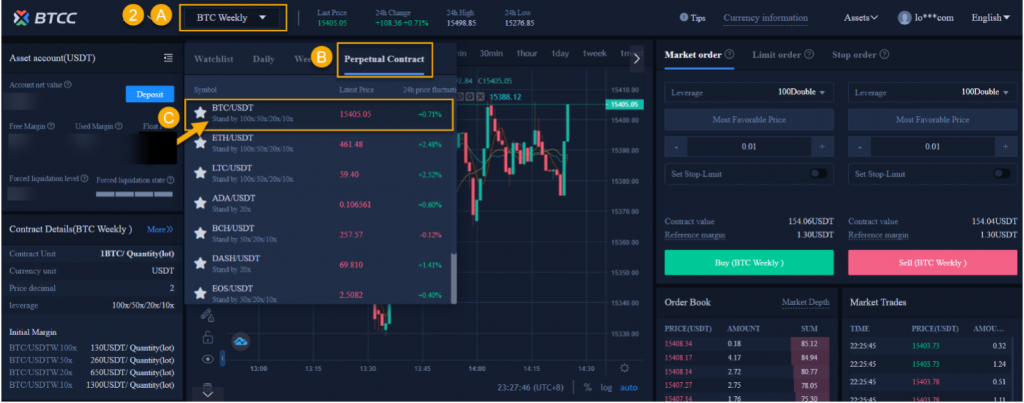

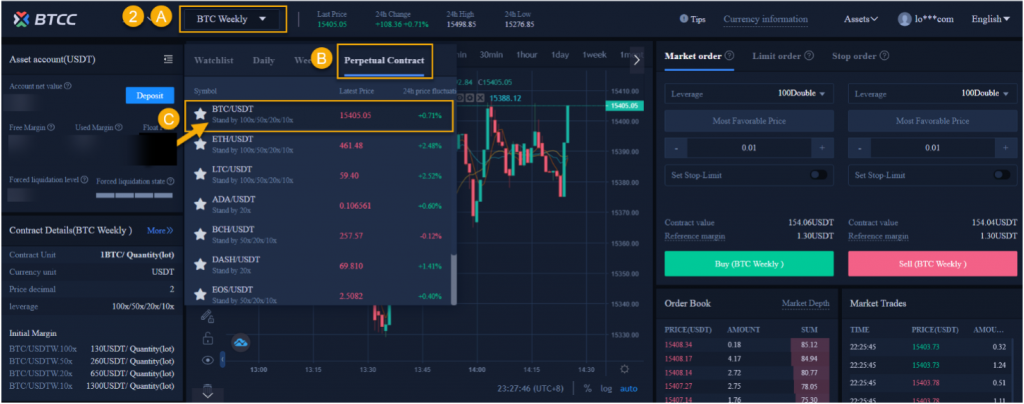

2 – Switch Between the BTC Weekly and Perpetual Contracts.

Now that you have the BTCC trading terminal before you, the next step is to select the type of Bitcoin futures contract you will like to trade. Remember, the daily and weekly futures have an expiration date, while the perpetual futures have no expiry date.

Click on the market watch drop-down button as shown on the above image, set to BTC weekly futures by default, and navigate to the perpetual futures contract, which we’ll continue with as we go forward in this guide.

Under the Perpetual contract, click on the BTC/USD to set the main chart window to the perpetual futures contract, as shown in the image above.

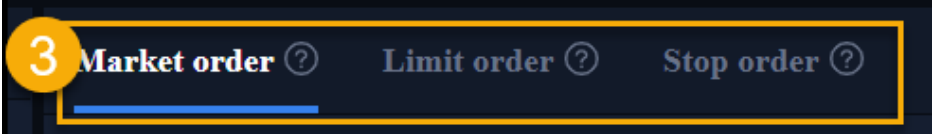

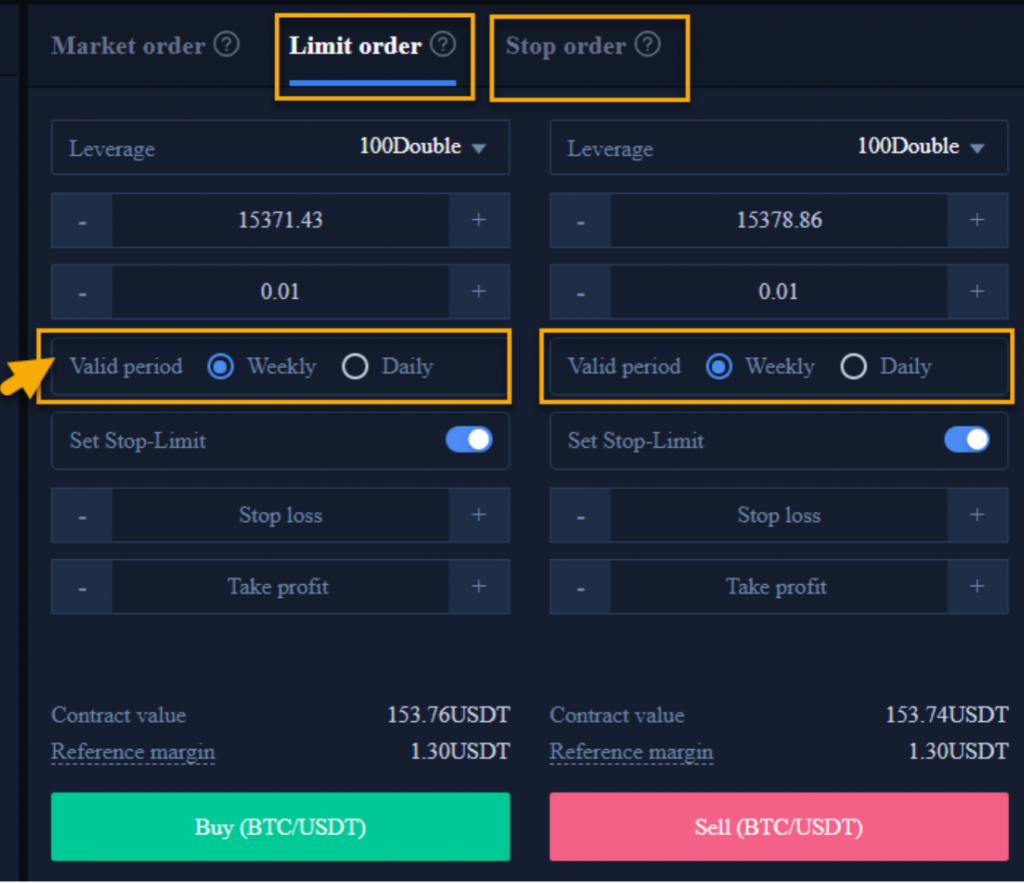

3 – Select Order (Market Order (Instant) or Pending Orders (Limit Order or Stop Order)

With the main chart window now set to the BTC/USDT perpetual contract, you can now select the type of order to buy or sell.

Market order

Order panel

Trades can be entered by an instant buy/sell order or pending orders, with two types (buy/sell limit orders, or buy/sell stop orders).

Pending Orders

A significant difference between market orders and pending orders is that pending orders will only activate as live orders when the market price reach the pending price level. As a result, these orders have a validity period where they get deleted if the market price does not activate the pending orders into live market orders.

The validity period can be set to one day or one week using the radio button as shown in the image below.

Limit Order:

Limit orders are pending orders where you expect the Bitcoin price to bounce off from your established price level.

Buy Limit order:

This type of limit order is set at a distance below the bid/ask price, where you anticipate the Bitcoin price to bounce back into a bullish trend upon hitting the set price.

Sell Limit Order:

The sell limit order is set when you anticipate a downward trend for BTC price.

The limit order is placed at a price level above the BTC bid/ask price while you wait for the market price to activate the sell order and resume the bearish trend.

Stop Order:

Stop orders are types of pending orders that traders placed when they expect the Bitcoin price to break through the established price threshold and continue in the same direction.

Buy Stop Order:

The buy stop order is placed above the bid/ask price in anticipation of a continuation of the bullish trend.

Sell Stop Order:

The sell stop order is placed below the bid/ask price, where you expect a downtrend to continue.

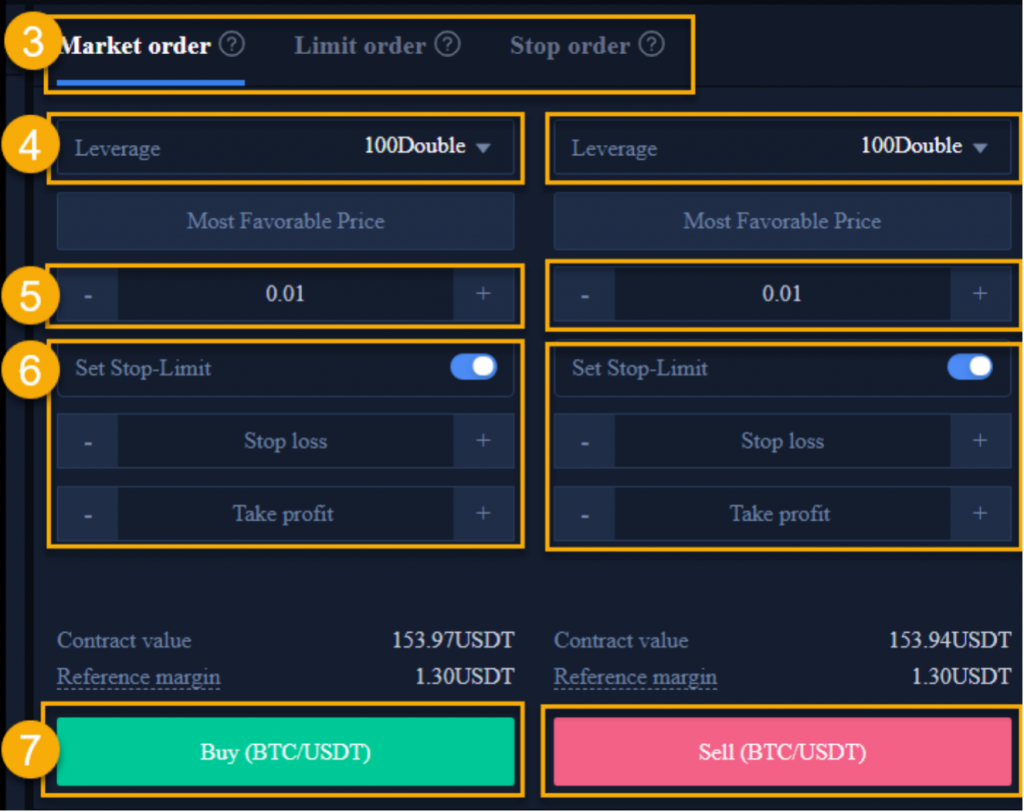

4 – Choose the Leverage That You Prefer to Trade and Afford the Risks

As mentioned in the introduction, buying or selling the BTC futures contract enables you to scale up your buying or selling power using leverage. BTCC crypto exchange offers leverage that enable you to trade from 5X up to 100X of your capital.

5 – Select Lot Size

Next, we input the lot size for either a buy or sell order. The lot size for trade on the BTC perpetual futures contract ranges from 0.01 to 2 quantity (lot).

Conversely, the lot size for the regular BTC weekly futures contract ranges from 0.01 to 30 quantity (lot).

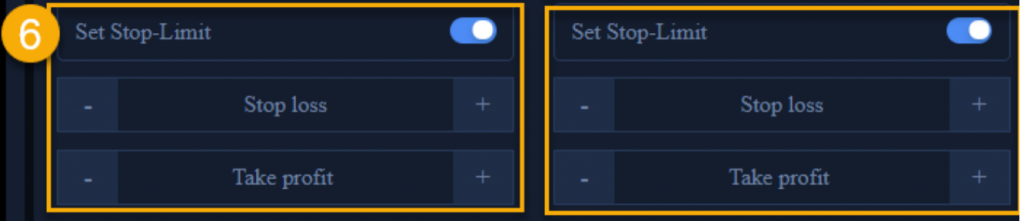

6 – Set Stop Loss and Take Profit by Switching the S/L and T/P

To set your take profit and stop loss levels for your trade, you can turn on the toggle button beside the “Set stop-limit” label. It is set to off by default. Although you can buy or sell a Bitcoin BTC futures contract without setting your take profit or stop loss targets, we consider it is the best practice to always establish these levels.

The stop loss is a price level where you instruct the broker to exit your trades if it does not go in your chosen direction. In contrast, the take profit level is set to close your transaction in profit when the Bitcoin price reaches an established price threshold.

7 – Click the Buy or Sell Button to Activate Your Order

Now, you finally made it to the last step, you can click on the buy or sell button to initiate your trade for the Bitcoin futures.

Trade Bitcoin Futures on BTCC Now: https://www.btcc.com/en-US/trade/perpetual/XRPUSDT

| Download App for Android | Download App for iOS |

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

Don’t miss:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

ADA Cardano Price Prediction 2025, 2030

Algorand Price Prediction 2030

MANA Coin Price Prediction 2030

HBAR Price Prediction 2022, 2025, 2030

Stellar Lumens (XLM) Price Prediction 2030

Algorand (ALGO) Price Prediction 2022, 2025, 2030

Apecoin Price Prediction 2022, 2025, 2030

CRO Crypto Price Prediction 2025

XRP Price Prediction 2022, 2025, 2030

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*