Recommended

Yield Farming vs Staking: Which Strategy Is Better for Earning Passive Income?

Yield farming vs staking: Both being two of the most popular and profitable ways to earn passive income from crypto, which one is suitable for you?

The debate over the best way to generate passive income from cryptocurrencies has been going on for years. Many investors are turning towards yield farming and crypto staking as two of the most popular and profitable passive income strategies; however, there is huge confusion surrounding these terms.

Yield farming and staking are both viable ways to earn passive income without the need to be active in the markets, but there are significant differences between them that can impact your investment returns. In this article, we’ll dive into the similarities and differences between these two strategies and explore the pros and cons of each, to help you make an informed decision about which option works best for your goals.

What is Yield Farming?

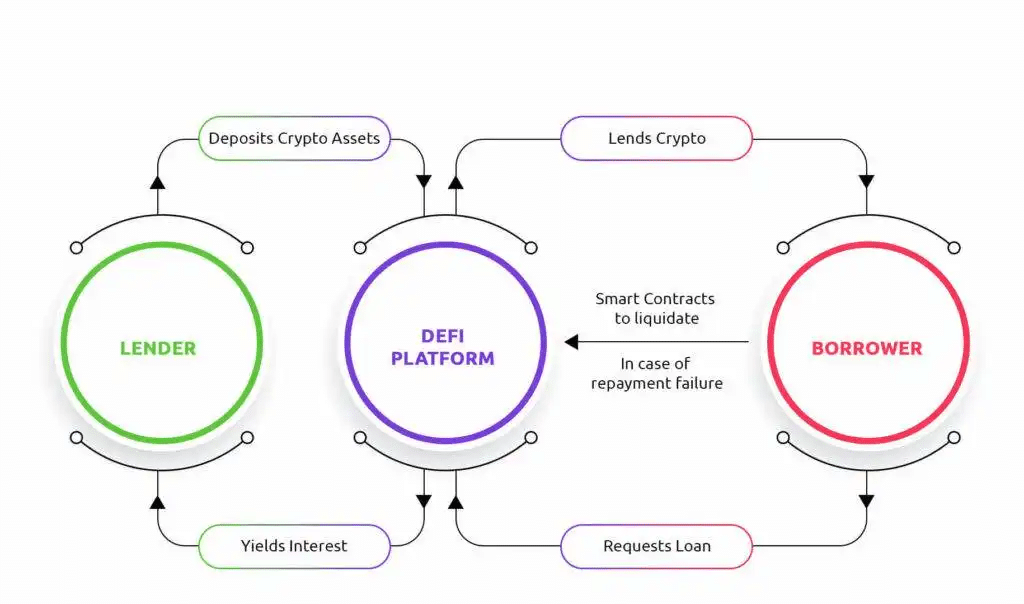

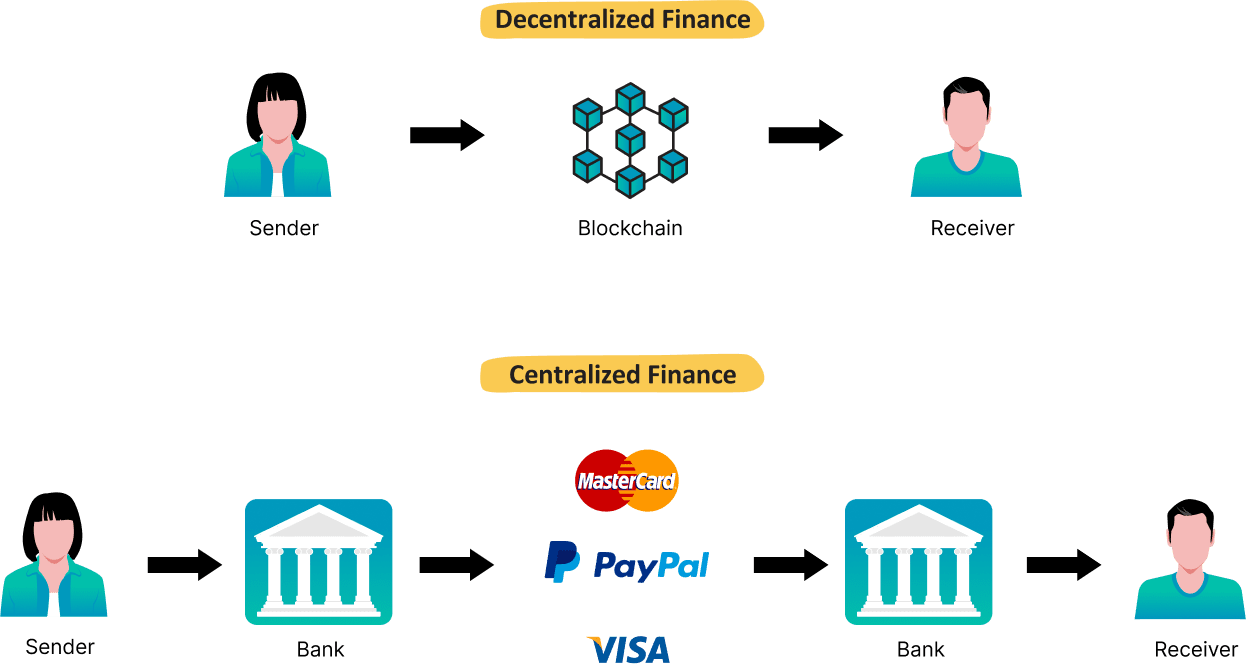

The process of providing liquidity to DeFi (Decentralized Finance) protocols, such as liquidity pools and crypto lending and borrowing services, is known as yield farming. It’s been compared to farming because it’s a novel approach for “growing” your cryptocurrency.

Yield Farming (also known as liquidity mining) is currently the most popular method of profiting from crypto assets. A yield farmer receives a percentage of the platform fees from a DEX (Decentralized Exchange) like Uniswap when they supply liquidity. The platform fees are paid by token swappers who use the liquidity. It’s a win-win situation: holders of cryptocurrencies can gain more exposure, while protocols benefit from increased liquidity and transaction volume.

Liquidity Mining

Some crypto enthusiasts recognize liquidity mining and yield farming as two different investment strategies — mainly because users receive the Liquidity Provider Token (LP Token) from the liquidity mining system in return for the trading pair.

However, these terms are often used interchangeably. Crypto yield farming may also be called DEX mining, DeFi mining, DeFi liquidity mining, or crypto liquidity mining.

| Download App for Android | Download App for iOS |

How Does Yield Farming Work?

One of the key concepts behind yield farming is Automatic Market Makers (AMMs), permissionless and automatic trading platforms that don’t require users to put in orders, unlike traditional exchanges involving buyers and sellers. AMMs enable investors to trade more efficiently and conveniently without intermediaries or third parties. Furthermore, with automated market makers, trades are made almost instantaneously, further increasing the appeal of yield farming for many investors.

Liquidity Providers and Liquidity Pools

The AMM system maintains the order book, which is made up mostly of liquidity pools and liquidity providers (LPs).

In essence, liquidity pools are smart contracts that collect money to make it easier for cryptocurrency users to lend, borrow, purchase, and trade digital currency. Liquidity providers, who contribute money to liquidity pools, use that money to fuel the DeFi ecosystem. The liquidity pool incentivizes them.

Advantages of Yield Farming

Yield farming has allowed many everyday investors to reap the rewards from digital assets without having a deep understanding of blockchain technology or developing complicated trading strategies. The rewards generated through yield farming have made it possible to see returns that would otherwise have been unattainable with traditional investment vehicles. As DeFi continues to grow and evolve, it’s clear that crypto farming will become a more mainstream method for generating passive income online.

| Download App for Android | Download App for iOS |

Best Yield Farming Platform

Different forms of yield farming companies provide various financial services, the majority of which generate amazingly large interest. You might earn 0.01% to 0.25% a year from large banks, but these low returns can’t match the 20% to 200% profits certain DeFi platforms promise. The greater the interest rate, the riskier the staking pool — it’s quite a frequent correlation. Keep an eye out for fraud and unproven platforms that could cost you money.

The most profitable DeFi platforms (Aave, Curve, Uniswap, etc.) are on Ethereum, but Binance Smart Chain (BSC) also has some substantial projects, such as PancakeSwap and Venus Protocol, to rival the Ethereum network.

Here’s the list of best-yield farms:

- Liquidity Providing on Uniswap: ~20% to 50% APR

- Earn interest on Aave: ~0.01% to 15% APR

- Yield farming on PancakeSwap: ~8% to 250% APR

- Liquidity Providing on Curve Finance: ~2.5% to 25% APR

- Yearn Finance: ~0.3% to 35% APY

The high yield rates (APY) of yield farming pools make them extremely competitive. Rates frequently fluctuate, forcing liquidity farmers to alternate between different venues. The drawback is that every time a farmer departs or enters a liquidity pool, they must pay gas expenses.

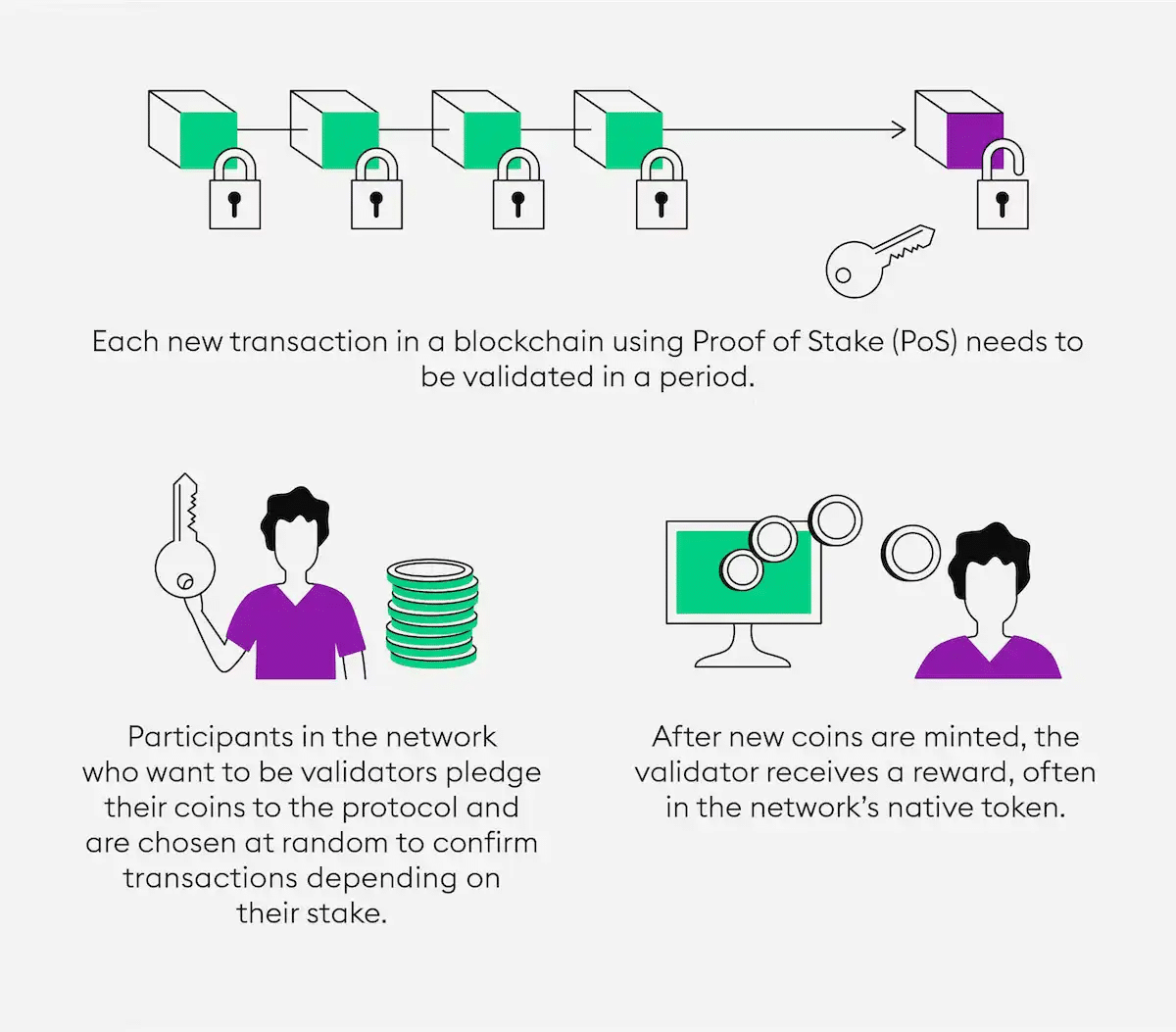

What Is Crypto Staking?

Staking is an increasingly popular trend in the cryptocurrency industry as it allows users to earn a passive yet high income while supporting their favorite network or protocol. It involves holding a set amount of coins or tokens in a secure wallet and participating in the process of verifying transactions on certain blockchain networks, such as Ethereum, Polkadot, BNB, Cardano, etc. In return, stakers are rewarded with more coins or tokens, which can generate a steady stream of revenue. With rewards often depending on the volatility of the network, staking can be highly profitable if done properly, making it an attractive option for crypto enthusiasts looking to diversify their portfolio.

| Download App for Android | Download App for iOS |

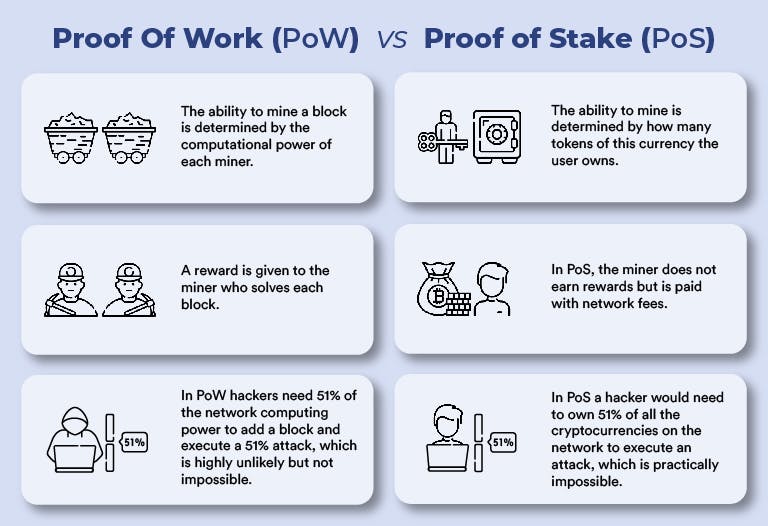

Proof of Work vs Proof of Stake

When it comes to cryptocurrency, there are two core consensus mechanisms that stand out, which are Proof of Work (PoW) and Proof of Stake (PoS). While PoW is currently the most dominant protocol in the industry, PoS has also grown increasingly popular.

Each of these protocols has its own advantages and disadvantages. With PoW, miners dedicate computing power in order to process (validate) transactions — miners receive rewards for their hard work by earning tokens. This makes it a secure system, but PoW is also associated with huge energy consumption.

With PoS, stakeholders commit tokens from their balance and get rewards. This eliminates mining, thereby reducing energy costs. However, because this protocol utilizes validator selection algorithms for transaction verification, it could lead to centralization of control if implemented incorrectly.

Thus, neither protocol is intrinsically better or worse; understanding the advantages and disadvantages of each can help determine which one will be the most appropriate for a particular situation.

How does Staking Crypto Work?

Staking is a popular way of earning income in the blockchain world by committing funds as a form of collateral. It involves locking up an amount of cryptocurrency to generate rewards through verification processes, similar to mining but with less effort and risk. In exchange for staking their tokens, users can receive rewards for contributing to the ecosystem’s security and stability.

| Download App for Android | Download App for iOS |

How to Stake Crypto?

To stake cryptos, users must download and synchronize wallets and transfer coins. Users can set up their wallet’s staking settings, check statistics on the staked coin, and keep an eye on blockchains for rewards. Make sure all network security settings are up-to-date with the highest levels of protection enabled so as not to put staking funds at risk. Additionally, you should back up your data as often as possible since unexpected events can cause disruptions that can jeopardize your funds. Staking crypto is a great way to reward yourself for taking proactive steps towards keeping your wallet secure and supporting the network’s consensus.

Best Staking Crypto

Here are the most staked cryptocurrencies:

- Ethereum

- Cardano

- Tezos

- Polygon

- Theta

All five offer high potential rewards for those willing to lock up their funds within the network for a period of time. Although rewards vary in each case, staking any of the top five is regarded as more reliable and consistent in comparison with other coins.

| Download App for Android | Download App for iOS |

DeFi Staking

Because DeFi platforms are decentralized and hence less prone to security breaches than traditional banking applications, they are frequently more secure than the latter. DeFi set-ups also offer users access to incentives like high APYs, additional governance privileges, or voting rights that other financial systems cannot provide.

Investors participating in DeFi should take a few extra precautions when dealing with staking. These consist of:

- Taking into account the DeFi platform’s security;

- Determining how liquid staking tokens are;

- Investigating whether rewards lead to inflation;

- Diversifying with different staking platforms and initiatives.

Yield Farming vs Staking: What’s the Similarities and Differences?

Similarities

Both yield farming and crypto staking are two of the most popular ways for crypto enthusiasts to earn passive income.

Differences

Although the terms “yield farming” and “staking” are occasionally used synonymously, there are some clear distinctions between the two.

- Profitability

Yield farming and staking generate quite different profits, which are typically expressed in terms of “annual percentage yield,” or APY.

For instance, yield farmers who join a new project or approach early on can profit significantly. According to CoinGecko, the possible return range is from 1% to 1,000% APY.

Unlike yield farming, staking payouts typically vary from 5% to 14%.

- Risk Levels

Yield farming offers a higher yield but also carries bigger risks. One of the reasons — there is a higher danger of a “rug pull” because crypto farming is frequently used in newer DeFi projects. On established PoS networks, where this danger is reduced, staking is more prevalent.

However, there is a degree of risk associated with volatility in both yield farming and staking. In the event that token values unexpectedly fall, both yield growers and stakers can lose money. There is also the possibility of liquidation, which might happen if your investment cannot be covered by your collateral.

Users can yield farm stablecoins, too. As long as the tokens don’t lose their peg, stablecoin pools are very secure. In this case, an impermanent loss can be entirely prevented.

- Complexity

Staking is frequently viewed as a less complicated passive income technique because it only requires investors to choose a staking pool and lock in their cryptocurrency. It also doesn’t demand significant initial investment. On the other hand, yield farming can be time-consuming because investors must decide which tokens to lend and on which platform, with the potential to repeatedly move platforms or tokens. Ultimately, how actively you choose to manage your investments may determine whether you decide to stake or yield farm.

One crypto asset is all that is needed to start staking. In contrast, yield farming allows you to make money from a trading pair.

- Liquidity

When comparing yield farming vs staking, the winning tactic is obvious to investors looking for liquidity. Both of these tactics require a crypto investor to possess a certain quantity of crypto assets in order to be profitable. However, unlike in staking, investors are not required to lock up their money when engaging in yield farming — with this technique, they maintain full control over the cryptocurrency and can withdraw at any time.

- Inflation

PoS tokens are often subject to inflation, and any yield given to stakers is made up of a newly created token supply. Staking your tokens at least entitles you to benefits that are proportionate to the amount staked and are in pace with inflation. The value of your current possessions declines due to inflation if you miss out on staking.

- Duration

Users must stake their money on various blockchain networks for a set time frame. Some also have a required minimum sum.

- Transaction Fees

Yield farmers can switch pools as frequently as weekly. They continuously modify their techniques to increase revenues and fully maximize their income. That’s why gas fees are undoubtedly a major problem for yield farmers who are free to switch between liquidity pools but must pay a transaction fee in the process, which might be overlooked when comparing yield farming to staking. Even if yield farmers find a larger return on another network, they must consider any switching costs.

- Security

Because stakers are taking part in the stringent consensus procedure used by the underlying blockchain, staking is typically more secure.

On the other hand, yield farming (especially if it’s based on more recent DeFi protocols) might be more susceptible to hackers. In particular, if there are bugs in the code of a smart contract.

- Impermanent Loss

Yield farmers are at risk of temporary loss in double-sided liquidity pools due to cryptocurrency price fluctuations. The rise in a digital asset’s value has no benefits for investors. As an illustration, if an investor deposited money into a yield farming pool and the price of cryptocurrencies soared, the investor would be better off keeping those cryptocurrencies instead of adding them to the pool. If the value of the investor’s tokens declines, they could also suffer temporary loss. Staking does not result in temporary loss.

| Download App for Android | Download App for iOS |

Yield Farming vs Staking: Which Is Suitable for You?

Choosing between yield farming and staking as a form of investment can be tricky. While both provide the potential for additional income, it’s important to understand which is right for your circumstances and goals.

Staking is an excellent choice for investors who don’t care about short-term price volatility but are concerned about earning returns on their long-term investments. Avoid locking up money for staking if you might need it back quickly before the staking time is up.

For investors who prefer short-term methods, yield farming is a good option. It doesn’t call for securing money. You can switch between platforms in search of a greater APY. When using a short-term approach, yield farming can produce more revenue. In contrast to staking, it is a high-risk endeavor. Tokens with a low trading volume frequently gain the most from yield farming because it is the only practical way to trade them.

Yield Farming vs Staking: Which Is a Better Investment for Short Term?

Both tactics offer particular advantages for investors who favor shorter time horizons and are trying to choose between yield farming and staking.

Compared to the active yield farming technique, the predicted return and risk could be lower in staking. On the other hand, yield farming doesn’t call for a lockup of money if you need cash for a short-term approach. Execution is key, as it is with any investing approach, and a little bit of luck never hurts.

| Download App for Android | Download App for iOS |

Yield Farming vs Staking: Which Is a Better Investment for Long Term ?

Yield farming can be rather profitable in the long run because it enables investors to move between platforms and tokens in search of a higher APY. Yield farmers can reinvest their income in the scheme to generate more crypto interest as long as they have faith in the network and the protocols they utilize. As a result, yield farming may be a fantastic strategy to diversify your investment portfolio and boost your income.

Yield farming has the potential to be fairly successful in the long run, despite the absence of an immediate payout. Since there is no lockup in place, it is possible to switch between platforms and tokens in search of the highest yield.

Even though active yield farming might ultimately result in higher income, you must take the expense of switching between yield aggregators and tokens into account. Staking continues to be the most secure tactic in the long term. As a result, staking rewards are more consistent.

Yield Farming vs Staking: Conclusion

Staking and yield farming are two excellent passive income strategies. Since the two ideas are still somewhat fresh, they are occasionally even used synonymously. Both entail keeping cryptocurrency assets in order to generate interest. For both situations, one can employ both short-term and long-term methods.

While yield farming may require some strategic maneuvering to move and reap more earnings, staking is a more intuitive concept. Staking crypto might not be as highly gratifying as YF, but it is more secure. Deciding between yield farming and staking may depend on your level of sophistication and what is best for your entire portfolio.

Yield Farming vs Staking – FAQs

Is yield farming better than staking?

In most cases, yield farming offers a greater return than staking. However, those returns are dynamic. On the other hand, users can be certain of their earnings at the end of the staking term, thanks to the fixed APY offered by this strategy. Eventually, it all boils down to your own risk appetite and investment style.

Is yield farming riskier than staking?

Yield farming (especially leveraged yield farming) may be risky because it is impacted by price volatility associated with certain tokens; however, many yield farmers have seen positive returns with this strategy.

Is yield farming profitable?

Yes, yields can often range from 5% to 30%, depending on the specific DeFi protocol and asset class in question. Although there are risks associated with every investment strategy, yield farming can be an interesting option for traders seeking higher returns without taking on too much risk.

Is liquidity mining the same as yield farming?

Liquidity mining is a form of yield farming and another DeFi lending protocol, where users will stake their cryptocurrency into a pool to be used by other users.

What is the disadvantage of staking?

Sometimes, staking requires a lockup or vesting period, where your crypto can’t be transferred for a certain period of time. This can be a disadvantage, as you won’t be able to trade staked tokens during this period even if prices shift.

Read More:

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

When Will Pi Coin Launch: Pi Network Phase 4 Release Date

Pi Coin Price Prediction 2025: Will Pi Coin Be Worth Anything?

Moon Bitcoin Review – Your Best Chance to Get Free Bitcoins

Metamask Airdrop – To Get $MASK Token For Free?

Wild Cash App by Hooked Protocol: Answer Quiz to Earn $HOOK

Hooked Protocol Price Prediction: How High Can HOOK Coin Go?

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Will Shibarium Burn Remove 111 Trillion SHIB Annually?

HBAR Price Prediction 2025, 2030

Amazon Stock Price Prediction: Is Amazon Expected to Go Up?

NIO Stock Forecast 2025, 2030: Is NIO a Good Stock to Buy?

Top AI based Cryptocurrencies to Watch Out in 2023

Best Aptos Wallets for You to Store Aptos Coin

Bitcoin Futures Trading for Beginners

Is Ethereum a Good Buy in 2023?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*