Recommended

What is Leverage Trading in Crypto? How Can I Trade at 500X Leverage?

Leverage is the act of initiating a trading position with borrowed capital, thereby potentially magnifying the associated losses or profits. By utilizing leverage, a trader is able to exert greater influence over a greater portion of an asset than if they were utilizing their own capital alone. The hazards are also amplified in tandem with the returns, as losses are magnified.

Traditional financial markets (TradFi) employ leverage in addition to cryptocurrencies, commodities, equities, bonds, and real estate.

What is Crypto Leverage Trading?

Margin is a fraction of the amount a trader requires as security to start a more prominent position. When trading, you can double the amount of positions called leverage. Thus, if a margin trader uses 100 times the leverage, their risk and possible profit can be increased by 100 times.

Leverage is a powerful tool for traders. You can use it to benefit from relatively small price fluctuations, provide larger position sizes for your portfolio, and grow your capital more quickly.

Leveraged trading is like margin trading.Margin is a small fraction of the amount a trader needs as security to start a more prominent position. When the transaction is in progress, if a trader uses 100 times the leverage, their risk and possible profit can be increased 100 times.

Different Bitcoin exchanges offer different levels of leverage. While some Bitcoin exchanges offer 200x leverage, enabling traders to create positions worth 200x their original deposit, other Bitcoin exchanges only provide 20x, 50x, or 100x leverage. A trade with 100:1x is called a 100x leverage trade.

Look more:Best High Leverage Crypto Trading Exchange Platform

| Download App for Android | Download App for iOS |

How does Leverage Trading Work in Crypto

You must deposit funds into your trading account, which is referred to as collateral, before you may comprehend leverage in cryptocurrency trading. The collateral needed to establish a position differs according to the leverage you select and the total value you desire to open.

Crypto Leverage Trading Example

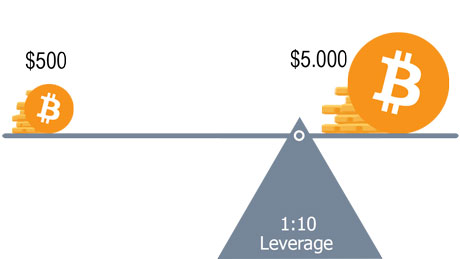

Assuming you have chosen to invest $5,000 in Bitcoin using a 1:10 leverage ratio, the necessary margin in this scenario would be 1/10 of the $5000, or $500, which would serve as collateral for the loan. The needed margin decreases with increasing leverage; for example, with 1:40 leverage and a $5,000 stake, the margin would be $5000/40, or $125.

This was the best part. However, there is a catch: if you decide to go long but the market moves against you and your margin falls below the maintenance threshold (also known as the maintenance margin), your funds will be liquidated unless you add more funds to your account. This means that the higher the leverage, the higher the risks of getting liquidated.

It goes without saying that leverage can be used for both long and short positions. In case you didn’t know, initiating a long position indicates your expectation that an asset’s price will rise, and initiating a short position indicates the opposite expectation.

Look more:Best Crypto Exchange to Trade with Leverage

Benefits of Using Leverage

- Expanded profits. You only need to invest a fraction of the value of the trade to make the same profit as any other regular trade on the exchange.

- Take advantage of opportunities. Using leverage frees up capital that can be used for other investments. The ability to increase the amount available for investment is called leverage.

- Profiting from market declines. Using leveraged products to speculate on market movements allows you to benefit from both down and up markets.

Look more:How do contracts trade on BTCC? BTCC Account Guide.

| Download App for Android | Download App for iOS |

Risks of Using Leverage

Margin trading was, until recently, much more common in currency markets, as it was generally considered too risky to be used in highly volatile cryptocurrency markets.

Unlike regular trading, you can lose your entire initial investment margin trading. Further, the more you leverage, the quicker you can lose it. For example, if I go long on a 3:1 margin. Margin trading is a type of leveraged trading. It’s means that I can deposit $100 into a margin account and get three times my buying power trading balance.

It’s also means that if I trade three times my balance ($300) and my position becomes -$100, I will lose everything I hold as collateral. I have made more money in a short period through margin trading than I have ever made in my entire life. And more money is lost than ever before.

Leverage increases risk and cryptocurrencies are more volatile than stocks and other traditional markets. However, recognizing the potential risk, the vvolatility of cryptocurrencies creates profits for traders, and in a shorter period, only a part of the investment can produce significantly high profits.

Different Types of Leverage Trading

Leverage trading has been introduced into cryptocurrency markets in a few key ways. Here’s a quick rundown of how each operates:

Crypto Futures

Without having to own the underlying commodity, traders can take long or short positions on cryptocurrencies using crypto futures contracts. In a manner similar to the last example, traders can achieve leverage by opening positions valued at a multiple of the collateral capital they deposit as margin. Daily price variations lead to the “marking to market” process, which settles profits or losses to accounts on a daily basis. As previously mentioned, trading futures carries a risk of forced liquidations.

Margin Trading

Through margin trading, cryptocurrency traders can open leveraged spot positions by borrowing money from their cryptocurrency exchange. Traders can open positions priced at a multiple of the collateral capital they deposit as margin. Keep in mind that exchanges set maintenance margin thresholds and restrictions that, if not met, could result in forced liquidations. When positions are closed out, gains or losses are realized.

Crypto Options

The buyer of an options contract has the option, but not the duty, to purchase or sell the underlying cryptocurrency asset on or before the expiration date at a predetermined “strike” price. If the buyer exercises an option, the seller/writer assumes the responsibility to fulfill the option. Because of the comparatively little upfront premium paid in relation to the magnitude of the position established, leverage is achieved.

| Download App for Android | Download App for iOS |

Where to Trade Futures at 500X Leverage?

BTCC was established in 2011, making it one of the world’s oldest and most reliable cryptocurrency exchanges. A popular option for many traders, BTCC has established a solid reputation in the market for its dedication to security and legal compliance over the years. The platform, which is available in the US, Canada, and Europe, is especially well-suited for traders from these regions.

Apart from bitcoin trading, BTCC provides traders with cutting-edge tools like copy trading, perpetual futures, and tokenised stocks that let them access non-crypto assets like gold, silver, and US equities. Because of its range of choices, BTCC is appropriate for both novice and seasoned traders seeking a secure and regulated platform.

More than 300 cryptocurrency futures contracts are supported by the BTCC platform, including well-known pairs like BTC/USDT and ETH/USDT. Without actually holding the underlying assets, traders can speculate on future price movements, offering a flexible means of making money in both rising and declining markets.

The flexibility that BTCC provides with leverage is one of its main advantages. Futures contracts on individual assets can be traded with leverage up to 500x in five well-known pairs: BTC/USDT, ETH/USDT, DOGE/USDT, SOL/USDT, and XRP/USDT. The platform provides variable leverage of up to 50x for various contracts for less aggressive methods.

BTCC provides a variety of futures contract settlement options. These contracts offer flexibility for various trading strategies because they can be settled in either USDT (USDT-margined futures) or the cryptocurrency itself (coin-margined futures).

Market, limit, and stop-loss orders are features of BTCC that improve user experience by providing traders with options to maximise their entry and exit locations. Features like stop-loss and take-profit, which automatically close positions when specific criteria are achieved, are especially helpful for risk management.

How to Trade on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

| Download App for Android | Download App for iOS |

Conclusion

With leverage, you may easily start with less capital while yet having the chance for bigger returns. The combination of leverage and market volatility, however, might cause a rapid liquidation, particularly when trading with a leverage of 1:100. Before using leverage, be sure you’re trading safely and assessing the risk involved.

You should never use leverage or trade with money you cannot afford to lose.

Once you understand how to control it, leverage becomes a tool you can confidently use. If you like to take a hands-off approach to trading, leverage may not be the best choice for you. Otherwise, with the right management, leverage may be a powerful tool for success. Leverage, like any sharp instrument, requires caution when used improperly; nevertheless, this becomes irrelevant once mastery is achieved.

Since high-leverage trades can swiftly deplete your trading account if they go wrong, owing to big losses incurred by large-lot sizes, trading with lower-leverage allows you more breathing room by establishing a broader but reasonable stop and avoiding a bigger capital loss. Remember that the leverage can be adjusted to fit the requirements of any trader.

Where to Trade Crypto Futures?

You can trade crypto futures on BTCC Now. Over 300 USDT-margined perpetual trading pairs are available for users to trade, including many popular altcoins and meme-coins.

You can deposit and receive up to 10,055 USDT now when you sign up and verify your account on BTCC Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

| Download App for Android | Download App for iOS |

About BTCC

BTCC is a leading cryptocurrency trading platform that is distinguished by its ability to balance the simplicity of use with advanced features. It provides a comprehensive educational program through the BTCC Academy, 24/7 customer support, and robust security to both novices and experts. BTCC is a top choice for digital asset investors due to its emphasis on user contentment, which fosters a secure and informed trading environment across a variety of cryptocurrencies.

BTCC is one of the few exchanges in the market that offers high-leverage options for investors and concentrates extensively on futures trading. Users have access to more than 300 USDT-margined perpetual trading pairs, which encompass numerous prominent altcoins and meme-coins. Additionally, the platform has recently implemented spot trading to facilitate novice users who may not be acquainted with futures trading.

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

100x Leverage CryptoLeverage crypto100x Crypto LeverageCrypto Trading 100x Leverage100x Margin CryptoCrypto Leverage Trading500x Leverage

BTCC trading guides

Related articles

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- support@btcc.com

- listing@btcc.com

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*